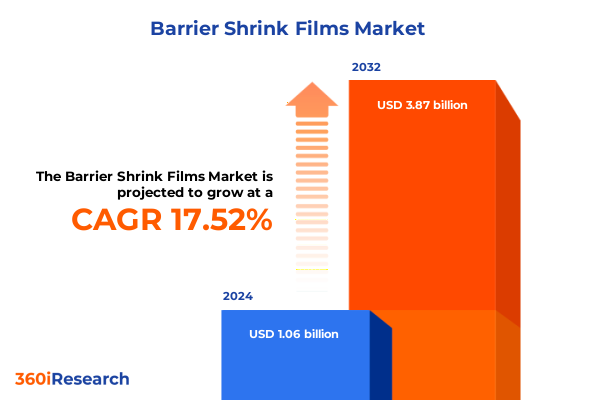

The Barrier Shrink Films Market size was estimated at USD 1.23 billion in 2025 and expected to reach USD 1.43 billion in 2026, at a CAGR of 17.69% to reach USD 3.87 billion by 2032.

Unlocking the Future of Barrier Shrink Films Through Innovation, Enhanced Performance, Sustainability, and Strategic Industry Transformation

Barrier shrink films have become an indispensable component in modern packaging ecosystems, delivering robust protection and extending product shelf life across diverse industries. These specialized films, engineered to provide an effective barrier against moisture, gases, and external contaminants, are increasingly vital for preserving product integrity in sectors ranging from food and beverage to pharmaceuticals. As consumer demand shifts toward fresher, safer, and more sustainable packaging, barrier shrink films offer the versatility and performance required to meet stringent regulatory standards and consumer expectations.

Over recent years, innovations in polymer science and processing technologies have propelled barrier shrink films to the forefront of packaging solutions. Enhanced barrier properties delivered by advanced materials prevent spoilage and maintain product quality throughout transportation and storage. At the same time, manufacturers are optimizing mechanical strength and transparency to ensure both functional and aesthetic requirements are satisfied. This dual focus on performance and presentation positions barrier shrink films as a core enabler of brand differentiation, while also addressing environmental concerns through reduced packaging waste.

Moreover, the integration of barrier shrink films into supply chain strategies has unlocked new opportunities for cost efficiencies and operational improvements. By reducing product damage and minimizing the need for secondary packaging layers, these films support lean inventory management and lower transportation costs. As stakeholders across the value chain-from raw-material suppliers to end users-seek to streamline processes and enhance sustainability credentials, barrier shrink films emerge as a critical solution for driving value and resilience.

Looking ahead, the convergence of consumer trends, regulatory pressures, and technological advancements underscores the compelling need for a comprehensive understanding of the barrier shrink film market. This report’s executive summary provides a high-level overview of key drivers, challenges, and strategic imperatives, equipping decision-makers with the insights necessary to capitalize on emerging opportunities and navigate the evolving landscape.

Navigating Transformative Shifts in Packaging Dynamics Driven by Regulatory, Technological, and Sustainability Imperatives Shaping Barrier Shrink Films

The landscape of barrier shrink films is undergoing transformative shifts driven by evolving consumer expectations, stringent environmental regulations, and rapid technological advancements. Across various end-use industries, brand owners are demanding packaging solutions that not only preserve product quality but also convey a commitment to sustainability and circular economy principles. As a result, manufacturers are investing heavily in research and development to introduce biodegradable and compostable barrier films, while simultaneously enhancing barrier performance to rival conventional polymers.

Technological innovation in film extrusion and coating processes is reshaping production efficiencies and enabling the development of multi-layer structures with ultra-thin profiles. These advancements deliver superior barrier properties against oxygen and moisture infiltration without compromising film flexibility or optical clarity. In parallel, the advent of smart packaging solutions-incorporating sensors and indicators-has begun to integrate with barrier shrink films, offering real-time monitoring of freshness and temperature exposure throughout the supply chain.

