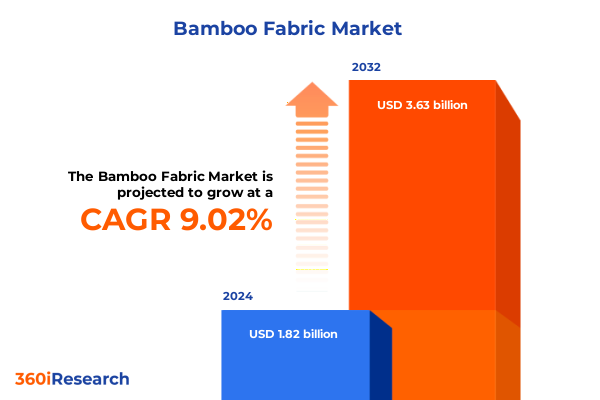

The Bamboo Fabric Market size was estimated at USD 1.82 billion in 2024 and expected to reach USD 1.97 billion in 2025, at a CAGR of 9.02% to reach USD 3.63 billion by 2032.

How rapidly evolving material science and consumer expectations are reshaping bamboo textile adoption across apparel, home, healthcare and industrial value chains

Bamboo textiles occupy a unique position at the intersection of natural-resource appeal and modern fiber engineering. What began as a consumer-facing promise-soft, breathable fabrics with an eco-friendly backstory-has evolved into a complex product family spanning mechanically processed bamboo linen, regenerated-cellulose viscose and lyocell variants, and blended constructions that balance cost, hand and performance. Across apparel, home textiles, healthcare applications and industrial uses, interest in bamboo-based materials is being driven by consumers seeking perceived naturalness while manufacturers and brands pursue fibres that offer a competitive combination of drape, moisture management and biodegradability.

At the same time, the raw-material qualities of bamboo-fast growth, low pesticide demand and strong carbon-sequestration potential-coexist with important processing realities that shape supply chains and purchasing decisions. Converters and brands now make sourcing choices based on the difference between mechanical extraction routes that produce coarse, naturally derived linen-like yarns and chemically regenerated routes that yield silky viscose or lyocell with very different environmental footprints. These upstream technical distinctions have downstream consequences for product claims, cost structures, regulatory compliance and brand risk exposure. The remainder of this summary examines those dynamics and their operational implications in a way that supports informed executive decision-making.

Innovations in closed-loop processing, rising functional performance demands, and trade policy volatility are jointly recasting the competitive landscape for bamboo textiles

The bamboo-fabric landscape is being transformed by three converging shifts: rising scrutiny of processing practices, accelerating demand for functional and sustainable fibers, and geopolitical trade policies that are reconfiguring supply routes. Environmental due diligence and supply-chain transparency programs are forcing brands to distinguish between mechanically produced bamboo linen and regenerated cellulosic outputs; brands that once relied on simplistic “bamboo” claims are now investing in traceability and third-party verification to avoid reputational and regulatory risk. This is driving investment in closed-loop regeneration technologies as well as greater use of certified dissolving pulp and footprint-focused fiber standards.

Parallel to sustainability pressures, customer expectations for performance fabrics-moisture management, softness, and durability-have expanded the addressable applications for bamboo-derived yarns beyond casual wear into medical textiles, premium bedding and certain technical niches. As these product performance requirements rise, manufacturers are adapting by blending bamboo fibers with cotton or engineered viscose blends to achieve targeted hand feel and cost points. Meanwhile, trade policy volatility and accelerated e-commerce adoption are altering inventory, lead-time and channel strategies, prompting brands to reassess nearshoring, multi-sourcing and direct-to-consumer fulfillment models. These combined forces are moving the sector from niche novelty toward a more industrialized, compliance-driven market.

