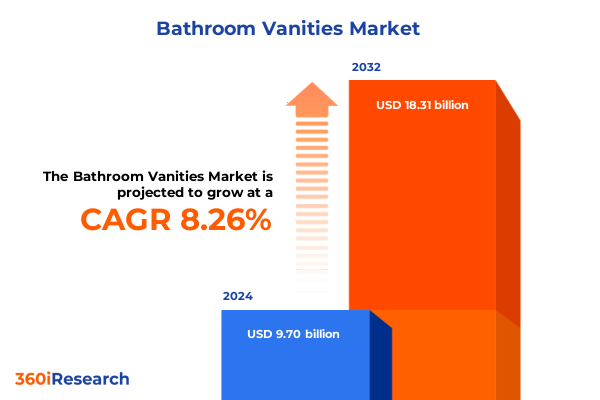

The Bathroom Vanities Market size was estimated at USD 10.40 billion in 2025 and expected to reach USD 11.15 billion in 2026, at a CAGR of 8.41% to reach USD 18.31 billion by 2032.

Discover the Essential Role of Modern Bathroom Vanities in Driving Functional Design and Elevated Aesthetic Experiences for Consumers

In an era defined by heightened consumer expectations and evolving living spaces, bathroom vanities have transcended their traditional role as merely practical fixtures. Today, they represent a fusion of functionality and aesthetics, becoming central design elements that reflect personal style and drive home value. From urban lofts seeking sleek, minimalistic integrated structures to suburban residences favoring freestanding consoles with artisanal wood finishes, the diversity of vanity configurations underscores their importance in modern interior design.

The convergence of technological innovation with home improvement trends has further elevated the profile of bathroom vanities. Smart sensors, integrated lighting systems, and touchless faucets are no longer novelties but anticipated features, prompting manufacturers and designers to rethink how cabinetry and countertops can adapt to connected environments. Meanwhile, growing environmental consciousness among end users has sparked demand for sustainable materials such as engineered composites and responsibly sourced wood, establishing new benchmarks for product development and supply chain transparency.

Navigating these dynamics requires a clear understanding of the market’s multifaceted nature. Whether a manufacturer is refining its freestanding and wall-mounted offerings or a distributor is optimizing its e-commerce and specialty showroom channels, aligning product portfolios with consumer priorities is critical. This report offers a strategic lens through which stakeholders can assess underlying trends, regulatory influences, and competitive strategies, setting the stage for informed decision-making and sustained market growth.

Exploring How Technological Innovation and Sustainability Mandates Are Redefining the Bathroom Vanity Marketplace and Consumer Expectations

Over the past five years, the bathroom vanity arena has undergone sweeping transformation catalyzed by digital disruption and heightened sustainability mandates. E-commerce platforms have carved out a significant share of channel activity, enabling consumers to explore diverse finishes and configurations virtually, compare price points instantly, and access direct-to-consumer brands that bypass traditional storefront constraints. This shift has compelled home improvement chains and specialized showrooms to invest in omnichannel experiences that seamlessly integrate online browsing with in-person consultation.

Simultaneously, the pressure to meet eco-conscious standards has accelerated the adoption of lower-impact materials. Composite laminates infused with recycled resins, stone alternatives that reduce quarrying demands, and responsibly managed wood sources have emerged as mainstream options. These materials not only satisfy regulatory criteria but also resonate with a consumer base that values transparency in sourcing and production.

Moreover, personalization is no longer an afterthought but a core differentiator. Mass customization engines powered by digital configurators allow end users to specify dimensions, finishes, and integrated tech features with unprecedented precision. The outcome is a market where flexibility replaces one-size-fits-all mindsets, prompting key players to reengineer manufacturing processes and logistics networks. As the landscape shifts, agility and innovation will remain paramount for brands aiming to capture value and loyalty in this rapidly evolving segment.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariffs on Imported Bathroom Vanity Components and Supply Chain Strategies

The introduction of updated U.S. import tariffs in early 2025 targeting cabinetry components and raw materials has had significant ripple effects across the bathroom vanity supply chain. These levies, designed to protect domestic manufacturers of wood and metal elements, have increased landed costs for freestanding, integrated, and console-style vanities that rely on imported parts. In response, many importers have revisited their sourcing strategies, shifting orders to tariff-exempt countries or vertically integrating production closer to end markets.

