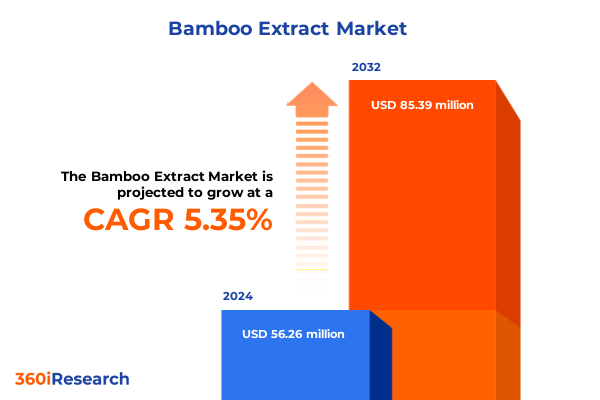

The Bamboo Extract Market size was estimated at USD 58.78 million in 2025 and expected to reach USD 65.28 million in 2026, at a CAGR of 5.47% to reach USD 85.38 million by 2032.

Unveiling the Origin, Bioactive Composition, and Emerging Potential of Bamboo Extract Across Multiple Industry Verticals

Bamboo extract is derived from various parts of the bamboo plant-leaves, shoots, and stems-through sophisticated processing techniques that concentrate its natural bioactive profile. This botanical derivative is renowned for its rich content of silica, phenolic acids, flavonoids, and other antioxidative compounds. Scientific studies have demonstrated that bamboo leaf and sheath extracts exhibit potent anti-inflammatory effects, effectively reducing pro-inflammatory cytokine expression in human macrophages without compromising cell viability, while also delivering robust free-radical scavenging activity in assays such as ABTS, DPPH, and FRAP. Further research into bamboo shaving fractions confirms that these extracts possess significant antioxidant capacities linked to high levels of total flavonoids and phenolic acids. The unique mineral composition, notably organic silica, supports connective tissue formation and maintenance, offering enhanced bioavailability over inorganic sources, which underpins the extract’s adoption in skin, hair, and bone health formulations.

Across diverse sectors, bamboo extract’s multifunctional properties are driving innovation in product development. Nutraceutical brands leverage its antioxidant and anti-inflammatory benefits to support joint health and immune modulation, while food and beverage formulators integrate it into functional beverages and foods seeking natural wellness claims. In cosmetics and personal care, bamboo-derived silica contributes to collagen synthesis and hydration, reinforcing barrier function in skincare and fortifying hair and nail strength. Its antimicrobial and skin-soothing attributes further expand potential applications in oral care and beyond.

The convergence of consumer demand for clean-label ingredients and advances in extraction science has enabled producers to tailor bamboo extract profiles with precision. Techniques such as supercritical fluid extraction, enzyme-assisted processes, and high-pressure methods optimize yield and preserve bioactive integrity, setting a new standard for ingredient quality. These innovations provide formulators with reliable, high-purity extracts designed for targeted efficacy, reinforcing bamboo extract’s position as a versatile, science-backed solution in product formulations.

Exploring the Pivotal Sustainability, Technological, and Regulatory Forces Redefining Bamboo Extract’s Market Landscape Globally

The rise of sustainability mandates and circular-economy initiatives has profoundly reshaped the bamboo extract landscape. Stakeholders are increasingly prioritizing sourcing practices that minimize environmental impact, leveraging bamboo’s rapid renewal cycle and low-input cultivation requirements to reduce carbon footprints. This has led to the valorization of processing residues and by-products as feedstock for extract production, creating additional revenue streams and reinforcing commitments to waste reduction and resource efficiency.

Simultaneously, technological breakthroughs in extraction science have elevated competitive dynamics. High-pressure and solvent-reduction techniques, alongside supercritical fluid and enzyme-assisted processes, now enable manufacturers to fine-tune bioactive profiles, isolating specific flavonoid and phenolic fractions for bespoke product claims. Digital transformation across supply chains has introduced end-to-end transparency, allowing traceability from plantation to finished extract, and fostering greater consumer confidence in authenticity and quality.

