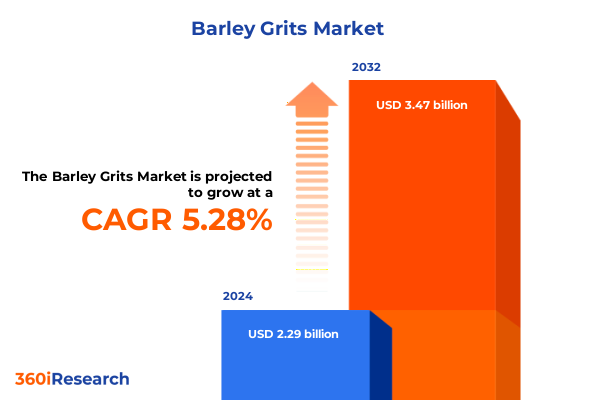

The Barley Grits Market size was estimated at USD 2.40 billion in 2025 and expected to reach USD 2.51 billion in 2026, at a CAGR of 5.39% to reach USD 3.47 billion by 2032.

Exploring the Evolution and Significance of Barley Grits as an Instrumental Ingredient Driving Innovation across Food, Feed, and Brewing Sectors

The barley grits market has evolved far beyond its traditional role as a humble breakfast staple, emerging as a multifaceted ingredient with applications that span the food, brewing, and animal feed industries. Over recent years, rising consumer interest in whole grains, coupled with an increased focus on ingredient transparency and functional benefits, has propelled barley grits into the spotlight. Nutrition-conscious consumers and innovative food manufacturers alike now view barley grits as a versatile component capable of delivering texture, flavor, and health benefits in equal measure.

Simultaneously, producers and processors have invested in refining milling techniques and streamlining supply chains to ensure consistent quality and traceability from farm to table. Advances in agronomic practices have enhanced barley crop yields and nutrient profiles, while processing innovations have enabled the creation of specialized product forms, such as quick cooking variants, that cater to the on-demand lifestyle of modern consumers. As a result, barley grits have become a bridge between traditional culinary uses and contemporary foodservice and retail formats.

In this context, stakeholders across the value chain are challenged to understand the diverse drivers shaping demand and to anticipate the shifts that will define future growth. By examining the evolving consumer preferences, technological breakthroughs, and regulatory developments that influence barley grits, this introduction sets the stage for a comprehensive analysis. Such a foundation is essential for strategic decision-making and for unlocking the full potential of barley grits in an ever-changing marketplace.

Unveiling the Major Shifts in Barley Grits Demand and Supply Dynamics Fueled by Sustainable Practices and Technological Advancements in Processing

Shifts in consumer appetites and industry practices have reconfigured the barley grits landscape in profound ways. Recently, a heightened emphasis on plant-based nutrition and functional food ingredients has elevated barley grits from a niche offering to a mainstream strategic component. This trend is mirrored by food processors who integrate barley grits into high-protein snack formulations and fortified bakery products in response to consumer demands for healthier indulgences.

Technological advancements have further catalyzed this transformation. Improved milling methods now yield uniform grit sizes that enhance cooking consistency and expand use cases across both industrial-scale and artisanal applications. Traceability solutions, powered by blockchain and digital farm-to-fork platforms, have also gained traction, enabling brands to substantiate quality claims and meet stringent food safety requirements, thereby bolstering consumer confidence and brand loyalty.

Moreover, the convergence of sustainability imperatives and innovation has ushered in new opportunities. Growers are adopting regenerative agriculture practices that not only strengthen soil health but also enhance the nutritional properties of barley. Concurrently, processors are exploring greener energy sources and water-efficient operations to minimize their environmental footprint. These combined shifts underscore a paradigm in which barley grits are no longer viewed merely as an agricultural commodity but as a cornerstone of sustainable, value-added product portfolios.

Analyzing the Comprehensive Effects of 2025 United States Tariff Implementations on Barley Grits Trade Flows, Pricing, and Supply Chains

The 2025 imposition of new United States tariffs on imported barley grits has reverberated across global trade networks, reshaping cost structures and redirecting supply flows. Domestic processors have confronted elevated input costs, prompting a strategic pivot toward local sourcing and in some cases accelerated investments in milling capacity to circumvent the financial burden of higher duties. As a result, millers situated in leading barley-producing regions of North America have expanded their operational footprints to capture incremental demand.

