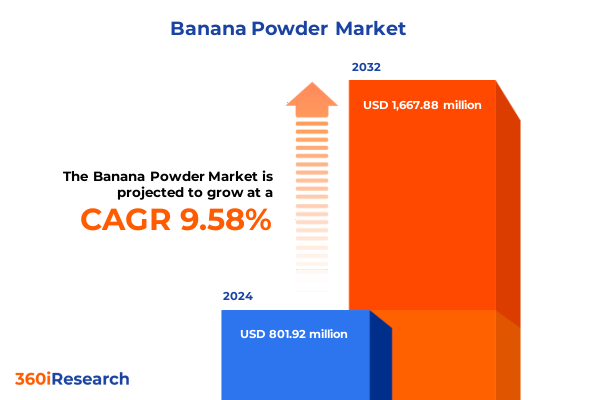

The Banana Powder Market size was estimated at USD 868.98 million in 2025 and expected to reach USD 945.18 million in 2026, at a CAGR of 9.76% to reach USD 1,667.87 million by 2032.

Unveiling the Core Dynamics of the Banana Powder Market Within a Shifting Consumer Landscape Driven by Health Preferences and Innovation

The banana powder market is experiencing an inflection point as evolving consumer priorities and technological breakthroughs converge to redefine its role across food and nutrition ecosystems. In an era where health consciousness and convenience are paramount, banana powder has emerged as a versatile ingredient that addresses demand for natural flavor, functional nutrition, and extended shelf life. Its intrinsic attributes-nutrient density, fiber content, and inherent sweetness-align closely with the growing focus on clean-label formulations and plant-based wellness solutions. These drivers are encouraging manufacturers to innovate new product formats and applications that extend beyond traditional categories such as baking and confectionery into dietary supplements and sports nutrition.

Moreover, the nutritional profile of banana powder, including its potassium content and antioxidant potential, further amplifies its appeal among health-oriented consumer segments. As more brands incorporate fruit-based powders into ready-to-drink beverages, fortified snacks, and infant formula, the ingredient’s role shifts from a simple flavor enhancer to a functional component that delivers measurable benefits. Concurrently, the convergence of improved drying techniques, supply chain digitization, and sustainability mandates is reshaping how banana powder is produced, packaged, and distributed. This introductory overview frames the comprehensive analysis that follows, highlighting why banana powder is swiftly moving from niche usage toward mainstream adoption in both industrial and retail arenas.

Examining the Transformational Forces Reshaping Banana Powder Production Distribution and Consumer Engagement Across Global Supply Chains

Over the past two years, the banana powder value chain has undergone profound changes driven by technological, regulatory, and market dynamics. Innovations in spray drying, freeze drying, and air drying have enhanced flavor retention, nutrient preservation, and powder functionality, enabling producers to offer higher-quality products at scale. These advancements have empowered manufacturers to meet stringent clean-label requirements, reduce processing energy footprints, and tailor particle size for specific applications like instant beverages and encapsulated flavor blends. Meanwhile, blockchain-based traceability solutions are increasingly adopted to verify origin, certify organic credentials, and ensure transparency from plantation to powder silo, thereby strengthening trust among consumers and B2B partners.

Digital commerce platforms have also shifted power dynamics within the banana powder ecosystem. E-commerce channels are expanding reach and lowering barriers to entry for niche players offering organic or specialty formulations, while larger suppliers are leveraging data analytics to optimize pricing, forecast demand, and streamline logistics. At the same time, sustainability imperatives are prompting companies to evaluate water usage, carbon emissions, and waste management at every stage of the drying process. This transformative phase underscores how the intersection of innovation, digitalization, and environmental stewardship is reshaping the production, marketing, and consumption of banana powder across global supply chains.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on the Competitiveness and Pricing Dynamics of Banana Powder Imports

In early 2025, new tariff schedules imposed by the United States government targeted select agricultural and specialty food ingredients, including freeze-dried and spray-dried fruit powders. These measures increased import duties on processed banana products by a significant margin, altering the cost structure for import-dependent suppliers and widening the price gap between domestic and foreign producers. As importers faced higher landed costs, many were compelled to pass these increases along to industrial buyers, which rippled through to food manufacturers, beverage formulators, and retail private labels.

Domestic banana powder producers gained a relative advantage under the new tariff regime, prompting several to expand processing capacity and invest in efficiency-enhancing technologies. However, the price sensitivity of end consumers limited the full absorption of cost increases, leading some brands to reformulate blends, incorporate cost-effective carriers, or negotiate raw material contracts earlier in the season. Despite these challenges, the tariff-triggered realignment stimulated greater local sourcing efforts, fostered partnerships with U.S. banana growers in tropical regions, and accelerated innovation in processing methods to offset higher duty burdens. In sum, the cumulative impact of the 2025 United States tariffs has redefined competitive positioning, cost management strategies, and supply chain agility within the banana powder market.