The tariff adjustments have also prompted smaller specialty manufacturers to pursue strategic partnerships with domestic mills and foundries, reinforcing local supply security while mitigating cost pressures. By integrating composite and engineered wood operations within U.S. facilities, these players are insulating themselves from future policy fluctuations. At the same time, large-scale distributors and home improvement chains are leveraging their purchasing power to negotiate long-term contracts that lock in favorable rates for aluminum and stainless steel vanity frames.

Despite higher input costs, brands have largely avoided passing the full burden onto consumers through price hikes, instead absorbing expenses through operational efficiency improvements. Lean manufacturing techniques, consolidated shipping routes, and cross-border fulfillment hubs have emerged as key tactics for preserving competitive price positioning. As these supply chain adaptations take hold, stakeholders should continue monitoring tariff developments closely to anticipate potential cost shifts and maintain resilient procurement strategies.

Unveiling Critical Customer and Market Segmentation Insights That Illuminate Product, Channel, Material, Pricing, and Style Dynamics

A nuanced view of the bathroom vanity sector reveals distinct performance trends when parsed by product type, distribution model, material composition, pricing tier, end-user orientation, and stylistic preference. In terms of product frameworks, integrated vanities that combine sinks, countertops, and storage into single modules have gained traction in high-end renovations, whereas console-style and freestanding models are preferred by cost-sensitive residential buyers for their ease of installation and design versatility. Wall-mounted vanities appeal to the urban demographic seeking to maximize floor space and convey a modern, streamlined aesthetic.

On the channel front, direct-to-consumer e-commerce has made significant inroads by offering personalized configurators and expedited shipping, yet third-party marketplaces remain vital for niche specialty brands that rely on broad discoverability. Traditional home improvement stores continue to serve as pivotal destinations for first-time homeowners and DIY enthusiasts, while boutique kitchen and bath showrooms excel in delivering curated design services and premium fabricator partnerships.

Material preferences are also evolving. Composite substrates like laminate and resin have grown in demand for their cost-effectiveness and moisture resistance, while metal frameworks-predominantly aluminum and stainless steel-deliver industrial charm and durability. Stone surfaces retain an air of luxury, with granite maintaining its long-standing appeal and marble experiencing renewed interest in veined patterns that align with contemporary interiors. Wood finishes remain a cornerstone of classic and transitional styles, with engineered alternatives offering greater stability in humid environments compared to solid timber.

Examining price tiers reveals that mid-range offerings capture broad residential adoption by balancing cost and quality, while premium and luxury segments drive innovation through bespoke finishes and integrated smart features. Economy models continue to address entry-level requirements, particularly in rental properties and commercial projects where cost control is paramount. Distinct requirements between commercial and residential end users further shape demand; commercial clients prioritize compliance with health and safety regulations and ease of maintenance, whereas homeowners seek aesthetic customization and long-term durability.

Lastly, stylistic segmentation highlights the rise of industrial vanities leveraging raw metal accents, juxtaposed against modern and minimalist forms that emphasize clean lines and neutral color palettes. Rustic and traditional designs persist in markets valuing heritage motifs and handcrafted details, while transitional styles bridge the gap by blending contemporary functionality with classic warmth. This multi-dimensional segmentation underscores the importance of aligning product roadmaps and marketing narratives to the distinct expectations of each customer cohort.

This comprehensive research report categorizes the Bathroom Vanities market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Style

- Distribution Channel

- End User

Analyzing Regional Nuances and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Bathroom Vanity Markets

Regional dynamics within the bathroom vanity landscape reflect broader economic and cultural forces. In the Americas, the United States remains the dominant market, propelled by sustained renovation activity in both urban and suburban housing stock. Incorporating smart fixtures and premium materials is especially prevalent in coastal metropolitan areas, while entry-level freestanding models maintain traction in secondary markets. Latin American economies are gradually embracing home improvement trends, with rising middle-class demand for integrated bathroom solutions and an uptick in DIY showrooms that offer modular vanity systems.

