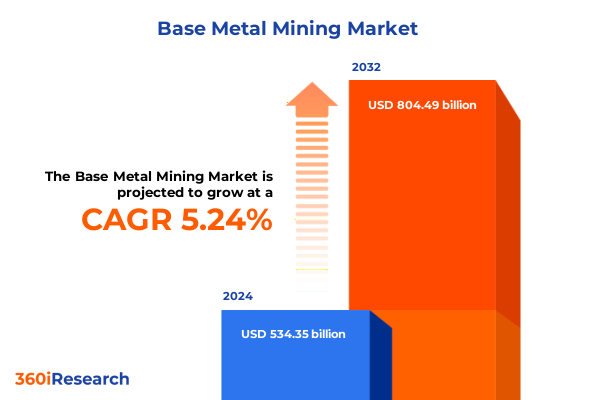

The Base Metal Mining Market size was estimated at USD 561.65 billion in 2025 and expected to reach USD 590.64 billion in 2026, at a CAGR of 5.26% to reach USD 804.49 billion by 2032.

Uncovering the Emerging Forces Driving Rapid Evolution Across the Global Base Metal Mining Sector

The global base metal mining industry is at a pivotal juncture as the imperatives of the energy transition, digital transformation, and evolving regulatory landscapes converge. Copper, a critical metal for electrical infrastructure, is projected to face a substantial supply shortfall without significant investment and policy support, underscoring the urgency of securing new resources and enhancing recycling efforts. Simultaneously, aluminum producers are navigating unprecedented tariff changes that have reshaped global trade flows and challenged supply chain resilience.

Against this backdrop, mining companies are adopting advanced technologies and innovative strategies to remain competitive. The integration of artificial intelligence, digital twins, and predictive analytics is revolutionizing exploration and operations, enabling smarter decision-making and real-time optimization across the value chain. As a result, industry leaders are redefining their approaches to resource development, cost management, and sustainability, setting new benchmarks for efficiency and environmental stewardship.

Exploring How Decarbonization, Circular Economy Strategies, and Digital Innovation Are Reshaping Mining Operations Globally

The landscape of base metal mining is undergoing transformative shifts as companies confront the dual challenges of meeting surging demand and reducing environmental impact. In response to intensifying pressure for sustainable operations, firms are accelerating decarbonization efforts by integrating renewable energy sources, electrifying fleets, and piloting hydrogen-powered transport systems, reflecting a growing commitment to “real zero” emissions targets. Concurrently, the focus on circularity has spurred major investments in recycling infrastructure, with leading producers forging partnerships to reclaim copper from electronic scrap and bolster secondary supply streams.

Parallel to these sustainability initiatives, the digital core of mining enterprises is being reimagined. Next-generation ERP implementations, combined with GenAI-driven workforce upskilling programs, are empowering companies to harness data-driven insights at scale and optimize every facet of their operations. This convergence of technology and human capital is enabling smarter, more resilient business models that can adapt quickly to market volatility, regulatory shifts, and evolving stakeholder expectations.

Analyzing the Widespread Market Disruptions Triggered by Recent United States Tariff Policies on Base Metals

In 2025, the United States introduced sweeping tariff measures that have had far-reaching consequences for base metal markets. Steel and aluminum imports saw ad valorem tariff rates jump from 25% to 50% in June, heightening costs for downstream industries and prompting a reevaluation of supply chain strategies. Within copper markets, the unexpected announcement of a 50% import tariff effective August 1, 2025, catalyzed a surge in physical shipments ahead of the deadline, draining inventories on global exchanges and causing historic spreads between U.S. and LME price benchmarks.

These tariff policies have introduced strategic complexities for producers and consumers alike. U.S. refiners face higher feedstock costs, while global producers have scrambled to redirect shipments and recalibrate commercial terms. The resulting uncertainty has amplified market volatility, as stakeholders await clarifications on product scope and potential exemptions. At the same time, the tariff-induced price divergence has underscored gaps in domestic processing capacity, renewing calls for investment in smelting and refining assets to strengthen supply chain autonomy.

