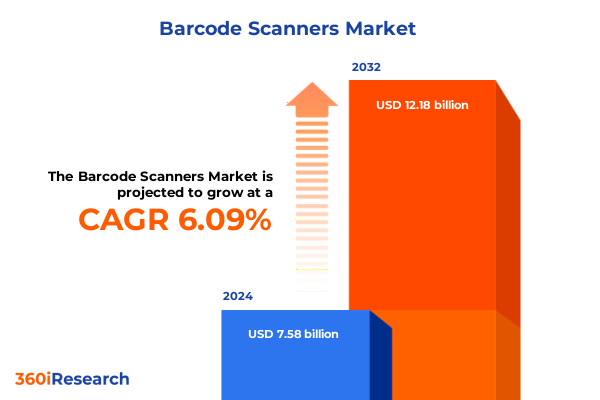

The Barcode Scanners Market size was estimated at USD 8.04 billion in 2025 and expected to reach USD 8.53 billion in 2026, at a CAGR of 7.30% to reach USD 13.18 billion by 2032.

Navigating the Barcode Scanner Revolution Revealing How Emerging Technologies and User-Centric Innovations Are Shaping the Future of Data Capture Across Diverse Industrial Verticals

The barcode scanner market has evolved from simple optical readers to sophisticated devices that blend cutting-edge hardware with intelligent software capabilities. Against the backdrop of growing digital transformation efforts, organizations increasingly depend on these scanning solutions to capture, process, and manage critical data across diverse operational contexts. This report sets the stage by exploring how end-to-end visibility in supply chains, real-time inventory tracking, and compliance with regulatory standards are all predicated on reliable data capture technologies. As a result, barcode scanners have moved beyond transactional tools to become strategic assets that propel efficiency, accuracy, and connectivity throughout enterprise ecosystems.

Moreover, the convergence of technologies such as the Internet of Things, mobile computing, and cloud platforms is redefining what modern barcode scanners can achieve. Enhanced imaging components and AI-driven decoding algorithms enable faster scanning speeds and higher accuracy rates, even under challenging environmental conditions. Consequently, organizations across healthcare, manufacturing, retail, and transportation and logistics sectors are capitalizing on these innovations to optimize workflows, minimize errors, and deliver superior customer experiences. Set against this dynamic backdrop, the subsequent analysis delves into pivotal shifts, tariff dynamics, segmentation nuances, regional trends, competitive landscapes, and strategic recommendations that collectively shape the future trajectory of barcode scanning solutions.

Identifying the Major Technological and Operational Disruptions Transforming the Barcode Scanning Landscape for Enhanced Precision and Productivity in Modern Workflows

Significant technological breakthroughs are propelling barcode scanners into a new era of operational excellence. Artificial intelligence and machine learning are now embedded into decoding engines, allowing devices to automatically adjust to varying code symbologies and environmental factors. This transformative leap enables enterprises to streamline deployment and reduce the need for manual configuration, ultimately driving faster onboarding and lower total cost of ownership. Furthermore, advanced wireless connectivity options, including Bluetooth and Wi-Fi, are fostering seamless integration with mobile computers, tablets, and IoT networks, thus bridging the gap between handheld scanning and real-time analytics.

In addition, the rise of 2D imaging systems has broadened application possibilities, enabling the capture of complex QR codes, RFID tags, and direct part markings on curved or reflective surfaces. As a result, businesses in manufacturing can reliably track serialized components on production lines, while retailers can engage consumers through interactive digital experiences triggered by smartphone-scanned codes. To that end, ergonomic design improvements and wearable scanning solutions are elevating user comfort and productivity, particularly in high-volume environments such as warehouses and distribution centers. Together, these shifts are reshaping the landscape, unlocking unprecedented levels of precision, efficiency, and actionable insight.

Examining the Far-Reaching Consequences of 2025 United States Tariffs on Hardware Imports and the Subsequent Ripple Effects on Barcode Scanner Procurement and Pricing

Effective January 2025, the United States implemented increased tariff levies on select imported hardware components, including crucial imaging sensors and microprocessors predominantly sourced from major overseas manufacturers. These measures have led to a notable uptick in landed costs for complete barcode scanner units, prompting procurement teams to reassess vendor strategies and negotiate revised contract terms. Consequently, some organizations are exploring alternative sourcing hubs and working directly with component suppliers to mitigate the financial impact, while others are accelerating investments in domestic assembly capabilities to secure supply continuity.

Moreover, the ripple effects of these tariffs extend beyond equipment acquisition. Heightened cost pressures have incentivized scanner OEMs to optimize product designs for component flexibility, allowing for easy substitution of tariff-exempt parts without compromising performance. In parallel, system integrators are advising clients to reevaluate total lifecycle expenses by factoring in maintenance, software support, and extended warranty services. As a result, forward-thinking industry leaders are adopting a more holistic procurement approach, balancing near-term budget constraints with long-term operational resilience in an increasingly protectionist trade environment.