Unearthing Distinct Consumer and Industry Segments Through Form Type Packaging Application Distribution Channel and End User Perspectives

Insights into the banana powder market become clearer when examined through multiple segmentation lenses that shape demand and supply strategies. When evaluating product form, air dried variants continue to capture attention for their cost efficiency, whereas freeze dried options appeal to premium segments seeking maximum nutrient retention and flavor fidelity; spray dried formats, meanwhile, facilitate blend uniformity in powdered mixes and instant beverage systems. In parallel, the conventional segment remains the backbone of mass-market offerings, while organic banana powders are carving out a niche among health-conscious consumers willing to pay a premium for certified non-GMO and pesticide-free credentials.

Packaging innovations further define differentiation strategies; bulk bags serve industrial food manufacturers prioritizing volume and cost-effectiveness, jars cater to retail shoppers seeking resealability and premium shelf appeal, and single-serve sachets align with on-the-go consumption trends and sample distribution tactics. The breadth of applications-from bakery formulations and beverage blends to confectionery inclusions, dietary supplement capsules, infant formula fortifications, and sports nutrition powders-highlights banana powder’s versatility. Distribution channels shape go-to-market approaches as well, with offline sales through convenience stores and specialty retailers offering tactile shopping experiences and immediate availability, while supermarket and hypermarket chains provide mass reach and brand visibility; online platforms complement these by unlocking geographic flexibility and targeted digital marketing. Lastly, end user segmentation underscores divergent needs: food manufacturers demand consistent functional properties, ingredient stability, and bulk supply agreements, whereas retail consumers seek transparent labeling, innovative usage formats, and value-driven pricing structures.

This comprehensive research report categorizes the Banana Powder market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Type

- Packaging

- Distribution Channel

- Application

- End User

Illuminating Regional Demand Drivers Supply Chain Nuances and Growth Potential Across Americas Europe Middle East Africa and Asia-Pacific Markets

Regional nuances play a pivotal role in shaping banana powder dynamics across the globe. In the Americas, the United States leads demand through robust consumption in bakery and beverage sectors, supported by well-established import networks and large-scale food processing industries. Latin American producers, particularly in Brazil and Ecuador, serve as key exporters, leveraging proximal supply chains to minimize transit time and preserve product quality. This proximity also underpins collaborative initiatives centered on sustainable farming practices and fair trade certification, which resonate strongly with North American buyers.

The Europe, Middle East and Africa region presents a tapestry of demand drivers and logistical considerations. Western European markets prioritize organic and clean-label ingredients, leading to a premium segment for freeze dried and certified organic powders. Meanwhile, Southern Europe and parts of the Middle East are witnessing steady growth in functional food launches that incorporate banana powder for texture enhancement and flavor modulation. Africa’s expanding retail infrastructure is gradually opening opportunities for sachet-packaged banana powder, though supply chain bottlenecks and currency fluctuations remain challenges for consistent market penetration.

Asia-Pacific functions as both a major production hub and an emerging consumption frontier. Nations such as India and Indonesia boast abundant banana cultivation, resulting in capital investments in localized drying and value-add processing plants. China and Southeast Asian markets are increasingly incorporating banana powder into powdered beverage mixes and dietary supplement blends, driven by rising disposable incomes and growing awareness of fruit-based nutrition. Cross-border trade within Asia-Pacific benefits from regional trade agreements that reduce tariffs on agricultural products, facilitating smoother movement of powdered goods and strengthening interlinked supply networks.

This comprehensive research report examines key regions that drive the evolution of the Banana Powder market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives Competitive Positioning and Innovation Roadmaps of Leading Banana Powder Manufacturers and Suppliers Globally

A survey of leading companies in the banana powder landscape reveals a spectrum of strategic priorities, from operational expansion to product innovation. Several global ingredient suppliers have deepened partnerships with banana growers in tropical geographies, securing exclusive sourcing agreements and enabling year-round supply. These collaborations are often complemented by investments in advanced drying lines and automated quality control systems, ensuring batch-to-batch consistency and adherence to stringent food safety standards.

Product innovation is another focal point for market leaders. R&D teams are exploring novel encapsulation techniques to enhance flavor longevity, mixability, and nutrient bioavailability. Some manufacturers have launched branded banana powder variants that emphasize prebiotic fibers or probiotic compatibility, targeting high-growth segments in digestive health formulations. Others have prioritized organic certifications and non-GMO validation to align with retailer and consumer demands in developed markets.

On the competitive front, mergers and acquisitions have gained momentum as companies seek to diversify their ingredient portfolios and expand geographic footprints. New entrants with specialized expertise in freeze drying have attracted investment from strategic buyers aiming to bolster premium product lines. Simultaneously, established players are leveraging digital marketing platforms and e-commerce partnerships to increase direct-to-consumer engagement, offering recipe inspiration and subscription models that foster brand loyalty. These company-level strategies collectively reflect a dynamic ecosystem where scale, specialization, and innovation converge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Banana Powder market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarkay Food Products Ltd.

- AGRANA Beteiligungs-AG

- Banatone Industries

- Chiquita Brands International Sàrl

- Cool Milling Ventures Corporation

- Dole plc

- Döhler GmbH

- Fresh Del Monte Produce Inc.