Turning to Europe, the Middle East & Africa, regulatory emphasis on water conservation and circular economy principles encourages manufacturers to introduce low-flow faucets and recyclable material compositions. In Western Europe, a blend of minimalist Scandinavian and luxurious Mediterranean design cues shapes consumer preferences, whereas in the Middle East, opulent finishes and stone-heavy countertops resonate with high-net-worth buyers. African markets, particularly in South Africa and Nigeria, are witnessing incremental growth driven by expanding hospitality projects seeking durable, easy-to-maintain vanity installations.

The Asia-Pacific region stands out for its rapid urbanization and construction boom. In China and India, large-scale residential and commercial developments fuel demand for both standardized and semi-custom vanity models. Preference for space-saving wall-mounted designs is strong in densely populated cities, while resort destinations in Southeast Asia drive demand for vanities crafted from locally sourced wood and stone. As e-commerce penetration deepens across the region, local brands are partnering with digital marketplaces to offer configurable options that meet diverse climatic conditions and design sensibilities.

This comprehensive research report examines key regions that drive the evolution of the Bathroom Vanities market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Industry Players’ Strategic Moves and Innovation Footprints Shaping the Competitive Bathroom Vanity Landscape

Within this competitive terrain, a handful of legacy manufacturers and emerging disruptors vie for market leadership by leveraging product innovation, vertical integration, and strategic partnerships. Established cabinetry firms with deep distribution networks continue to reinforce their positions through expanded showrooms, private label collaborations with home improvement chains, and in-house sustainable material initiatives. These companies benefit from economies of scale yet face pressure to introduce design flexibility that matches nimble direct-to-consumer entrants.

Conversely, digitally native brands have capitalized on streamlined supply chains and user-friendly configurators to deliver personalized vanities directly to consumers. By bypassing traditional channel markups and investing heavily in online marketing, they challenge incumbents on cost and customization. Partnerships with material specialists and 3D printing pioneers enable rapid prototyping of new designs, effectively shortening the product development cycle.

Mid-sized regional players are carving out niche opportunities in premium resort and commercial segments by offering end-to-end design services, including installation and post-sale maintenance packages. Through targeted alliances with architects, interior designers, and hospitality groups, they secure repeat business and enhance project visibility. These collaborative models underscore the value of service differentiation alongside product excellence in a market where buyer expectations continue to rise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bathroom Vanities market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alya Bath, LLC

- American Woodmark Corporation

- Ancerre Designs, LLC

- Duravit AG

- Fortune Brands Home & Security, Inc.

- Geberit AG

- Grohe AG

- HCG Holding Co., Ltd.

- IKEA Group

- James Martin Furniture, LLC

- KEUCO GmbH & Co. KG

- Kohler Co.

- LIXIL Group Corporation

- Masco Corporation

- Oppein Home Group Inc.

- Porcelanosa Grupo

- Robern, Inc.

- Roca Sanitario, S.A.

- Ronbow, Inc.

- Strasser Woodenworks, Inc.

- TOTO Ltd.

- Villeroy & Boch AG

- Wyndham Collection, LLC

Implementing Actionable Strategic Recommendations to Optimize Supply Chains, Elevate Digital Channels, Embrace Sustainability, and Unlock Growth

For industry leaders aiming to solidify their market position and catalyze growth, a strategic roadmap anchored in four core imperatives is essential. First, diversifying supply chains through a blend of domestic production and tariff-exempt sourcing regions will enhance resilience against regulatory shifts while preserving competitive pricing. This approach should be complemented by investments in lean manufacturing processes and cross-border fulfillment hubs to streamline logistics expenditures.

Second, elevating digital engagement by refining online configurators, adopting augmented reality tools for virtual showroom experiences, and personalizing marketing content based on user behavior can drive conversion rates and foster brand loyalty. Omnichannel integration-seamlessly linking e-commerce interfaces with physical consultation spaces-will be vital in capturing both digitally native consumers and traditional showroom visitors.

Third, embedding sustainability into product roadmaps by increasing the use of recycled composites, exploring low-carbon stone alternatives, and pursuing cradle-to-cradle certifications will resonate with eco-conscious buyers and preempt regulatory constraints. Supply chain transparency initiatives-enabled through blockchain-based tracking or third-party audited supplier registries-will further bolster corporate reputations.

