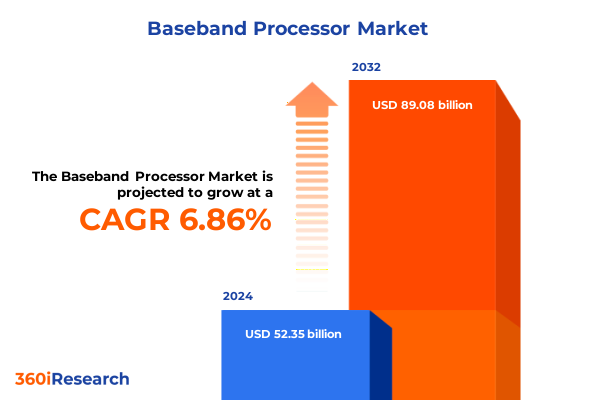

The Baseband Processor Market size was estimated at USD 55.99 billion in 2025 and expected to reach USD 59.36 billion in 2026, at a CAGR of 6.85% to reach USD 89.08 billion by 2032.

Exploring the critical role of next-generation baseband processors in enabling advanced connectivity, AI integration, and seamless signal processing

The evolution of cellular and connectivity technologies has accelerated dramatically over the past decade, driven by the global rollout of fifth-generation wireless networks. Baseband processors now serve as the critical bridge between radio frequency front ends and application layers, handling complex signal processing tasks in real time. This transformation is evident in modern smartphones, where the integration of multi-mode baseband chipsets demands unparalleled performance and power efficiency to support immersive user experiences and high-speed data transfers. The rise of artificial intelligence within modem architectures has further raised the bar, enabling on-device network optimization and intelligent power management to extend battery life without compromising throughput or latency. AsOEMs and network operators strive to meet ever-growing consumer and enterprise demands, baseband processor innovation remains at the forefront of enabling ultra-low latency applications and massive machine-type communications across diverse market segments

Understanding how open architectures, 5G evolution, and edge integration are redefining baseband processor innovation and competitive dynamics

The baseband processor landscape is being reshaped by groundbreaking shifts in network architecture and component design, heralding a new era of flexibility and scalability. As 5G deployments expand across sub-6 gigahertz and millimeter-wave bands, chipmakers are developing modular, software-defined baseband solutions that can adapt to evolving air interface standards. This trend is reinforced by the emergence of open RAN frameworks, which decouple hardware and software stacks to enable multi-vendor interoperability and faster innovation cycles. Meanwhile, the industry’s exploration of open instruction sets like RISC-V is unlocking new opportunities for custom accelerator integration, fostering differentiation in signal processing workloads. Edge computing capabilities are increasingly embedded directly within baseband systems, reducing dependency on centralized servers and enabling real-time analytics for applications such as autonomous driving and industrial automation. This convergence of open architectures, next-generation air interface support, and intelligent edge processing is redefining the competitive landscape, compelling legacy providers and new entrants alike to rethink their product roadmaps and partnerships

Examining how the 2025 United States Section 301 tariff escalation on semiconductors is reshaping sourcing strategies, supply chains, and domestic capacity building

In response to concerns about supply chain resilience and domestic semiconductor capabilities, the United States Trade Representative finalized Section 301 tariff increases on key semiconductor categories, including foundational baseband components, taking effect January 1, 2025. The tariff rate for semiconductors under HTS headings 8541 and 8542 escalated to 50 percent, marking a substantial rise from previous levels and signaling a strategic shift in trade policy intent on protecting domestic manufacturing investments. Concurrently, the Office of the USTR launched a new investigation in early 2025 targeting legacy chip imports under Section 301, with public hearings held in March to assess their impact on critical industries such as automotive, telecommunications, and aerospace. Together, these measures have driven chipmakers and OEMs to reevaluate sourcing strategies, accelerate diversification of manufacturing footprints, and increase engagement with allied foundries in Taiwan, South Korea, and Japan. Although tariff pressures have translated into near-term cost inflation for imported baseband processors, they have also stimulated investments in domestic fabrication and assembly capabilities, ultimately strengthening the long-term resilience of the semiconductor supply chain.

