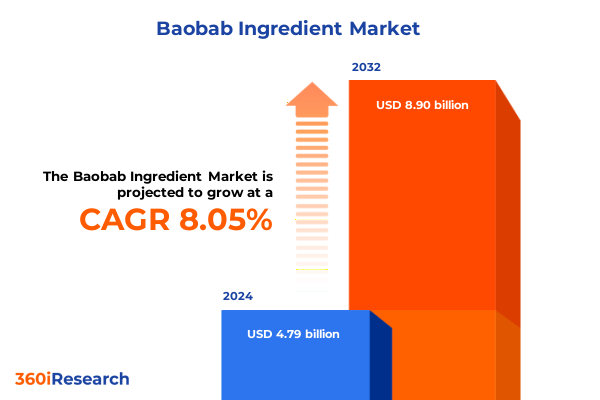

The Baobab Ingredient Market size was estimated at USD 5.12 billion in 2025 and expected to reach USD 5.47 billion in 2026, at a CAGR of 8.23% to reach USD 8.90 billion by 2032.

Setting the Stage for a New Era in Baobab Ingredient Adoption Across Diverse Industries and Emerging Consumer Health Trends

The baobab fruit has emerged as a symbol of natural wellness and versatility, captivating industries ranging from food and beverage to cosmetics. This powerhouse ingredient, derived from an iconic African tree, is distinguished by its exceptional nutrient density and functional properties. With growing consumer emphasis on clean-label products and plant-based nutrition, baobab has transcended niche status to become a mainstream functional ingredient.

Against this dynamic backdrop, businesses across varied sectors are exploring baobab’s unique profile to drive product differentiation and support health-conscious brand narratives. Its antioxidant-rich profile and prebiotic fiber content resonate strongly with wellness-oriented consumers, while its sensory neutrality facilitates broad application in formulations. As a result, manufacturers and ingredient suppliers alike are strengthening their value propositions through targeted baobab integrations.

Consequently, stakeholders are seeking deeper insights into evolving consumer preferences, regulatory frameworks, and supply chain considerations. This executive summary sets the stage by outlining key developments, market drivers, and strategic imperatives shaping the baobab ingredient landscape today. It offers a concise yet comprehensive lens through which decision-makers can orient their innovation pipelines, align with emerging sustainability expectations, and anticipate challenges in a rapidly evolving marketplace.

Understanding How Innovation, Sustainability Demands, And Regulatory Changes Are Transforming The Baobab Ingredient Landscape Globally

Innovation and sustainability are converging to redefine the baobab ingredient ecosystem. On the one hand, breakthroughs in extraction technologies are unlocking higher yields of bioactive compounds, enabling formulators to deliver enhanced efficacy while maintaining product integrity. On the other hand, mounting regulatory scrutiny around sourcing practices has prompted an industry-wide pivot toward traceable, ethically harvested raw materials. Consequently, supply chain transparency has become a pivotal differentiator among leading providers.

Moreover, evolving consumer expectations for clean, green ingredients have driven rapid adoption of certifications that validate organic status and fair trade credentials. These credentials are now nearly indispensable for brands targeting the health and wellness market. At the same time, strategic partnerships between producers and research institutions are accelerating clinical studies on baobab’s functional benefits, laying the groundwork for future substantiation of health claims in key markets.

Transitioning seamlessly into digital ecosystems, ingredient suppliers are leveraging blockchain and other data-driven solutions to monitor quality metrics in real time, thereby minimizing risks associated with adulteration and logistical inefficiencies. Together, these transformative forces are shaping an industry that is more agile, transparent, and evidence-based than ever before, establishing a robust foundation for sustained growth and innovation.

Analyzing The Far-Reaching Effects Of Newly Imposed United States Tariffs In 2025 On Baobab Ingredient Importation And Value Chain Dynamics

United States authorities introduced a revised tariff structure in early 2025 affecting imported botanical ingredients, with baobab among the list of reclassified items. As a result, businesses reliant on African-sourced raw material have encountered a recalibration of landed costs, prompting adjustments in pricing strategies and supply chain configurations. This policy shift has influenced stakeholder decisions around inventory management and contract negotiations, particularly for those operating on thin margin structures.

In response, some enterprises have prioritized vertical integration efforts by establishing processing facilities closer to points of origin, thereby insulating operations from customs-related volatility. Others have forged long-term supplier agreements to secure preferential terms and reduce exposure to fluctuating duties. Consequently, downstream manufacturers have begun to reassess their product development roadmaps, integrating cost containment measures into formulation planning.

Looking ahead, this tariff landscape underscores the importance of proactive trade compliance and strategic diversification of feedstock sources. Companies are now increasingly exploring alternative markets for baobab procurement or blending baobab with complementary local botanicals to mitigate fiscal impact. These adaptive strategies reflect a broader industry imperative: to preserve product affordability and maintain market competitiveness in the face of evolving trade regulations.