Finally, prioritizing selective expansion into high-growth regional markets-whether through joint ventures, localized manufacturing partnerships, or targeted digital campaigns-can unlock new revenue streams. Engaging architects, interior designers, and property developers as strategic allies will not only drive specification projects but also amplify brand storytelling within influential professional networks.

Understanding the Rigorous Research Methodology Underpinning Market Insights Including Data Collection, Validation, and Analytical Frameworks

This report’s insights are derived from a multi-faceted research methodology designed to ensure robustness, reliability, and relevance. Primary research included structured interviews with senior executives from leading manufacturers, distributors, and design firms, as well as surveys of homeowners and commercial project managers to gauge emerging preferences and pain points. These primary inputs were supplemented by field visits to manufacturing facilities, showrooms, and trade exhibitions to observe production processes and assess the latest product innovations in situ.

Secondary research encompassed the review of public company filings, government trade and tariff databases, industry association publications, and architectural design journals to track regulatory developments, material innovations, and channel evolution. Data triangulation techniques were applied to reconcile conflicting perspectives and validate key trends. For instance, input cost analyses were cross-checked against customs import records and supplier price lists to ascertain tariff impacts accurately.

Analytical frameworks such as SWOT assessments, Porter’s Five Forces analyses, and scenario planning modules were employed to interpret the data and translate findings into strategic imperatives. The methodology also incorporated peer review by industry experts to ensure that conclusions reflect practical realities. While every effort was made to mitigate biases, readers should consider the dynamic nature of trade policies and consumer behaviors when applying these insights to decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bathroom Vanities market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bathroom Vanities Market, by Product Type

- Bathroom Vanities Market, by Material

- Bathroom Vanities Market, by Style

- Bathroom Vanities Market, by Distribution Channel

- Bathroom Vanities Market, by End User

- Bathroom Vanities Market, by Region

- Bathroom Vanities Market, by Group

- Bathroom Vanities Market, by Country

- United States Bathroom Vanities Market

- China Bathroom Vanities Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Insights on Market Dynamics, Emerging Opportunities, and Strategic Imperatives for Stakeholders in the Bathroom Vanity Sector

The bathroom vanity market stands at a pivotal juncture, shaped by converging forces of digital innovation, sustainability imperatives, and shifting trade policies. Although 2025 tariffs have introduced short-term cost challenges, they have also galvanized a wave of supply chain realignment and domestic production investments that enhance long-term resilience. Segmentation dynamics reveal that no single strategy dominates; success hinges on articulating a clear value proposition across product types, channels, materials, price ranges, end-user priorities, and stylistic trends.

Regional analysis underscores that growth opportunities are as varied as the design preferences exhibited across the Americas, EMEA, and Asia-Pacific. Leading companies are balancing the efficiencies of large-scale manufacturing with the customization capabilities demanded by today’s consumers. Meanwhile, the rise of digitally native brands demonstrates that user-centric, agile business models can capture market share by delivering transparent, cost-effective solutions.

Looking forward, stakeholders who integrate sustainable practices, strengthen omnichannel engagement, and nurture strategic collaborations will be best positioned to navigate the evolving landscape. As consumer expectations continue to escalate, the ability to anticipate trends and pivot with agility will define market leadership in the bathroom vanity sector.

Engage with Ketan Rohom to Secure Comprehensive and Actionable Bathroom Vanity Market Intelligence Tailored for Strategic Decision Making

If you’re seeking a deeper understanding of the forces shaping the bathroom vanity market and need tailored insights to inform strategic priorities, our dedicated Associate Director of Sales & Marketing, Ketan Rohom, is ready to guide you through the report’s comprehensive findings and help align recommendations with your organization’s objectives. The report delivers an in-depth exploration of evolving consumer behaviors, emerging regional opportunities, regulatory impacts, and competitive best practices-ensuring that decision-makers have the confidence and clarity required to navigate market complexities. By partnering with Ketan Rohom, you will gain direct access to expert support for interpreting the data, as well as assistance in customizing the analysis to your specific product lines, geographic focus, or investment thesis. Reach out today to secure your copy of the full market research report and lay the groundwork for informed, growth-driven decisions that capitalize on the bathroom vanity sector’s dynamic landscape.

- How big is the Bathroom Vanities Market?

- What is the Bathroom Vanities Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?