- Hunan MT Health Inc.

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kanegrade Limited

- Mevive International

- Naturalin Bio-Resources Co. Ltd.

- NuNaturals Inc.

- NUTRIBUD FOODS PRIVATE LIMITED

- Saipro Biotech Pvt. Ltd.

- Symrise AG

- Taj Agro International

- Vinayak Ingredients Pvt. Ltd.

Offering Practical Strategic Roadmaps and Priority Initiatives for Industry Leaders to Capitalize on Emerging Opportunities in the Banana Powder Value Chain

Industry stakeholders looking to strengthen their market position should prioritize strategic diversification of supply sources by establishing alliances with multiple banana producers across different regions to mitigate climatic and geopolitical risks. Concurrently, investing in advanced drying technologies-such as hybrid freeze and spray methods-can optimize micronutrient preservation and flavor retention while lowering operational costs over the long term. To capitalize on escalating demand for clean-label and organic ingredients, achieving third-party certifications and transparent traceability is essential, and companies should allocate resources to meet evolving regulatory standards and retail requirements.

To capture the shift toward direct-to-consumer channels, ingredient suppliers and brand owners can build robust digital platforms that offer customized formulation services, interactive recipe content, and seamless subscription options. Collaboration with ingredient technology startups and research institutions will accelerate the development of value-added formulations, such as fiber-enriched or probiotic-compatible banana powders, tapping into wellness trends. Additionally, optimizing packaging innovation-focusing on sustainable materials and user convenience-can differentiate offerings in both retail and institutional segments. By aligning these recommendations with a holistic sustainability narrative that addresses water conservation, waste reduction, and fair-trade participation, industry leaders will be well-positioned to drive growth and resilience in the banana powder market.

Detailing a Research Framework Encompassing Multi-Stage Data Acquisition Analytical Methodologies and Validation Protocols Underpinning the Banana Powder Study

This study is underpinned by a rigorous, multi-stage research framework combining primary and secondary data sources. The process began with a comprehensive review of industry publications, trade journals, and publicly available company documents to establish baseline knowledge of production technologies, application landscapes, and regulatory environments. Following this, expert interviews were conducted with processing plant managers, procurement directors at food ingredient distributors, and technical specialists in drying technologies to validate supply-side insights and identify emerging trends.

Quantitative data was triangulated using multiple proprietary and public databases to map historical shipment volumes, application penetration rates, and product launch activity across key regions. Analytical methodologies included SWOT analysis for competitive profiling, value chain mapping to assess cost structures, and scenario planning to evaluate the impact of external factors such as tariffs and sustainability regulations. Validation protocols comprised iterative reviews with an advisory panel of industry veterans and cross-checking against baseline figures provided by leading trade associations. This comprehensive approach ensures that the conclusions and recommendations presented herein are grounded in robust evidence and industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Banana Powder market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Banana Powder Market, by Form

- Banana Powder Market, by Type

- Banana Powder Market, by Packaging

- Banana Powder Market, by Distribution Channel

- Banana Powder Market, by Application

- Banana Powder Market, by End User

- Banana Powder Market, by Region

- Banana Powder Market, by Group

- Banana Powder Market, by Country

- United States Banana Powder Market

- China Banana Powder Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Drawing Cohesive Insights and Strategic Implications from the Banana Powder Market Analysis to Inform Future Decision-Making and Industry Roadmaps

The analysis of the banana powder market underscores its transition from a niche flavoring agent to a strategic functional ingredient driven by health trends, processing innovations, and evolving distribution models. Key takeaways highlight the significance of advanced drying methods in capturing premium segments, the influence of 2025 United States tariffs on competitive positioning, and the criticality of segmentation strategies across form, type, packaging, application, distribution, and end user contexts.

Regional insights reveal divergent growth trajectories, with the Americas leveraging established supply chains, EMEA prioritizing organic and clean-label credentials, and Asia-Pacific balancing production scale with rising domestic consumption. Company-level dynamics center on strategic sourcing alliances, product innovation in encapsulation and fortification, and M&A activities that strengthen technological capabilities and market access. Actionable recommendations focus on supply diversification, technology investment, certification attainment, digital channel development, and sustainability alignment.

Ultimately, the market’s trajectory will be shaped by the ability of stakeholders to anticipate regulatory shifts, respond to consumer preferences for natural and functional ingredients, and harness technological advancements in processing and logistics. This comprehensive perspective provides decision-makers with the insights needed to navigate complexities and seize opportunities in the rapidly evolving banana powder landscape.

Connect Directly with Ketan Rohom Associate Director Sales and Marketing to Secure Your Banana Powder Market Research Report and Gain Actionable Insights

To explore this in-depth and secure the insights that will shape your strategic positioning, connect directly with Ketan Rohom Associate Director Sales and Marketing to secure your Banana Powder Market Research Report and gain actionable insights tailored to your business objectives

- How big is the Banana Powder Market?

- What is the Banana Powder Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?