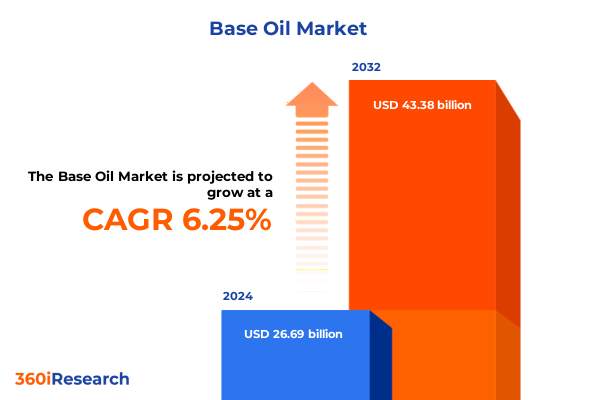

The Base Oil Market size was estimated at USD 28.29 billion in 2025 and expected to reach USD 30.00 billion in 2026, at a CAGR of 6.29% to reach USD 43.38 billion by 2032.

Exploring the foundational dynamics and evolving market forces that define today’s global base oil ecosystem for strategic decision-making

The base oil industry underpins vast segments of the global economy by supplying the critical fluid foundations for lubricants, greases, and a multitude of specialty applications. This complex supply chain stretches from crude oil refining and hydroprocessing to sophisticated chemical engineering processes that produce distinct product grades suited to varied performance requirements. As such, understanding the fundamental forces and operational mechanisms at work within the base oil landscape is essential for stakeholders across the value chain.

Recent years have witnessed an evolution in both the sources and the quality of base oils, driven by regulatory pressures to reduce emissions, the emergence of bio-based feedstocks, and advances in refining technologies that yield higher-purity synthetic stocks. Simultaneously, end-user industries demand heightened performance characteristics-improved thermal stability, lower volatility, and extended service life-pushing suppliers to innovate continuously. Coupled with geopolitical disruptions and supply chain realignments, the industry now finds itself in a period of unprecedented transformation.

This introduction sets the stage for a deep dive into the dynamic shifts, policy impacts, segmentation nuances, and regional imperatives defining today’s base oil market. By framing these foundational dynamics, industry leaders can better anticipate market movements, optimize product portfolios, and align strategic investments to maintain competitive advantage in a rapidly evolving environment.

Understanding how sustainability mandates, digital innovation, and emerging electrification demands are reshaping base oil production and applications

The base oil sector is experiencing transformative shifts fueled by sustainability mandates, digitalization of operations, and evolving product demand. Heightened environmental regulations have accelerated the adoption of hydrocracked and hydrogenated stocks over conventional solvent-refined Group I oils, reshaping refining capacities worldwide. In parallel, breakthroughs in bio-based oil technologies are opening new pathways for renewable lubricants, particularly in markets with aggressive carbon-reduction targets. These developments are driving producers to reevaluate their feedstock blends and invest in flexible facilities capable of processing both traditional and renewable inputs.

Digital transformation is another pivotal trend, as data analytics, predictive maintenance, and advanced process control systems enhance operational efficiencies and product consistency. Producers leveraging real-time monitoring and artificial intelligence can optimize reaction conditions and minimize energy consumption, yielding not only cost savings but also improved environmental footprints.

Moreover, the rise of electric vehicles and electrification across industrial segments is influencing base oil formulations, prompting the development of low-viscosity, high-dielectric-strength oils for e-axles and powertrain cooling fluids. As these electric-centric applications proliferate, the balance between mineral, synthetic, and bio-derived oils will continue to evolve, underscoring the need for agile research and development strategies.

Taken together, these seismic shifts demand that industry players reimagine traditional business models and embrace innovation to meet the dual imperatives of performance excellence and sustainability.

