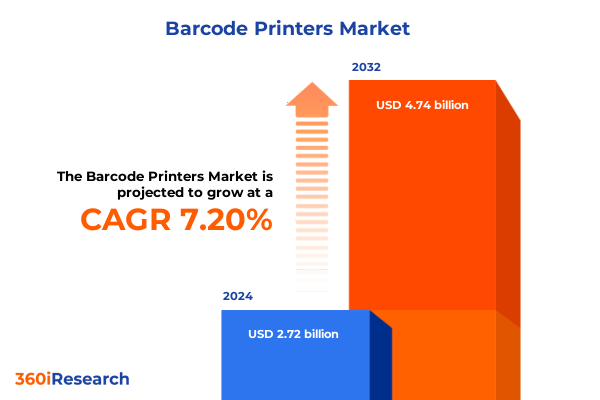

The Barcode Printers Market size was estimated at USD 2.87 billion in 2025 and expected to reach USD 3.04 billion in 2026, at a CAGR of 7.41% to reach USD 4.74 billion by 2032.

Unveiling the Dynamic Evolution of Barcode Printing Technologies Amidst Emerging Trends and Structural Shifts Reshaping Industry Performance

The barcode printer market is at the forefront of modernization, with AI-powered predictive maintenance systems emerging to minimize equipment downtime and optimize maintenance schedules. Manufacturers are adopting advanced sensor arrays integrated with AI algorithms to foresee potential failures before they impact operations, a trend highlighted by industry surveys showing significant cost savings through reduced unplanned downtime. Simultaneously, the rise of cloud-based printing platforms enables centralized printer management, remote configuration, and real-time print-job monitoring, streamlining workflows across distributed operations and reflecting the growing shift towards SaaS delivery models. Furthermore, sustainability concerns are reshaping product design and consumables selection, driving innovations such as recyclable thermal papers, energy-efficient print modules, and soy-based inks, which address mounting regulatory pressures and corporate sustainability goals.

Transitioning from analog workflows to digital-first operations, organizations are placing renewed emphasis on seamless integration between printing hardware and broader enterprise systems. This integration is enabling real-time data capture and traceability, reinforcing barcode printers as mission-critical components in smart factories, omnichannel retail environments, and dynamic logistics networks. As these foundational trends coalesce, the barcode printing sector is poised for a period of rapid evolution characterized by enhanced performance, ecological accountability, and heightened connectivity.

Exploring the Technological Revolutions and Operational Transformations Redefining Barcode Printing Across Diverse Industry Verticals and Use Cases

Technological revolutions within the barcode printing sector are driven by AI-powered predictive maintenance modules that leverage real-time diagnostics to anticipate equipment faults, enabling proactive service scheduling that drives operational efficiency. Moreover, the integration of cloud-based printing platforms has provided enterprises with unprecedented control over remote device fleets, allowing centralized configuration of print parameters and bi-directional data exchange critical to modern digital supply chains. In parallel, the push towards mobility and wearable solutions is extending the reach of barcode printing beyond fixed workstations, empowering field service technicians, healthcare practitioners, and retail associates with portable, wireless printing capabilities that seamlessly integrate with handheld scanners and tablets. Sustainability has also become a cornerstone of innovation, prompting the development of eco-friendly consumables and energy-optimized hardware, as organizations strive to meet stricter environmental mandates and corporate responsibility targets. These transformative shifts signal a broader confluence of digitalization, connectivity, and ecological stewardship redefining the capabilities and roles of barcode printers across industry verticals.

Furthermore, the emergence of voice-enabled printing functionality is facilitating hands-free operations in high-volume or safety-critical environments, enabling operators to initiate print jobs via simple voice commands that accelerate throughput and reduce manual handling errors. Coupled with advanced IoT sensors, these voice-activated systems feed performance metrics into unified dashboards that inform continuous improvement initiatives. Looking ahead, the integration of next-generation communication protocols promises to bolster on-demand printing performance, ensuring ultra-low latency and reliable operation in distributed production scenarios. As these convergent capabilities mature, they will underpin a new era of intelligent, responsive, and sustainable barcode printing ecosystems.

Assessing the Far Reaching Consequences of 2025 U.S. Tariff Policies on Barcode Printer Supply Chains, Pricing Dynamics, and Industry Adaptation

In early 2025, the United States government enacted sweeping tariff measures imposing a 25 percent duty on imports from Canada and Mexico alongside a 20 percent levy on Chinese goods, citing national security and fair trade concerns. These actions have reverberated across global supply chains, compelling hardware manufacturers and importers of barcode printing equipment to reassess supplier relationships, reconfigure logistics networks, and absorb elevated input costs. Many companies have been prompted to diversify their procurement strategies, shifting assembly operations to alternative geographies such as Southeast Asia and Eastern Europe to mitigate exposure to punitive tariffs. As a result, the average cost of key printer components, including circuit boards and print heads, has increased substantially, leading vendors to implement price adjustments or cultivate localized manufacturing alliances to safeguard margin structures.