Converging with these operational shifts, evolving consumer preferences underscore a convergence of health and wellness trends. Bamboo extract is no longer confined to traditional herbal applications but is increasingly featured in mainstream innovation pipelines across food and beverage, nutraceuticals, and personal care. Formulators are capitalizing on its antioxidant, anti-inflammatory, and antimicrobial properties to meet the demand for natural, efficacious solutions that address everything from digestive wellness to skin barrier support. This fusion of sustainability, technology, and consumer behavior is setting a new paradigm for bamboo extract’s role in product development and market growth.

Assessing the 2025 United States Tariff Regime’s Compound Impact on Bamboo Extract Supply Chains and Cost Structures for Strategic Reorientation

In 2025, the United States introduced revised tariff schedules targeting phytochemical imports, including bamboo-derived extracts, which significantly altered cost structures across the value chain. These stepped-up duties on select organic compounds intensified scrutiny on sourcing strategies, prompting buyers to evaluate near-shoring options and to renegotiate long-term supplier contracts to hedge against landed-cost volatility. The immediate effect was a notable uptick in import expenses that challenged price-sensitive segments while premium offerings demonstrated greater resilience in absorbing cost increases.

Beyond direct pricing pressure, the tariff regime catalyzed strategic investments in domestic cultivation and processing capacities. Ingredient producers allocated capital to agricultural infrastructure and extraction facilities closer to end-use markets, aiming to mitigate future policy uncertainties and to enhance supply-chain resilience. Although establishing local operations demands substantial lead times and upfront expenditures, these initiatives promise to strengthen long-term competitive positioning and to decrease reliance on volatile import channels.

End users and distributors, facing an environment of regulatory flux, have recalibrated formulation and inventory strategies. Premium product lines have increasingly incorporated bamboo extract despite cost headwinds, whereas cost-conscious manufacturers explored alternative botanicals or adjusted usage rates. Distributors adopted flexible contract structures and diversified sourcing footprints to ensure continuity. Collectively, these adaptations underscore the importance of agile supply-chain management and proactive policy monitoring as fundamental capabilities for navigating tariff-driven disruptions in the bamboo extract market.

Dissecting Market Dynamics Through Product Forms, Applications, Channels, End Users, Functions, and Botanical Sources of Bamboo Extract

A clear view of market segmentation enables stakeholders to align product strategies with specific demand drivers. Across product forms, bamboo extract is offered as capsules, liquids, powders, and tablets, each format catering to different manufacturing workflows and consumer preferences. Powder concentrates are favored for industrial dosing accuracy, while liquid extracts are prized for rapid bioavailability in nutraceutical applications. Capsules and tablets offer convenient dosage forms for direct-to-consumer health supplements.

Application-based segmentation reveals bamboo extract’s broad utility. In animal feed, it serves as a natural growth promoter and health supplement. Cosmetic formulations incorporate bamboo’s antimicrobial and mineral-rich profile across haircare, oral care, and skincare. In the food and beverage sector, functional beverages and functional foods leverage the extract’s antioxidant properties to create healthy-positioned offerings. Nutraceuticals and pharmaceuticals capitalize on the ingredient’s anti-inflammatory, antimicrobial, and antioxidant functions to support targeted health claims.

Distribution channels span direct sales, online platforms, brick-and-mortar retail, and wholesale networks. Direct sales facilitate customized partnerships for co-development, online channels offer broad reach and cost efficiency for emerging brands, while retail and wholesale structures maintain established supply lines to large-scale ingredient buyers.

Finally, end users-including food and beverage companies, nutraceutical enterprises, personal care brands, and pharmaceutical manufacturers-demonstrate distinct innovation cycles and regulatory benchmarks. Functional demand categories further segment the market into anti-inflammatory, antimicrobial, and antioxidant applications, and the botanical source-leaf, shoot, or stem extracts-allows suppliers to differentiate products based on purity, yield, and bioactive concentration. Understanding these layered segmentation dimensions is critical for identifying high-value opportunities and prioritizing resource allocation across the bamboo extract landscape.

