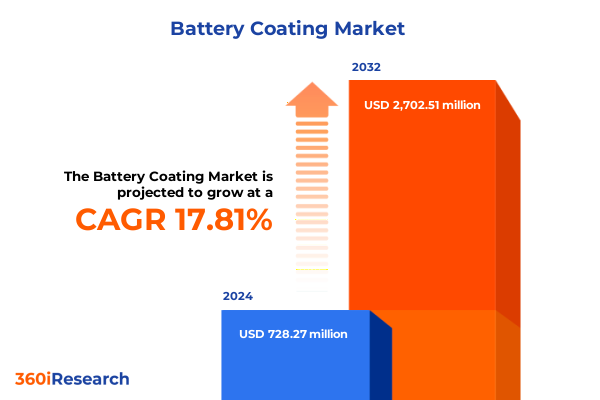

The Battery Coating Market size was estimated at USD 848.07 million in 2025 and expected to reach USD 988.27 million in 2026, at a CAGR of 18.00% to reach USD 2,702.51 million by 2032.

Unveiling the Critical Role of Battery Coatings in Enhancing Performance Safety and Sustainability Across Modern Energy Systems

Battery coatings have emerged as a pivotal element in the evolution of modern energy storage systems, offering critical enhancements in performance, safety, and longevity. By applying specialized coatings to battery packs, electrodes, and separators, manufacturers can mitigate common challenges such as dendrite formation, thermal runaway, and capacity fade. Innovations in coating techniques are rapidly transforming production processes; a recent development by AM Batteries replaces traditional slurry-based drying methods with direct spray application, potentially reducing energy consumption and CO2 emissions by up to 40% while eliminating toxic solvent use. As electric vehicles, consumer electronics, and grid energy storage converge on higher power and safety requirements, the demand for tailored coating solutions is intensifying, making coatings an indispensable layer in next-generation battery architectures.

Embracing Next Generation Technologies and Regulatory Drivers Reshaping the Battery Coating Ecosystem from Novel Materials to Advanced Application Methods

The landscape of battery coating has been reshaped by the convergence of advanced materials research, regulatory mandates, and disruptive manufacturing technologies. Nanomaterial-infused coatings now offer unprecedented control over ion transport and interface stability, accelerating charge rates and extending cycle life. Concurrently, machine-learning frameworks are expediting the discovery of redox-active organic electrode materials, reducing reliance on critical metals and paving the way for lower-carbon alternatives. Additionally, the implementation of real-time process control in electrode production is transitioning from theoretical concept to pilot deployments, promising reductions in material waste and enhanced yield consistency across coating lines. These interconnected shifts are fostering a more agile, sustainable, and high-performance battery industry.

Assessing the 2025 U.S. Tariff Landscape Impacting Imported Battery Components and Their Ripple Effects on North American Coating Supply Chains

In response to perceived supply-chain vulnerabilities, U.S. authorities introduced a series of tariffs targeting Chinese-made battery components, including a jump from 7.5% to 25% on lithium-ion EV battery imports effective August 1, 2024, and planned tariff increases on non-EV lithium-ion batteries by January 1, 2026. These measures, coupled with broader Section 301 actions, have contributed to caution among major suppliers; LG Energy Solution has warned of slowing EV battery demand into early 2026, attributing part of the headwinds to new U.S. tariffs and the phase-out of federal purchase incentives. As pricing pressures mount, many producers are realigning capacity toward energy storage systems and sourcing materials domestically to navigate the evolving tariff environment.

Deep Dive into Multifaceted Segmentation Revealing Battery Coating Markets across Types Materials Technologies Functions and Applications

The battery coating market can be examined through a comprehensive lens of interrelated segments. On the basis of coating function, the industry encompasses battery pack, electrode, and separator coatings, with electrode coatings further delineated into anode and cathode layers. Material-type segmentation highlights the use of ceramics, metallics, and polymers; metallic coatings include aluminum, cobalt, copper, lithium, nickel, titanium, and zinc, whereas polymeric solutions span acrylics, epoxies, fluoropolymers, polyethylene oxide, and polyimide. Battery type segmentation covers lead-acid, lithium-ion, nickel-metal hydride, and cutting-edge solid-state platforms. Technological approaches range from atomic layer and chemical vapor deposition to slot-die, sol-gel, spray, electrochemical, and physical vapor deposition methods. The spectrum of functionality differentiates coatings designed for corrosion resistance or thermal management. Finally, applications extend across automotive-encompassing electric and hybrid vehicles-consumer electronics, energy storage systems such as grid storage and renewable integration, industrial equipment, and medical devices, with each end-use demanding highly tailored coating properties.

This comprehensive research report categorizes the Battery Coating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Type

- Battery Types

- Coating Technologies

- Functionality

- Application

Regional Dynamics Driving Battery Coating Adoption Insights from the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics are exerting distinct influences on battery coating uptake and innovation. In the Americas, robust investment under the Inflation Reduction Act has catalyzed expansion in North American battery pack application centers and electrode binder capacity, fostering local supply chains and incentivizing water-based, low-VOC formulations. Meanwhile, Europe, Middle East, and Africa regions are navigating strict environmental regulations-such as the EU Battery Regulation mandating carbon-footprint disclosures-and pursuing ceramic and hybrid coatings to meet stringent safety and sustainability objectives. Across Asia-Pacific, rapid electric vehicle adoption in China, Japan, and South Korea is driving volume demand for advanced separators and electrode coatings, while emerging markets in Southeast Asia and Latin America are gaining momentum through cost-competitive imports and supportive government incentives. These differentiated trajectories underscore the need for agile regional strategies and localized partnerships.

