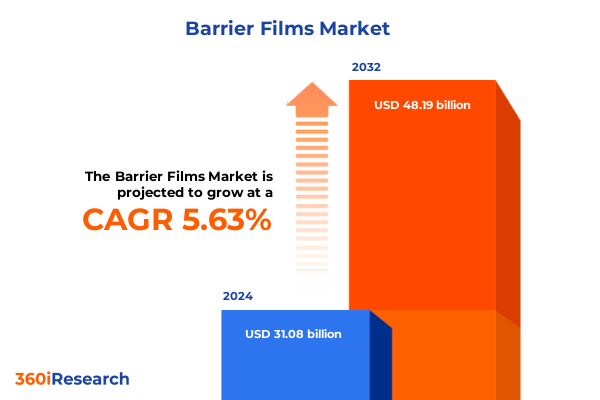

The Barrier Films Market size was estimated at USD 32.56 billion in 2025 and expected to reach USD 34.11 billion in 2026, at a CAGR of 5.76% to reach USD 48.19 billion by 2032.

Unveiling the Strategic Role of Advanced Barrier Films in Safeguarding Products and Elevating Packaging Performance Across Industries

Advanced barrier films serve as critical enablers in modern packaging, providing essential protection against oxygen, moisture, light, and other external factors that can compromise product quality and shelf life. As companies strive to meet stringent regulatory requirements and elevated consumer expectations, barrier films have emerged as a cornerstone of innovation in industries ranging from food and beverages to pharmaceuticals and consumer goods. By combining high-performance polymers, multi-layer structures, and sophisticated coating technologies, these films ensure product integrity throughout transportation, storage, and retail display.

Moreover, the market is witnessing an increasing shift toward sustainable and circular packaging solutions. Manufacturers are exploring bio-based polymers and recyclable laminates to address environmental concerns without sacrificing barrier performance. Consequently, barrier films are positioned at the nexus of performance optimization and sustainability, driving companies to reimagine packaging systems that reduce waste, lower carbon footprints, and resonate with eco-conscious consumers. This executive summary offers a comprehensive overview of the transformative trends shaping the barrier film landscape and outlines strategic insights for stakeholders seeking to stay ahead in a rapidly evolving market.

Exploring the Integral Technological Innovations and Sustainable Trends Revolutionizing Barrier Film Applications and Sustainability Strategies Worldwide

The barrier film landscape is undergoing a profound transformation fueled by innovations in polymer science and manufacturing processes. Recent advances in multi-layer coextrusion and nanocomposite coatings have enabled films to achieve unprecedented levels of barrier performance, mechanical strength, and clarity. These breakthroughs have empowered brand owners to adopt thinner, lighter packaging formats that reduce material consumption while maintaining critical protection rates. In tandem, digital printing technologies have revolutionized aesthetics and customization, enabling high-resolution graphics and variable data printing directly on barrier substrates.

Equally significant is the acceleration of sustainability imperatives. Companies are increasingly investing in recycle-friendly structures and mono-polymer laminates that simplify end-of-life processing. In response, chemical innovators are developing bio-derived polymers such as polylactic acid blends and engineered polyhydroxyalkanoates that offer competitive barrier properties. As a result, industry participants are transitioning from traditional fossil-based materials toward greener alternatives without compromising performance. This shift toward eco-innovations and smart manufacturing techniques is reshaping supply chains and redefining value propositions across the barrier film ecosystem.

Analyzing the Comprehensive Impact of 2025 United States Tariffs on Barrier Film Supply Chains Cost Structures and Market Dynamics

The imposition of revised tariffs on barrier film imports into the United States in 2025 has exerted far-reaching effects on supply chain configurations and cost structures. Heightened duty rates on key imported film grades prompted many downstream converters to reassess sourcing strategies, leading to nearshoring initiatives and enhanced domestic production investments. As import costs surged, negotiations between buyers and suppliers intensified, driving collaborative efforts to optimize material formulations and streamline production workflows to mitigate price pressures.

In addition, these tariff adjustments accelerated supply base diversification. Manufacturers sought alternative export origins in Southeast Asia and Latin America, balancing cost efficiencies with logistical reliability. Consequently, raw material suppliers and film producers have pursued capacity expansions in North America, supported by local policy incentives and targeted capital expenditure. While some cost increases were absorbed upstream, a portion was passed through to end users, prompting brand owners to explore value engineering and packaging redesign. Overall, the evolving tariff landscape of 2025 has reinforced the need for agile sourcing models and proactive risk management across the barrier film value chain.

Uncovering Critical Segmentation Insights by Type Material Packaging End User and Distribution Channel to Reveal Key Market Drivers and Opportunities

A nuanced understanding of market segmentation reveals distinct demand drivers and performance priorities. By type, metalized barrier films deliver superior oxygen and moisture resistance alongside visual appeal, making them a preferred choice for snack foods and premium consumer goods, while transparent barrier films cater to applications where product visibility and clarity are paramount. White barrier films, on the other hand, offer an optimal canvas for branding and labeling, enabling companies to enhance shelf presence and consumer recognition.