Unveiling Comprehensive Market Nuances Through Deep Dives into Product, Process, Project and End-Use Dimension Analyses

The base metal mining market can be dissected through multiple lenses, each offering a unique view of where value is created and opportunities lie. Segmentation by metal type highlights that copper has emerged as the linchpin of the energy transition, with demand projected to outpace supply unless recycling and new developments gain momentum. Aluminum remains central to transportation and construction sectors, even as recent tariff shifts have prompted supply chain realignments and reshored capacity considerations. Nickel’s role in battery chemistries underscores its strategic importance, though oversupply concerns in certain regions have introduced price pressures and inventory imbalances.

When examined by product form, cathodes continue to underpin refined metal sales, but concentrates-spanning heap leach, roasted, and SX-EW processes-are gaining prominence as early-stage feedstock for smelters. Ingots, pellets, and powders serve specialized industrial applications, and their evolving grade specifications reflect end-use demands. Diving deeper into mining methods reveals that open pit operations, whether bench, conventional, or terrace, dominate output volumes, even as underground block caving, cut-and-fill, and room-and-pillar techniques enable access to deeper orebodies. In situ leaching offers lower-impact extraction but is limited by mineralogy and hydrogeology constraints.

The diversity of end-use industries-ranging from aerospace and consumer goods to electrical and electronics subsegments like communications, consumer electronics, industrial systems, and renewable energy-creates a mosaic of demand profiles that inform product and process priorities. Process type analysis further underscores the critical role of refining pathways-chemical leaching versus electrolytic methods-alongside bioleaching, heap leaching, smelting, and solvent extraction/electrowinning in defining cost structures and environmental footprints. Lastly, project stage segmentation, from exploration through production and eventual closure and rehabilitation, illuminates the front-end risk inherent in new developments and the capital intensity at each phase, with development sub-stages such as advanced exploration, feasibility, and pilot testing serving as crucial investment decision points.

This comprehensive research report categorizes the Base Metal Mining market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Metal Type

- Source

- Product Form

- Mining Method

- End-Use Industry

Examining How Diverse Regulatory Regimes and Investment Climates Shape Regional Base Metal Mining Dynamics

Regional dynamics in the base metal mining industry reveal differentiated growth drivers, regulatory environments, and investment climates. In the Americas, North American producers are scaling up exploration and development activities to meet robust domestic demand for electrification and infrastructure projects. Latin American nations, particularly Chile and Peru, remain pivotal copper suppliers, yet policy uncertainty and water resource constraints are prompting new sustainability collaborations and localization of downstream assets.

Europe, the Middle East, and Africa present a multifaceted picture. European refiners are pursuing low-carbon metal certifications, propelled by EU regulatory frameworks and consumer expectations. In parallel, Middle Eastern investment funds are diversifying into mining assets globally, while African nations are advancing licensing reforms to attract foreign capital into greenfield copper and nickel projects, balancing economic growth with social and environmental governance imperatives.

The Asia-Pacific region is defined by a concentration of refining capacity in China, where over 70% of key energy-related minerals are processed, and by ambitious expansions in Australia, which is targeting nickel and copper growth corridors. Additionally, Southeast Asian hubs like Indonesia are contending with resource nationalism, while India is strengthening its domestic steel production and mineral processing to enhance supply security for its burgeoning infrastructure sector.

This comprehensive research report examines key regions that drive the evolution of the Base Metal Mining market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning Among Top-Tier Base Metal Mining Companies

Leading players in the base metal mining arena are deploying distinct strategies to secure competitive advantages. BHP is advancing its flagship projects with a focus on sustainable sourcing and is evaluating desalination-linked expansions to underpin its copper supply pipeline. Rio Tinto continues to streamline its portfolio toward tier-one assets while accelerating digital integration to drive operational efficiency.

Glencore is leveraging recycling partnerships and ramping up low-carbon product offerings to meet increasing demand for sustainable metals. Freeport-McMoRan is concentrating on resource optimization at its large-scale copper operations and exploring downstream smelting opportunities in key markets. Anglo American’s FutureSmart Mining initiative is pioneering automation, electrification, and biodiversity programs within its Amplats and Los Bronces assets. Emerging players such as CMOC with its Tenke Fungurume operation are capitalizing on ESG certifications like the Copper Mark to access premium markets and investor pools.

