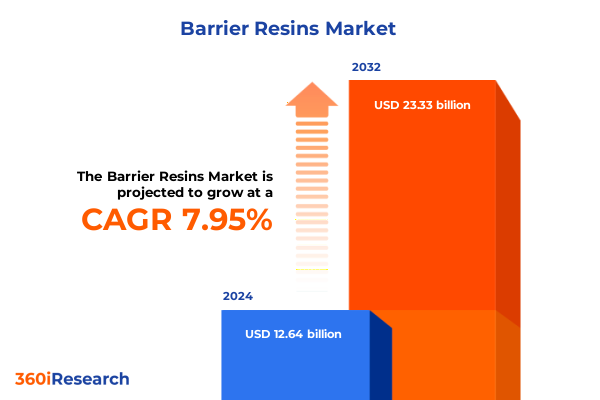

The Barrier Resins Market size was estimated at USD 13.63 billion in 2025 and expected to reach USD 14.70 billion in 2026, at a CAGR of 7.97% to reach USD 23.33 billion by 2032.

Leading the Charge in Advanced Polymer Solutions to Enhance Barrier Efficacy, Sustainability, and Market Resilience Across Packaging and Industrial Domains

The field of barrier resins has evolved into a cornerstone of modern industrial applications, driven by ever-increasing demands for enhanced protection against gas transmission, moisture ingress, and flavor preservation. In its most essential form, a barrier resin functions as a selectively permeable shield, leveraging advanced polymer architectures to inhibit undesirable transfer of substances between packaged contents and the external environment. This capacity has rendered these specialized materials indispensable across a spectrum of sectors, from food and beverage packaging to critical pharmaceutical vials and next-generation automotive components.

Rapid progress in polymer chemistry, coupled with mounting regulatory emphasis on product safety and sustainability, has spurred a renaissance in barrier resin technology. Contemporary formulations integrate multi-layer constructs, nanocomposite additives, and bio-based constituents to achieve performance levels that were inconceivable a decade ago. As organizations grapple with tightening environmental standards and consumer preferences that increasingly favor extended shelf life with minimal resource consumption, the strategic importance of selecting the right barrier resin solution cannot be overstated. Consequently, manufacturers and end-user industries alike are compelled to deepen their comprehension of this dynamic arena, positioning themselves to capitalize on the transformative potential these materials offer.

Uncovering Disruptive Innovations and Regulatory Transformations That Are Reshaping Barrier Resin Applications Globally

Within the last several years, barrier resin technology has been reshaped by a wave of disruptive innovations that have redefined performance benchmarks and cost structures. Developments in co-extrusion processes allow monolayer films to rival traditional multilayer constructs in both barrier efficiency and throughput, dramatically reducing manufacturing complexity. Nanocomposite-enhanced platforms incorporating clay and graphene derivatives have further elevated gas and moisture resistance without sacrificing mechanical flexibility. These breakthroughs are complemented by strides in digital printing compatibility, which enable directly printed barrier packages that streamline branding workflows and reduce waste.

Regulatory landscapes have also undergone pivotal shifts, exerting significant influence on raw material selection and end-of-life considerations. The European Union’s Packaging and Packaging Waste Regulation has intensified the requirement for recyclability and the use of recycled content, while the U.S. Food and Drug Administration has expanded its scrutiny of extractables in pharmaceutical packaging. Together, these policies have catalyzed a strategic pivot toward bio-based barrier resins and recyclable monomaterials. In response, resin producers are forging alliances with recycling consortia and investing in closed-loop certification programs, thereby ensuring compliance while sustaining margin integrity.

Analyzing the Ripple Effects of 2025 United States Tariff Adjustments on Raw Material Pricing, Supply Chains, and Profit Margins

The introduction of new tariffs by the United States in early 2025 has injected a layer of complexity into global barrier resin supply chains. With levies imposed on key monomers and imported polymer intermediates originating from certain trade partners, raw material costs have experienced upward pressure at every tier. This landscape has compelled resin converters to reassess longstanding procurement agreements, exploring alternative feedstock sources in regions unaffected by the tariffs. In many instances, companies have engaged in dual-sourcing strategies, balancing cost impacts against logistics overheads and lead‐time variability.