This comprehensive research report categorizes the Bamboo Extract market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Function

- Source

- Application

- Distribution Channel

- End User

Evaluating Regional Nuances in the Bamboo Extract Market Across Americas, EMEA, and Asia-Pacific to Inform Tailored Growth Strategies

Regional market dynamics for bamboo extract exhibit distinct drivers and challenges across the Americas, Europe, the Middle East & Africa, and the Asia-Pacific. In the Americas, a robust health and wellness culture underpins steady demand for natural ingredients, supported by advanced extraction infrastructure and well-established botanical ingredient networks. North American regulatory frameworks emphasize supply-chain transparency and rigorous quality standards, shaping premium positioning for bamboo extract products.

The Europe, Middle East & Africa region presents a mosaic of regulatory regimes, where stringent safety and traceability requirements coexist with high-growth potential in emerging markets. European formulators demand certified and traceable ingredients, particularly for personal care applications, while growth in the Middle East and Africa is fueled by urbanization and rising disposable incomes, creating new markets for natural wellness solutions.

In Asia-Pacific, abundant bamboo resources, favorable government initiatives, and integrated supply-chain ecosystems make the region both the largest producer and consumer of bamboo extract. Cost advantages and proximity to raw materials enable local suppliers to offer competitive pricing, while domestic brands actively integrate bamboo extract into traditional medicine, functional foods, and beverages. Tailored go-to-market strategies that respect regional regulatory nuances, distribution infrastructures, and consumer preferences are essential for capitalizing on these varied growth landscapes.

This comprehensive research report examines key regions that drive the evolution of the Bamboo Extract market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Key Industry Players Advancing Innovation in Bamboo Extract Extraction, Purity, and Applications

The competitive landscape of the bamboo extract market features both global ingredient conglomerates and specialized biotech innovators. Multinational firms such as International Flavors & Fragrances, Givaudan, BASF, and Evonik leverage extensive R&D capabilities and proprietary extraction platforms to deliver high-purity bioactive profiles at scale. These companies often hold patents on advanced enzyme-enhanced and supercritical extraction processes, enabling the isolation of targeted phenolic fractions for premium product claims.

Mid-sized and regional players, including Xi’an Sobeida Biotech, Shaanxi Evergreen Biology Engineering Group, and Xi’an Lyphar Biotech, focus on niche applications such as veterinary supplements and specialty skincare segments. Their agility and focus on bespoke service models allow them to serve high-margin, low-volume markets with tailored extract grades and formulation support. New entrants continue to emerge through contract manufacturing platforms, utilizing excess capacity in general-purpose extraction facilities to introduce innovative formulations and capture early-stage market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bamboo Extract market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambe Ns Agro Products Pvt. Ltd.

- Arkure Health Care

- Azelis Corporate Services NV/SA

- Bio Botanica, Inc.

- Botanic Planet Canada Inc.

- Cactus Botanics

- Croda International PLC

- FORMULATOR SAMPLE SHOP S.R.L.

- Greenjeeva

- Greenphyt

- Greentech SA

- Herbal Creative

- Herbo Nutra

- JUNO BAMBOO WATER

- K.-W. Pfannenschmidt GmbH

- Kshipra Biotech Private Limited

- Laverana Digital GmbH & Co. KG

- Lessonia

- Martini S.p.A.

- Moso International B.V.

- Nutrient Innovations, Inc.

- Orgenetics Inc.

- Shaanxi Jiahe Phytochem Co., Ltd.

- Specialty Natural Products Co.,Ltd.

- Thangam Extracts

Formulating Actionable Strategic Initiatives for Industry Leaders to Capture Market Share and Enhance Resilience in Bamboo Extract Value Chains

Industry leaders must proactively align their investment and innovation roadmaps to capture the full potential of the bamboo extract market. Organizations can differentiate by developing branded ingredient lines with clinically substantiated health benefits, securing premium positioning and enhancing consumer loyalty. Investing in regional processing hubs and diversifying supplier geographies can mitigate supply risks associated with tariff volatility while reducing lead times and logistical costs.

Collaborative initiatives across the value chain-from bamboo growers to extraction specialists and formulators-can accelerate co-innovation. Joint development agreements and strategic partnerships enable shared R&D expenditures, faster regulatory approvals, and access to complementary expertise. Concurrently, deploying data-driven quality control and real-time analytics in manufacturing can ensure batch consistency, maintain compliance with evolving standards, and optimize operating margins.