This comprehensive research report delivers an in-depth overview of the principal market players in the Base Metal Mining market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abra Mining

- Anglo American Plc

- Antofagasta Plc

- Aurubis AG

- BHP Group Limited

- Boliden Group

- CMOC Group Limited

- Codelco

- Freeport-McMoRan, Inc.

- Glencore plc

- Honey Badger Silver Inc

- Hudbay Minerals Inc.

- Imperial Metals Corp.

- Lundin Mining Corporation

- Mitsubishi Corporation

- Norilsk Nickel

- Rio Tinto Ltd.

- Saudi Arabian Mining Company

- SGS S.A.

- Southern Copper Corp.

- Southern Copper Corporation

- The Lhoist Group

- United States Steel Corp.

- Vale S.A.

- WorleyParsons Limited

- Zijin Mining Group Co., Ltd.

- Zuellig Industrial Group

Actionable Strategies for Executives to Enhance Sustainability, Resilience and Competitiveness in Metal Mining

Industry leaders should prioritize the integration of renewable energy and electrified mobile equipment to reduce carbon intensity and align with evolving regulatory benchmarks. At the same time, companies must bolster circularity by cementing partnerships for scrap recovery and investing in advanced refining technologies that accommodate lower-grade concentrates.

To navigate tariff uncertainties, stakeholders should engage proactively with policymakers to advocate for clear guidelines while diversifying feedstock sources and considering nearshoring of critical smelting capacity. Digital transformation remains imperative; establishing a unified digital core and deploying GenAI for workforce reskilling can yield significant productivity gains and enhance safety performance. Lastly, fostering transparent ESG reporting and securing recognized certifications will strengthen social license, unlock financing opportunities, and satisfy value-led sustainability commitments.

Outlining the Rigorous Multi-Method Approach Underpinning Insights into the Base Metal Mining Domain

This research synthesized insights from primary interviews with C-suite executives, technical experts, and supply chain stakeholders, complemented by a rigorous review of secondary sources, including industry reports, regulatory publications, and financial filings. A dual research framework guided the analysis: a top-down approach leveraging macroeconomic indicators and trade data, and a bottom-up methodology aggregating project-level intelligence and company disclosures.

Segmentation categorizations were developed through iterative validation exercises, mapping product flows across mining methods, processing pathways, and end-use applications. Quantitative findings and qualitative narratives were triangulated to ensure consistency and to highlight divergent perspectives. All data points underwent cross-verification against reputable institutional sources, while limitations such as evolving tariff policies and permitting timelines were explicitly acknowledged.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Base Metal Mining market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Base Metal Mining Market, by Metal Type

- Base Metal Mining Market, by Source

- Base Metal Mining Market, by Product Form

- Base Metal Mining Market, by Mining Method

- Base Metal Mining Market, by End-Use Industry

- Base Metal Mining Market, by Region

- Base Metal Mining Market, by Group

- Base Metal Mining Market, by Country

- United States Base Metal Mining Market

- China Base Metal Mining Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings across Market Drivers, Trade Dynamics, Company Strategies and Regional Developments

The base metal mining sector stands at an inflection point, driven by the imperatives of energy transition, technological innovation, and shifting trade policies. As demand for metals like copper, nickel, and aluminum continues to rise, companies must navigate supply constraints, environmental obligations, and evolving market dynamics. Tariff actions in the United States have crystallized the need for agile strategies that encompass supply chain diversification, domestic processing capacity, and stakeholder engagement.

Looking ahead, the interplay of regional developments, company strategies, and segmentation-specific drivers will define the competitive landscape. By adopting forward-looking recommendations around decarbonization, circularity, digital transformation, and policy advocacy, industry participants can position themselves for sustainable growth and resilience amid uncertainty.

Seize Exclusive Insights Today by Connecting with Our Sales and Marketing Expert for Immediate Access to the Complete Base Metal Mining Report

Are you ready to gain a competitive edge and navigate the complexities of the base metal mining sector with confidence? Reach out to Ketan Rohom, Associate Director, Sales & Marketing, and let us guide you to the insights and strategies you need. Secure your access to the comprehensive market research report today and empower your organization with the knowledge to thrive in an increasingly dynamic industry landscape.

- How big is the Base Metal Mining Market?

- What is the Base Metal Mining Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?