Regulatory frameworks around the globe are also exerting significant influence on the barrier shrink film market’s trajectory. Governments in key regions are imposing stringent mandates on single-use plastics and incentivizing the adoption of recyclable packaging materials. This regulatory momentum is catalyzing collaboration among stakeholders to develop closed-loop systems and recycling infrastructures that facilitate the recovery and repurposing of barrier films. As a consequence, partnerships between resin producers, film converters, and waste management entities have gained prominence, underscoring the importance of end-to-end integration to achieve sustainability targets.

Going forward, the interplay between sustainability, regulatory compliance, and technological breakthroughs will continue to redefine the barrier shrink film sector. Organizations that proactively embrace these transformative shifts-by engaging in cross-industry alliances, accelerating material innovation, and optimizing film architectures-will be best positioned to cater to evolving market demands and establish long-term competitive advantage.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Barrier Shrink Film Supply Chains, Pricing Structures, and Strategic Sourcing Decisions

The implementation of cumulative tariffs by the United States in 2025 has introduced new complexities to the barrier shrink film supply chain, affecting raw-material sourcing and cost structures across the value chain. Tariffs levied on imported resins, including various grades of polyethylene and specialty polymers, have increased the landed cost of resin feedstock for converters, compelling them to reassess procurement strategies. As a result, many film producers are exploring domestic resins and alternative suppliers to mitigate exposure to fluctuating import duties.

Additionally, secondary tariffs on film coatings and additives have heightened the need for tighter inventory management and longer planning horizons. High-volume converters have turned to hedging strategies and long-term supply agreements to secure material availability and stabilize pricing, while smaller players face challenges in passing through additional costs to customers. Consequently, distributors and end-users have become more sensitive to price volatility, driving increased collaboration between supply chain partners to align forecasts and share risk.

In response to tariff pressures, some manufacturers have accelerated local production investments, establishing or expanding domestic film extrusion and lamination capacities. This strategic shift not only reduces dependency on imports but also enables greater agility in responding to customer specifications and regulatory changes. Conversely, global converters servicing multi-region operations have adjusted production footprints, leveraging free trade agreements and bonded warehousing to optimize cross-border flows.

While the cumulative effect of 2025 tariffs has introduced operational challenges, it has also spurred innovation in resin formulation and film design. By adopting enhanced material blends that rely less on high-cost imports, converters are developing barrier shrink films with competitive performance and cost profiles. Ultimately, the long-term impact of tariff measures will hinge on the industry’s collective ability to adapt sourcing models, embrace flexible manufacturing practices, and strengthen supply-chain collaboration under an evolving trade policy environment.

Illuminating Segmentation Insights Across Material Composition, Packaging Formats, Product Types, Applications, and End User Industries for Strategic Clarity

Material composition stands at the heart of performance differentiation in barrier shrink films, as each polymer brings distinct barrier, mechanical, and processing characteristics to the final construct. Films based on Ethylene Vinyl Alcohol deliver excellent oxygen barrier properties that preserve product freshness, while Polyethylene variants-encompassing HDPE, LDPE, and LLDPE-offer a balanced combination of flexibility, toughness, and sealability. Polypropylene is valued for its heat resistance and clarity, whereas Polyvinyl Chloride provides durability and shrink control at low temperatures. Polyvinylidene Chloride films are frequently utilized where superior moisture barrier is critical. By tailoring material blends, converters achieve specific barrier and functional requirements without compromising processing efficiency.

Packaging formats provide another axis of customization, enabling brands to choose the optimal shrink configuration for their distribution and retail needs. Bundle wrap solutions are designed for grouping multiple units, while collation wrap is employed to secure stacked products on trays and sleeves. Label and unit-load wraps integrate branding with film functionality, and pallet wrap ensures stability during bulk transportation. Sleeve wraps, which include both cold-shrink and heat-shrink variations, enable precise application around irregularly shaped containers and promotional items. Each format reflects a trade-off between material usage, application speed, and end-use requirements, underscoring the need for converters to offer diverse packaging type options.

Product differentiation between cling and non-cling films further enhances the adaptability of barrier shrink solutions. Cling films, available in hand wrap and machine wrap formats, cling to themselves and provide consistent tension for manual or automated wrapping operations. Non-cling films-offered in plain and printed variants-deliver smooth surfaces for graphics and branding, making them ideal for retail displays and promotional packaging. The choice between cling and non-cling reflects operational considerations such as film feed rate, wrapping speed, and print quality, guiding manufacturers toward the most appropriate product type for their production lines.