Marketing strategies should incorporate digital education campaigns that translate complex scientific evidence into accessible messages, bridging the gap between technical claims and consumer understanding. Finally, embracing sustainability certifications and transparent reporting frameworks will reinforce brand credibility among environmentally conscious stakeholders and cultivate long-term trust. These measures, collectively, will equip industry leaders to navigate current headwinds and secure sustained growth in the evolving bamboo extract ecosystem.

Detailing the Rigorous Multi-Phase Research Approach Underpinning Our Bamboo Extract Market Analysis for Unbiased, Data-Driven Insights

Our analysis is grounded in a multi-phase research methodology designed to deliver rigorous, unbiased insights. The process commenced with primary interviews involving C-level executives and technical leaders specializing in agronomy and extraction science, providing qualitative perspectives on supply-chain innovations and regulatory developments. Concurrently, quantitative surveys captured the views of ingredient buyers and formulators across major end markets.

Secondary research included comprehensive reviews of trade data, regulatory filings, and patent databases to track shifts in tariff provisions and technological advancements. Proprietary sentiment-analysis algorithms mined scientific literature and social media channels to gauge emerging trends and stakeholder perceptions. Data integrity was ensured through cross-validation against third-party certification registries and import-export statistics.

Analytical rigor was applied via frameworks such as SWOT, Porter’s Five Forces, and scenario-planning models to assess competitive pressures and forecast policy impacts, while all findings underwent internal peer review and editorial scrutiny. This structured approach underpins our conclusion that the bamboo extract market is entering a phase defined by strategic supply-chain localization, technological differentiation, and consumer-driven innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bamboo Extract market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bamboo Extract Market, by Product Form

- Bamboo Extract Market, by Function

- Bamboo Extract Market, by Source

- Bamboo Extract Market, by Application

- Bamboo Extract Market, by Distribution Channel

- Bamboo Extract Market, by End User

- Bamboo Extract Market, by Region

- Bamboo Extract Market, by Group

- Bamboo Extract Market, by Country

- United States Bamboo Extract Market

- China Bamboo Extract Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Insights and Future Outlook to Conclude the Critical Drivers Shaping the Bamboo Extract Industry’s Next Phase of Growth

Synthesizing the converging insights reveals that bamboo extract stands at an inflection point fueled by sustainability imperatives, regulatory shifts, and consumer demand for natural, multifunctional ingredients. Tariff-induced cost pressures have accelerated localization and strategic diversification, strengthening supply-chain resilience while catalyzing new partnerships across the value chain.

Segment-specific opportunities abound in applications that harness bamboo extract’s anti-inflammatory, antioxidant, and antimicrobial functions, particularly within high-growth niches such as functional beverages, specialty cosmetics, and targeted nutraceutical formulations. Regional nuances-from the premium, traceability-focused markets in Europe to the resource-rich, cost-competitive environment of Asia-Pacific-require tailored strategies that align with local regulatory frameworks and consumer preferences.

Competitive dynamics favor players who can integrate end-to-end capabilities-spanning agronomic sourcing, advanced extraction, formulation support, and digital marketing-to deliver differentiated offerings with compelling value propositions. As the industry matures, transparency, clinical substantiation, and sustainability credentials will become key decision-criteria for buyers and end consumers. These drivers will define the next chapter of growth, innovation, and competitive positioning in the global bamboo extract market.

Engage with Ketan Rohom to Elevate Your Strategic Position in Bamboo Extract Markets Through Customized Market Intelligence Solutions

Unlock unparalleled access to our comprehensive bamboo extract market insights by partnering directly with Ketan Rohom. With Ketan’s deep expertise in market intelligence and strategic advisory, you can secure tailored analysis, real-time updates, and customized data solutions designed to strengthen your competitive positioning. Reach out to explore subscription models, bespoke research briefs, and dedicated support that empower you to make informed decisions, mitigate tariff-driven risks, and capitalize on emerging opportunities in the global bamboo extract industry. Elevate your strategy today by connecting with Ketan Rohom for a detailed consultation.

- How big is the Bamboo Extract Market?

- What is the Bamboo Extract Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?