Revealing Critical Insights Derived From Diverse Baobab Ingredient Segmentation Across Form Extraction Method Source Type Grade And Distribution Channel

Market participants have adopted a multidimensional approach to segmentation, beginning with the array of physical forms in which baobab ingredient is available. From capsules offering standardized dosing for supplement brands, to extracts that concentrate polyphenols and fiber for functional formulations, to oils prized for emollient action in skincare, and finally to powdered variants that integrate seamlessly into beverages, bakery, and nutritional bars, each form addresses distinct customer needs and usage patterns.

When examining extraction methods, cold pressing serves to preserve delicate vitamins and unsaturated fatty acids; solvent extraction facilitates high-purity isolations; and supercritical CO2 extraction is valued for its environmental profile and ability to yield contaminant-free concentrates. Parallel to these technical distinctions, source type emerges as a fundamental driver, with conventional harvests offering cost advantages and organic-certified operations commanding premium positioning.

Grading frameworks further refine product classification, delineating cosmetic grade for personal care applications, food grade for edible formulations, and pharmaceutical grade where stringent purity standards are paramount. Distribution channels diverge between B2B customers-ranging from cosmetic and pharmaceutical companies to food and beverage manufacturers and dietary supplement producers-and B2C outlets, which encompass specialty health stores, e-commerce platforms, and traditional supermarkets and hypermarkets.

Finally, end use industries illustrate the breadth of baobab’s applicability. Animal nutrition leverages its mineral profile for feed supplements; cosmetics and personal care brands formulate anti-aging, hair care, and skin care products; food and beverage sectors incorporate baobab into bakery, confectionery, dairy, snack bars, cereals, and sports nutrition applications; nutraceutical and dietary supplement providers utilize it for antioxidants, digestive health, immunity, and weight management; and pharmaceutical formulations include anti-inflammatory, digestive, immune health supplements, and traditional herbal remedies.

This comprehensive research report categorizes the Baobab Ingredient market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Extraction Method

- Source Type

- Grade

- Distribution Channel

- End Use Industry

Examining Regional Variations In Baobab Ingredient Adoption Highlighting Distinctive Market Drivers Across Americas EMEA And Asia-Pacific

Regional dynamics for baobab ingredient adoption reveal divergent growth trajectories and regulatory landscapes. In the Americas, consumer demand for functional foods and nutraceuticals continues to surge, underpinned by robust retail channels and a mature regulatory framework that accommodates botanical ingredient usage. Manufacturers in this region are increasingly integrating baobab into sports nutrition and dietary supplement portfolios, capitalizing on high consumer awareness of natural health solutions.

By contrast, Europe, the Middle East & Africa presents a complex mix of advanced markets where strict safety assessments govern ingredient approvals alongside emerging economies that offer abundant raw material access and artisanal production models. Here, regulatory harmonization efforts and regional trade agreements are gradually simplifying cross-border commerce, while sustainability-driven procurement practices are reshaping supply partnerships.

Meanwhile, Asia-Pacific is distinguished by dynamic consumer trends favoring traditional botanicals and a growing appetite for Western-style functional products. Regulatory agencies in key markets such as Japan, Australia, and China are enhancing their frameworks to better accommodate novel food ingredients, which opens new avenues for baobab integration in beverages, confectionery, and personal care formulations. Across all territories, the interplay between regulation, consumer preference, and supply chain evolution continues to define strategic priorities for stakeholders seeking to expand their footprint in the global baobab ingredient market.

This comprehensive research report examines key regions that drive the evolution of the Baobab Ingredient market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Entities Shaping The Baobab Ingredient Market Through Innovation Collaborations And Strategic Positioning Worldwide

A select group of pioneering companies has catalyzed the emergence of baobab as a mainstream ingredient. Leading botanical extract specialists have invested heavily in proprietary extraction platforms, optimizing yield and purity to serve high-value personal care and pharmaceutical applications. Concurrently, vertically integrated producers have established direct partnerships with community cooperatives, ensuring consistent quality and fostering local socioeconomic development.

Ingredient distributors with global reach have incorporated baobab into their product portfolios, leveraging established sales channels to accelerate market penetration. These organizations have also facilitated regulatory support services, helping brand owners navigate compliance requirements in diverse jurisdictions. At the same time, innovative startups have differentiated themselves by focusing on sustainable harvesting methods and transparent supply chains, appealing to ethically minded consumers and premium brand segments.

Collaborations between research institutions and commercial entities are further driving product innovation, with co-funded studies validating baobab’s functional benefits and enabling stronger health claims. Across the value chain, these corporate and academic synergies are setting benchmarks for quality, traceability, and clinical substantiation, solidifying baobab’s position as a go-to ingredient for next-generation wellness and personal care formulations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baobab Ingredient market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aduna Ingredients

- Arusha

- Baobab Foods

- Botanica Natural Products

- Cliganic

- Grounded Ingredients

- Iswari

- NEXIRA

- Organic Baobab

- Purenso

- Supplement Factory Ltd.

- The Naked Pharmacy Ltd.