Evaluating the multilayered effects of the United States’ 2025 tariff actions and reciprocal duties on cross-border base oil supply chains

The United States implemented a new 10% ad valorem tariff on most imported goods, effective April 5, 2025, under a broad economy-wide measure. However, base oil imports, including those classified under the Harmonized System codes for Group III stocks, were expressly exempted in Annex II of the order, shielding critical supply lines for high-performance lubricant formulations. This exemption has provided short-term relief to downstream producers reliant on premium base stocks from Northeast Asia and the Middle East.

In response to earlier U.S. energy import tariffs, Canada imposed reciprocal 25% duties on a list of American goods valued at $30 billion, including motorcycle tires and rubber articles crucial to naphthenic base oil demand. This measure has indirectly weighed on U.S. exports of naphthenic stocks and finished lubricants, as Canadian processors adjust feedstock sourcing and redirect surplus volumes to Europe to avoid retaliatory barriers. The net effect has been a temporary reshuffling of North American trade flows, with limited impact on global supply due to alternative sourcing options.

Mexico announced pending retaliatory measures targeting U.S. energy products but has not yet implemented them; regulatory timelines for import permit approvals (one to two months) have thus far shielded the market from significant disruptions. Meanwhile, European Union trade policy has maintained base oils on exemption lists, averting direct tariff exposure but highlighting the potential for indirect consequences if broader commodity markets falter under geopolitical strain.

Collectively, these 2025 tariff developments underscore the fragility of cross-border supply chains and the importance of strategic sourcing flexibility. While direct levy impacts have been mitigated through exemptions, the secondary effects of reciprocal duties and market uncertainty have prompted industry stakeholders to diversify suppliers and reinforce logistical resilience.

Illuminating how differentiated grade tiers, feedstock origins, application demands, end-user industries, and sales channels converge to shape base oil market segmentation

An effective segmentation framework reveals distinct value propositions for each product grade tier, from the robust solvency characteristics of solvent-refined Group I oils to the superior purity and performance of hydrocracked Group III stocks and the advanced molecular uniformity found in Group V synthetics. While Group II products often bridge cost and performance, offering enhanced oxidation stability over Group I, Group IV and V grades cater to niche, high-temperature, and specialty applications. Recognizing these technical differentials enables suppliers to align grade offerings with precise end-use performance requirements.

Base oil chemistry also influences sustainability profiles, as bio-based oils emphasize renewable feedstocks that address life cycle carbon footprints, whereas mineral stocks derive directly from crude refining. Synthetic formulations, on the other hand, optimize molecular weight distribution through chemical synthesis, delivering unmatched thermal resilience but commanding premium pricing. Targeting the right blend of mineral, synthetic, and bio-based oils can help organizations balance environmental goals with cost considerations.

Application type adds another layer of complexity, with engine oils demanding high viscosity indices and shear stability, industrial lubricants requiring thermal conductivity and load-carrying capacity, metalworking fluids prioritizing water solubility and corrosion inhibition, rubber process oils focusing on polymer compatibility, and transmission fluids emphasizing frictional properties and seal compatibility. Each application segment drives specific base oil grade selection and additive packages, influencing overall product design.

Finally, end-user industry dynamics-from automotive and aviation to construction, energy, industrial manufacturing, and marine-dictate volume projections, performance standards, and regulatory compliance thresholds. Sales channels, whether offline through traditional distribution networks or online via digital platforms, further shape go-to-market strategies and customer engagement models, underscoring the importance of a nuanced segmentation approach for market participants.

This comprehensive research report categorizes the Base Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Grade

- Base Oil

- Application Type

- End-user Industry

- Sales Channel

Unveiling regional production strengths, consumption patterns, and investment trends across the Americas, EMEA, and Asia-Pacific base oil markets

The Americas region continues to lead in base oil production and consumption, driven in large part by robust automotive and industrial manufacturing sectors in the United States and Canada. The region’s expansive refining infrastructure supports a diverse mix of Group I, II, and II+ outputs, while growing investments in petrochemical integration have expanded access to hydrocracked and high-viscosity stocks. Latin American markets, buoyed by energy sector expansions in Brazil and Mexico, are augmenting downstream lubricant production, although infrastructure bottlenecks and import dependencies persist.

