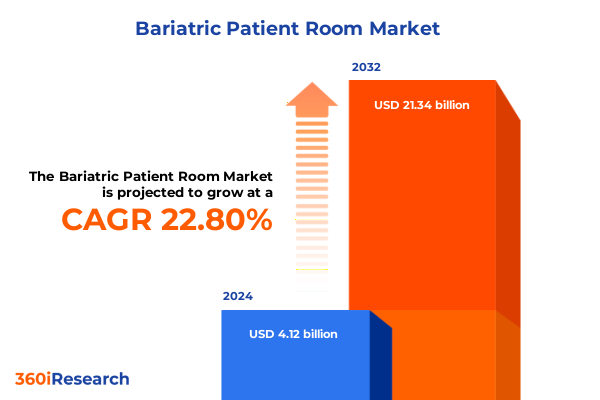

The Bariatric Patient Room Market size was estimated at USD 5.08 billion in 2025 and expected to reach USD 6.27 billion in 2026, at a CAGR of 22.73% to reach USD 21.34 billion by 2032.

Illuminating the Transformative Journey of Bariatric Patient Rooms to Enhance Care Delivery and Operational Efficiency in Contemporary Healthcare Facilities

The rise in obesity rates and the corresponding increase in bariatric procedures have catalyzed a critical need for patient rooms that can safely accommodate higher weight capacities while delivering exceptional levels of comfort and care. As healthcare providers strive to align clinical environments with the unique needs of bariatric patients, the design and outfitting of these rooms have emerged as pivotal factors in ensuring both patient safety and staff efficiency. Modern bariatric patient rooms are no longer mere repositories for standard equipment; they represent purpose-built ecosystems that integrate reinforced structural elements, adaptive furnishing, and specialized monitoring solutions to support complex care pathways.

Against a backdrop of evolving regulatory requirements and heightened scrutiny of patient outcomes, facilities are being challenged to reimagine their spaces in ways that promote dignity and autonomy. The imperative to enhance patient experience has spurred innovations in modular room layouts, intuitive safety systems, and collaborative care zones that facilitate interdisciplinary teamwork. Crucially, these transformations are underpinned by an evidence-based approach to room planning that considers ergonomic principles, infection control protocols, and the psychosocial dimensions of bariatric care. This convergence of clinical needs, technological capabilities, and patient-centric design philosophies sets the stage for a marketplace characterized by rapid evolution and strategic differentiation.

Navigating the Emerging Tectonic Shifts Reshaping the Landscape of Bariatric Patient Room Solutions with Innovation and Patient-Centered Design

The landscape of bariatric patient room solutions is being reshaped by a wave of innovation that extends far beyond load-bearing infrastructure. Digital health technologies, for example, have become essential components of the modern bariatric environment, enabling clinicians to remotely monitor vital signs through integrated telemetry systems and predictive analytics platforms. These tools not only enhance clinical oversight but also reduce the frequency of in-room visits, mitigating infection risks and optimizing staff allocation. At the same time, cutting-edge materials and antimicrobial surface treatments are redefining hygiene standards, supporting rigorous infection prevention protocols without compromising on durability or aesthetic appeal.

Equally significant is the shift toward patient experience optimization. Advanced lighting systems that adjust to circadian rhythms, adaptive climate control zones, and voice-activated room controls are converging to create environments that soothe anxiety and foster recovery. Meanwhile, sustainable design principles are gaining prominence as healthcare organizations pursue carbon reduction goals and seek to lower long-term operational costs. In this context, manufacturers and service providers are collaborating with facility managers to develop plug-and-play modules that can be retrofitted into existing spaces, enabling rapid deployment of bariatric-ready rooms with minimal downtime. By embracing these multifaceted trends, stakeholders are charting a course toward spaces that are as adaptable as they are supportive of clinical excellence.

Assessing the Cumulative Ripple Effects of 2025 United States Tariff Policies on Bariatric Patient Room Supply Chains and Cost Structures

Policy developments in 2025 have introduced a new layer of complexity to supply chain planning for bariatric patient room components. In March of that year, a 25% tariff on steel and aluminum–containing medical equipment took effect, impacting items such as hospital bed frames and patient lift structures that rely on these core materials. Concurrently, tariffs on semiconductors and personal protective equipment doubled to 50%, increasing the landed costs of electronic monitoring devices and disposable accessories like gowns and gloves. These measures have placed upward pressure on procurement budgets and prompted providers to reassess long-term equipment strategies.