Regulatory and tariff developments in 2025 have reconfigured landed costs, compliance burden, and sourcing strategies for companies that import bamboo-derived fabrics into the United States

United States tariff actions in 2025 added a new operational constraint that companies sourcing bamboo-derived fabrics must manage carefully. Executive and regulatory changes affecting de minimis treatment for low-value cross-border shipments, recent Section 232 national security probes and the legacy Section 301 measures that targeted certain Chinese imports have created a more complex cost-and-compliance environment for apparel and textile imports. The suspension of duty-free de minimis treatment and related executive-level orders changed how small parcels are treated at customs and created a framework under which parcel-level duties or ad valorem levies are now assessed in ways that materially shift landed-cost calculations for direct-to-consumer imports. These changes immediately raised the profile of import-compliance, origin documentation and tariff classification work for cross-border fast-fashion and small-batch suppliers, including those who source bamboo viscose and related blends. The White House executive action that revised de minimis treatment and the federal-level processes that enable tariff stacking via emergency authorities are public and should be integrated into import-cost models and channel strategy reviews.

Beyond parcel-level rules, the continuing legacy of Section 301 and selective tariff lists targeting Chinese-origin goods means that procurement teams must evaluate alternative suppliers and build redundancy in sourcing. Although some duties and lists date from earlier policy cycles, their presence has led many brands to consider nearshoring, multi-country sourcing and increased inventory buffers to avoid surprise cost increases or shipment delays. At the same time, new Section 232 investigations initiated in 2025 into medical and industrial inputs have added another layer of uncertainty for companies producing healthcare-grade bamboo textiles and technical fabrics that may fall into national-security review processes. The net effect is an environment where commercial decisions about supplier selection, channel mix and pricing require closer coordination with customs counsel and global trade operations.

Where product applications, fabric construction, distribution channels and fiber processing choices intersect to determine differentiation, compliance needs, and margin potential in the bamboo textile value chain

Segmentation analysis shows how product, process and channel choices determine competitive positioning for bamboo fabrics. When viewed by end use, the category splits into distinct opportunity sets: apparel-where kidswear, menswear and womenswear demand different price and performance trade-offs; healthcare-where hospital linen, hygiene products and medical textiles require validated cleanliness, biocompatibility and supply resilience; home textile applications that include bath, bedding and curtains & drapes where consumer quality expectations and chemical-safety certifications drive purchasing decisions; and technical textile uses in agricultural, automotive and industrial settings where specification, durability and compliance are paramount. Each end-use cluster imposes different certification needs and tolerances for regenerated versus mechanical fibers, and this should guide R&D and supplier qualification priorities.

From a fabric-type perspective, material choices range from bamboo blend constructions to stand-alone bamboo linen, bamboo viscose and organic bamboo lines. Blends-especially cotton blends and viscose blends-are frequently used to tune cost, hand and wash performance; cotton-blend constructions often prioritize durability and cost-efficiency, while viscose blends emphasize drape and softness. The distribution channel segmentation differentiates offline from online dynamics: independent retailers, specialty stores and supermarkets & hypermarkets remain important for larger-format and value-oriented distribution, whereas brand websites and e-commerce platforms enable direct-to-consumer margins, quicker assortment testing and tighter traceability signals. Finally, the fiber-type split between mechanical fiber and regenerated fiber matters for sustainability claims and processing risk: mechanical fibers like bamboo linen and fiber felt support marketing narratives centered on natural processing, while regenerated fibers such as modal and viscose require explicit supplier-level environmental controls and certifications to substantiate responsible sourcing claims. Together, these segmentation lenses reveal where margin, compliance and brand-risk levers sit in the value chain and where investment in verification or product development will have the most leverage.

