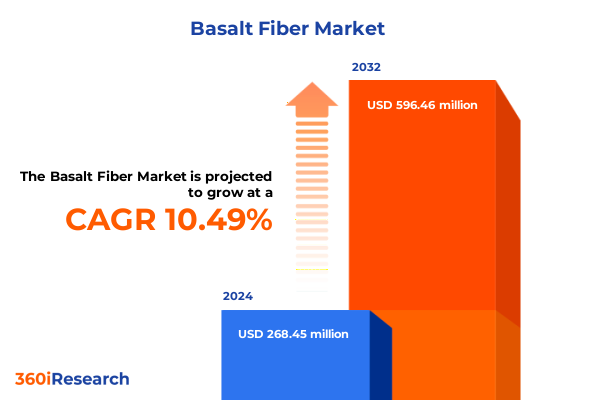

The Basalt Fiber Market size was estimated at USD 293.35 million in 2025 and expected to reach USD 325.28 million in 2026, at a CAGR of 10.66% to reach USD 596.46 million by 2032.

Exploring the Breakthrough Production Methods and Sustainable Advantages that Position Basalt Fiber as a Next-Generation Engineering Material

Basalt fiber is emerging as a critical high-performance material across a diverse range of industries. Produced by melting crushed basalt rock at temperatures exceeding 1,400°C and extruding the molten material through fine nozzles, basalt fiber offers an eco-friendly manufacturing process with minimal emissions and no need for additives or resins. This single-material approach not only simplifies production but also aligns with growing sustainability mandates that prioritize low-impact supply chains. With a filament diameter typically between 10 and 20 microns, basalt fibers avoid the respiratory hazards associated with thinner particles, making them safer alternatives to asbestos and enabling broader adoption in construction and insulation applications.

In addition to its fabrication advantages, basalt fiber delivers exceptional mechanical and thermal performance. Leading industry research highlights its high tensile strength, with specific strength values that rival or exceed those of traditional glass fibers, alongside superior thermal resistance, enabling service temperatures up to 800°C without degradation. Furthermore, these mineral-based fibers exhibit outstanding durability in corrosive and UV-rich environments, reinforcing their suitability for marine, chemical, and outdoor civil infrastructure uses. As decision-makers pursue materials that combine performance with environmental responsibility, basalt fiber’s unique profile positions it as a compelling solution for next-generation composites and specialty applications.

Unveiling Game-Changing Technological Enhancements and Regulatory Drivers Accelerating Basalt Fiber Adoption Across Key Industrial Sectors

The basalt fiber landscape is undergoing transformative shifts driven by technological breakthroughs and evolving regulatory frameworks. Recent advances in furnace and extrusion design have enabled the production of continuous basalt fibers at scale with tighter diameter control and more consistent fiber quality. These improvements facilitate integration into automated composite manufacturing lines, lowering barriers for original equipment manufacturers in sectors such as aerospace and automotive to adopt basalt-reinforced components without extensive retooling. At the same time, innovative surface treatments and sizing formulations enhance resin compatibility, unlocking novel resin-matrix combinations that were previously impractical.

Analyzing the 2025 U.S. Tariff Regime and Its Cumulative Effects on Basalt Fiber Supply Chains Cost Structures and Market Competitiveness

Effective April 5, 2025, the U.S. government’s universal 10% tariff on imported goods marked a pivotal shift in the cost dynamics of raw materials, including basalt fiber sourced from key producing regions. These duties, imposed under an emergency national trade order, elevated import costs immediately while planned reciprocal surcharges on major trading partners threatened to introduce additional variability in pricing and supply. Although legal challenges have paused certain country-specific rates, the baseline tariff remains in effect, compelling domestic buyers to reassess global sourcing strategies and inventory management.

Simultaneously, the U.S. steel and aluminum tariffs reinstated in March 2025 under Section 232 were expanded to include derivative materials with significant metal content, effectively capturing products that integrate basalt fiber with metallic reinforcements. While basalt fiber itself is not directly metal-based, composite panels and hybrid sections containing aluminum or steel matrices have experienced cost pressures, driving composite fabricators to review laminate constructions. Collectively, these cumulative tariff measures have reshaped competitive dynamics, prompting an accelerated focus on domestic production capabilities and supplier diversification to mitigate heightened import expenses.