Uncovering Critical Segmentation Insights That Drive Customization and Service Excellence Across the Diverse Spectrum of Bariatric Patient Room Solutions

A nuanced examination of equipment type segmentation reveals that bariatric patient rooms encompass a broad spectrum of assets, from robust furniture solutions to advanced patient lifts. Within this framework, monitoring systems and hospital beds are being engineered with higher weight thresholds and integrated alarms to prevent caregiver injury and enhance patient safety. In parallel, mobility aids are receiving design upgrades that balance strength with streamlined storage profiles, while ceiling and mobile lift variants cater to diverse architectural constraints and floor-loading limitations. Adopting these differentiated product classes allows providers to specify the optimal combination of fixed and portable equipment for each facility layout.

Service type segmentation underscores the growing emphasis on holistic care pathways. Dietary counseling services now include both preoperative and postoperative modules that are coordinated with nursing care and psychological support programs, reflecting an integrated approach to weight management. Physical therapy offerings-ranging from ambulatory therapy sessions in dedicated rehabilitation spaces to in-room therapy for patients requiring isolation-complement these nutritional and mental health interventions. Age group segmentation further refines response strategies: pediatric bariatric patients benefit from specialized monitoring protocols and caregiver training, while geriatric cohorts demand tailored mobility solutions and fall prevention measures. Distribution channel analysis shows that contract sales teams leverage long-term relationships to secure bundled solutions, whereas manufacturer sales forces and online platforms provide flexible acquisition models for immediate needs. Finally, facility type segmentation highlights the differentiated requirements of hospitals, long-term care centers, and specialty clinics-particularly surgical centers and weight loss clinics-each of which adopts equipment and service suites calibrated to their treatment focus and throughput volumes.

This comprehensive research report categorizes the Bariatric Patient Room market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Service Type

- Age Group

- Distribution Channel

- Healthcare Facility Type

Distilling Key Regional Dynamics across the Americas, Europe Middle East and Africa, and Asia Pacific Shaping Bariatric Patient Room Market Trajectories

Regional dynamics in the Americas continue to be driven by strong reimbursement frameworks and established clinical infrastructure, positioning the United States and Canada at the forefront of adopting comprehensive bariatric room configurations. Market participants in this region benefit from mature supply chains, robust domestic manufacturing capabilities, and a regulatory environment that encourages innovation through clear pathways for equipment approval. This stability, however, is tempered by rising labor costs and the need to address rural healthcare access, compelling providers to explore telemonitoring and mobile care units as extensions of the inpatient environment.

Across Europe, the Middle East & Africa, market variation is considerable. Western European nations emphasize sustainability and lean facility designs, investing in multi-use rooms that can be rapidly reconfigured for diverse patient populations, including bariatric. Regulatory harmonization efforts under the Medical Device Regulation framework facilitate cross-border product launches but also require heightened compliance investments. In the Middle East, ambitious healthcare infrastructure projects are driving demand for turnkey bariatric suites, while African markets are prioritizing capacity building and local assembly partnerships to enhance access and affordability.

Asia-Pacific exhibits some of the fastest growth trajectories, fueled by rising obesity prevalence and expanding private healthcare networks. Emerging economies such as India and China are witnessing increased investments in weight management clinics and specialized surgical centers that demand integrated room solutions. Local manufacturers are rapidly scaling production to meet domestic needs, while international suppliers form strategic alliances to navigate complex distribution landscapes. Across this region, digital health platforms are also being embedded into bariatric environments, reflecting a broader digital transformation agenda.

This comprehensive research report examines key regions that drive the evolution of the Bariatric Patient Room market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Initiatives Fueling Advances in Bariatric Patient Room Equipment and Service Offerings

Leading industry participants are deploying differentiated strategies to capture value in the bariatric patient room segment. Global medical technology firms known for their acute care portfolios are expanding into bariatric-specific product lines, leveraging existing relationships to cross-sell reinforced beds and lift systems. Conversely, specialized manufacturers with a focus on mobility aids and power-assisted devices are forging partnerships with service providers to offer bundled installation and maintenance agreements, enhancing the total cost of ownership proposition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bariatric Patient Room market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALVO Medical Sp. z o.o.

- Arjo AB

- Canon Medical Systems Corporation

- Chinesport S.p.A.

- Etac AB

- EZ Way, Inc.

- Famed Żywiec Sp. Z O.O.

- GE Healthcare

- GF Health Products, Inc.

- Herman Miller, Inc.

- Hill-Rom Holdings, Inc.