This comprehensive research report categorizes the Bamboo Fabric market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End Use

- Fabric Type

- Distribution Channel

- Fiber Type

How regional production capabilities, regulatory priorities and buyer expectations across the Americas, EMEA and Asia-Pacific shape sourcing choices and supply resilience for bamboo textiles

Regional dynamics are central to practical sourcing and go-to-market planning. The Americas continue to be a major demand center where premium bedding, performance apparel and an increasing share of technical textile procurement are concentrated; buyers in this region are particularly sensitive to traceability, chemical safety certifications and supplier resilience due to regulatory scrutiny and consumer expectations. Europe, Middle East & Africa exhibit a mixed policy environment: European buyers emphasize lifecycle credentials, ecolabels and closed-loop systems, while markets across the Middle East and Africa combine rising retail sophistication with opportunistic sourcing that favors competitive price points and reliable logistics. Asia-Pacific remains the dominant production hub for bamboo raw material processing and conversion, combining large-scale raw bamboo supply, established viscose and lyocell conversion capacity, and an extensive network of upstream pulp and finishing facilities. This concentration of manufacturing expertise supports scale but also concentrates risk when trade restrictions or supply shocks occur.

As a consequence, regional strategy must balance commercial priorities with regulatory realities. Companies should map which regions supply certifiable closed-loop viscose or mechanically processed linen, which regions offer cost advantages for blends, and which demand centers require tighter documentation or rapid replenishment. That mapping will determine inventory strategies, lead-time buffers and the extent to which nearshoring or multiple-source strategies are necessary to protect continuity of supply and brand claims.

This comprehensive research report examines key regions that drive the evolution of the Bamboo Fabric market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Which operational capabilities—traceability, closed-loop processing and tariff-aware supply chains—separate market leaders from laggards in the bamboo fabric ecosystem

Companies active in the bamboo textile space have differentiated themselves through vertical integration, adoption of advanced viscose technologies, or narrow specialization in mechanically processed fibers. Leaders that have invested in traceable dissolving pulp, partnerships with closed-loop fiber producers and third-party ecolabels are positioned to capture premium placements with sustainability-conscious buyers and institutional procurement teams. Other firms compete on flexibility and rapid-turn manufacturing that supports direct-to-consumer and private-label retail channels where speed-to-market and SKU variety can outcompete marginal sustainability differentials. A third group focuses on technical textiles-developing certified substrates for hygiene, filtration and automotive interiors where performance specifications and regulatory compliance create defensible B2B margins.

Across these company strategies, three operational attributes correlate strongly with commercial success: demonstrable supply-chain transparency (documented chain-of-custody and supplier audits), investment in low-impact or closed-loop processing technologies (to mitigate environmental and worker-risk exposures), and disciplined tariff and trade-risk management that keeps landed costs predictable. Firms that fail to explicitly address at least two of these attributes are increasingly vulnerable to buyer pushback and compliance costs, while those that do so can convert traceability and certification investments into commercial differentiation and more favorable retail placements. For buyers and investors, identifying where a supplier sits on this spectrum helps clarify how to prioritize partner selection and where to allocate due-diligence resources.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bamboo Fabric market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Zhejiang Tikyo Bamboo and Wood Industry Co., Ltd.

- Sichuan Texgreen Bamboo Textile Co., Ltd.

- Fujian Xinye Bamboo Biotechnology Co., Ltd.

- Jiangxi Jiujiujiu Bamboo Textile Group Co., Ltd.

- Xiamen Bamboo Fiber Technology Co., Ltd.

- Jiangxi Aimin Bamboo Fiber Technology Co., Ltd.

- ZIRK India Private Limited

- Bambro Textiles Private Limited

- Entwistle Bamboo Limited

- Sublime Bamboo Corporation

Actionable steps leaders should take now to convert compliance obligations and tariff uncertainty into supply resilience, validated sustainability claims and commercial differentiation

Leaders should treat the next 12–24 months as a window to convert compliance obligations into competitive advantage. First, prioritize verified traceability for any regenerated-cellulose inputs and require supplier documentation that distinguishes mechanically processed bamboo from viscose and lyocell. This reduces reputational risk and makes sustainability claims defensible. Second, accelerate qualification of closed-loop viscose and lyocell suppliers-companies that can demonstrate solvent recovery, lower water use and recognized ecolabels-because those relationships will be essential for premium retail listings and institutional procurement. Third, embed tariff-and-origin scenario planning into commercial forecasts and pricing models so that changes in parcel treatment, emergency tariff powers or targeted sector investigations can be reflected quickly in landed-cost and margin analyses.