Application segments define the ultimate use case of barrier shrink films, shaping film architecture and property requirements. In food packaging, sub-categories such as bakery and confectionery, dairy, fresh produce, and meat and poultry dictate unique barrier and optical specifications. Industrial packaging applications like bundle wrap, collation wrap, and pallet wrap focus on load containment and protection during transit. Pharmaceutical packaging utilizes blister film and bottle wrap to safeguard sensitive medications and conform to strict hygiene protocols. Retail packaging, including bags and pouches, demands high clarity and printability to enhance shelf impact. Each application category imposes distinct performance criteria that converter partners must address through targeted film design.

Lastly, extension into end-user industries reveals the strategic importance of barrier shrink films across diverse market verticals. In automotive assembly processes, films protect precision components from moisture and dust during storage and transport. Consumer electronics employ barrier shrink films to provide static protection and scratch resistance for devices and accessories. Within food and beverage, films maintain freshness and extend shelf life while adhering to food safety regulations. In the pharmaceutical sector, barrier shrink films ensure product integrity and compliance with regulatory standards. By understanding the varied demands of each end-user industry, stakeholders can prioritize product development and service offerings that align with sector-specific requirements, reinforcing competitive positioning.

This comprehensive research report categorizes the Barrier Shrink Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Packaging Type

- Product

- Application

- End User Industry

Uncovering Regional Nuances and Growth Drivers in the Barrier Shrink Film Market Across Americas, Europe-Middle East-Africa, and Asia-Pacific Territories

Regional dynamics play a pivotal role in shaping the barrier shrink film market, as each geography presents unique drivers related to consumption patterns, regulatory frameworks, and supply-chain infrastructure. In the Americas, mature economies such as the United States and Canada have witnessed growing demand for sustainable packaging solutions, driven by both corporate sustainability goals and consumer preferences for eco-friendly materials. Multinational brand owners continue to standardize film specifications across North American operations, while converters have increased investments in recycling initiatives to close the materials loop and comply with evolving directives on single-use plastics.

Conversely, Europe, the Middle East, and Africa are characterized by a diverse regulatory landscape and varying levels of market maturity. The European Union’s plastic packaging directive has accelerated the adoption of recyclable and compostable barrier films, prompting manufacturers to reengineer film compositions with increased post-consumer recycled content. In the Middle East, significant investments in food processing and cold-chain infrastructure are driving volume growth for barrier films, although the market remains sensitive to raw-material price fluctuations. Across Africa, rising urbanization and retail modernization are creating opportunities for local film converters, even as logistical challenges and inconsistent regulatory enforcement continue to constrain expansion.

Asia-Pacific represents the fastest-growing region for barrier shrink films, propelled by population growth, rising disposable incomes, and rapid industrialization. China, as a leading converter and resin producer, leverages economies of scale to supply both domestic and export markets with cost-competitive film solutions. Meanwhile, Southeast Asian nations such as Thailand, Vietnam, and Indonesia are experiencing surges in packaged food and beverage consumption, elevating the need for high-performance barrier films. In Japan and South Korea, advanced manufacturing techniques and stringent quality standards drive the adoption of multi-layer films with tailored barrier properties. Regional trade agreements and localized production hubs further support market expansion and cross-border collaboration within the Asia-Pacific zone.

Given these regional variances, companies must calibrate market entry and expansion strategies to local market attributes. Strategic partnerships with regional converters, investments in localized recycling facilities, and alignment with regulatory roadmaps are critical for capitalizing on growth opportunities. By embracing a regional approach that balances centralized innovation with decentralized execution, stakeholders can optimize resource allocation and achieve sustainable market penetration across the Americas, Europe-Middle East-Africa, and Asia-Pacific territories.

