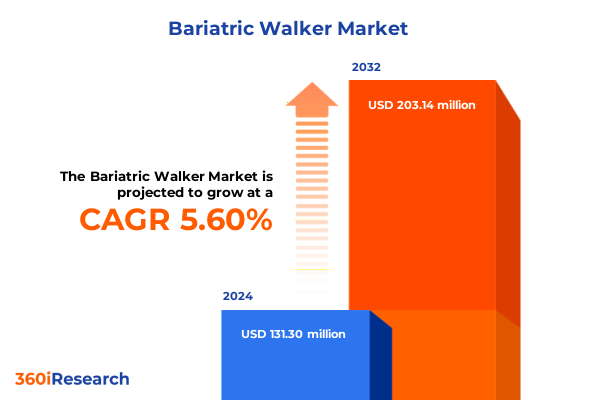

The Bariatric Walker Market size was estimated at USD 138.60 million in 2025 and expected to reach USD 151.72 million in 2026, at a CAGR of 5.61% to reach USD 203.13 million by 2032.

Unveiling the Future of Bariatric Walkers to Enhance Patient Independence and Transform Mobility Solutions for Healthcare Providers

The introduction lays the groundwork for understanding how bariatric walkers have evolved from niche mobility aids into essential tools for empowering individuals with higher body weights across diverse care settings. It begins by tracing the roots of bariatric mobility solutions, highlighting how medical device innovation and growing awareness of obesity care have converged to spur a renaissance in design and functionality. With rising prevalence of obesity and related mobility challenges, healthcare professionals and patients alike have moved beyond one-size-fits-all assistive devices to demand purpose-built solutions that address safety, comfort, and long-term usability. As a result, device manufacturers have prioritized ergonomics, expanded weight capacities, and integrated advanced materials that strike the balance between durability and ease of use.

Furthermore, the introduction frames the report’s objectives, guiding readers through the imperative to evaluate key trends, regulatory shifts, market drivers, and barrier dynamics that define the bariatric walker ecosystem. It underscores the importance of regulatory compliance and reimbursement frameworks that directly influence procurement decisions across hospitals, home healthcare programs, and rehabilitation centers. By spotlighting the intersection of demographic shifts, patient advocacy, and technological advancement, this opening section primes decision-makers to appreciate why bariatric walkers now command unprecedented attention within broader mobility solutions portfolios.

Transitioning from historical context to contemporary relevance, the introduction establishes a narrative thread that links patient outcomes to operational imperatives for care providers. It positions the report as both a strategic compass and an actionable toolkit, inviting stakeholders to explore how emerging innovations can reconcile clinical efficacy with economic sustainability. Through this lens, the introduction crystallizes the report’s promise: to illuminate pathways for driving meaningful improvements in patient mobility, reducing caregiver strain, and enhancing institutional efficiency.

Redefining Bariatric Walker Innovation Through Technological Integration and Evolving Care Paradigms to Meet Diverse Patient Needs

Over the past five years, the bariatric walker landscape has undergone transformative shifts driven by an interplay of technological breakthroughs and evolving care paradigms. Initially, manufacturers focused on simply scaling up traditional walker designs to accommodate higher weight capacities, but were soon compelled to infuse their products with cutting-edge features. Advances in lightweight alloy frames and high-density polymers have yielded devices that are both robust enough to support larger patients and nimble enough to facilitate easy maneuverability. As a result, the latest generation of bariatric walkers now integrates telescoping frame adjustments, anti-slip ergonomic grips, and modular accessories that allow seamless customization for patient anatomy and care environment.

Moreover, digital integration has emerged as a pivotal trend reshaping product roadmaps. Sensor-based stability analytics, fall-risk monitoring, and cloud-enabled data capture have found their way into premium walker models. These innovations not only enrich clinical insights into patient progress but also dovetail with telehealth initiatives that monitor mobility beyond facility walls. Consequently, care teams can now leverage real-time analytics to optimize therapy regimens, reduce readmission rates, and demonstrate quantifiable outcomes to payers.

In parallel, the shift toward value-based care has elevated the importance of mobility solutions that deliver demonstrable improvements in patient quality of life. Payers and providers are increasingly tying reimbursements to functional outcome metrics, compelling device makers to validate their products through rigorous usability studies and real-world evidence. This convergence of design sophistication and outcome-driven reimbursement underscores a pivotal shift: bariatric walkers are no longer passive aids but integral components of comprehensive mobility management programs. Such reorientation has not only expanded the competitive landscape to include technology enablers but also fostered deeper collaboration among orthopedic specialists, physical therapists, and product engineers.

