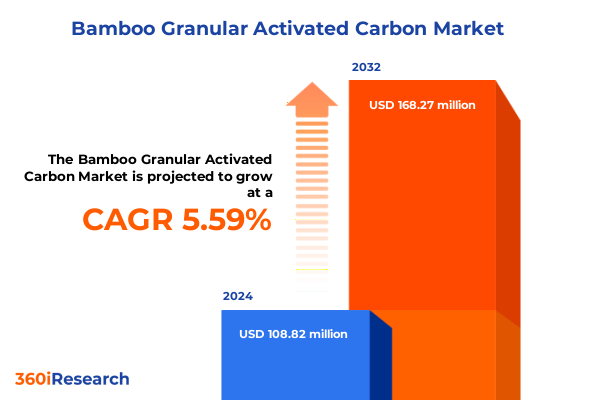

The Bamboo Granular Activated Carbon Market size was estimated at USD 114.68 million in 2025 and expected to reach USD 120.88 million in 2026, at a CAGR of 5.63% to reach USD 168.27 million by 2032.

Unveiling the Strategic Emergence and Widening Applications of Bamboo Granular Activated Carbon in Evolving Environmental and Industrial Markets

Bamboo Granular Activated Carbon has emerged as a strategically significant material due to its unique combination of sustainability and high-performance adsorption properties. Derived from rapidly regenerating bamboo biomass, this adsorbent exhibits a remarkable pore structure and surface area that enable it to capture contaminants with exceptional efficiency. Unlike conventional sources of activated carbon derived from coal or coconut shells, bamboo offers the dual benefits of rapid growth cycles and low ecological footprint, positioning bamboo activated carbon as a cornerstone of circular economy initiatives. Market stakeholders are increasingly recognizing these environmental advantages alongside the material’s technical merits, leading to an accelerated integration into diverse remediation and purification workflows.

As demand for cleaner water and air intensifies across regulatory landscapes, various industries are adopting bamboo granular activated carbon to meet stringent quality standards. In municipal water utilities, this adsorbent is deployed to remove trace organic compounds and residual disinfectants, ensuring compliance with ever-tightening environmental directives. Industrial players are leveraging its high adsorption capacity in gas treatment and air filtration systems, while the cosmetics sector benefits from its natural purity and marketing appeal in formulations claiming natural detoxification. The food and beverage industry similarly exploits its ability to eliminate off-flavors and impurities, underscoring its versatility across sectors.

This executive summary sets the stage for an in-depth exploration of transformative market shifts, the cumulative impact of recent U.S. trade measures, detailed segmentation analysis, and regionally nuanced perspectives. It culminates in strategic recommendations and a concise overview of the rigorous research methodology employed to generate these actionable insights. Readers will gain a thorough understanding of the current landscape and a clear roadmap for navigating the dynamic bamboo granular activated carbon market.

Identifying the Transformative Technological Regulatory and Market Innovations Shaping Bamboo Granular Activated Carbon Value Chains Globally

Technological innovation has been a primary catalyst in reshaping the landscape of bamboo granular activated carbon production and application. In activation processes, chemical activation using phosphoric acid or potassium hydroxide is increasingly preferred for its precise control over pore development and surface chemistry, resulting in materials tailored for specific adsorption challenges. Meanwhile, advances in physical activation protocols, notably steam and carbon dioxide treatment, are gaining traction among manufacturers seeking lower-chemical footprints and simplified effluent management. Hybrid approaches that combine chemical and physical techniques are now emerging, promising the optimized balance between performance and sustainability.

Concurrently, regulatory developments are redefining quality benchmarks and safety protocols across markets. In North America, updates to federal water treatment standards and ambient air quality guidelines have tightened permissible levels of organic micropollutants and volatile organic compounds, driving utilities and manufacturers to adopt higher-grade adsorbents. The European Union’s REACH and Cosmetics Regulation frameworks, as well as the U.K.’s post-Brexit regulatory regime, emphasize material traceability and compositional purity, further elevating the role of certified bamboo-derived adsorbents. In Asia-Pacific and EMEA regions, tightening pharmaceutical quality guidelines and food safety requirements are also fueling demand for high-performance activated carbons with verifiable raw material provenance.

Market dynamics are also being influenced by digitalization and performance monitoring innovations. Suppliers are deploying advanced process control systems and data analytics to refine activation parameters, ensuring batch-to-batch consistency. Blockchain-enabled traceability solutions are being piloted to authenticate bamboo sourcing and production pathways, catering to end-user demands for sustainability credentials. As these transformative trends converge, the bamboo granular activated carbon market is being redefined by a synergy of technological advancements, regulatory pressures, and supply chain transparency initiatives.