This comprehensive research report examines key regions that drive the evolution of the Battery Coating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators Shaping Battery Coating Advancements through Strategic Investments Partnerships and Technology Breakthroughs

Major industry players are advancing battery coating capabilities through targeted R&D, capacity expansions, and strategic collaborations. PPG is showcasing its PPG CORATHERM™ and CORABOND™ platforms for thermal management and fire protection at leading international conferences , while Arkema has committed $20 million to boost PVDF binder capacity in Kentucky by 15%, aligning with upcoming U.S. gigafactory ramp-ups. Solvay and Orbia have formed a joint venture to establish the largest North American PVDF production facility compliant with Inflation Reduction Act requirements, reinforcing domestic supply of key binder and separator materials. BASF has inaugurated U.S. production lines for Licity® water-based anode binders in Monaca and Chattanooga, enhancing regional resilience and sustainability for electric vehicle and energy storage supply chains. These concerted efforts illustrate a competitive landscape propelled by innovation and local-market alignment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery Coating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&A Company, Inc.

- Akzo Nobel N.V.

- Alkegen

- Alteo Alumina

- AM Batteries

- APV Engineered Coatings

- Arkema Group

- Axalta Coating Systems Ltd.

- Beneq Oy

- Compagnie de Saint-Gobain S.A.

- Contemporary Amperex Technology Co., Limited

- Covestro AG

- Dürr AG

- Forge Nano Inc.

- HIRANO TECSEED Co., Ltd.

- KEYENCE Corporation

- Nano One Materials Corp.

- Nordson Corporation

- Parker-Hannifin Corporation

- Patvin Engineering Pvt. Ltd.

- PPG Industries, Inc.

- SK Inc.

- Solvay SA/NV

- Tanaka Chemical Corporation

- The DECC Company

- Wright Coating Technologies

- Xiamen Tmax Battery Equipments Limited

Strategic Blueprint for Industry Stakeholders to Accelerate Battery Coating Innovation Supply Chain Resilience and Regulatory Alignment in a Competitive Market

To navigate the evolving battery coating ecosystem, industry leaders should prioritize diversified material sourcing, including dual-supply strategies for polymers and ceramics, to insulate against geopolitical and raw-material disruptions. Investment in solvent-free and aqueous coating technologies will not only address stringent environmental regulations but also reduce operational costs and enhance safety. Collaborative R&D consortia-uniting materials suppliers, equipment manufacturers, and end-users-can accelerate commercialization of emerging nanocoatings and AI-driven formulation platforms. Companies must strategically engage with policy makers to align incentive programs with scalable domestic production, ensuring long-term viability of advanced battery technologies. Finally, adopting modular coating application centers adjacent to gigafactories can streamline process integration, shorten qualification cycles, and foster closer feedback loops between material developers and cell producers, driving continuous performance improvements.

Transparency in Research Approach Combining Rigorous Primary and Secondary Methods to Deliver Unbiased Insights into the Battery Coating Landscape

Our research approach synthesizes rigorous secondary analysis with targeted primary interviews to deliver a balanced perspective on industry dynamics. We conducted in-depth reviews of technical literature, patent filings, and regulatory frameworks to map the technological landscape. Publicly available company disclosures, press releases, and government notices-alongside proprietary databases-underpin the assessment of capacity expansions, policy actions, and competitive moves. Supplementing this, structured interviews with coating technology executives, battery manufacturers, and regulatory experts provided qualitative insights into adoption barriers and emerging opportunities. Data validation protocols and triangulation techniques were applied to ensure consistency and minimize bias. This transparent methodology underlies each insight presented, ensuring stakeholders can make informed, high-confidence decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery Coating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery Coating Market, by Type

- Battery Coating Market, by Material Type

- Battery Coating Market, by Battery Types

- Battery Coating Market, by Coating Technologies

- Battery Coating Market, by Functionality

- Battery Coating Market, by Application

- Battery Coating Market, by Region

- Battery Coating Market, by Group

- Battery Coating Market, by Country

- United States Battery Coating Market

- China Battery Coating Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Battery Coating Developments and Market Drivers into a Cohesive Narrative for Decision-Makers Seeking Actionable Clarity

As the battery industry advances toward ever-higher performance and sustainability targets, coatings will remain a strategic lever for differentiation and risk mitigation. The convergence of novel materials, precision deposition techniques, and supportive regional policies is catalyzing a new era of battery architectures. By understanding the multifaceted segmentation, tariff implications, and regional dynamics, stakeholders are better equipped to allocate resources effectively and foster meaningful partnerships. Leading players are demonstrating the benefits of localized production, advanced binder chemistries, and cross-sector collaboration to meet the rigorous demands of electric mobility and grid storage. Ultimately, integrating these insights into corporate strategies will enable decision-makers to harness coating innovations, ensure regulatory compliance, and secure competitive advantage as global energy systems continue to electrify.

Secure Your Strategic Edge by Partnering with Ketan Rohom for In-Depth Battery Coating Market Research to Drive Growth and Competitive Advantage

To deepen your strategic understanding of the battery coating market and gain exclusive access to detailed analyses, contact Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through comprehensive insights on cutting-edge technologies, regulatory impacts, and competitive landscapes. By engaging with Ketan, you will secure customized support tailored to your organization’s goals, ensuring you uncover actionable intelligence to accelerate growth, mitigate risks, and capitalize on emerging opportunities. Reach out today to procure the definitive market research report and position your leadership team at the forefront of innovation and sustainability in the battery coating arena.

- How big is the Battery Coating Market?

- What is the Battery Coating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?