Material composition further delineates market segments. Polyamide variants are valued for their robust mechanical properties and high barrier against aromas and contaminants, whereas polyethylene grades provide cost-effective moisture resistance for general-purpose packaging. Polyethylene terephthalate excels in offering a balance of clarity, strength, and barrier performance, while polypropylene is often selected for its seal integrity and thermal resistance. Packaging format segmentation illustrates that bags and pouches dominate flexible packaging applications due to convenience and reclosability, while blister packs remain essential for healthcare products, and sachets and stick packs address single-serve and on-the-go consumption.

End-user segmentation underscores diverse adoption patterns. The consumer goods industry leverages barrier films to preserve premium cosmetic and personal care items; the food industry prioritizes shelf-life extension and freshness; the healthcare industry demands stringent protection for medical devices; and pharmaceutical applications necessitate uncompromising sterility and security. Distribution channel segmentation highlights that traditional offline platforms fulfill large volume industrial requirements, whereas online platforms are driving rapid growth in e-commerce packaging solutions. This integrated segmentation analysis illuminates unique needs and strategic opportunities within the barrier film market.

This comprehensive research report categorizes the Barrier Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Packaging

- End Users

- Distribution Channel

Delving into Regional Dynamics Revealing Growth Patterns Challenges and Strategic Imperatives across Americas EMEA and Asia-Pacific Packaging Markets

Regional dynamics reveal significant heterogeneity in the adoption and evolution of barrier films across global markets. In the Americas, stringent food safety regulations and well-established cold chain infrastructure have spurred demand for high-performance barrier solutions, particularly within the food and beverage sector. Meanwhile, pharmaceutical packaging in this region benefits from robust quality standards, driving innovation in tamper-evident and child-resistant films. In addition, a growing emphasis on sustainability initiatives has prompted leading converters to invest in recyclable and mono-polymer laminates.

Across Europe, Middle East and Africa, regulatory frameworks such as the EU’s Plastic Packaging Directive have prompted rapid deployment of eco-friendly barrier films. Manufacturers are responding with bio-based barrier coatings and enhanced recyclability, aligning with circular economy goals. High value industries like pharmaceuticals and personal care have become testbeds for advanced barrier formulations, integrating antimicrobial properties and intelligent packaging functionalities.

In Asia-Pacific, a robust manufacturing ecosystem and cost advantages have established the region as a global production hub. Rapid urbanization and rising disposable incomes are elevating demand for convenient packaged foods, driving adoption of flexible barrier films in pouches and sachets. Government incentives for domestic polymer production and investments in sustainable technologies are further accelerating market growth, making Asia-Pacific a critical arena for competitive positioning and capacity expansions.

This comprehensive research report examines key regions that drive the evolution of the Barrier Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Initiatives and Competitive Positioning of Leading Barrier Film Manufacturers Shaping Industry Evolution

Key industry participants are deploying diverse strategies to fortify their market positions. Leading manufacturers are investing in capacity expansions and greenfield projects to meet rising demand in strategic geographies, while simultaneously upgrading production lines to accommodate advanced coextrusion and coating technologies. Strategic mergers and acquisitions are reshaping the competitive landscape, as companies pursue synergies in R&D, distribution networks, and sustainability capabilities.

Furthermore, major players are forging partnerships across the value chain. Collaborations with polymer developers have led to breakthrough barrier materials optimized for lighter gauge structures and enhanced recyclability. Joint ventures with converters and brand owners are fostering co-development initiatives that address application-specific challenges, from aroma retention in snack packaging to moisture protection in pharmaceutical blister packs. In parallel, entrants focused on bio-derived polymers and circular economy solutions are gaining traction through pilot projects and demonstration lines.

As competitive intensity mounts, leading companies are also emphasizing transparency and traceability. Blockchain-based tracking systems and digital watermarking are being integrated into barrier film production to ensure supply chain integrity and facilitate end-of-life recovery. By leveraging these strategic initiatives, industry frontrunners are setting new benchmarks in performance, sustainability, and customer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Barrier Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor Plc

- Atlantis Pak Co. Ltd.

- Berry Global Inc.

- Constantia Flexibles

- Cosmo Films

- Coveris Management GmbH

- Glenroy, Inc.

- Huhtamaki Oyj

- Innovia Films by CCL Industries Inc.

- Jindal Poly Films Ltd.

- Mitsubishi Chemical Holdings Corporation

- Proampac Holdings Inc.

- Raven Industries, Inc. by CNH Industrial N.V.

- Sonoco Products Company

- Sumitomo Chemical Co., Ltd.