Unlocking Dynamic Market Segmentation Insights That Reveal How Fiber Types Product Variants Applications and Industry Verticals Are Shaping Strategic Opportunities

The basalt fiber market can be understood through an integrated segmentation lens that illuminates where value is created and where strategic opportunities lie. From a material perspective, the classification into continuous, staple, and superthin fibers enables manufacturers to tailor products for either high-strength composite reinforcements, thermal insulation applications, or premium quality fireproof materials, respectively. This typology drives production priorities and capital investment decisions for fiber processors seeking optimal furnace and tooling configurations.

In parallel, the differentiation by product type-ranging from pultruded rebar and chopped strand sheets to woven and braided textiles-reflects critical deployment choices in construction reinforcement, composite panels, and advanced performance fabrics. These variants dictate downstream processing methods and partner networks, from concrete contractors specifying rebar replacements to electronics firms sourcing protective mesh for EMI shielding. At the application level, basalt fiber’s versatility is on display across complex assemblies in aircraft structures, lightweight automotive components, corrosion-resistant concrete reinforcement, high-durability industrial cladding, advanced shipbuilding composites, and efficient thermal insulation systems. Each use case imposes distinct performance requirements and regulatory or certification pathways, shaping product development roadmaps.

Complementing these functional segments, the analysis by industry vertical-spanning aerospace, automotive, construction, electronics, and marine-provides strategic insight into end-market drivers and growth catalysts. Aerospace and automotive sectors prioritize weight reduction and fire safety, leading to composite panels and interior trim made from continuous basalt fibers with specialized sizings. Construction and marine sectors, meanwhile, leverage basalt fiber’s corrosion resistance and long-term durability for reinforced concrete and hull components. In electronics, the thermal and electrical insulation properties of basalt textiles support emerging needs in data centers and power systems.

This comprehensive research report categorizes the Basalt Fiber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Type

- Application

- Industry Vertical

Delineating Distinct Regional Growth Drivers and Adoption Patterns Shaping Basalt Fiber Demand in the Americas EMEA and Asia-Pacific

Geographic trends in basalt fiber adoption reveal distinct regional dynamics that reflect infrastructure priorities, policy environments, and supply chain maturity. In the Americas, growing emphasis on rebuilding aging transportation networks and expanding renewable energy projects has heightened demand for corrosion-resistant concrete reinforcements and wind turbine blade composites. North American manufacturers are also ramping up domestic fiber capacity to reduce exposure to import duties and to ensure continuity for critical defense and aerospace applications.

Across Europe, the Middle East, and Africa, stringent climate regulations-particularly the EU’s Carbon Border Adjustment Mechanism-are accelerating the uptake of low-carbon construction and industrial materials. Basalt fiber, with its low embodied emissions compared to steel and glass alternatives, is positioned to benefit from decarbonization mandates and green building certification requirements. Government incentives and research partnerships are further strengthening regional supply chains, enabling mid-sized producers to compete effectively against larger incumbents.

In the Asia-Pacific region, rapid industrialization and infrastructure spending, notably in China and India, are driving the largest volume growth in basalt fiber consumption. Demand from the automotive sector for lighter vehicle structures and from the electronics industry for high-performance thermal insulation is expanding local production footprints. Investments in vertical integration-from quarry acquisition to fiber extrusion-are streamlining costs and positioning Asia-Pacific producers as key global suppliers.

This comprehensive research report examines key regions that drive the evolution of the Basalt Fiber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Moves and Competitive Differentiators Among Leading Players Advancing Basalt Fiber Innovations and Market Penetration

Leading companies in the basalt fiber arena are pursuing strategies that combine capacity expansion, process innovation, and targeted partnerships to secure market leadership. European specialist incumbents have leveraged decades of glass fiber expertise to adapt furnace designs and sizing chemistries for basalt feedstock, creating premium continuous fiber products aimed at aerospace and automotive OEMs. In North America, material innovators are integrating basalt fibers into hybrid composite systems while collaborating with research centers to validate performance in defense and infrastructure projects. Meanwhile, Asia-Pacific producers are capitalizing on vertical integration, managing everything from basalt quarry operations to downstream pultrusion factories to ensure cost-efficient, large-scale output.

This comprehensive research report delivers an in-depth overview of the principal market players in the Basalt Fiber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arab Basalt Fiber Company

- Armbasalt CJSC

- ASA.TEC GmbH

- Basalt Engineering, LLC

- Basalt Fiber & Composite Materials Technology Development

- Basalt Fiber Tech Pty. Ltd.

- Basalt Technologies Corp.

- Basaltex NV

- Deutsche Basalt Faser GmbH

- Fiberbas construction and building technologies

- Final Advanced Materials SARL

- Galen Panamerica LLC

- HG GBF Basalt Fiber Co., LTD.