Assessing the Cumulative Effects of United States Trade Policies and 2025 Tariff Implementations on Bamboo Granular Activated Carbon Market Dynamics

On November 9, 2023, the United States International Trade Commission reaffirmed the continuation of an existing antidumping duty order on activated carbon imported from China, concluding in its five-year sunset review that revocation would likely lead to material injury in the U.S. market. This determination preserves duties on such imports at variable rates, effectively insulating domestic producers from a potential influx of lower-priced, China-origin products. For stakeholders in the bamboo granular activated carbon segment, which frequently sources specialized activation agents and machinery components from China, the persistence of these duties amplifies cost considerations and underscores the imperative for diversified supply strategies.

Layered onto antidumping measures are broader Section 301 tariffs imposed on Chinese-origin products, with additional escalations scheduled to take effect on January 1, 2025. Among the more than 350 harmonized tariff schedule classifications impacted are certain chemical precursors and processing equipment that are critical to activated carbon manufacture, including natural graphite and select catalyst materials. The newly finalized tariff increases reflect rates that are substantially higher than prior levels, compelling producers to navigate intricate customs classifications and consider eligibility for product exclusions where possible. The aggregate effect of antidumping orders and Section 301 levies has introduced greater supply chain complexity, prompting some manufacturers to explore alternative feedstocks, repurpose domestic reactivation facilities, and negotiate bulk contracts with non-Chinese suppliers to mitigate ongoing cost volatility.

Revealing Deep Segmentation Insights Reflecting Process Variations Raw Materials Applications and Distribution Channels Driving Market Differentiation

In analyzing process-based segmentation, two predominant activation methods emerge, each with distinct advantages and trade-offs. Chemical activation methods, which utilize activating agents such as phosphoric acid or potassium hydroxide, enable precise control over pore size distribution and surface functionalization, making them particularly suited for high-end applications requiring tailored adsorption selectivity. Conversely, physical activation processes rely on high-temperature steam or carbon dioxide treatment to develop porosity without the need for chemical agents, offering a lower environmental footprint and simplified effluent handling. The choice between these activation pathways is increasingly influenced by end-user demand for sustainability credentials as well as cost-efficiency considerations in large-scale production facilities.

When evaluating raw material segmentation, the distinction between bamboo waste and natural bamboo feedstock is central to material sourcing strategies. Bamboo waste encompasses byproducts from construction, furniture, and agricultural operations, delivering a circular economy advantage by repurposing biomass that would otherwise be discarded. Natural bamboo, harvested specifically for activated carbon production, affords greater consistency in fiber density and ash content, which translates to more predictable activation outcomes. Producers balance the availability and cost differentials of these inputs against end-product performance requirements, shaping strategic procurement decisions.

Application-based segmentation highlights a spectrum of end markets that leverage the unique properties of bamboo granular activated carbon. In air purification systems, its high microporosity and rapid adsorption kinetics are harnessed to remove volatile organic compounds and odors. Within the cosmetics industry, its benign origin and detoxification claims inform product formulations ranging from facial masks to exfoliants. The food and beverage sector deploys bamboo-derived adsorbents to eliminate off-flavors and trace contaminants in sugar refining and beverage conditioning. Industrial applications encompass flue gas treatment and solvent recovery, while the pharmaceutical field leverages its inertness for active pharmaceutical ingredient purification. Lastly, water treatment applications-from municipal drinking water to wastewater remediation-represent the most established market, driven by regulatory mandates and public health imperatives.

Distribution channel segmentation reveals a bifurcated landscape of direct and retail sales models. Direct sales, encompassing B2B portals and long-term contractual agreements, dominate high-volume and custom-tailored transactions, enabling suppliers to secure predictable off-take and foster collaborative product development. Retail sales channels, targeting smaller-scale end-users and niche application segments, rely on bulk packaging and e-commerce platforms to facilitate rapid procurement. This dual-channel structure affords market participants the flexibility to address both large institutional buyers and a dispersed network of specialized consumers.

This comprehensive research report categorizes the Bamboo Granular Activated Carbon market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Raw Material

- Process

- Granule Size

- Application

- Distribution Channel

Uncovering Key Regional Dynamics Highlighting the Americas Maturing Markets Europe Middle East Africa Complexities and Asia-Pacific Emerging Opportunities

In the Americas, market dynamics are shaped by a confluence of regulatory stringency and robust infrastructure investment. The United States Environmental Protection Agency’s tightening of drinking water standards for emerging contaminants, such as per- and polyfluoroalkyl substances, has driven utilities to adopt advanced adsorption media, with bamboo granular activated carbon gaining traction for its performance and sustainability credentials. Canada’s focus on municipal wastewater reuse and Latin America’s growing industrialization have similarly elevated the role of high-grade adsorbents. Supply chain considerations in North America are further influenced by protective trade measures and proximity to major manufacturing hubs, resulting in an ecosystem where both domestic production and selective imports coexist in response to demand.