Beyond immediate cost considerations, these tariff adjustments have precipitated strategic realignments in production footprints. Several multinational resin manufacturers have accelerated investments in North American polymerization facilities to mitigate exposure to duties and capitalize on favorable domestic incentives. Meanwhile, end-user industries are increasingly adopting total cost of ownership models, weighing higher initial resin pricing against savings realized through lower inventory carrying costs and reduced exchange rate risk. Collectively, the cumulative impact of these trade measures underscores the necessity for dynamic supply chain resilience and agile commercial structures in the barrier resin ecosystem.

Unlocking Strategic Advantages Through In-Depth Resin Type, Application, Form, and End-User Industry Demarcation Insights

Understanding the nuances of barrier resin market segmentation provides critical clarity for product developers and procurement specialists alike. When examining resin type, ethylene vinyl alcohol stands out for its exceptional oxygen barrier, frequently utilized in sensitive food packaging applications, while polyethylene terephthalate enjoys widespread adoption in rigid containers thanks to its robust mechanical strength. Polyvinyl alcohol offers superior moisture resistance in flexible films, and polyvinylidene chloride continues to serve demanding pharmaceutical packaging needs due to its proven stability under sterilization.

Application-driven analysis reveals divergent growth trajectories and performance requirements. In automotive systems, barrier resins contribute to fuel cell efficiency and corrosion prevention, whereas the construction sector leverages these materials for vapor retarders and protective membranes. Packaging remains the largest domain, where bottles and containers demand high clarity and sanitary compliance, films require exceptional formability, and both flexible and rigid formats benefit from tailored barrier attributes. Across forms, pellets dominate production due to processing ease, flakes derived from recycling operations enable circularity initiatives, and powder offerings support specialized coating applications. End-user industry insight further refines this view: agriculture utilizes barrier coatings for seed protection, cosmetics benefit from odor-tight packaging, food and beverage products demand extended shelf life, and pharmaceutical manufacturers insist on uncompromising purity standards.

This comprehensive research report categorizes the Barrier Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Form

- Application

- End User Industry

Unearthing Nuanced Drivers, Regulatory Imperatives, and Consumer Trends Shaping Barrier Resin Adoption Across the Americas, EMEA, and Asia-Pacific Regions

Regional factors play an instrumental role in defining barrier resin demand, regulatory compliance, and commercialization pathways. In the Americas, stringent food safety standards and the maturation of pharmaceutical manufacturing hubs have elevated the importance of high-barrier solutions, prompting domestic capacity expansions and innovation partnerships between resin developers and consumer packaged goods firms. Meanwhile, recycling mandates in parts of North America are driving increased adoption of recyclable monolayer barrier systems that align with circular economy objectives.

Across Europe, the Middle East & Africa, legislative frameworks such as the EU’s Single-Use Plastics Directive and ambitious EPR targets are stimulating rapid advancement in bio-based barrier chemistries and post-consumer recycling initiatives. Collaborations between resin producers and waste management enterprises have emerged to overcome regional infrastructure fragmentation. In Asia-Pacific, surging demand from electronics and electric vehicle battery manufacturers, combined with the growth of cold-chain logistics in emerging markets, is fueling investments in high-performance barrier films. Localized polymer production, supported by government incentives in multiple countries, has further enhanced regional competitiveness while mitigating cross-border tariff exposures.

This comprehensive research report examines key regions that drive the evolution of the Barrier Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry-Leading Innovators Shaping Barrier Resin Technologies Through Strategic Partnerships, Capacity Expansions, and Sustainable Portfolios

Leading resin producers have adopted divergent strategies to navigate the evolving barrier resin landscape. Global chemical companies are leveraging their integrated petrochemical footholds to secure upstream feedstock supply, while simultaneously accelerating R&D efforts in next-generation barrier platforms. Some are forging strategic partnerships with film converters and packaging equipment OEMs to co-develop turnkey solutions that streamline production and improve end-user value propositions.

Smaller, specialty resin manufacturers are pursuing dual avenues of growth through targeted acquisitions and technology licensing agreements. By acquiring niche players with proprietary high-barrier polymer blends or coating technologies, these firms are supplementing their portfolios and entering adjacent end-use markets. Additionally, collaboration with material science research institutions has enabled accelerated prototyping cycles and faster time-to-market for novel formulations. Across the board, a pronounced shift toward sustainability credentials-such as carbon footprint labeling and bio-based content certification-has emerged as a key differentiator in competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Barrier Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- BP Polymers

- Denka Chemicals Holdings Asia Pacific Pte Ltd

- Du Pont de Nemours

- Eastman Chemical Company

- Evergreen Chemicals Co., Ltd.