- Incotelogy GmbH

- Isomatex. S.A.

- JiLin Tongxin Basalt Technology Co.,Ltd

- Kamenny Vek LLC

- LAVA INTERNATIONAL LIMITED

- Mafic SA

- Rockfiber

- Sichuan Aerospace Tuoxin Basalt Industrial Co., LTD

- Sichuan Jumeisheng New Material Technology Co., Ltd.

- Sichuan Qianyi Composites Co., Ltd

- Sudaglass Fiber Technology, Inc.

- Zhengzhou Dengdian Basalt Fiber Co., Ltd.

Actionable Strategies and Tactical Roadmap for Industry Leaders to Capitalize on Evolving Opportunities Within the Global Basalt Fiber Ecosystem

To navigate the evolving basalt fiber ecosystem and capture emerging opportunities, industry leaders should adopt a multifaceted strategy that balances innovation with operational resilience. First, investing in modular production units and flexible extrusion lines can enable rapid shifts between continuous, staple, and superthin fiber output based on real-time market signals. This agility reduces capital risk and positions manufacturers to respond to sector-specific demand surges, such as those in marine composites or thermal insulation for data centers.

Second, establishing strategic alliances with composite fabricators and end-use equipment manufacturers can foster co-development of tailored formulations and sizing chemistries. Such collaborations accelerate product qualification cycles, enhance supply chain transparency, and enable premium positioning based on validated performance metrics. Finally, optimizing supply chain footprints through regional production hubs or toll-processing agreements will mitigate tariff exposure and logistical volatility. By aligning capacity close to key markets in North America, EMEA, and Asia-Pacific, companies can secure consistent feedstock access and reduce delivery lead times.

Detailing a Comprehensive Research Methodology Combining Targeted Primary Interviews Secondary Data Analysis and Rigorous Validation to Underpin the Study

This research analysis is grounded in a rigorous methodology that integrates both primary and secondary data streams, ensuring the insights are robust, comprehensive, and actionable. The study commenced with an extensive review of industry publications, regulatory frameworks, and major policy developments to establish foundational context. Secondary inputs were complemented by proprietary databases and historical market intelligence to map production capacities, trade flows, and technological milestones.

Primary research comprised in-depth interviews with senior executives, R&D leaders, and procurement specialists within the basalt fiber value chain. These dialogues provided qualitative perspectives on growth drivers, pain points, and investment priorities. Data triangulation techniques were applied to validate findings, using multiple vendor disclosures and cross-referencing public financial statements. Finally, the analysis was subjected to a multi-level review process involving subject matter experts and external consultants, ensuring methodological integrity and minimizing bias.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Basalt Fiber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Basalt Fiber Market, by Type

- Basalt Fiber Market, by Product Type

- Basalt Fiber Market, by Application

- Basalt Fiber Market, by Industry Vertical

- Basalt Fiber Market, by Region

- Basalt Fiber Market, by Group

- Basalt Fiber Market, by Country

- United States Basalt Fiber Market

- China Basalt Fiber Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Insights and Strategic Imperatives Emphasizing Basalt Fiber’s Pivotal Role in Future Sustainable Infrastructure and Manufacturing Innovations

In conclusion, basalt fiber is poised to play an increasingly prominent role in high-performance and sustainable applications across multiple industries. Advances in production technology, combined with evolving regulatory incentives and heightened raw material scrutiny, are converging to propel adoption rates. As supply chains adjust to new tariff landscapes and regional value propositions, companies that prioritize flexibility, collaborative innovation, and proximity to key end-markets will unlock the greatest competitive advantage.

By understanding the interplay between fiber classifications, product forms, application requirements, and industry vertical demands, decision-makers can align investments with areas of highest strategic significance. The insights within this report empower stakeholders to navigate market complexities and to position their organizations for long-term growth in an era defined by performance imperatives and sustainability ambitions.

Engage with Ketan Rohom to Secure Customized Basalt Fiber Market Intelligence and Propel Your Growth with Expert Research

If you’re ready to transform your strategic planning with unparalleled insights into the basalt fiber market’s latest dynamics and growth opportunities, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage directly with Ketan to explore customized research packages, gain access to our comprehensive full-length report, and secure the intelligence you need to make confident, data-driven decisions. Take the next step toward market leadership today by contacting Ketan Rohom to purchase the complete market research report and unlock tailored solutions that will power your competitive advantage.

- How big is the Basalt Fiber Market?

- What is the Basalt Fiber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?