For the broader printing industry, including barcode printing solutions, these tariffs have disrupted access to essential consumables such as specialized ribbons and label substrates sourced from Canada, which previously benefitted from preferential trade terms, heightening vulnerability to supply interruptions and cost volatility. In response, leading manufacturers have accelerated efforts to secure long-term agreements with alternate suppliers, invest in tariff-induced cost absorption programs, and refine inventory management frameworks to pre-stock critical components. These strategic adaptations underscore the imperative for agility and resilience in procurement to maintain continuity of service and competitive positioning within the barcode printer landscape.

Uncovering Critical Insights From Market Segmentation Analyses Across Printer Types, Technologies, Industries, and Application Niches

In parsing the barcode printer market, distinct device categories such as card printers, desktop printers, industrial printers, kiosk printers, and mobile printers each address specific operational requirements. Card printers support secure ID issuance in government and corporate environments, while desktop and kiosk printers cater to in-store labeling and ticketing applications. Industrial printers deliver rugged performance and high throughput for manufacturing and logistics hubs, and mobile printers empower on-the-go receipt and label generation in field service, retail replenishment, and healthcare rounds. Underlying these hardware segments, technology classifications encompass direct thermal, inkjet, RFID, and thermal transfer modalities, the latter subdivided into resin, wax resin, and wax ribbon formulations to meet varying demands for durability, print resolution, and environmental resistance. From a sectoral perspective, end-user industries span government, healthcare, logistics and transportation, manufacturing, and retail, reflecting broad requirements for regulatory compliance, patient safety, shipment tracking, asset management, and point-of-sale efficiency. Within these verticals, applications range from product labeling and receipt printing to tagging, ticketing, and wristband issuance, underscoring the versatility of barcode printing solutions in addressing diverse process challenges.

This comprehensive research report categorizes the Barcode Printers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Printer Type

- Technology

- Application

- End-user Industry

Highlighting Strategic Regional Variations and Opportunities in the Barcode Printer Market Throughout Americas, EMEA, and Asia-Pacific Territories

In the Americas, the United States has witnessed explosive uptake of mobile barcode printers within retail, logistics, and healthcare sectors, where compact, wireless thermal devices facilitate on-demand label and receipt generation at the point of need. Canada has parallel trends, with industrial thermal transfer printers integrated into smart factory architectures to enhance traceability and inventory accuracy across production lines. Meanwhile, Latin America is emerging as a high-growth market underpinned by expanding e-commerce and retail ecosystems, prompting investments in both portable and desktop barcode printing solutions to support agile order management and track-and-trace functions across the supply chain. Europe demonstrates a balanced mix of demand for high-performance industrial printers in manufacturing hubs and mobile devices in omnichannel retail environments, with substantial adoption of RFID-based labeling to comply with stringent regulatory regimes and accelerate warehouse automation. In Asia-Pacific, rapid industrialization and government initiatives promoting Industry 4.0 have propelled the region to lead global growth, driven by robust demand for automation, pervasive IoT integration, and the proliferation of e-commerce platforms that rely on wireless and high-speed barcode printing capabilities. Collectively, these regional variations underscore the importance of customizing product features, service models, and go-to-market approaches to match localized operational and regulatory requirements.

This comprehensive research report examines key regions that drive the evolution of the Barcode Printers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Innovation Initiatives of Leading Barcode Printer Manufacturers Shaping Industry Leadership

Leading manufacturers such as Avery Dennison, Canon, Dascom, Honeywell, Oki, SATO Holdings, Zebra Technologies, Toshiba Tec, Postek, Brother, Epson, DYMO, Primera Technology, TSC Auto ID Technology, and MUNBYN collectively shape the competitive landscape through differentiated product portfolios, strategic partnerships, and global service networks. For example, Zebra Technologies continues to expand its automation capabilities with solutions such as the Aurora Velocity™ scan tunnel, combining high-speed barcode reading, AI-driven label detection, and machine vision to streamline warehouse sorting operations displayed at ProMat 2025. Datalogic has introduced embedded AI modules in its scanning solutions to enhance in-store retail loss prevention and operational visibility, underscoring a broader trend of integrating intelligent analytics directly into hardware platforms. Cognex’s advancements in AI-powered barcode reading algorithms further illustrate the pursuit of improved decode rates and resilience in challenging scanning environments, reflecting the ongoing emphasis on software-driven performance enhancements within the industry. Across the ecosystem, companies are also pursuing sustainability-driven innovations in printer design and consumables, forging alliances with paper, ribbon, and electronics suppliers to deliver holistic solutions that address environmental and operational objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Barcode Printers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avery Dennison Corporation

- BIXOLON Co., Ltd.