Europe, the Middle East, and Africa (EMEA) showcase a complex mosaic of mature markets with stringent environmental regulations, emerging Gulf refining expansions, and African economies gradually increasing local lubricant blending capabilities. The European Union’s drive toward stricter emissions standards has accelerated the shift to hydrotreated and synthetic base oils, while Middle Eastern producers leverage abundant crude feedstocks to invest in advanced hydrocracking capacity. In Africa, nascent industrialization is spurring growth, but logistical constraints and policy uncertainty pose ongoing challenges.

Asia-Pacific remains the fastest-growing region, propelled by surging demand from China, India, Southeast Asia, and Australia. Major refiners in Northeast Asia continue to dominate Group III production, outpacing global competitors with significant capacity expansions. India’s drive toward self-sufficiency has spurred local Group II and II+ investments, while bio-based lubricant initiatives are emerging in Japan and South Korea. Southeast Asian economies blend imports and local production to serve vibrant automotive, marine, and heavy-industry sectors.

Collectively, these regional insights reveal a landscape marked by technological leadership in established markets, aggressive capacity growth in emerging economies, and the interplay of environmental regulations, infrastructure development, and end-use demands.

This comprehensive research report examines key regions that drive the evolution of the Base Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining how leading base oil producers are leveraging refining upgrades, strategic partnerships, and sustainability imperatives to gain market advantage

Key industry players are strategically investing in upgrading refining complexes to boost hydrocracked base oil capability and enhance margins. Major integrated oil companies continue to leverage proprietary hydroprocessing technologies to expand their Group II and III footprints, while specialty chemical firms are focusing on high-value Group V and bio-based segments to differentiate offerings.

Collaborative ventures between refiners and additive formulators are increasingly common, enabling co-development of tailor-made lubricant solutions that optimize performance and environmental compliance. Players with robust R&D pipelines are introducing advanced bio-blend technologies, aiming to capture market share in regions with aggressive decarbonization targets.

Operational excellence remains a core competitive lever, with leading companies deploying digital twins and advanced analytics to maximize yield and minimize energy consumption. Supply chain agility, including strategic hub expansions in key consumption markets, ensures responsiveness to shifting tariff landscapes and customer specifications.

Sustainability credentials have become paramount, prompting frontrunners to obtain third-party certifications, adopt circular economy practices, and publicly commit to net-zero targets. As these firms refine their portfolios, partnerships with technology providers and startups are helping accelerate innovation in renewable feedstocks and closed-loop recycling initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Base Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abu Dhabi National Oil Company

- BP p.l.c.

- Calumet, Inc.

- Chevron Corporation

- Ergon, Inc.

- ExxonMobil Corporation

- GS Caltex Corporation

- Hindustan Petroleum Corporation Limited

- HollyFrontier Corporation

- Indian Oil Corporation Ltd

- LUKOIL Lubricants company

- Nynas AB

- PetroCanada Lubricants Inc.

- PETRONAS Lubricants International Sdn. Bhd.

- Phillips 66 Company

- Repsol S.A.

- S-Oil Corporation

- S.K.Oil Incorporation

- Saudi Arabian Oil Company

- Sepahan Pouyesh Arya CO.

- Shell plc

- TotalEnergies SE

Implementing strategic feedstock diversification, digital enablement, policy engagement, and customer co-innovation to lead in the base oil market

Leaders in the base oil sector should prioritize feedstock diversification by securing agreements with both traditional refineries and emerging bio-oil producers to hedge against supply disruptions and regulatory shifts. Investing in flexible processing units capable of toggling between hydrocracked mineral and vegetable-derived feeds will enhance resilience and environmental performance.