Within Europe, Middle East, and Africa, diverse regulatory regimes and varying stages of economic development create a mosaic of market opportunities. Western European nations leverage stringent REACH chemistry protocols and ambitious circular economy policies to foster demand for traceable, bamboo-derived adsorbents. In the Middle East, large-scale water desalination projects have begun integrating bamboo-based activated carbon to enhance post-treatment quality, while African markets, though nascent, are exploring low-cost water purification solutions to address rural and peri-urban access challenges. Across the region, strategic alliances between local distributors and global manufacturers are emerging as a key enabler of market penetration.

Asia-Pacific continues to account for the lion’s share of both production and consumption, underpinned by abundant bamboo resources and established manufacturing infrastructure. China and India, in particular, have scaled up production capacities, targeting domestic water treatment projects and export markets. Southeast Asian nations are leveraging agricultural bamboo waste streams to develop niche value chains, supported by government incentives aimed at rural development and sustainable industry. The region’s rapid industrial growth, coupled with escalating environmental regulations in countries such as Japan and Australia, perpetuates strong demand for high-performance activated carbon solutions.

This comprehensive research report examines key regions that drive the evolution of the Bamboo Granular Activated Carbon market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Initiatives Driving Innovation Production and Competitive Positioning in the Bamboo Granular Activated Carbon Sector

The competitive landscape of the bamboo granular activated carbon sector features both multinational corporations and specialized regional entities advancing differentiated strategies. Established global players, including longstanding activated carbon manufacturers, are extending their portfolios to incorporate bamboo-based offerings, emphasizing investments in dedicated activation facilities and advanced process optimization. These organizations leverage established distribution networks and capital reserves to secure feedstock partnerships, while channeling resources into research and development aimed at enhancing adsorption specificity for emerging contaminants.

Regional specialists are carving out market niches through focused technological initiatives and strategic alliances. In Southeast Asia, producers are collaborating with bamboo plantation operators to establish vertically integrated supply chains that guarantee raw material traceability and cost efficiencies. European companies are differentiating their products through rigorous certification programs, such as ISO and third-party sustainability audits, positioning their bamboo granular activated carbon for premium applications in water and air treatment. In North America, emerging startups are forging partnerships with technology providers to pilot novel activation techniques that reduce energy consumption.

In parallel, industry participants are broadening their service portfolios to include reactivation services, on-site carbon replacement programs, and digital monitoring solutions. By offering turnkey service agreements that encompass periodic performance assessments and carbon reprocessing, suppliers are deepening customer relationships and driving recurring revenue streams. This service-centric model is complemented by technology licensing and joint development agreements, enabling smaller-scale manufacturers to adopt proven activation protocols without significant capital expenditure. Collectively, these strategic initiatives underscore a market in which both scale and specialization coexist to drive ongoing innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bamboo Granular Activated Carbon market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGICO Cement International Engineering Co., Ltd.

- BWG Bamboo Vietnam Group

- EcoBambu Bamboo Joint Stock Company

- Fujian Yuanli Active Carbon Co., Ltd.

- Jiangxi Futan New Materials Co., Ltd.

- Mhatre & Modi Specialty Chemicals

- Nanjing Zhengsen Environmental Protection Technology Co., Ltd.

- Ningxia Yongruida Carbon Co., Ltd.

- Piyali Engineering Corporation

- Shanghai Lekang Activated Carbon Co., Ltd.

- Vedic Orgo LLP

- Xiamen All Carbon Corporation

Developing Actionable Strategic Recommendations for Industry Leaders to Navigate Complexities of Supply Chains Innovation and Regulatory Environments Effectively

As the bamboo granular activated carbon market evolves, industry leaders are advised to prioritize continuous process optimization. Conducting systematic studies to refine activation parameters-including temperature profiles, dwell times, and activating agent concentrations-can yield materials with tailored porosity and surface chemistries suited to specific end uses. Investing in pilot-scale trials and leveraging process simulation tools will enable firms to accelerate innovation cycles, reduce energy consumption, and optimize yield, thereby enhancing competitive positioning in high-value application segments.

Securing stable, ethically managed bamboo supply chains is also imperative. Forming strategic alliances with agricultural cooperatives and waste management enterprises ensures consistent access to high-quality bamboo waste, mitigating raw material price volatility and reinforcing corporate sustainability narratives. By engaging in joint cultivation initiatives or long-term procurement agreements, companies can not only reduce input costs but also demonstrate tangible contributions to rural economies and environmental stewardship, enhancing stakeholder confidence.