Unpacking the intricate application, technology, and manufacturing-node segmentation shaping today’s baseband processor market

The baseband processor market exhibits a multifaceted segmentation landscape that reflects the diverse demands of modern connectivity. Within automotive applications, processors serve advanced driver assistance systems and infotainment units, each imposing distinct performance and latency requirements. In IoT devices, industrial modules prioritize reliability and harsh-environment operation, smart home hubs focus on low-power wireless integration, and wearables demand minimal energy consumption for prolonged battery life. Smartphones and tablets remain cornerstone segments, driving continuous enhancements in multi-band and multi-mode support. Processor type segmentation underscores the contrast between discrete digital signal processors tailored for specialized workloads, field-programmable gate arrays offering post-silicon flexibility, and system-on-chip solutions that integrate baseband, application, and power management cores into unified packages. Architectural diversity spans established Arm cores optimized for broad ecosystem compatibility, custom DSP designs forged for high-throughput tasks, and nascent RISC-V implementations enabling bespoke accelerators. End-use categories extend beyond consumer devices to encompass industrial automation, telecom infrastructure supporting both 4G LTE and sub-6 gigahertz as well as millimeter-wave 5G networks, and automotive electrification systems demanding real-time V2X connectivity. Data rate segmentation highlights solutions attuned to use cases from sub-1 Gbps telemetry to multi-gigabit mmWave backhaul links, with high-performance variants engineered for sustained throughput above 10 Gbps. Power consumption tiers distinguish ultra-low-power processors for battery-sensitive endpoints, low-power designs balancing duty-cycle energy budgets, and high-performance platforms that trade higher consumption for peak processing headroom. Finally, manufacturing node variation reflects ongoing transitions from mature 28 nanometer processes to 14 nanometer, 10 nanometer, and advanced 7 nanometer nodes to drive further gains in integration density, energy efficiency, and RF performance.

This comprehensive research report categorizes the Baseband Processor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Processor Type

- Architecture

- Data Rate

- Power Consumption

- Application

Exploring unique regional drivers and deployment patterns influencing baseband processor demand across Americas, EMEA, and Asia-Pacific markets

Regional dynamics of the baseband processor industry illustrate how localized technology priorities and supply chain structures influence adoption trends. In the Americas, North American OEMs and network operators invest heavily in multi-mode 5G modems tailored to both legacy LTE and emerging 5G standards, with a particular focus on ultra-reliable low-latency communications for industry and defense applications. Meanwhile, Latin American carriers prioritize cost-optimized systems that address inconsistent spectrum allocations and evolving rural broadband strategies. In EMEA, the rollout of private 5G networks for critical infrastructure and manufacturing has fostered demand for processors featuring robust security modules and long-term support commitments. Meanwhile, variances in automotive production across Germany, France, and the U.K. drive distinct baseband requirements for ADAS and central gateways. The Asia-Pacific region accounts for the largest share of global baseband processor consumption, fueled by expansive 5G network coverage in China, Korea, and Japan, alongside surging smartphone and IoT device manufacturing in Southeast Asia. Device OEMs in India are increasingly incorporating sub-6 gigahertz mmWave solutions into mid-range devices to deliver differentiated performance, while Australia’s industrial automation sector leverages private-network rollouts for mining and agriculture sectors, underscoring the breadth of regional demand profiles

This comprehensive research report examines key regions that drive the evolution of the Baseband Processor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling dominant baseband chipset players and emerging challengers to illuminate strategic positioning, in-house innovation, and collaborative ecosystems

The competitive landscape for baseband processors remains concentrated among a handful of technology leaders, each deploying distinct strategies to capture market share and foster innovation. Qualcomm maintains dominance in high-end 5G modems, leveraging its extensive patent portfolio and early investments in mmWave integration to deliver industry-leading throughput and energy efficiency. MediaTek has gained traction by targeting mid-range smartphone segments and emerging markets, offering cost-effective system-on-chip solutions that integrate advanced power management and on-device AI acceleration. Samsung leverages its vertically integrated manufacturing capabilities to supply both internal Galaxy device lines and strategic OEM partners, while continuing to enhance its neural processing units for intelligent connectivity. Apple’s entry into custom baseband design with its C1 modem marks a pivotal shift toward end-to-end silicon optimization for the iPhone ecosystem, reflecting a broader industry move toward in-house R&D to control performance and supply chain stability. Additionally, emerging players specializing in RISC-V architectures and security-hardened designs are gaining interest from defense, aerospace, and private-network operators seeking tailored solutions for sovereign connectivity applications. Partnerships among chipset vendors, IP licensors, and foundries continue to define market entry barriers and co-innovation pathways, shaping the roadmap for next-generation baseband platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baseband Processor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASE Technology Holding Co., Ltd.

- Beijing Zhiguangxin Holding

- Broadcom Inc.

- CEVA, Inc.

- CML Microsystems PLC

- E-Space Inc.

- Fujian Star-Net Communication Co., Ltd.

- GCT Semiconductor Holding, Inc

- Huawei Technologies Co., Ltd.

- Infineon Technologies AG

- Intel Corporation

- Lattice Semiconductor Corporation

- Marvell Technology, Inc.