Assessing the Comprehensive Effects of 2025 United States Tariffs on the Production, Supply Chain Dynamics, and Market Accessibility of Bariatric Walkers

The 2025 tariff adjustments enacted by United States policymakers have introduced an unprecedented layer of complexity to the bariatric walker supply chain, prompting manufacturers to reassess sourcing strategies and production footprints. With a targeted increase on intermediate frames and advanced alloy assemblies, import costs for high-performance materials have surged, rippling through inventory planning and margin calculus. This recalibration has driven stakeholders to explore alternative raw material sources, including domestic foundries and low-tariff trading partners, in order to preserve price competitiveness while maintaining the structural integrity required for safe bariatric applications.

Furthermore, the elevated duties on specialized components such as digital sensors and hydraulic braking mechanisms have shifted the balance of innovation investment. Product teams now face the dual challenge of localizing key manufacturing processes and mitigating the financial impact on final unit prices. In response, some leading firms have accelerated joint ventures with value-added resellers and regional fabricators to circumvent tariff burdens. These strategic alliances enable the consolidation of subassembly operations within North America, thereby streamlining logistics and reducing exposure to cross-border levies.

Beyond cost implications, the tariff environment has spurred a renewed emphasis on supply chain resilience. Companies are diversifying their supplier base to include secondary and tertiary sources, while bolstering buffer inventories of critical components to shield against geopolitical volatility. This trend aligns with a broader industry recognition that regulatory shifts can materialize rapidly, necessitating preemptive scenario planning. Consequently, organizations that proactively realign their procurement frameworks are better positioned to sustain uninterrupted production and meet escalating demand for bariatric mobility solutions.

Illuminating Critical Segmentation Patterns Impacting Bariatric Walker Adoption Across Product Variants, User Environments, and Distribution Pathways

By examining core segmentation layers, the bariatric walker sector reveals nuanced patterns that inform both product development and go-to-market strategies. Within the product type dimension, electric variants have gained traction due to their ability to reduce caregiver exertion; battery-operated options, in particular, are distinguishing themselves through choices between traditional lead-acid batteries and the increasingly favored lithium-ion alternatives, with the latter offering faster charging cycles and lighter total package weights. Parallel to these trends, plug-in configurations maintain a strong foothold in institutional settings where continuous power availability ensures uninterrupted operation. Conversely, manual walkers remain indispensable for price-sensitive applications, with folding frames appealing to home healthcare providers seeking portability and non-folding designs valued for maximum structural stability.

End user segmentation further clarifies demand drivers. Home healthcare consumers prioritize compact form factors and intuitive adjustment mechanisms that facilitate independent mobility. In hospitals and clinics, high-throughput environments necessitate devices that withstand frequent disinfecting and variable operator handling, leading to a preference for reinforced frames and corrosion-resistant finishes. Meanwhile, rehabilitation centers emphasize outcome-oriented features, such as adjustable track widths and integrated fall-prevention supports, to optimize therapy protocols and accelerate patient progress milestones.

Distribution channel insights round out this portrait of segmentation-driven demand. Offline channels, anchored by hospital suppliers, pharmacy chains, and specialty medical stores, emphasize direct relationships, product demonstrations, and on-site technical training. These touchpoints foster trust among clinicians and procurement teams critical to high-value acquisitions. On the other hand, online sales via e-commerce platforms, manufacturer websites, and third-party marketplaces cater to a growing segment of price-conscious buyers and remote care coordinators. In this digital realm, transparent pricing, user reviews, and simplified ordering workflows are instrumental in capturing emerging demand from independent practitioners and regional care networks.

This comprehensive research report categorizes the Bariatric Walker market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Distribution Channel

Analyzing Regional Nuances Driving Bariatric Walker Utilization Trends Across the Americas, EMEA Territories, and Asia-Pacific Markets

Geographic analysis of the bariatric walker domain uncovers distinct regional characteristics that shape purchasing behaviors and innovation priorities. In the Americas, robust healthcare infrastructure combined with a mature reimbursement environment has fostered early adoption of electric and sensor-enabled walker configurations. Moreover, patient advocacy groups and obesity treatment initiatives have heightened end-user awareness, creating pull-through demand that encourages vendors to localize support networks and invest in comprehensive training programs. This region’s emphasis on quality compliance and regulatory rigor further propels manufacturers to conform to stringent safety and performance standards, thereby reinforcing its leadership position in premium device segments.

Across Europe, the Middle East, and Africa, the EMEA region presents a tapestry of healthcare funding models and infrastructure maturity levels. Western European markets exhibit sustained interest in advanced walker technologies, bolstered by reimbursement regimes that reward demonstrable improvements in mobility outcomes. By contrast, many markets in Eastern Europe and parts of the Middle East prioritize cost-effective manual solutions, prompting regional distributors to customize entry-level bariatric walkers that maximize durability at constrained budgets. In Africa, nascent specialized care programs are paving the way for pilot initiatives that pair simplified bariatric walkers with telehealth-enabled monitoring, underscoring a trend toward hybrid care models even in resource-limited settings.