This comprehensive research report examines key regions that drive the evolution of the Barrier Shrink Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Collaboration, and Competitive Advantage in the Global Barrier Shrink Film Ecosystem

Leading organizations in the barrier shrink film industry are distinguished by their commitment to innovation, sustainability, and supply-chain integration, setting the tone for competitive dynamics across the value chain. Global manufacturers are investing heavily in next-generation film formulations, leveraging advanced co-extrusion technologies to reduce film gauge while enhancing multi-functional barrier performance. These initiatives reflect a broader industry shift toward lighter weight films that lower overall packaging carbon footprint without compromising protective capabilities.

Strategic collaborations and joint ventures have emerged as key tactics for scaling sustainable solutions and accelerating time-to-market. Partnerships between resin producers and film converters facilitate early access to bio-based polymers and high-barrier additives, enabling co-development of materials that meet circular economy criteria. Additionally, alliances with recycling and waste-management firms are becoming commonplace as industry leaders seek to establish closed-loop systems and bolster post-consumer recycled content in barrier films.

Innovation extends beyond materials to encompass digital tools that enhance operational efficiency and product traceability. Several major players are integrating Industry 4.0 concepts, deploying real-time monitoring systems on extrusion lines and leveraging data analytics to optimize yield and reduce downtime. These digitalization efforts enhance responsiveness to customer specifications and market fluctuations, reinforcing service excellence.

Sustainability credentials also serve as a critical differentiator, with leading companies pursuing third-party certifications and lifecycle assessments to validate environmental claims. Transparency throughout the supply chain-from raw-material sourcing to end-of-life disposal-reinforces brand credibility and supports compliance with evolving regulatory mandates. By combining material innovation, digitalization, and robust sustainability programs, the industry’s foremost participants are charting a path toward a more resilient, efficient, and environmentally responsible barrier shrink film ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Barrier Shrink Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Berry Global Group, Inc.

- CCL Industries Inc.

- Constantia Flexibles GmbH

- Cosmo Films Ltd.

- Coveris Holdings S.A.

- Huhtamaki Oyj

- Innovia Films Ltd.

- Jindal Poly Films Ltd.

- Mitsubishi Chemical Corporation

- Mondi plc

- ProAmpac Holdings Inc.

- Sealed Air Corporation

- Toray Industries, Inc.

- Uflex Limited

- Winpak Ltd.

Delivering Actionable Strategic Recommendations to Equip Industry Leaders with Insights for Operational Excellence and Sustainable Growth

Industry leaders seeking to maintain and expand their competitive position in barrier shrink films should prioritize a strategic roadmap that integrates sustainability, operational agility, and customer-centric innovation. First, organizations should accelerate the development and adoption of high-performance bio-based and recycled polymers, collaborating with upstream partners to secure reliable feedstock and drive down material costs. By embedding circularity principles into product design, companies will not only meet regulatory requirements but also appeal to environmentally conscious consumers.

Simultaneously, investing in advanced manufacturing technologies is essential for enhancing productivity and reducing waste. Film converters should explore the implementation of continuous process automation, in-line quality control systems, and predictive maintenance platforms to optimize production efficiency and minimize downtime. These investments will enable flexible scaling of output and rapid customization in response to shifting market demands.

To mitigate supply-chain risks introduced by trade policies and raw-material volatility, stakeholders should diversify sourcing channels and strengthen partnerships across geographies. Establishing local resin compounding and film conversion capacities can reduce exposure to import duties and logistical disruptions, while long-term agreements with strategic suppliers provide cost stability. Moreover, developing agile inventory management frameworks-supported by real-time demand forecasting-will help balance service levels with inventory carrying costs.

Finally, deepening customer engagement through collaborative innovation and value-added services will differentiate market offerings. By leveraging digital platforms to share insights on packaging performance and sustainability metrics, suppliers can co-create solutions with brand owners that address evolving consumer preferences and regulatory expectations. In doing so, industry players will cultivate stronger customer loyalty and unlock new growth avenues, ensuring long-term resilience in the competitive barrier shrink film landscape.

Outlining a Rigorous Research Methodology Incorporating Quantitative Analysis, Qualitative Expertise, and Multidimensional Validation Frameworks

The underlying research methodology for this report integrates robust quantitative analysis with comprehensive qualitative insights to ensure data integrity and actionable conclusions. Initially, extensive secondary research was conducted, drawing on publicly available industry publications, technical white papers, and regulatory filings to establish baseline market characteristics and technology trends. This phase provided a foundational understanding of material innovations, regional regulations, and supply-chain structures.