- Brother International Corporation

- Canon Inc.

- Citizen Systems Japan Co., Ltd.

- Dascom Systems Germany GmbH

- GoDEX International Co., Ltd.

- Honeywell International Inc

- Linx Printing Technologies

- Postek Electronics Co., Ltd.

- Printronix, Inc.

- SATO Holdings Corporation

- Seiko Epson Corporation

- Star Micronics Co., Ltd.

- Toshiba Corporation

- TSC Auto ID Technology Co., Ltd.

- Wasp Barcode Technologies

- Zebra Technologies Corporation

Delivering Actionable Strategic Recommendations to Help Industry Leaders Navigate Technological, Regulatory, and Supply Chain Challenges Effectively

Industry leaders should prioritize investment in AI-driven predictive maintenance capabilities to reduce unplanned downtime and optimize service workflows, leveraging sensor data analytics to drive continuous improvement in printer reliability. They must also embrace cloud-native printing and device management platforms that facilitate centralized oversight, seamless firmware updates, and remote diagnostics, thereby enhancing operational visibility and security. Building resilient supply chains is imperative: companies should diversify sourcing across geographies, establish strategic stock buffers for critical components, and explore nearshoring options to mitigate the risk of tariff-induced cost fluctuations. Furthermore, firms can differentiate through sustainability by adopting recyclable printing substrates, optimizing power consumption of hardware, and transparently reporting environmental impact metrics. Collaborative partnerships with software providers, consumable manufacturers, and systems integrators will be key to delivering end-to-end solutions that align with customer requirements for integration with enterprise resource planning and warehouse management systems. Finally, tailored go-to-market strategies that account for regional regulatory frameworks, language requirements, and service support expectations will enable providers to capture emerging opportunities in underserved markets.

Detailing Rigorous Research Methodology and Analytical Frameworks Underpinning Comprehensive Barcode Printer Market Insights

This analysis was conducted using a rigorous two-pronged research approach that incorporated both primary and secondary data collection. Primary insights were gathered through in-depth interviews with C-level executives and technical leads from barcode printer manufacturers, system integrators, and major end-user organizations in retail, healthcare, and logistics sectors to validate market drivers, technology priorities, and procurement challenges. Concurrently, secondary research involved cross-referencing industry reports, trade publications, regulatory filings, and reputable news outlets to establish a comprehensive baseline of market dynamics, competitive activities, and emerging trends. Data from these sources were triangulated to ensure consistency and accuracy, with quantitative and qualitative findings synthesized through a structured analytical framework. The methodology emphasizes transparency, repeatability, and objectivity, providing stakeholders with a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Barcode Printers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Barcode Printers Market, by Printer Type

- Barcode Printers Market, by Technology

- Barcode Printers Market, by Application

- Barcode Printers Market, by End-user Industry

- Barcode Printers Market, by Region

- Barcode Printers Market, by Group

- Barcode Printers Market, by Country

- United States Barcode Printers Market

- China Barcode Printers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Reflections on the Future Trajectory of the Barcode Printer Market and Strategic Imperatives for Stakeholders

The barcode printer market is undergoing a profound transformation driven by converging trends in artificial intelligence, cloud computing, and sustainability. Organizations that harness the predictive capabilities of AI, integrate printing platforms into holistic digital ecosystems, and proactively adapt to evolving trade landscapes will secure a competitive edge. Regional market variations, from the mobile-first context of the United States to the industrial automation hubs of Asia-Pacific and the regulatory sophistication of Europe, underscore the need for nuanced strategies tailored to local conditions. As leading manufacturers continue to innovate in hardware design, consumables, and software integration, end-users stand to benefit from greater operational agility, cost efficiency, and compliance assurance. Navigating the complexities of this dynamic environment will require a blend of technological foresight, supply chain resilience, and collaborative partnerships. Stakeholders who align their product roadmaps and investment priorities with these imperatives will be best positioned to thrive in the evolving barcode printing ecosystem.

Engage With Ketan Rohom to Unlock Tailored Barcode Printer Market Intelligence That Drives Data-Driven Decisions and Growth Opportunities

For a deeper dive into the latest market developments and to explore tailored insights on strategic growth opportunities, please contact Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide comprehensive guidance on leveraging these findings to optimize your product strategies, enhance operational resilience, and capitalize on emerging regional dynamics. Reach out today to secure your copy of the full barcode printer market report and enable data-driven decision-making that drives competitive advantage

- How big is the Barcode Printers Market?

- What is the Barcode Printers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?