In Asia-Pacific, the rapid modernization of healthcare systems intersects with rising obesity rates and a growing geriatric population. Key markets such as Japan and Australia are adopting integrated mobility solutions that link advanced electric walkers with outcome-tracking software, while emerging markets like India and Southeast Asia are witnessing accelerated uptake of both manual and battery-operated devices driven by expanding home healthcare services. Across this diverse landscape, regional stakeholders are forging manufacturing alliances and technology transfer agreements, thereby accelerating the diffusion of best-in-class bariatric walker innovations from established to emerging markets.

This comprehensive research report examines key regions that drive the evolution of the Bariatric Walker market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market-Leading Players and Strategic Collaborations Shaping Competitive Dynamics in the Bariatric Walker Industry Landscape

Industry leaders have carved differentiated positions by aligning product portfolios, strategic partnerships, and innovation roadmaps with evolving care imperatives. One prominent manufacturer has distinguished itself through a comprehensive range of electric bariatric walkers equipped with IoT-enabled stability monitoring, underscoring its commitment to data-driven patient outcomes. Another key player has focused on modular manual designs that facilitate rapid configuration changes across care settings, boosting operational flexibility for multi-site health networks. Complementing these product strategies, select organizations have pursued vertical integration, acquiring component suppliers or establishing in-house battery assembly lines to fortify supply chain resilience amid shifting trade policies.

Strategic alliances have also emerged as a potent growth lever. Leading device firms are co-developing customized solutions with rehabilitation specialists to embed physiotherapist feedback loops directly into product enhancement cycles. Parallel collaborations between mobility device manufacturers and telehealth platform providers have created bundled offerings that encompass both hardware and remote monitoring services, exemplifying a shift toward holistic mobility management ecosystems. These cross-industry partnerships not only diversify revenue streams but also deepen engagement across the patient journey, fostering stickier relationships and opening new channels for aftermarket services.

Meanwhile, mid-tier participants are capitalizing on niche segments, such as pediatric bariatric walkers and specialized narrow-track models for UK-style corridors, to secure footholds in under-served applications. By emphasizing rapid product development cycles and local customer support, these companies maintain agility in responding to sudden demand shifts, reinforcing their standing among regional distributors and smaller care providers. Collectively, these diverse corporate strategies underscore a competitive landscape defined by technological differentiation, partnership ecosystems, and adaptive supply chain models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bariatric Walker market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agiliti Health, Inc.

- Alimed Inc.

- Avacare Medical

- Briggs Healthcare

- Carex Health Brands

- Cobi Rehab

- Compass Health Brands Corporation

- Duro-Med Industries, Inc.

- GF Health Products, Inc.

- HealthSmart International by Convey Health Solutions Holdings, Inc.

- HME Home Health Ltd.

- Hms-vilgo

- Invacare Corporation

- Karma Medical Products Co., LTD.

- McKesson Corporation

- Medical Depot, Inc.

- Medline Industries, Inc.

- Medline Industries, L.P.

- Milliken & Company

- Nova Medical Products, Inc.

- OasisSpace

- Performance Health Holding, Inc.

- Roscoe Bariatric

- Safety and Mobility Pty Ltd

- Topro Limited

- Vive Health LLC

Empowering Industry Stakeholders with Strategic Recommendations to Accelerate Innovation, Optimize Distribution, and Strengthen Market Positioning

To excel in the dynamic bariatric walker arena, industry stakeholders should prioritize a multi-pronged approach that aligns innovation with market realities and patient-centered care frameworks. First, accelerating the integration of intelligent safety features will be paramount. By embedding real-time stability sensors and fall-risk analytics, manufacturers can differentiate their offerings while delivering measurable clinical value. Moreover, collaborating with digital health platforms to create seamless data exchange protocols will strengthen ties with care providers seeking comprehensive mobility solutions.

Second, supply chain agility must become a strategic imperative. Decision-makers should expand dual-sourcing strategies for critical alloys and electronic components, thereby mitigating exposure to trade fluctuations and ensuring continuity of supply. Establishing regional subassembly hubs can further reduce lead times and transportation costs, positioning organizations to respond quickly to shifting demand across continents.

Third, distribution channel optimization remains critical. While offline relationships continue to drive high-value institutional sales, scaling digital commerce capabilities will capture growing demand from remote care coordinators and independent practitioners. Tailored e-commerce experiences, complete with virtual product demos and flexible financing options, will unlock new buyer segments and streamline procurement cycles.

