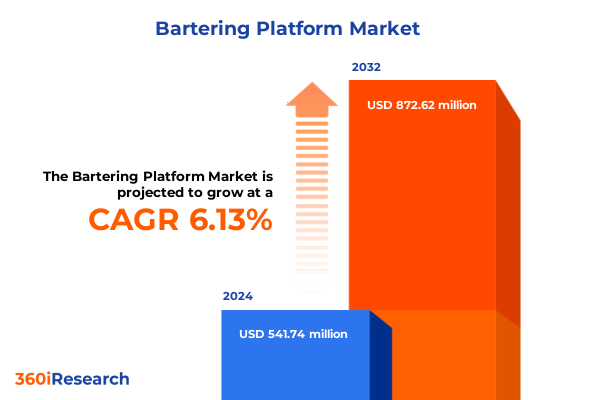

The Bartering Platform Market size was estimated at USD 573.76 million in 2025 and expected to reach USD 608.36 million in 2026, at a CAGR of 6.17% to reach USD 872.62 million by 2032.

Navigating the Evolving Bartering Ecosystem Unveiling the Rise of Seamless Digital Exchange Networks and Emerging Collaborative Economies

The bartering ecosystem has evolved from informal community exchanges to sophisticated digital platforms that connect businesses, individuals, and organizations across the globe. As traditional trade networks adapt to technological advances, bartering platforms are emerging as viable channels for sourcing products and services without monetary transactions. This shift highlights a growing appetite for alternative economic models driven by shared-value principles and resource optimization.

Against a backdrop of fluctuating supply chains and rising operational costs, these innovative platforms enable participants to circumvent conventional market constraints. By facilitating direct and indirect exchanges, they foster collaborative economies that range from hyperlocal community networks to global online marketplaces. The convergence of mobile technologies, social networking, and secure transaction protocols has further accelerated user adoption and engagement.

This executive summary offers an authoritative overview of the key factors shaping the bartering platform market. It synthesizes recent industry developments, regulatory influences, and strategic insights to equip decision-makers with a clear understanding of emerging opportunities and challenges. The following sections delve into transformative market shifts, tariff implications, segmentation and regional analyses, leading companies, and actionable recommendations to guide your organization’s strategy in this dynamic landscape.

Identifying the Pivotal Drivers Reshaping Bartering Platforms Through Technological Innovations and Transformational Consumer Behavior Shifts

Over the past several years, technological innovation has emerged as the primary catalyst redefining how bartering platforms operate and scale. The integration of mobile-first designs and intuitive user interfaces has streamlined peer-to-peer interactions, enabling participants to swiftly negotiate trades from virtually anywhere. At the same time, advancements in blockchain and distributed ledger technologies are being explored to enhance transaction transparency, build trust, and reduce fraud-a critical requirement for platforms facilitating high-value exchanges.

In parallel, shifting consumer preferences are reinforcing the move toward sustainable and circular economies. Modern users increasingly value resource efficiency and community-driven resource sharing, which aligns directly with the ethos of barter exchanges. This cultural shift has inspired platform operators to expand beyond basic goods exchanges into service bartering and experiential offerings such as travel and accommodation swaps.

Furthermore, regulatory landscapes and tariff policies are creating new market entry points for cross-border bartering. As businesses and individuals seek to alleviate tariff burdens, platforms are innovating by incorporating multi-currency scrip systems and indirect exchange models. These developments are amplifying network effects and fostering the emergence of hybrid ecosystems where digital infrastructure converges with traditional local exchange trading systems.

Evaluating the Strategic Implications of 2025 Tariff Adjustments on Bartering Dynamics and Cross-Border Trade Ecosystems

In 2025, the United States implemented a series of tariff adjustments that significantly altered the economics of imported goods, particularly in sectors such as electronics, home furnishings, and certain media products. As duties on select consumer goods rose, businesses and individuals began to explore barter-based alternatives to mitigate increased procurement costs. This trend underscored the strategic importance of bartering platforms as mechanisms for cost avoidance and supply chain resilience.

These tariffs prompted platform operators to enhance their value propositions by facilitating indirect exchanges and scrip-based systems, allowing participants to accumulate voucher credits that can be redeemed across diverse vendor networks. Such mechanisms help circumvent cash-based transactions subject to new tariffs, effectively replenishing supply lines without incurring prohibitive duties.

Consequently, platform adoption grew among small and medium enterprises seeking to preserve profit margins in a high-tariff environment. The heightened interest in non-monetary trade channels also spurred investments in digital infrastructure, including secure identity verification protocols and integrated logistics partnerships. As a result, the bartering landscape in 2025 has become more sophisticated, reflecting a broader strategic pivot toward alternative trade models driven by regulatory stimuli.