Uncovering In-Depth Segmentation Perspectives to Illuminate Application End User Technology Type and Distribution Channel Nuances That Drive Market Dynamics

Analysis of application-based segmentation reveals that healthcare environments prioritize 2D imaging scanners for their ability to capture small, densely packed codes on medication labels and specimen containers, while manufacturing facilities rely heavily on laser scanners for high-speed reading of traditional linear barcodes on assembly lines. In retail, presentation scanners are favored at point of sale counters to deliver rapid customer throughput, whereas transportation and logistics operations increasingly deploy wearable scanning solutions to empower hands-free workflows in dynamic warehouse settings.

When examining end users, government agencies leverage rugged fixed-mount scanners at inspection points and border crossings to ensure robust code reading under harsh conditions, while healthcare providers integrate handheld wireless scanners within electronic medical records systems to uphold patient safety and compliance. Logistics companies focus on embedded scanning modules within automated sorting equipment to boost throughput, and manufacturing firms adopt a hybrid mix of wired handheld devices for quality control alongside fixed scanners for package verification. Retailers, seeking omnichannel consistency, deploy a blend of in-store and kiosk-mounted scanners to bridge online and offline customer journeys.

Technology-driven distinctions further emphasize the market’s diversity, as imaging scanners, encompassing both 1D and 2D capabilities, cater to complex code formats and variable surfaces, while laser technology maintains its relevance for cost-effective, high-speed linear code scanning. Type-based variations highlight the spectrum of fixed scanners for stationary scanning applications, handheld solutions split between wired and wireless options with further subdivisions into Bluetooth, USB, and Wi-Fi connectivity, presentation scanners optimized for countertop use, and wearable form factors designed for mobility. Distribution channel preferences span direct sales from manufacturers, specialized distributor networks, online platforms offering rapid fulfillment, and traditional retail outlets that combine device sales with value-added services.

This comprehensive research report categorizes the Barcode Scanners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- End User

- Technology

- Type

- Distribution Channel

Exploring Regional Market Dynamics to Highlight How Americas Europe Middle East Africa and Asia Pacific Regions Are Influencing Global Barcode Scanner Adoption Trends

In the Americas, barcode scanner adoption is propelled by robust e-commerce growth and renewed investment in automated distribution centers. Stakeholders benefit from established logistics infrastructure and regulatory environments that support digital transformation, driving early uptake of advanced 2D imaging and wearable scanning solutions. Additionally, government initiatives aimed at modernizing public health and customs processes have spurred demand for ruggedized fixed and handheld devices across North and South American markets.

Turning to Europe, the Middle East, and Africa, regional diversity shapes a complex deployment landscape. Western European nations emphasize interoperability and data security, leading to increasing adoption of cloud-enabled scanners with end-to-end encryption. Meanwhile, emerging economies in the Middle East and Africa focus on cost-effective scanning solutions to support expanding retail and healthcare networks. Regulatory frameworks, such as GDPR in Europe, further influence scanner selection criteria, prompting both manufacturers and end users to prioritize devices with secure firmware updates and comprehensive audit trails. Across these markets, distributors and value-added resellers play a pivotal role in localizing solutions and delivering integration expertise.

In Asia Pacific, rapid industrialization and government-driven smart city initiatives are catalyzing widespread investment in scanning technologies. Manufacturing powerhouses in East Asia leverage high-speed laser and imaging scanners to optimize production lines, while Southeast Asian logistics hubs integrate scalable wearable and fixed scanning systems to manage surging parcel volumes. Moreover, the region's dynamic digital retail landscape, characterized by mobile-based payment ecosystems, is fostering innovative presentations and kiosk scanners that seamlessly interface with smartphone applications.

This comprehensive research report examines key regions that drive the evolution of the Barcode Scanners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players and Highlighting Strategic Initiatives That Are Defining Competitive Landscape and Innovation Trajectories in Barcode Scanning

Leading industry players are differentiating through sustained investment in research and development, rolling out next-generation scanners that integrate AI-driven vision systems and cloud-based analytics. Long-established manufacturers continue to expand their portfolios by acquiring specialized imaging startups and forging partnerships with software providers to enhance device intelligence. At the same time, an emerging cohort of agile vendors is gaining traction by focusing on customizable solutions, rapid prototyping, and regionally tailored support services.

Competitive positioning also reflects a strategic shift toward service-oriented models. Companies are bundling hardware offerings with subscription-based software platforms that deliver advanced asset tracking, real-time monitoring, and predictive maintenance capabilities. This evolution from transactional sales to recurring revenue streams is reshaping pricing strategies and customer engagement practices. Furthermore, alliances with logistics integrators, healthcare software providers, and retail technology consultants are enabling leading players to embed scanning capabilities directly into broader automation ecosystems. Ultimately, this multifaceted approach underscores how innovation, customer-centricity, and strategic partnerships are defining the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Barcode Scanners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adesso Inc.