Finally, forging deeper partnerships with rehabilitation networks, insurance providers, and patient advocacy groups will amplify market reach. Co-developed training programs and outcome documentation initiatives can bolster reimbursement support and reinforce device efficacy. By executing these integrated strategies, industry leaders will be well-positioned to deliver superior patient outcomes, drive revenue growth, and sustain competitive advantage in a rapidly evolving market.

Detailing Rigorous Research Methodologies Employed to Ensure Comprehensive, Accurate, and Insight-Driven Analysis of the Bariatric Walker Market

The research employed a rigorous multi-stage methodology to ensure comprehensive coverage and data accuracy. Initially, a structured secondary research phase synthesized peer-reviewed medical journals, health policy databases, and regulatory filings to establish foundational industry knowledge. This was augmented by an extensive review of manufacturers’ technical documentation and user manuals, providing granular insights into device specifications and feature sets. In parallel, patent analysis was conducted across major intellectual property repositories to map innovation trajectories within bariatric walker technologies.

Building on this desk-based foundation, the primary research phase involved in-depth interviews with orthopedic specialists, rehabilitation therapists, procurement officers, and supply chain managers across North America, Europe, and Asia-Pacific. These interviews probed pain points, adoption barriers, and emerging feature preferences directly from market participants. Furthermore, select focus groups with home healthcare coordinators and hospital equipment managers offered real-world perspectives on usability and maintenance considerations. Quantitative validation was achieved by surveying a representative sample of end users and distributors, enabling cross-regional comparisons of priority attributes and purchasing criteria.

To enhance validity, data triangulation was applied by cross-referencing primary findings with shipment records, importer-exporter databases, and regulatory approval timelines. This multi-vector approach minimized biases and ensured that emerging trends were corroborated by both anecdotal evidence and hard data. Finally, an iterative expert review process, involving senior analysts and clinical advisors, refined the key insights and recommendations, ensuring that the final deliverable offers actionable guidance underpinned by sound methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bariatric Walker market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bariatric Walker Market, by Product Type

- Bariatric Walker Market, by End User

- Bariatric Walker Market, by Distribution Channel

- Bariatric Walker Market, by Region

- Bariatric Walker Market, by Group

- Bariatric Walker Market, by Country

- United States Bariatric Walker Market

- China Bariatric Walker Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Summarizing Key Insights and Strategic Implications to Chart the Path Forward for Stakeholders in the Bariatric Walker Sector

The conclusion distills the report’s critical takeaways, reaffirming how converging dynamics are reshaping the bariatric walker ecosystem. From the ascendancy of smart sensor-enabled models to the recalibration of supply chains under 2025 tariff regimes, stakeholders must navigate a landscape characterized by both opportunity and complexity. The segmentation insights highlight the need for product portfolios that address discrete requirements across electric versus manual variants, diverse end-user environments, and evolving distribution pathways. Regional analysis underscores that while the Americas lead in premium solutions adoption, nuanced cost-performance trade-offs in EMEA and rapid infrastructure development in Asia-Pacific will define next-generation growth corridors.

Strategically, the competitive arena is increasingly defined by alliances that integrate clinical expertise, digital health capabilities, and manufacturing prowess. The actionable recommendations offer a clear blueprint for companies seeking to leverage these partnerships, optimize supply networks, and engage emerging buyer segments through both offline and digital channels. Meanwhile, the research methodology section provides transparency into the rigorous processes that underpin the report’s findings, instilling confidence in the validity of the insights.

As stakeholders confront evolving reimbursement models and heightened outcome expectations, this report serves as a vital navigational aid. By synthesizing diverse perspectives-from rehabilitation specialists to procurement leaders-it enables decision-makers to align their product roadmaps and go-to-market strategies with the nuanced realities of the bariatric walker domain. Ultimately, the report’s concluding insights illuminate pathways for sustained innovation, market resilience, and enhanced patient mobility outcomes.

Engage Directly with Associate Director Ketan Rohom to Secure the Definitive Bariatric Walker Market Research Report for Strategic Advantage

Unlock unparalleled strategic insight into the bariatric mobility space by connecting directly with Ketan Rohom, the Associate Director of Sales & Marketing renowned for guiding Fortune 500 healthcare providers through vital mobility investments. Drawing on an extensive track record of delivering actionable intelligence, he will guide your team through the report’s most compelling findings and tailor recommendations to your unique objectives. Engage now to secure the definitive research asset that equips your organization with the market clarity needed to outpace the competition, forge high-value partnerships, and drive longterm growth. Take the next step by reaching out to Ketan Rohom to obtain the comprehensive bariatric walker market research report.

- How big is the Bariatric Walker Market?

- What is the Bariatric Walker Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?