Decoding Market Complexity Through Key Segmentation Insights Spanning Platform Types Products Business Models and User Applications

A deep dive into market segmentation reveals distinct user behaviors and platform capabilities across diverse dimensions. When considering platform type, community barter networks and local exchange trading systems cater to hyperlocal exchanges that foster trust through proximity, whereas mobile bartering applications and online platforms deliver scalability and access to a broader user base. Each type brings unique monetization strategies and engagement models, informing how operators tailor features and marketing approaches.

Examining barter system structures uncovers a progression from direct exchange models, where goods and services are traded one-to-one, to indirect systems relying on intermediary tokens or digital scrip. The latter affords greater flexibility, reducing the need for exact value matching, and has gained traction for high-value or niche offerings. This evolution has been mirrored in product categorizations: books and media exchanges remain popular entry points, while electronics, clothing, accessories, and home and furniture trades drive higher transaction volumes and platform revenues.

Business models further differentiate the landscape as platforms bridge exchanges between businesses, consumers, or peer-to-peer cohorts. In business-to-business scenarios, bulk trading and service bartering can drive operational efficiencies, whereas business-to-consumer and consumer-to-consumer models focus on user experience and community engagement. Application-specific segments, spanning event ticket trading, household goods exchange, service bartering, and travel and accommodation swaps, each demand tailored functionality and trust frameworks. Finally, the end-user dimension highlights three core groups: business enterprises leveraging barter to optimize budgets, individual participants seeking cost savings and community interaction, and non-governmental organizations coordinating resource-sharing initiatives for social impact.

This comprehensive research report categorizes the Bartering Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Exchange Model

- Physical Goods

- Business Model

- Application

- End-User

Examining Regional Bartering Trends and Opportunities Within the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics shape growth trajectories and strategic priorities across the bartering platform ecosystem. In the Americas, digital adoption rates are high and regulatory environments are relatively well-defined, empowering platforms to offer integrated mobile and web-based experiences. Here, service bartering and consumer-to-consumer exchanges dominate, driven by mature e-commerce behaviors and strong community networks.

Across Europe, the Middle East, and Africa, a mixed regulatory landscape coexists with burgeoning interest in circular economy initiatives. Platforms in Western Europe focus on sustainable exchange models, often partnering with municipalities and non-profit organizations to support social programs. Meanwhile, in emerging economies within the region, informal local exchange trading systems persist alongside growing digital platforms, creating hybrid market structures.

Asia-Pacific presents the most dynamic growth potential, as rapidly expanding internet penetration and mobile payment infrastructures enable large-scale adoption. Corporate barter networks and business-to-business exchanges have surged in major economies where tariff volatility incentivizes alternative procurement methods. Additionally, travel and accommodation swaps thrive in culturally interconnected markets with high levels of intra-regional mobility.

This comprehensive research report examines key regions that drive the evolution of the Bartering Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Bartering Platform Innovators Driving Market Evolution Through Strategic Partnerships and Service Differentiation

Several pioneering companies are at the forefront of innovating within the bartering space, each distinguished by their platform architectures and go-to-market strategies. One leading innovator has developed a robust community barter network that emphasizes social engagement and localized trust mechanisms, reinforcing user loyalty through gamification and reputation systems. Another prominent player has introduced a mobile-first solution that integrates real-time chat, geolocation matching, and secure in-app token management to facilitate seamless peer-to-peer exchanges.

In the sphere of B2B bartering, corporate-focused platforms have emerged to streamline large-scale barter agreements, offering customized analytics dashboards and integrated logistics partnerships. These solutions enable enterprises to match surplus inventory with complementary needs, optimizing supply chains in high-tariff environments. On the consumer side, specialized services dedicated to event ticket trading and household goods exchange leverage AI-powered recommendation engines to enhance match quality and reduce transaction friction.

Collectively, these companies are forging new pathways by expanding application scopes-into service bartering, travel swaps, and NGO-driven community programs-while institutionalizing secure verification protocols. Their strategic partnerships with financial institutions, logistics providers, and regulatory bodies underscore a commitment to building resilient, scalable barter ecosystems that can adapt to evolving market demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bartering Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Barter Business Exchange, Inc.

- Barter Network Ltd

- Barter Software X

- Barter Technologies Pte. Ltd

- Bartercard

- Barterchain LTD.

- BarterPay Canada Inc.

- Barter’d Ltd

- Biz4Group LLC

- BizXchange, Inc.

- Corporate Barter, Inc.

- Equitrade International

- F6S Network Limited

- International Monetary Systems, Ltd.

- JPM Global, Inc.

- Listia Inc.

- Network4Barter

- Think Barter Network

- Tradebank International Inc.

- TradeFirst

- TradeMade, Inc.