- AirTrack

- Argox by SATO Holdings Corporation

- Banner Engineering Corp.

- Bluebird Inc

- CipherLab

- Code Corporation

- Cognex Corporation by Brady Corporation

- Datalogic S.P.A.

- DENSO Corporation

- Fujitsu Limited

- Honeywell International Inc.

- Mettler-Toledo GmbH

- Motorola Solutions, Inc.

- Omron Corporation

- Opticon Sensors Europe B.V.

- Real Time Automation, Inc.

- Scandit AG

- Sick AG

- Synertron Technology, Inc.

- TNA Solutions Pty. Ltd.

- Toshiba Infrastructure Systems & Solutions Corporation

- Unitech Electronics Co., LTD.

- Zebra Technologies Corporation

Delivering Actionable Strategic Recommendations to Empower Industry Leaders in Leveraging Technological Advances and Market Insights for Sustainable Growth

Industry leaders should prioritize development of AI-enhanced decoding algorithms that dynamically adapt to evolving code standards and environmental conditions. By embedding machine learning capabilities at the edge, organizations can reduce reliance on centralized processing and improve scanning accuracy across diverse use cases. In addition, forging strategic alliances with cloud platform providers will enable seamless integration of scanning data into enterprise resource planning, warehouse management, and customer relationship management systems, driving actionable insights and operational agility.

Simultaneously, diversifying component sourcing strategies is critical to mitigating tariff-related risks and ensuring uninterrupted production. Cultivating relationships with multiple suppliers, including domestic and nearshore partners, will afford greater flexibility in response to shifting trade policies. Moreover, embracing modular hardware designs allows for swift component swaps and rapid customization, speeding time to market. To that end, companies should also enhance their sustainability profiles by incorporating recyclable materials and energy-efficient components, which not only align with evolving regulatory requirements but also resonate with environmentally conscious end users seeking to reduce their carbon footprints.

Delineating Robust Research Methodology Framework Encompassing Data Collection Analysis Techniques and Validation Processes to Ensure Unbiased Insights

Our research methodology combines rigorous primary data collection with extensive secondary source validation to ensure comprehensive and unbiased insights. Initial data gathering involved in-depth interviews with C-level executives, procurement managers, and technical specialists from a cross-section of healthcare, manufacturing, retail, and logistics organizations. These conversations provided qualitative perspectives on emerging challenges, technology adoption motivations, and strategic priorities driving investment decisions in scanning solutions.

Complementing these insights, secondary research encompassed analysis of industry journals, regulatory filings, patent databases, and financial reports to track technology trends, competitive developments, and tariff policy shifts. Quantitative data was triangulated through vendor surveys and shipment data aggregation, followed by statistical analysis to identify overarching patterns and correlations. To enhance data integrity, findings were validated through expert reviews and cross-checked against publicly available case studies. This multilayered approach delivers robust and actionable intelligence that underpins the comprehensive analysis presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Barcode Scanners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Barcode Scanners Market, by Application

- Barcode Scanners Market, by End User

- Barcode Scanners Market, by Technology

- Barcode Scanners Market, by Type

- Barcode Scanners Market, by Distribution Channel

- Barcode Scanners Market, by Region

- Barcode Scanners Market, by Group

- Barcode Scanners Market, by Country

- United States Barcode Scanners Market

- China Barcode Scanners Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Critical Findings to Present a Cohesive Overview of Market Drivers Challenges and Opportunities Shaping the Barcode Scanner Ecosystem

Synthesizing the critical findings reveals a barcode scanner market at the intersection of technological innovation and evolving trade dynamics. While AI-enabled imaging and cloud integration are unlocking new performance thresholds, tariff policy changes are reshaping procurement strategies and supply chain architectures. These dual forces underscore the need for organizations to balance rapid adoption of advanced capabilities with strategic resilience against cost fluctuations and component shortages.

Ultimately, the path forward demands a holistic understanding of application-specific requirements, end-user expectations, and regional market nuances. By aligning scanning solution investments with broader digital transformation agendas, enterprises can harness real-time data capture to drive operational excellence, customer satisfaction, and regulatory compliance. As the competitive landscape continues to evolve, those who proactively embrace innovation, diversify sourcing, and cultivate strategic partnerships will be best positioned to capitalize on the transformative potential of barcode scanning technologies.

Connect with Associate Director of Sales and Marketing Ketan Rohom Today to Secure Your Comprehensive Barcode Scanner Market Research Report and Gain Actionable Insights

For tailored guidance on harnessing the latest insights and unlocking the full potential of barcode scanning technologies, we invite you to connect with Ketan Rohom, Associate Director of Sales and Marketing. By engaging directly, you can secure your comprehensive market research report and gain privileged access to strategic findings that will inform procurement, implementation, and innovation initiatives. Reach out today to chart a precise path forward in this rapidly evolving industry and ensure your organization stays ahead of transformative trends.

- How big is the Barcode Scanners Market?

- What is the Barcode Scanners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?