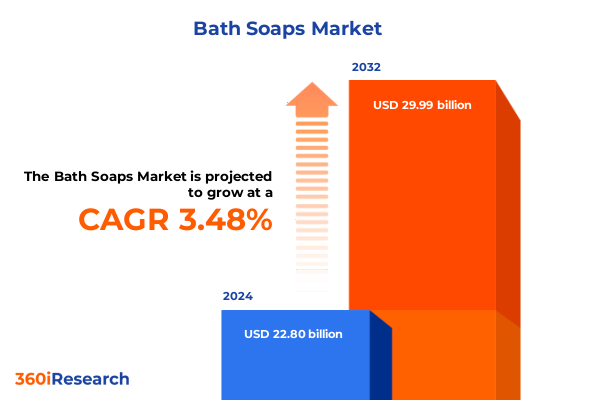

The Bath Soaps Market size was estimated at USD 23.60 billion in 2025 and expected to reach USD 24.43 billion in 2026, at a CAGR of 3.96% to reach USD 30.99 billion by 2032.

Discovering the Core Forces Propelling the Bath Soap Market Through Evolving Consumer Preferences Sustainability Trends and Breakthrough Innovation Strategies

The bath soap market stands at a dynamic crossroads shaped by a resurgence of holistic wellness and demand for multifunctional bodycare solutions. Consumers are increasingly seeking products that not only cleanse but also nourish, drawing on ingredients like turmeric, retinol, and exotic botanicals that support skin health beyond simple hygiene. Complementing this, the fusion of artisanal craftsmanship with circular economy principles has spurred the adoption of upcycled ingredients such as coffee grounds, fruit peels, and olive pomace, reflecting a deeper consumer commitment to sustainability and ethical sourcing.

Moreover, advances in personalization are redefining consumer engagement, with bespoke soap formulations tailored to individual skin types, scent preferences, and even wellness goals. This customization ethos is amplified by digital platforms, where interactive tools and data-driven recommendations foster deeper brand loyalty. In tandem, the shift toward minimalistic, transparent ingredient lists and eco-friendly packaging underscores a broader industry pivot toward trust and authenticity. As a result, bath soap has evolved from a commodity to a lifestyle statement, demanding that companies balance innovation, transparency, and operational agility to capture discerning consumer interest.

Exploring the Transformations Reshaping the Bath Soap Industry as Digital Commerce Sustainability and Ingredient Innovations Converge to Define Future Success

The bath soap industry is undergoing transformative shifts driven by emerging digital commerce models, sustainability mandates, and rapid ingredient innovation. Online sales channels, particularly direct-to-consumer and e-commerce marketplaces, have surged as consumers prioritize convenience and curated experiences, prompting brands to invest heavily in data analytics, subscription models, and immersive digital storytelling. Simultaneously, the rise of social media platforms has democratized influence, with viral trends dictating product launches and driving demand for shareable packaging and micro-niche offerings.

At the same time, the imperative to mitigate environmental impact has catalyzed breakthroughs in sustainable packaging and clean formulations. Refillable systems, compostable wraps, and minimalistic designs have become table stakes, compelling innovators to integrate plant-based plastics, seed-infused papers, and QR-enabled transparency tags that trace ingredient provenance. Coupled with this, adaptogenic herbs, postbiotics, and fermented actives are carving out new therapeutic niches, emphasizing skin microbiome health and holistic well-being. Together, these converging forces are redrawing competitive boundaries and setting the stage for a new era of consumer-centric, purpose-driven soap brands.

Analyzing the Far-Reaching Effects of New US Trade Tariffs on Bath Soap Imports Supply Chains Manufacturing Costs and Consumer Pricing Dynamics in 2025

In 2025, the United States implemented sweeping tariff measures that have significantly affected the importation of bath soap and related personal care products. A baseline 10% tariff on all imports took effect on April 5, 2025, while additional levies on goods from key manufacturing hubs such as China and Vietnam have pushed rates as high as 54% and 46% respectively, disrupting established supply chains and raising procurement costs. These elevated duty structures have reverberated through every tier of the value chain, from raw material sourcing to finished-goods distribution.

The cumulative impact on manufacturers and distributors has been pronounced, with incremental import costs largely transferred to wholesalers and, ultimately, end consumers. Industry analysts estimate that nearly two-thirds of increased duties are passed along as higher retail prices, constraining discretionary spending on premium and niche soap formulations. To navigate this new trade environment, many leaders have accelerated nearshoring initiatives, diversified supplier networks, and scaled domestic production capabilities. While these strategic pivots bolster resilience, they underscore an urgent need for agile risk management and dynamic sourcing strategies across the bath soap landscape.