- Kuraray Co., Ltd.

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Holdings Corporation

- Nippon Gohsei Co., Ltd.

- Solvay S.A.

- The Dow Chemical Company

Implementing Proactive Strategies to Enhance Resilience, Sustainability, and Competitive Positioning in the Barrier Resin Landscape

Industry leaders poised for sustained success are those that incorporate circular economy principles into core business models. By investing in chemically recyclable barrier resins and forging alliances with post-consumer recycling enterprises, organizations can reduce dependency on virgin feedstocks while responding to mounting regulatory and consumer demands for eco-conscious packaging. Moreover, proactive engagement in cross-industry consortia accelerates standard-setting for recyclability and ensures interoperability across product lifecycles.

Concurrently, strengthening supply chain visibility through digital traceability platforms allows for real-time monitoring of raw material flows and tariff exposures. Configuring procurement systems to incorporate alternative feedstock sources and logistics overlays enhances agility in response to trade policy shifts. Finally, prioritizing co-development agreements with film and container converters for customized barrier solutions unlocks incremental value by aligning material properties with evolving application-specific performance criteria. Collectively, these strategic moves position companies not only to weather current market headwinds but to emerge as innovation leaders.

Adopting Rigorous Mixed-Method Research Approaches Combining Primary Insights, Secondary Data, and Quantitative Analysis for Robust Barrier Resin Intelligence

Our research methodology integrates comprehensive secondary intelligence with targeted primary interviews to deliver a robust understanding of the barrier resin sector. Secondary data sources include trade journals, patent filings, regulatory agency publications, and technical whitepapers, which are triangulated to identify key technology trends and historical regulatory shifts. This is complemented by in-depth interviews with polymer chemists, packaging engineers, and supply chain executives to validate critical assumptions and uncover nuanced market drivers.

Quantitative analysis is employed to map production capacities, feedstock supply chains, and cost structures, leveraging industry-standard models and proprietary process simulations. Additionally, case study evaluations of major application segments provide contextual clarity on end-user adoption barriers and performance imperatives. The result is a multi-dimensional perspective that balances empirical data with stakeholder insights, ensuring the findings are both actionable and reflective of real-world operational dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Barrier Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Barrier Resins Market, by Resin Type

- Barrier Resins Market, by Form

- Barrier Resins Market, by Application

- Barrier Resins Market, by End User Industry

- Barrier Resins Market, by Region

- Barrier Resins Market, by Group

- Barrier Resins Market, by Country

- United States Barrier Resins Market

- China Barrier Resins Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Consolidating Key Findings to Illuminate Future Pathways for Innovation, Sustainability, and Market Leadership in Barrier Resin Technologies

As barrier resin technologies continue to advance, the intersection of performance innovation, regulatory evolution, and sustainability imperatives will define the competitive landscape. Organizations that maintain a forward-looking posture-embracing bio-based materials, investing in recyclable architectures, and cultivating supply chain flexibility-will be best positioned to seize emerging opportunities. Stakeholders must continuously refine their material selection criteria to account for shifting consumer expectations, regulatory requirements, and trade policy influences.

Looking ahead, collaborative platforms that bring together resin manufacturers, converters, policymakers, and recyclers will be critical in establishing standardized frameworks for circularity and safety. Continued investment in R&D, coupled with strategic partnerships, will unlock new barrier applications in sectors ranging from advanced electronics to biomedical packaging. Ultimately, the companies that integrate technological prowess with sustainability and operational agility will lead the charge, redefining what is possible in barrier resin innovation.

Engage with Our Associate Director to Secure Comprehensive Barrier Resin Insights and Elevate Your Strategic Decision-Making

For organizations poised to harness the full potential of barrier resin advancements, direct engagement with our Associate Director, Sales & Marketing, Ketan Rohom, is the definitive next step. By collaborating closely, decision-makers gain privileged access to in-depth analyses, proprietary insights, and strategic frameworks that can be customized to their unique operational requirements.

Ketan Rohom is available to guide you through how the intelligence within this comprehensive industry report can inform capital investment decisions, R&D initiatives, and supply chain optimization strategies. Reach out today to secure your copy of the market research report and empower your organization with the clarity and foresight needed to lead in an increasingly competitive barrier resin landscape.

- How big is the Barrier Resins Market?

- What is the Barrier Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?