For exporters, the tariffs have introduced the necessity of recalibrating trade routes and identifying alternative markets with more favorable duty regimes. Some suppliers have shifted volumes to markets in Latin America and Asia-Pacific where bilateral agreements and regional trade partnerships offer lower barriers to entry. Consequently, traditional supply chains have been supplemented by more complex, multi-leg logistics strategies designed to mitigate tariff exposure while preserving lead-time commitments.

In parallel, pricing behaviors across the value chain have exhibited increased volatility. Buyers and sellers alike have adopted flexible contracting models that incorporate tariff pass-through clauses and dynamic cost-sharing mechanisms. This agility has allowed stakeholders to hedge against abrupt policy shifts and maintain supply continuity. As we delve into the broader repercussions of these tariff measures, it becomes evident that trade policy is not simply a cost factor but a strategic lever influencing sourcing decisions, distribution models, and competitive positioning within the barley grits sector.

Deciphering Core Segmentation Patterns Revealing Distinct Opportunities across Product Types, Applications, Distribution Channels, and End Users

Segmenting the barley grits landscape yields critical insights into how specific product forms and consumption scenarios drive value creation. When categorizing by product type, hulled grits offer the full bran and germ, appealing to brands prioritizing whole-grain claims and maximum nutrient retention. In contrast, pearled grits remove the outer layer, enabling a milder flavor profile and shorter cooking times favored by foodservice operations. The quick cooking range, subdivided into instant quick and regular quick, targets convenience-seeking consumers and pre-prepared meal producers who demand rapid reconstitution without sacrificing texture.

Consideration of application reveals further strategic nuances. In the animal feed sector, barley grits serve as a cost-effective energy source that can optimize feed formulations for livestock growth and health. Brewing applications leverage the unique starch characteristics of barley grits to produce specialty beers with deeper color profiles and enhanced mouthfeel. Within the food industry, bakeries incorporate barley grits into artisanal bread and specialty rolls to improve crumb structure and extend shelf life, while snack manufacturers embed them into extruded snacks to boost fiber content and deliver a satisfying crunch.

Analyzing distribution channels underscores the criticality of consumer convenience and evolving retail dynamics. Convenience stores provide on-the-go meal options featuring quick cooking grits, while supermarkets and hypermarkets serve as the primary touchpoints for traditional and value-added forms. Online platforms, encompassing both direct-to-consumer e-commerce and third-party marketplaces, have experienced rapid growth, enabling niche producers to reach specialized audiences without the constraints of brick-and-mortar distribution.

Finally, examination by end user highlights the bifurcation between commercial and residential demand. Commercial outlets, notably hotels and restaurants, integrate barley grits into menu innovations ranging from gourmet brunch dishes to internationally inspired entrées, reflecting a desire to differentiate culinary offerings. Meanwhile, the residential segment has embraced barley grits through meal kits and home-cooking tutorials that cater to health-oriented households seeking novel ingredients. Through these segmentation lenses, it becomes possible to tailor product development, marketing, and distribution strategies to the precise needs of each submarket.

This comprehensive research report categorizes the Barley Grits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Distribution Channel

- End User

Examining Regional Dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific That Shape Barley Grits Adoption and Industry Behavior Patterns

Regional dynamics play a pivotal role in shaping barley grits consumption patterns and growth prospects. In the Americas, a resurgence of artisanal food culture has sparked renewed interest in heritage grains, driving both premium bakeries and craft breweries to incorporate barley grits into their offerings. North American producers benefit from strong domestic barley cultivation, which translates into shorter supply chains and lower logistical overhead for local processors.

Across Europe, Middle East & Africa, regulatory frameworks promoting whole-grain intake and clean-label products have elevated the status of barley grits as a health-forward ingredient. European milling centers are innovating by blending barley grits with other cereals to create hybrid flour mixes, while Middle Eastern bakeries integrate grits into traditional flatbread recipes. In Africa, nascent feed mill sectors view barley grits as a high-energy component that supports livestock nutrition programs.