To address the complexities introduced by trade measures, firms should explore diversified sourcing strategies and regional production models. Establishing or expanding manufacturing facilities in jurisdictions with favorable trade arrangements can insulate operations from tariff fluctuations and minimize logistics uncertainty. Pursuing eligibility for tariff exclusions and actively participating in advocacy for industry-friendly trade policies will further reduce cost burdens. Moreover, fostering relationships with non-Chinese equipment and chemical suppliers can secure alternate supply channels, bolstering resilience against future trade disruptions.

Finally, integrating digital traceability platforms and customer engagement tools will differentiate market offerings and strengthen client trust. Implementing blockchain-based provenance tracking or QR code-enabled product authentication provides end-users with transparent visibility into feedstock origins and process flows. Supplementing these capabilities with interactive dashboards that monitor carbon performance metrics in real time can position suppliers as technology partners rather than mere commodity vendors, facilitating long-term contractual relationships and unlocking new service revenue streams.

Outlining a Rigorous Multi-Stage Research Methodology Integrating Primary Interviews Secondary Data and Expert Validation to Ensure Comprehensive Market Insights

The research methodology underpinning this market analysis was designed to deliver a robust and comprehensive perspective on the bamboo granular activated carbon landscape. The process commenced with extensive secondary research, drawing upon industry journals, regulatory filings, patent databases, and trade publications to capture macroeconomic trends, technology developments, and policy frameworks. This foundational step established the parameters for subsequent primary investigations.

Primary research was conducted through in-depth interviews with a cross-section of industry stakeholders, including production managers, R&D directors, supply chain executives, and end-user procurement teams. These dialogues provided nuanced insights into operational challenges, emerging application requirements, and strategic priorities. Interview findings were systematically coded and integrated with secondary data to enhance contextual understanding.

To ensure analytical rigor, quantitative data obtained from company disclosures and trade databases were triangulated against qualitative inputs and external benchmarks. Where discrepancies arose, supplemental follow-up engagements and expert workshops were convened to reconcile divergent perspectives. This iterative validation process reinforced the reliability of key conclusions and segmentation models.

While every effort was made to access the latest industry data and stakeholder viewpoints, certain limitations exist due to proprietary constraints and evolving market dynamics. Confidentiality agreements governed primary research interactions, ensuring participants could share sensitive information candidly. The resulting analysis represents a synthesis of the most current and credible insights available as of the research cut-off date.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bamboo Granular Activated Carbon market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bamboo Granular Activated Carbon Market, by Raw Material

- Bamboo Granular Activated Carbon Market, by Process

- Bamboo Granular Activated Carbon Market, by Granule Size

- Bamboo Granular Activated Carbon Market, by Application

- Bamboo Granular Activated Carbon Market, by Distribution Channel

- Bamboo Granular Activated Carbon Market, by Region

- Bamboo Granular Activated Carbon Market, by Group

- Bamboo Granular Activated Carbon Market, by Country

- United States Bamboo Granular Activated Carbon Market

- China Bamboo Granular Activated Carbon Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Conclusive Reflections on Market Drivers Challenges and Strategic Imperatives Underpinning the Future Trajectory of Bamboo Granular Activated Carbon

The bamboo granular activated carbon market is at a pivotal juncture, shaped by technological innovations, evolving regulatory landscapes, and complex trade environments. Its dual promise of high-performance adsorption and sustainable feedstock sourcing has catalyzed adoption across a diverse array of end markets, from potable water treatment to industrial emissions control. As environmental and public health imperatives intensify, the demand for materials offering both efficacy and traceability will only heighten.

Stakeholders must navigate intricate segmentation dynamics and geopolitical variables to capitalize on growth opportunities. Those who invest in process optimization, cultivate resilient supply chains, and embrace digital traceability will be best positioned to differentiate their offerings and secure long-term partnerships. Ultimately, the convergence of performance excellence and sustainability credentials will define competitive leadership in the years ahead.

Engage with Ketan Rohom to Access Comprehensive Bamboo Granular Activated Carbon Market Insights and Secure Your Definitive Research Report Today

For readers seeking a comprehensive, data-driven exploration of the bamboo granular activated carbon market, engaging with Ketan Rohom will provide personalized guidance and direct access to the full research report. With expertise in sales and marketing analytics and a deep understanding of adsorbent technologies, Ketan can offer tailored insights, pricing structures, and implementation roadmaps. To elevate your strategic planning and secure a competitive edge, reach out today to initiate your report purchase and embark on your journey toward informed decision-making and market leadership.

- How big is the Bamboo Granular Activated Carbon Market?

- What is the Bamboo Granular Activated Carbon Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?