Adopting advanced digital platforms for real-time process monitoring and predictive maintenance can yield significant cost savings and quality improvements. Integrating data from across the supply chain enables proactive management of inventory, logistics, and demand forecasting, while also supporting traceability initiatives critical for sustainability reporting.

Companies must engage proactively with policymakers and industry bodies to shape balanced regulations that encourage innovation without stifling competitiveness. Collaborative research consortia can accelerate the commercialization of next-generation synthetic and bio-based oils, distributing both risk and reward across stakeholders.

Cultivating deeper customer partnerships through co-innovation and performance-based service models will differentiate offerings and drive greater value capture. By aligning product development with specific application requirements, suppliers can enhance loyalty, justify premium pricing, and future-proof their portfolios against evolving market demands.

Detailing a multi-method research framework combining secondary data analysis, stakeholder interviews, quantitative modeling, and peer validation

Our research approach integrates comprehensive secondary and primary methodologies to ensure robust and reliable insights. Initially, an exhaustive review of industry publications, regulatory filings, and trade association reports established a current baseline of market dynamics. Proprietary data from customs and trade databases further quantified regional flows and grade-specific trade patterns.

Complementing desk research, extensive stakeholder interviews were conducted with senior executives at refiners, additive formulators, major lubricant blenders, and end-user technical managers. These conversations provided nuanced perspectives on evolving performance needs, supply challenges, and strategic priorities.

Quantitative analysis leveraged statistical models to correlate macroeconomic indicators, automotive production forecasts, and industrial output with base oil consumption trajectories. Scenario planning was employed to assess the sensitivity of trade flows and pricing under varying tariff and regulatory environments.

Finally, findings were validated through peer review by an Advisory Board comprising subject-matter experts from leading academic institutions and industry think tanks. This multi-stage validation ensures that conclusions and recommendations are both actionable and grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Base Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Base Oil Market, by Product Grade

- Base Oil Market, by Base Oil

- Base Oil Market, by Application Type

- Base Oil Market, by End-user Industry

- Base Oil Market, by Sales Channel

- Base Oil Market, by Region

- Base Oil Market, by Group

- Base Oil Market, by Country

- United States Base Oil Market

- China Base Oil Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing critical insights on innovation, regulation, and supply chain resilience to guide strategic leadership in the evolving base oil sector

The base oil market stands at a strategic inflection point where technological innovation, environmental imperatives, and geopolitical factors intersect. With emerging applications demanding bespoke fluid properties and sustainability expectations reaching an all-time high, traditional production paradigms must adapt rapidly to remain competitive.

Our analysis demonstrates that flexible processing capabilities, digital integration, and proactive policy engagement constitute the core pillars of future success. Companies able to navigate tariff uncertainties, optimize grade portfolios, and deliver performance-driven solutions will secure leadership positions in key regions.

As global supply chains continue to evolve, the agility to respond to shifting trade policies and feedstock availability will differentiate market leaders from laggards. By aligning strategic investments with the transformative shifts outlined herein, stakeholders can capitalize on new growth vectors in electrification, renewable lubricants, and advanced industrial applications.

This executive summary lays out the critical insights necessary to formulate winning strategies. As the base oil ecosystem evolves, those who embrace innovation and resilience will not only weather disruption but also unlock unprecedented value.

Empower your strategic positioning with tailored base oil market intelligence by engaging Ketan Rohom to acquire your definitive research report

Don’t miss the opportunity to equip your organization with industry-leading analysis and strategic foresight. Reach out directly to Ketan Rohom, the Associate Director of Sales & Marketing, to secure your comprehensive base oil market research report. Gain unparalleled visibility into the forces reshaping the sector, harness actionable insights, and position your business for sustainable growth in an evolving regulatory and technological landscape. Connect with Ketan today to elevate your market intelligence and drive competitive advantage.

- How big is the Base Oil Market?

- What is the Base Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?