Formulating Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Barrier Film Trends and Optimize Competitive Agility

To capitalize on emerging trends, industry leaders should prioritize the adoption of sustainable materials and mono-polymer architectures that facilitate circularity without compromising barrier performance. By investing in next-generation bio-based polymers and retrofit equipment for mono-layer film production, companies can reduce complexity in recycling streams and meet evolving regulatory requirements. In addition, diversifying sourcing strategies through nearshoring and multi-country supply models will mitigate tariff-induced cost volatility and enhance resilience against geopolitical disruptions.

Moreover, focusing on advanced coating and lamination technologies can unlock new value propositions. Collaborating with chemical innovators to develop ultra-thin barrier coatings or nanocomposite layers will support lighter, high-barrier films for premium applications. Strengthening traceability through digital platforms and blockchain solutions will further reinforce trust and compliance, particularly in healthcare and pharmaceutical segments.

Finally, building agile go-to-market capabilities is essential. Engaging directly with brand owners to co-create application-specific packaging, while leveraging e-commerce distribution channels, will drive incremental growth. Regularly monitoring tariff policies and participating in industry associations will ensure proactive responses to regulatory changes. By executing these recommendations, companies can secure competitive advantage and foster sustainable expansion in the evolving barrier film market.

Detailing Rigorous Research Methodology Integrating Primary Secondary Data Collection Statistical Validation and Analytical Frameworks for Barrier Film Studies

This market study employed a robust research methodology blending both primary and secondary data collection to ensure comprehensive and reliable insights. Primary research consisted of in-depth interviews with senior executives at film manufacturers, converters, material suppliers, and brand owners across the barrier film value chain. These interviews provided firsthand perspectives on technological developments, supply chain strategies, and end-user requirements. Additionally, structured surveys capturing quantitative data on production volumes, application preferences, and purchasing criteria were conducted with procurement and R&D professionals in food, pharmaceutical, healthcare, and consumer goods sectors.

Secondary research complemented these findings by leveraging annual reports, technical white papers, regulatory publications, and trade journals to validate market trends and competitive actions. Key statistical information was sourced from government agencies, industry associations, and polymer industry databases. Rigorous data triangulation and statistical validation processes were applied to reconcile discrepancies and enhance accuracy. Analytical frameworks-including PESTLE analysis, Porter’s Five Forces, SWOT evaluation, and value chain mapping-were utilized to assess macroeconomic influences, competitive intensity, organizational strengths, and end-to-end value delivery. This integrated approach ensures that the insights presented are both actionable and reflective of the most current industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Barrier Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Barrier Films Market, by Type

- Barrier Films Market, by Material

- Barrier Films Market, by Packaging

- Barrier Films Market, by End Users

- Barrier Films Market, by Distribution Channel

- Barrier Films Market, by Region

- Barrier Films Market, by Group

- Barrier Films Market, by Country

- United States Barrier Films Market

- China Barrier Films Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Future Outlook on Barrier Film Market Dynamics to Guide Strategic Decision-Making and Inspire Next-Generation Innovation

Drawing together the key findings, barrier films remain indispensable for preserving product integrity and extending shelf life across diverse end-use industries. Technological advancements in polymer science and manufacturing processes are redefining performance benchmarks, while sustainability imperatives are driving a decisive shift toward mono-polymer and bio-based solutions. Tariff adjustments in 2025 have underscored the necessity for flexible sourcing strategies and supply chain diversification, prompting industry participants to realign production footprints and supplier networks.

Segmentation analysis highlights differentiated growth pathways based on film type, material, packaging format, end-user requirements, and distribution channels, offering a granular view of evolving demand patterns. Regional insights reveal that the Americas, EMEA, and Asia-Pacific each present unique regulatory, economic, and infrastructure conditions, shaping strategic priorities accordingly. Leading companies are responding through capacity expansions, technology partnerships, and traceability innovations, positioning themselves to capitalize on market opportunities.

Looking ahead, stakeholders must embrace agility, collaboration, and sustainability to thrive in this dynamic environment. By integrating advanced barrier technologies, adopting circular economy principles, and maintaining proactive regulatory engagement, organizations can drive innovation and secure competitive advantage. This executive summary serves as a strategic roadmap for decision-makers seeking to navigate the complex landscape of barrier films and harness emerging growth opportunities.

Connect with Ketan Rohom to Secure Comprehensive Barrier Film Market Intelligence and Empower Strategic Growth through Customized Research Insights

To explore the depths of barrier film dynamics with a tailored lens, connect with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure comprehensive insights. By engaging directly, you can obtain a customized research package that aligns with your specific strategic priorities, encompassing in-depth analysis of technological trends, tariff impacts, segmentation drivers, and regional growth patterns. Empower your organization with actionable data and expert interpretation designed to elevate decision-making and accelerate market entry. Reach out today to receive a personalized proposal outlining the scope, methodology, and deliverables that will equip you with the intelligence necessary to outpace competitors and drive sustainable growth.

- How big is the Barrier Films Market?

- What is the Barrier Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?