In parallel, primary research involved structured interviews and surveys with key stakeholders, including film converters, resin suppliers, brand owners, and industry analysts. These conversations yielded firsthand perspectives on operational challenges, adoption barriers, and strategic priorities. By engaging multiple tiers of the value chain, the study captured nuanced viewpoints on emerging applications, sustainability expectations, and tariff impacts.

Data triangulation techniques were employed to validate insights and ensure consistency across sources. Quantitative data points-such as production capacities, import/export volumes, and raw-material pricing-were cross-referenced with qualitative findings to confirm trends and identify discrepancies. Additionally, a regional weighting model was developed to account for market maturity and regulatory divergence across the Americas, Europe-Middle East-Africa, and Asia-Pacific territories.

Expert validation workshops provided further rigor, bringing together industry veterans from materials science, packaging engineering, and supply-chain management. These sessions facilitated in-depth review of preliminary findings, enabling refinement of segmentation frameworks and strategic recommendations. By combining secondary research, primary interviews, data triangulation, and expert validation, the methodology ensures that the report’s conclusions are grounded in credible evidence and reflect the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Barrier Shrink Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Barrier Shrink Films Market, by Material

- Barrier Shrink Films Market, by Packaging Type

- Barrier Shrink Films Market, by Product

- Barrier Shrink Films Market, by Application

- Barrier Shrink Films Market, by End User Industry

- Barrier Shrink Films Market, by Region

- Barrier Shrink Films Market, by Group

- Barrier Shrink Films Market, by Country

- United States Barrier Shrink Films Market

- China Barrier Shrink Films Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Synthesis of Key Market Highlights, Strategic Implications, and Future Prospects in the Barrier Shrink Film Industry Landscape

In summary, the barrier shrink film market is at a crossroads defined by sustainability imperatives, technological breakthroughs, and evolving trade landscapes. Innovations in multi-layer film architectures and advanced polymer blends are driving performance enhancements, while the shift toward bio-based and recycled materials underpins a broader commitment to circularity. At the same time, regulatory pressures and 2025 tariff measures have recalibrated sourcing strategies and accelerated investments in localized production capabilities.

Segmentation insights reveal that material composition, packaging format, product type, application, and end-user industry considerations are critical for aligning product development with market needs. Regional analysis highlights distinct growth drivers across the Americas, Europe-Middle East-Africa, and Asia-Pacific, underscoring the importance of tailored go-to-market strategies. Meanwhile, leading companies are differentiating through innovation partnerships, digital transformation, and robust sustainability programs, setting a benchmark for the industry.

Actionable recommendations emphasize the need for strategic investments in sustainable materials, advanced manufacturing technologies, and supply-chain resilience. By fostering collaborative innovation and deepening customer engagement, market participants can navigate volatility and capture long-term growth opportunities. This report’s comprehensive approach ensures that decision-makers are equipped with the insights necessary to steer their organizations toward operational excellence and market leadership.

As the barrier shrink film sector continues to evolve, stakeholders who embrace sustainable innovation, agile supply-chain practices, and data-driven strategies will be best positioned to capitalize on emerging trends. The collective ability to align material science breakthroughs with consumer and regulatory demands will determine the winners in this dynamic and competitive landscape.

Act Now to Elevate Packaging Solutions by Securing the Comprehensive Barrier Shrink Films Market Report with Expert Sales and Marketing Guidance

To gain a competitive edge and unlock the full potential of barrier shrink films for your applications, take the next step by requesting the complete market research report from Ketan Rohom, Associate Director of Sales & Marketing. His expert guidance will help you navigate the evolving landscape of materials, regulations, and emerging opportunities. Engage directly with Ketan to customize the report scope to your strategic objectives and ensure you receive tailored insights that drive informed decision-making. Secure actionable intelligence now to position your organization at the forefront of innovation and sustainable growth in barrier shrink films.

- How big is the Barrier Shrink Films Market?

- What is the Barrier Shrink Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?