Asia-Pacific has emerged as a hotspot for barley grits expansion, driven by growing middle-class populations and increased awareness of functional foods. In countries like Japan and South Korea, demand for quick cooking variants has surged due to convenience-oriented lifestyles and busy urban demographics. Furthermore, Australia’s role as a key barley exporter ensures strong engagement between local producers and international buyers, fostering collaborative research into premium grit textures tailored to diverse culinary traditions.

Taken together, these regional insights illuminate how geographic factors-from agricultural endowments to consumer health policies-intersect to define unique value propositions for barley grits across the globe.

This comprehensive research report examines key regions that drive the evolution of the Barley Grits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Strengthening Positioning within the Global Barley Grits Competitive Landscape

Leading agri-grain corporations and specialized milling enterprises are actively shaping the competitive climate of the global barley grits space. Major integrated agribusinesses have pursued vertical integration strategies, securing barley supply through direct partnerships with farming cooperatives and thereby gaining greater control over quality parameters. These firms frequently leverage their expansive distribution networks to introduce private-label barley grit offerings in large retail chains.

Meanwhile, independent millers focus on product differentiation through innovation and customization. By investing in pilot plants and research collaborations with academic institutions, these companies develop novel grit formulations that deliver unique sensory attributes or enhanced functional properties. Some have established centers of excellence dedicated to process engineering, enabling rapid prototyping and scale-up of specialty grits designed for emerging applications, such as plant-based meat analogues and gluten-reduced bakery mixes.

Additionally, strategic alliances and joint ventures have emerged as key mechanisms for expanding geographic reach and complementing technical capabilities. Select players partner with brewing technology firms to co-develop barley grit variants optimized for craft beer production, while others collaborate with food ingredient distributors to extend their penetration into burgeoning e-commerce channels. Such cooperative models not only accelerate time to market but also distribute risk across multiple stakeholders, reinforcing resilience in an environment characterized by shifting trade policies and evolving consumption preferences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Barley Grits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer-Daniels-Midland Company

- Ardent Mills, LLC

- Bay State Milling Company, LLC

- Bunge Limited

- Cargill, Incorporated

- Grain Millers, LLC

- GrainCorp Limited

- Mamtakim Inc.

- McEwen & Sons

- Midlands Holdings

- Minn-Dak Growers, Ltd.

- Natural Way Mills

- Olam International Limited

- Pride Milling Company

- Richardson International Limited

- Shiloh Farms

- Skvyrskyi Grain Processing Factory, Ltd.

- The Congaree Milling Company

- The Quaker Oats Company

- The Scoular Company

- Vishal Daliya

- Viterra Inc.

- Woodland Foods, Ltd.

- YanGuFang International Group Co., Ltd.

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Barley Grits Trends, Mitigate Risks, and Drive Sustainable Growth Trajectories

To effectively harness the opportunities within the barley grits sector, industry leaders should prioritize the establishment of integrated sustainability frameworks that encompass both upstream cultivation and downstream processing. By adopting regenerative agricultural practices and investing in closed-loop processing systems, companies can secure a consistent supply of high-quality barley while demonstrating environmental stewardship to end consumers.

Furthermore, the acceleration of innovation in quick cooking and functional grit variants is essential. Allocating resources to co-development partnerships with food service operators and retail bakery chains can yield proprietary formulations that address specific texture, cooking time, and nutritional goals. Simultaneously, forging strategic alliances with technology providers specializing in advanced milling and traceability solutions will enhance transparency and efficiency across the value chain.

Diversification of distribution channels is recommended to reach both established and emerging consumer segments. Companies should expand direct-to-consumer e-commerce platforms featuring experiential digital content, such as cooking tutorials and nutritional guides, while also optimizing third-party online marketplaces to broaden market access. In addition, balanced engagement with traditional convenience store and supermarket partners will maintain the visibility of standard product lines.