- XO Software

- XporY.com

Crafting Proactive Strategies for Bartering Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Operational Challenges

Industry leaders should prioritize mobile user experience enhancements to capture on-the-go participants and accommodate high-frequency micro-exchanges. By simplifying onboarding flows with streamlined identity verification and intuitive trade listing processes, platforms can reduce drop-off rates and accelerate transaction cycles. In tandem, building robust security measures-such as biometric authentication and end-to-end encryption-will reinforce trust and safeguard against fraud, especially in high-value exchanges.

Diversifying application offerings beyond traditional goods is essential for sustaining engagement and expanding revenue streams. Introducing service bartering modules, from professional consulting swaps to peer-led educational exchanges, can attract new user segments and deepen platform stickiness. Strategic integration of logistics and payment partners will further smooth fulfillment processes, ensuring that both direct and indirect barter mechanisms operate efficiently regardless of geographical constraints.

To navigate fluctuating tariff environments, operators must cultivate partnerships with supply chain experts and policy think-tanks. This collaborative approach will enable rapid adjustments to scrip valuations and exchange rules as regulatory conditions evolve. Finally, leveraging data analytics to uncover usage patterns and track community sentiment will empower leaders to iterate on feature sets, deliver personalized trade recommendations, and maintain alignment with emerging sustainability and circular economy goals.

Outlining Rigorous Research Methodology and Analytical Frameworks Underpinning Comprehensive Bartering Market Analysis and Insights

The research underpinning this analysis employs a multi-phase approach, beginning with primary interviews conducted with platform executives, supply chain specialists, and end-user focus groups. These conversations provided qualitative insights into operational challenges, technology adoption barriers, and user satisfaction drivers. Simultaneously, a comprehensive survey spanning businesses, individuals, and non-governmental organizations captured quantitative data on transaction preferences, perceived value, and platform feature priorities.

Secondary research involved extensive review of regulatory filings, trade association reports, and academic studies related to circular economy frameworks and tariff policy developments. This was complemented by web traffic analytics and social media sentiment analysis, which illuminated user engagement trends and regional adoption patterns. Proprietary case studies of leading platform implementations supplied practical examples of successful integration and scalability tactics.

To ensure analytical rigor, findings were synthesized through established frameworks such as SWOT and PESTLE, allowing for systematic evaluation of internal competencies and external market forces. Cross-validation techniques triangulated qualitative and quantitative inputs to deliver a cohesive narrative that balances macroeconomic impacts with granular user behaviors. The result is a holistic view of the bartering landscape underpinned by transparent methodology and reproducible insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bartering Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bartering Platform Market, by Platform Type

- Bartering Platform Market, by Exchange Model

- Bartering Platform Market, by Physical Goods

- Bartering Platform Market, by Business Model

- Bartering Platform Market, by Application

- Bartering Platform Market, by End-User

- Bartering Platform Market, by Region

- Bartering Platform Market, by Group

- Bartering Platform Market, by Country

- United States Bartering Platform Market

- China Bartering Platform Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Takeaways and Forward-Looking Perspectives to Inform Strategic Decision Making in Bartering Ecosystems

This executive summary has illuminated the transformative forces reshaping the bartering platform ecosystem, from technological advancements to shifting consumer values and regulatory stimuli. The 2025 tariff adjustments in the United States have underscored the strategic utility of barter systems as cost mitigation and supply chain resilience tools, driving platform innovation in indirect exchange models and scrip-based mechanisms.

Key segmentation and regional insights have revealed a multifaceted market where platform types, barter systems, product categories, business models, and user applications each carve out unique growth corridors. Concurrently, the Americas, EMEA, and Asia-Pacific regions exhibit distinct adoption drivers, regulatory considerations, and partnership opportunities that inform tailored market entry and expansion strategies.

Leading companies continue to differentiate through mobile optimization, AI-driven matching engines, and integrated service modules, demonstrating the viability of diversified offerings. Actionable recommendations emphasize the importance of enhancing user experience, reinforcing security protocols, diversifying applications, and collaborating with policy experts to adapt to tariff fluctuations. Together, these insights provide the basis for informed strategic decisions in a rapidly evolving bartering landscape.

Engaging with Our Expert Ketan Rohom to Secure Your Comprehensive Market Research Report and Unlock Strategic Growth Opportunities

Thank you for exploring this comprehensive examination of the bartering platform landscape. To gain full access to our in-depth market research report and unlock tailored intelligence that will inform your strategic decisions, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Leverage Ketan’s expertise to discuss how these insights align with your organizational priorities and to secure the report that empowers you to stay ahead of emerging trends.

Reach out today to arrange a personalized consultation, explore specialized data sets, and receive guidance on integrating these findings into your growth roadmap. Partner with Ketan to translate market knowledge into actionable plans and drive sustainable value within your operations.

- How big is the Bartering Platform Market?

- What is the Bartering Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?