- Inspital Medical Technology GmbH

- Invacare Corporation

- Lumex Inc.

- MedaCure Inc.

- Medical Depot, Inc.

- Medifa GmbH & Co. KG.

- NewLeaf Home Medical

- ORTHOS XXI

- SFI Medical Equipment Solutions.

- Shanghai Huifeng Medical Instrument Co., Ltd

- STERIS

- Stryker Corporation

- The Cooper Companies Inc.

- Vancare, Inc.

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Opportunities and Mitigate Risks in Bariatric Patient Room Markets

To maintain competitive advantage, equipment manufacturers should invest in modular platform designs that allow rapid customization of bed frames, lifts, and monitoring modules for varying weight capacities and room configurations. Service providers can differentiate by integrating virtual care capabilities into postoperative counseling and physical therapy regimens, reducing readmission risks and enhancing continuity of care. Across the supply chain, companies must diversify sourcing by establishing dual-country manufacturing footprints and entering consortia that advocate for tariff exemptions or domestic incentive programs. In tandem, engaging directly with facility operators to co-develop pilot rooms can accelerate product iteration cycles and reinforce customer loyalty. By adopting a data-driven approach to product development and service delivery, industry leaders can align offerings with clinical outcomes and operational efficiencies, ultimately solidifying their position in this specialized market.

Elaborating a Robust Research Methodology Combining Primary Interviews Secondary Data and Analytical Frameworks for Comprehensive Insights

This research employs a mixed-methods approach to ensure comprehensive coverage of the bariatric patient room landscape. Primary data were collected through structured interviews with hospital administrators, surgical teams, rehabilitation specialists, and supply chain managers, allowing for direct insights into decision criteria, pain points, and future requirements. Secondary research included an extensive review of regulatory filings, peer-reviewed journals, industry publications, and financial disclosures to contextualize market drivers and emerging trends.

Quantitative data were triangulated against multiple sources to validate thematic findings and segment definitions. The analytical framework incorporated segmentation mapping aligned to equipment type, service type, age group, distribution channel, and facility type, overlaying regional variables to capture geo-specific nuances. A peer-review process involving independent subject-matter experts further refined the conclusions, while sensitivity analyses assessed the robustness of strategic recommendations under varying tariff and reimbursement scenarios

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bariatric Patient Room market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bariatric Patient Room Market, by Equipment Type

- Bariatric Patient Room Market, by Service Type

- Bariatric Patient Room Market, by Age Group

- Bariatric Patient Room Market, by Distribution Channel

- Bariatric Patient Room Market, by Healthcare Facility Type

- Bariatric Patient Room Market, by Region

- Bariatric Patient Room Market, by Group

- Bariatric Patient Room Market, by Country

- United States Bariatric Patient Room Market

- China Bariatric Patient Room Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesis of Insights Highlighting the Convergence of Patient Needs Technological Progress and Policy Implications in Bariatric Patient Rooms

The convergence of clinical imperatives, technological innovation, and policy shifts underscores the strategic importance of specialized bariatric patient rooms. Decision-makers must weigh evolving tariffs and supply chain complexities against the imperative to deliver high-quality, patient-centered care. The segmentation lens emphasizes that no single configuration or service model universally applies; rather, tailored solutions are required to meet the spectrum of needs across equipment categories, service offerings, age demographics, distribution channels, and facility types.

Regional insights highlight that while mature markets can capitalize on established infrastructures and reimbursement pathways, emerging regions present opportunities for strategic partnerships and capacity building. Meanwhile, leading companies are advancing the field through collaborative initiatives that span product development, service integration, and regulatory advocacy. As the bariatric patient room sector continues to mature, stakeholders who proactively align their strategies with these multifaceted trends will be best positioned to drive both clinical impact and operational excellence.

Engage with Ketan Rohom to Secure the Definitive Market Research Report and Propel Your Bariatric Patient Room Strategy into Tomorrow’s Healthcare Era

To explore the full depth of these findings and leverage them for your strategic planning, we invite you to discuss them directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise can guide you through the nuanced implications of this research and tailor actionable insights to your organizational priorities. By engaging with Ketan Rohom, you will gain access to customized data, detailed market analyses, and expert recommendations that align with your operational goals in the bariatric patient room sector. Reach out to schedule a personalized briefing and secure the comprehensive report that will illuminate the path forward for your business in this evolving landscape.

- How big is the Bariatric Patient Room Market?

- What is the Bariatric Patient Room Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?