Identifying Strategic Imperatives For Industry Leaders To Capitalize On Baobab Ingredient Opportunities While Navigating Complex Market Dynamics

Industry leaders should prioritize forging direct relationships with baobab growers to secure high-quality raw materials and reinforce supply chain resilience. By engaging in long-term off-take agreements and capacity-building initiatives, organizations can drive stability in sourcing while demonstrating commitment to sustainable practices. Moreover, investing in advanced extraction technologies will enable differentiation through enhanced potency and purity, meeting the exacting standards of pharmaceutical and premium personal care markets.

Simultaneously, companies must navigate evolving regulatory frameworks by aligning product development with emerging safety guidelines and proactively pursuing novel food approvals where required. Collaboration with expert consultants and regulatory bodies can expedite compliance processes and mitigate time-to-market risks. From a product strategy perspective, formulators are encouraged to explore synergistic blends that pair baobab with complementary botanicals or functional ingredients, thus unlocking new application opportunities.

Finally, transparent storytelling and evidence-based marketing are essential to build consumer trust. Stakeholders should leverage clinical research findings and sustainability credentials to craft compelling brand narratives. By integrating digital traceability solutions, businesses can offer end consumers visibility into the ingredient’s journey from harvest to shelf, reinforcing authenticity and driving premium positioning in crowded marketplaces.

Outlining Rigorous Research Methodology Employed To Ensure Data Integrity Comprehensive Analysis And Credible Insights On Baobab Ingredient Trends

The foundation of this research rests on a robust dual approach combining comprehensive secondary research with targeted primary investigations. Initially, an extensive review of academic journals, industry publications, regulatory documents, and trade databases was undertaken to map the current state of the baobab ingredient ecosystem. This desk research provided baseline insights into historical trends, regulatory trajectories, and technological advancements.

Building on these findings, primary interviews were conducted with a diverse cohort of stakeholders, including extraction technology vendors, ingredient distributors, brand formulators, and regulatory experts. These conversations offered nuanced perspectives on operational challenges, innovation roadmaps, and strategic priorities. Additionally, case studies were developed in collaboration with industry partners to illustrate best practices and real-world applications of baobab across multiple sectors.

All data points underwent rigorous triangulation, reconciling quantitative metrics with qualitative inputs to ensure accuracy and reliability. Analytical frameworks encompassing supply chain robustness, competitive landscape assessment, and segmentation analysis were applied to distill actionable insights. Together, these methodological rigor and multi-source validation protocols underpin the credibility of the conclusions drawn throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baobab Ingredient market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baobab Ingredient Market, by Form

- Baobab Ingredient Market, by Extraction Method

- Baobab Ingredient Market, by Source Type

- Baobab Ingredient Market, by Grade

- Baobab Ingredient Market, by Distribution Channel

- Baobab Ingredient Market, by End Use Industry

- Baobab Ingredient Market, by Region

- Baobab Ingredient Market, by Group

- Baobab Ingredient Market, by Country

- United States Baobab Ingredient Market

- China Baobab Ingredient Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings To Highlight The Transformative Potential And Future Trajectory Of Baobab Ingredient Utilization In Multiple Sectors

This executive summary highlights the multifaceted potential of baobab ingredient as a versatile, nutrient-dense botanical poised to disrupt traditional product formulations. From its rich vitamin and fiber profile to its adaptable form factors and extraction modalities, baobab addresses an array of industry needs. The transformative shifts in sustainability expectations, coupled with advancements in extraction technology and clinical substantiation, underscore baobab’s trajectory toward mainstream adoption.

The 2025 United States tariff adjustments have catalyzed strategic realignments in supply chain design and cost management, reinforcing the need for agile sourcing strategies. In parallel, detailed segmentation analyses reveal that differentiated approaches across form, extraction method, source type, grade, distribution channel, and end use industry are critical to meeting distinct market demands.

Regional patterns illustrate that mature markets in the Americas and Europe, the Middle East & Africa coexist with high-growth opportunities in Asia-Pacific, each governed by unique regulatory and consumer landscapes. Leading companies are setting benchmarks through innovation partnerships, sustainable practices, and transparent supply networks. Together, these insights form a cohesive narrative that underscores baobab’s transformative potential and its capacity to unlock new value propositions across health, wellness, and personal care domains.

Taking Action To Enhance Business Outcomes By Securing The Comprehensive Baobab Ingredient Market Insights Report For Informed Strategic Decision Making

To delve deeper into the evolving dynamics of the baobab ingredient sphere and gain a competitive edge in strategic planning, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging with a tailored briefing, stakeholders will unlock nuanced insights that guide product development, regulatory navigation, and partnership initiatives. A personalized consultation with Ketan provides an opportunity to discuss specific business objectives, understand bespoke research deliverables, and outline a bespoke engagement framework.

Embracing this next step ensures access to the most comprehensive and actionable intelligence on baobab ingredient innovations, sustainability pathways, and market intricacies. Decision-makers seeking to fortify their supply chain resilience and capitalize on emerging health and wellness trends will find this report indispensable. Connect with Ketan Rohom today to secure your copy of the full market research report and set the stage for informed strategic decision making and operational excellence.

- How big is the Baobab Ingredient Market?

- What is the Baobab Ingredient Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?