Revealing Insights from Key Market Segmentation That Illuminate Consumer Preferences Distribution Channel Dynamics Product Types and Ingredient Trends

Revealing insights from key market segmentation illuminates how distinct product types, distribution channels, end-user demographics, and ingredient categories drive strategic priorities. The product spectrum spans traditional bar soaps, glycerin formulations prized for clarity, liquid variants optimized for hygiene, and transparent soaps celebrated for their visual appeal. Each segment addresses unique consumer expectations-from sensory indulgence to clinical efficacy-and informs targeted innovation roadmaps.

Meanwhile, the distribution landscape encompasses convenience stores catering to on-the-go needs, pharmacies valued for their medical positioning, supermarkets and hypermarkets offering broad accessibility, and digital channels that blend direct-to-consumer personalization with expansive e-commerce marketplaces. Within end-user categories, offerings tailored to children emphasize gentle formulations, men’s lines focus on performance and fragrance intensity, unisex products balance versatility with aesthetic neutrality, and women’s segments deliver indulgent textures and premium botanicals.

On the ingredient frontier, fragrance-forward bars anchor the mainstream, while herbal blends and moisturizing complexes respond to wellness-driven demand. Medicated soaps, subdivided into antibacterial and antifungal applications, address clinical requirements, and the organic category underscores a commitment to clean, traceable inputs. Collectively, these layered segmentation insights empower stakeholders to align product development, channel investment, and marketing narratives with the precise needs of their target cohorts.

This comprehensive research report categorizes the Bath Soaps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient

- End User

- Distribution Channel

Vital Regional Perspectives Illuminating Distinct Market Drivers Consumer Demands and Growth Pathways Across Americas Europe Middle East Africa and Asia-Pacific

Vital regional perspectives illuminate how geographic nuances shape competitive advantage and growth trajectories in the bath soap market. In the Americas, robust digital retail ecosystems and a sophisticated direct-to-consumer infrastructure have underpinned market expansion, with platforms like Shopify hosting over two thousand U.S. soap storefronts alone. This e-commerce dominance is complemented by established supermarket and pharmacy networks that facilitate both mass-market penetration and premium brand activations.

Europe, the Middle East, and Africa demonstrate a heightened regulatory focus on environmental standards and ingredient transparency. Consumers in these territories increasingly demand organic certifications and sustainable packaging claims, with 45% of buyers citing eco-labels as a key purchase driver in recent surveys. Stringent EU directives on plastic waste and chemical safety continue to accelerate reformulations and drive investment in post-consumer recycling programs.

Across the Asia-Pacific region, artisanal and local botanical trends are flourishing, fueled by a growing middle class and rising wellness aspirations. Demand for handmade and artisanal natural soaps grew by nearly 38% from 2022 to 2024, reflecting consumer enthusiasm for authentic, heritage-inspired formulations. These regional insights underscore the imperative for adaptive strategies attuned to distinct cultural, regulatory, and economic landscapes.

This comprehensive research report examines key regions that drive the evolution of the Bath Soaps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unlocking Insights from Top Industry Leaders Their Strategic Moves Market Positioning and Innovation Excellence Shaping Success in the Bath Soap Market

Unlocking insights from top industry leaders reveals the strategic maneuvers and innovation pipelines that define competitive positioning. Procter & Gamble has reinforced its market leadership by streamlining its portfolio and focusing on core brands such as Ivory and Olay, delivering record profits and market share gains through operational simplicity and consumer-centric innovation. The company’s agile approach to responding to regional demand fluctuations, particularly in North America and Asia, underscores its resilience amid geopolitical headwinds.

Unilever, anchored by powerhouse brands like Dove and Lux, maintains a diversified product mix and an unwavering emphasis on sustainability, even as it recalibrates targets under CEO Fernando Fernandez. Its purpose-driven marketing campaigns and incremental packaging reforms continue to resonate with environmentally conscious consumers, despite internal debates over pacing and scope. Meanwhile, Colgate-Palmolive leverages the Palmolive brand’s heritage, focusing on natural ingredient communications and expansive distribution networks to defend its global footprint.

Emerging players such as Dr. Bronner’s and Burt’s Bees are carving out specialized niches by aligning regenerative organic certifications with transparent sourcing pledges. Dr. Bronner’s recent Purpose Pledge initiative and packaging updates underscore its leadership in ethical business practices and resonate strongly with the wellness community. Together, these companies exemplify diverse strategic pathways-from scale-driven consolidation to mission-oriented differentiation-fueling a dynamic and evolving competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bath Soaps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anuspa Heritage Pvt. Ltd.

- Beiersdorf AG

- Bradford Soap Works, Inc.

- Colgate-Palmolive Company

- Davines S.p.A.

- Forest Essentials

- Godrej Consumer Products Limited

- Henkel AG & Co. KGaA

- Himalaya Wellness Company

- ITC Limited

- Johnson & Johnson Services, Inc.