Operationally, synchronization across procurement, legal and sales teams is critical. Procurement should maintain a validated back-up supplier list across at least two regions; legal and customs specialists should pre-clear classification and duty treatments; and sales or merchandizing leads should adjust assortment strategies so that channel-appropriate fabrics-whether blends for price-sensitive value channels or certified regenerated fibers for premium channels-are prioritized to the right distribution model. Finally, invest selectively in product-lifecycle and material-passport tools that enable batch-level claims and support downstream take-back or recycling pilots; these investments both satisfy rising regulatory expectations and open new premium positioning opportunities with sustainability-focused buyers.

A mixed-methods research approach combining primary interviews, supplier technical literature and official regulatory releases to ensure operationally relevant, verified insights

Research and analysis for this executive summary were compiled using a mixed-methods approach that combines primary interviews with industry procurement executives, fabric mills and certification bodies, plus secondary research from regulatory documents, trade press and supplier technical literature. Primary interviews focused on supplier processing methods, certification practices, lead-time variability and the practical implications of tariff changes on landed cost. Secondary sources were used to validate policy developments, closed-loop technology claims, and regional manufacturing capacity. Where public policy or regulatory changes are discussed, original government releases and Federal Register actions were referenced to ensure accurate reflection of the compliance environment.

Data synthesis favored triangulation: where a single data point could be interpreted differently, cross-checking occurred between supplier documentation, independent reporting and regulatory releases to minimize single-source bias. Technical claims about fiber processing and solvent-recovery performance were compared against manufacturer technical literature and recognized industry ecolabel criteria. The methodology intentionally emphasized operationally relevant evidence-supply chain documentation, certification status, and trade measures-so that recommendations remain practicable for commercial and compliance teams.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bamboo Fabric market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bamboo Fabric Market, by End Use

- Bamboo Fabric Market, by Fabric Type

- Bamboo Fabric Market, by Distribution Channel

- Bamboo Fabric Market, by Fiber Type

- Bamboo Fabric Market, by Region

- Bamboo Fabric Market, by Group

- Bamboo Fabric Market, by Country

- Competitive Landscape

- List of Figures [Total: 28]

- List of Tables [Total: 1029 ]

Reconciling agronomic advantages, contrasting processing footprints and 2025 trade policy changes to build a resilient and credible approach to bamboo-based textiles

The bamboo fabric landscape now requires executives to reconcile three realities: bamboo’s agronomic advantages, the environmental implications of different processing routes, and a trade-policy environment that has grown more interventionist. Mechanically processed bamboo linen preserves many of the crop’s natural sustainability attributes but remains a niche, higher-cost option. Regenerated fibers such as viscose and lyocell extend bamboo’s commercial applicability but demand rigorous supplier verification and technology choices that prioritize closed-loop recovery and responsible pulp sourcing. Meanwhile, tariff and customs changes in 2025 mean landed-cost calculations and channel strategies must be revisited with greater frequency than in past cycles.

For decision-makers, the practical implication is straightforward: invest in supplier due diligence, prioritize certified closed-loop or mechanically processed inputs for premium channel positioning, and integrate trade-compliance teams into product-and-pricing planning. Doing so reduces reputational risk, stabilizes margins under evolving tariff regimes, and creates the conditions necessary to scale bamboo-based materials where they make the most technical and commercial sense. The opportunities are real, but they require disciplined execution across sourcing, product development and compliance.

Immediate private briefing and purchasing support available from an Associate Director in Sales and Marketing to secure the full market research study and customized deliverables

To acquire a comprehensive, executive-level market research report tailored for commercial decision-making, please contact Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you through the report’s scope, explain the segmentation approach and methodology, and arrange secure access to the full study and any available add-ons such as bespoke country annexes, custom data tables, or a private briefing. Reach out to request a proposal that outlines licensing options, enterprise access terms, and an executive briefing plan to ensure your team extracts immediate strategic value from the research.

- How big is the Bamboo Fabric Market?

- What is the Bamboo Fabric Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?