- MediaTek Inc.

- Murata Manufacturing Co., Ltd.

- Nvidia Corporation

- NXP Semiconductors N.V.

- Peraso Inc.

- Qualcomm Incorporated.

- Renesas Electronics Corporation

- Samsung Group

- Skyworks Solutions, Inc.

- Sony Group Corporation

- Texas Instruments Incorporated

Strategic imperatives for chipset developers and device OEMs to strengthen sourcing resilience, accelerate innovation, and capitalize on evolving network architectures

To navigate the complex baseband processor landscape, industry leaders should prioritize a dual-path strategy that balances performance differentiation with supply chain security. First, establishing multi-sourcing agreements with foundries across Taiwan, South Korea, and domestic U.S. fabs can mitigate tariff-induced cost volatility and geopolitical exposure. Concurrently, investing in modular baseband architectures that support both Arm and RISC-V cores enables rapid customization for diverse end-user requirements, from automotive autonomy to smart factory deployments. Second, integrating AI-driven power management and intelligent spectrum scanning directly within modem subsystems will optimize device battery life and network efficiency, creating tangible user experience benefits. Third, proactive engagement with open RAN initiatives and standards bodies ensures compatibility with next-generation disaggregated network architectures, opening new channels for software-centric service offerings. Finally, forging partnerships with security-focused IP vendors to embed hardware root-of-trust and encryption accelerators within baseband solutions will address growing concerns around data integrity and network sovereignty. By executing these recommendations, semiconductor firms and device OEMs can capitalize on emerging connectivity trends, hedge against regulatory shifts, and deliver differentiated solutions that resonate across segmented markets.

Detailing the blend of expert interviews, secondary data validation, and proprietary analytical frameworks underpinning this baseband processor market study

This analysis synthesizes insights from a combination of primary and secondary research methodologies. Extensive interviews were conducted with semiconductor executives, network infrastructure leaders, and device OEM product managers to capture real-world perspectives on technology adoption and procurement strategies. Secondary data was sourced from technical publications, regulatory filings, and manufacturer press releases to validate architecture choices, process-node migrations, and security enhancements. Market intelligence platforms provided benchmarks on shipment volumes, ASP trends, and regional deployment statistics, enabling a robust understanding of competitive positioning. To ensure balanced interpretation, quantitative data was triangulated against qualitative expert feedback, and potential biases were mitigated through cross-functional review sessions. The research team employed a proprietary framework to map technology, application, and regional dimensions, facilitating coherent segmentation analysis. This rigorous approach underpins the credibility of findings and recommendations presented herein, offering stakeholders a transparent view of both the impetus for and the impact of baseband processor innovations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baseband Processor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baseband Processor Market, by Processor Type

- Baseband Processor Market, by Architecture

- Baseband Processor Market, by Data Rate

- Baseband Processor Market, by Power Consumption

- Baseband Processor Market, by Application

- Baseband Processor Market, by Region

- Baseband Processor Market, by Group

- Baseband Processor Market, by Country

- United States Baseband Processor Market

- China Baseband Processor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing the critical touchpoints and strategic focal areas that will dictate success for baseband processor stakeholders in an increasingly connected future

The convergence of 5G network maturation, open computing paradigms, and evolving trade policies has positioned baseband processors at a strategic inflection point. Market leaders who harness modular architectures and diversify production footprints are poised to outpace legacy competitors, while those embedding AI-driven optimizations and robust security features will deliver the most compelling value propositions. However, the industry must remain vigilant of tariff dynamics, geopolitical tensions, and shifting regional priorities that could alter supply chain economics and technology roadmaps. As connectivity demands intensify across automotive autonomy, industrial IoT, and consumer electronics, the ability to seamlessly integrate new air interface standards and accelerator IP will determine long-term success. Stakeholders equipped with the insights and strategic guidance in this report are best positioned to anticipate disruptions, capture emerging opportunities, and shape the next wave of baseband processor innovation.

Reach out to an Associate Director of Sales and Marketing to secure the full baseband processor research report and unlock tailored strategic insights

We invite you to connect directly with Ketan Rohom, an accomplished Associate Director of Sales and Marketing, to secure your copy of the comprehensive baseband processor market research report and gain a competitive edge. By discussing your strategic objectives and information needs, you’ll unlock tailored insights and actionable data that empower informed decision-making. Reach out today to explore how this report can illuminate growth pathways, mitigate supply chain risks, and guide your next investments in connectivity technologies. Engage with Ketan Rohom and ensure your organization is equipped with the market intelligence needed to thrive in a rapidly evolving semiconductor landscape

- How big is the Baseband Processor Market?

- What is the Baseband Processor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?