- L’occitane International SA

- L’Oreal S.A.

- Magnolia Soap and Bath Company

- Manos Soap Co.

- Natura& Co.

- Osmia Organics, LLC

- PZ Cussons PLC

- Reckitt Benckiser Group PLC

- Shibuya Oil & Chemicals., Ltd.

- Stirling Soap Company

- The Avon Company

- The Procter & Gamble Company

- Twincraft Skincare

- Unilever PLC

- Vermont Country Soap Corp.

Actionable Strategies for the Bath Soap Industry Emphasizing Supply Chain Resilience Brand Differentiation Sustainable Practices and Enhanced Digital Engagement

Actionable strategies for the bath soap industry emphasize the importance of fortifying supply chain resilience and embracing nearshoring to mitigate tariff volatility. By diversifying supplier networks across multiple regions and forging local partnerships, companies can reduce exposure to sudden duty increases and maintain production continuity.

Brand differentiation should hinge on authentic storytelling that underscores clean, traceable formulations and ethical sourcing. Integrating upcycled by-products and indigenous botanicals into signature ranges will deepen consumer trust and align with circular economy principles. Simultaneously, sustainable packaging innovations such as refillable systems and compostable materials must become core to product design to meet both regulatory mandates and eco-consumer expectations.

On the digital front, expanding direct-to-consumer platforms with advanced personalization engines-leveraging AI-driven skin assessments and scent preference mapping-can elevate engagement and foster long-term loyalty. Embracing social commerce integrations and influencer collaborations will further amplify brand reach within Gen Z and millennial cohorts. By executing these strategic imperatives in tandem, industry leaders can proactively capture emerging opportunities and solidify their market positions.

Detailing the Research Methodology Underlying This Study Through Primary Interviews Secondary Research and Data Triangulation with Analytical Frameworks

Detailing the research methodology underlying this study reveals a rigorous, multi-layered approach to ensure validity and reliability. Primary research involved structured interviews with senior executives across manufacturing, retail distribution, and ingredient supply chain segments, as well as consumer focus groups to gauge preferences across age, gender, and lifestyle cohorts.

Secondary research encompassed an exhaustive review of regulatory filings, trade association publications, tariff schedules, and industry journals. Data triangulation was conducted by cross-referencing quantitative import-export statistics, financial disclosures of key companies, and independent market intelligence sources. Analytical frameworks including SWOT analysis, Porter’s Five Forces, and value chain assessments were applied to synthesize findings and identify critical success factors.

This robust methodology ensures that insights presented herein reflect the current realities and future trajectories of the bath soap market, providing stakeholders with a dependable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bath Soaps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bath Soaps Market, by Product Type

- Bath Soaps Market, by Ingredient

- Bath Soaps Market, by End User

- Bath Soaps Market, by Distribution Channel

- Bath Soaps Market, by Region

- Bath Soaps Market, by Group

- Bath Soaps Market, by Country

- United States Bath Soaps Market

- China Bath Soaps Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Implications for Stakeholders Navigating Bath Soap Market Complexities to Drive Growth Innovation and Sustainability

Synthesizing key findings and strategic implications underscores the intricate balance between innovation, sustainability, and operational agility that defines today’s bath soap landscape. Consumer preference for clean, plant-derived ingredients and eco-friendly packaging continues to accelerate, driving both established and emerging players to refine their value propositions and embrace circular economy models. Regulatory evolutions and tariff dynamics have heightened the importance of diversified sourcing and nearshoring strategies to safeguard margin stability.

Companies that successfully integrate advanced personalization through digital channels, coupled with authentic storytelling around ethical sourcing and regenerative practices, are best positioned to capture growth in premium segments. Meanwhile, operational excellence and flexible manufacturing footprints will determine resilience in the face of supply chain disruptions. As the market evolves, stakeholders must continuously monitor regional nuances, regulatory changes, and shifting consumer behaviors to remain competitive.

By internalizing these insights and executing targeted strategic initiatives, industry participants can navigate complexity, drive sustainable growth, and unlock new avenues of differentiation in a dynamic global market.

Contact Ketan Rohom to Secure Your Bath Soap Market Research Report and Empower Strategic Decisions With Expert Guidance for Sales and Marketing Success

Engaging directly with Ketan Rohom ensures you obtain personalized guidance tailored to your organization’s strategic objectives and market positioning. With his expertise in sales and marketing within the personal care sector, you will gain clear insights on leveraging the comprehensive market research report to inform product development, optimize distribution channel strategies, and refine promotional campaigns for maximum impact. Act now to collaborate with Ketan in securing actionable intelligence and driving your bath soap business toward sustained growth and competitive differentiation.

- How big is the Bath Soaps Market?

- What is the Bath Soaps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?