Finally, proactive scenario planning around trade policy shifts will enable organizations to anticipate tariff adjustments and reconfigure sourcing strategies with agility. Leveraging data analytics for real-time monitoring of import duties and establishing flexible supply arrangements will minimize disruption and safeguard competitive margins. By integrating these actionable steps into their strategic roadmaps, industry participants can strengthen resilience and position themselves for sustained expansion.

Outlining the Rigorous Methodological Framework Employed to Derive Credible and Insightful Findings within a Comprehensive Barley Grits Analysis

This analysis draws upon a rigorous dual-stage methodology combining extensive secondary research with targeted primary engagements. In the initial phase, a comprehensive review of academic publications, industry white papers, and regulatory documentation provided foundational insights into historical trends, technological advancements, and policy developments affecting barley grits.

Subsequently, qualitative interviews with key stakeholders-including grain growers, processing plant managers, food service executives, and regulatory experts-offered direct perspectives on operational challenges, emerging opportunities, and strategic priorities. These discussions were complemented by quantitative data collection from logistic providers, distribution channel audits, and consumption surveys, ensuring a robust triangulation of information.

Data synthesis involved advanced analytical techniques, including cross-segmentation correlation analysis to identify high-value submarkets, and scenario modeling to assess the implications of trade policy shifts and sustainability transitions. Ongoing advisory board reviews and peer validation sessions upheld the integrity of the findings, guaranteeing that interpretations accurately reflect real-world conditions.

Throughout the research lifecycle, stringent quality controls were applied to maintain consistency, reliability, and transparency. This methodological framework yields authoritative insights that empower stakeholders to navigate the barley grits landscape with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Barley Grits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Barley Grits Market, by Product Type

- Barley Grits Market, by Application

- Barley Grits Market, by Distribution Channel

- Barley Grits Market, by End User

- Barley Grits Market, by Region

- Barley Grits Market, by Group

- Barley Grits Market, by Country

- United States Barley Grits Market

- China Barley Grits Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing the Critical Takeaways and Strategic Implications for Stakeholders Operating in the Evolving Barley Grits Environment

In synthesizing the key themes of this study, it is clear that barley grits have transcended their traditional role to become a strategic ingredient in diverse industry contexts. The confluence of consumer health orientation, processing innovations, and sustainable agriculture practices underscores a transformative period for the sector. Moreover, the 2025 United States tariffs have illuminated the importance of agility in trade and supply chain management, compelling stakeholders to rethink sourcing and distribution models.

Segmentation insights reveal that distinct product types and application areas each present unique value propositions, while the expansion of online distribution channels has unlocked new avenues for growth beyond conventional retail. Regional analysis highlights the heterogeneous nature of demand drivers, with each geographic cluster exhibiting specific consumption patterns shaped by cultural preferences, regulatory regimes, and local supply capabilities.

Finally, competitive strategies employed by leading companies-ranging from vertical integration and process innovation to strategic partnerships-demonstrate the multifaceted approaches needed to secure market positioning. By translating these insights into actionable plans, organizations can navigate potential disruptions and capitalize on emerging opportunities within the barley grits ecosystem.

Engage with Associate Director Ketan Rohom to Access Bespoke Barley Grits Intelligence Tailored for Strategic Decision Making and Growth Acceleration

I invite you to partner with Associate Director Ketan Rohom to obtain an in-depth report designed to equip your organization with the critical intelligence needed to navigate the complexities of the barley grits sector. Through a personalized consultation, you will gain access to comprehensive insights that span trade dynamics, segmentation analyses, key regional drivers, and competitive positioning. By engaging directly, you will uncover tailored strategies that align with your growth objectives and risk tolerance, ensuring you stay ahead of evolving industry challenges.

This detailed report serves as a foundational tool for executives, product developers, supply chain managers, and strategic planners seeking to capitalize on emerging opportunities and preempt threats in the market. Your dialogue with Ketan Rohom will clarify how this intelligence can be applied to optimize sourcing, streamline distribution networks, and drive innovation in product offerings. Don’t miss this opportunity to transform raw data into actionable plans that deliver measurable business outcomes. Reach out today to secure your advantage in the barley grits landscape and accelerate your trajectory toward growth and resilience.

- How big is the Barley Grits Market?

- What is the Barley Grits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?