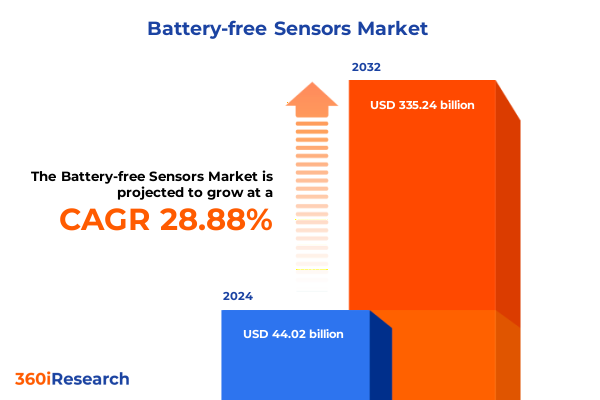

The Battery-free Sensors Market size was estimated at USD 56.33 billion in 2025 and expected to reach USD 72.09 billion in 2026, at a CAGR of 29.01% to reach USD 335.24 billion by 2032.

Pioneering the Future of Sensing with Innovative Battery-Free Technologies to Drive Sustainable Maintenance-Free IoT Deployments in a Connected World

The battery-free sensor landscape represents a paradigm shift in the world of sensing solutions, enabling devices to operate without conventional power sources and unlocking unprecedented opportunities for maintenance-free deployments. By leveraging energy harvesting technologies such as ambient radiofrequency, solar, thermal gradients, and mechanical vibrations, these sensors eliminate the need for batteries, thereby reducing waste and extending operational lifespans. Researchers from the National University of Singapore recently demonstrated a novel energy-harvesting module that efficiently converts ambient RF signals into direct current voltage, empowering sensors to function entirely on harvested energy and showcasing the practical viability of battery-free operation in diverse environments. Furthermore, industries across logistics, smart infrastructure, and asset tracking are increasingly prioritizing sustainability and energy efficiency, driving the adoption of solutions that minimize downtime and environmental impact.

As the Internet of Things (IoT) ecosystem continues to expand, the demand for sensors that can be deployed in hard-to-reach or remote locations without the burden of periodic battery replacements is accelerating. Advances in nanomaterials, ultra-low-power microelectronics, and miniaturized form factors are enabling a new generation of compact, high-performance sensors that seamlessly integrate with IoT networks. In particular, recent industry surveys indicate that over one-third of R&D investments in the sensor domain are now directed toward enhancing energy-harvesting efficiency and reducing power requirements, underscoring the strategic importance of battery-free technologies in future product roadmaps.

This executive summary presents a comprehensive overview of the battery-free sensor market, exploring transformative technological shifts, the impact of U.S. tariff policies, detailed segmentation insights, regional dynamics, competitive landscapes, and actionable recommendations. By synthesizing primary research findings and secondary data analysis, stakeholders will gain a clear understanding of the factors shaping market evolution and the strategies required to capitalize on emerging opportunities.

Unveiling the Major Technological and Market Dynamics Reshaping the Battery-Free Sensor Landscape for Industrial IoT Applications

The battery-free sensor market is undergoing a series of transformative shifts driven by innovations in energy-harvesting techniques, communication protocols, and miniaturization. As IoT architectures become more pervasive, the integration of sensors that can autonomously power themselves from ambient energy sources is redefining traditional operational models. Industries such as healthcare, logistics, and smart city infrastructure are at the forefront of this transformation, deploying battery-free sensors for real-time monitoring, predictive maintenance, and asset tracking with minimal environmental footprint.

Concurrently, the push toward miniaturized sensor modules is enabling the development of wearable and implantable devices capable of continuous physiological monitoring. Groundbreaking prototypes that harvest energy from magnetic fields around power lines and machinery have demonstrated the ability to support long-term health diagnostics and condition-based maintenance in aerospace and manufacturing settings. These advancements highlight the convergence of material science and circuit design, which is making battery-free solutions both practical and cost-effective for a wider array of use cases.

Moreover, the seamless integration of communication technologies such as Bluetooth Low Energy, Near Field Communication, and ultra-wideband protocols is expanding the reach of battery-free sensors into consumer electronics, retail automation, and industrial control systems. The ability to transmit data reliably while consuming minimal power has catalyzed the development of smart shelving solutions, remote patient monitoring platforms, and environmental sensing networks. Together, these converging trends are reshaping the sensor landscape and paving the way for scalable, maintenance-free IoT deployments.

Assessing the Comprehensive Impact of the 2025 U.S. Tariff Increases on Battery-Free Sensor Supply Chain Component Costs Across Key Markets

In January 2025, the United States implemented significant tariff increases under Section 301 that directly affect critical components used in battery-free sensor systems. Semiconductor devices essential for ultra-low-power data acquisition and processing are now subject to a 50% duty, while solar cells, including those integrated into energy harvesting modules, face a 50% tariff. Battery parts classified as non-lithium-ion will incur a 25% duty from late 2024 onward, and similar tariffs apply to key electronic materials leveraged in energy converters and power management circuits.

These tariff adjustments have a cascading effect on the cost structure of battery-free sensor solutions. Manufacturers sourcing photovoltaic cells, rectifiers, and microcontroller units from tariff-affected regions are experiencing notable increases in component expenses, which can translate into higher product costs and extended lead times. A previous round of tariff hikes in mid-2024 on semiconductors and lithium-ion batteries highlighted the potential for tariff-related price escalations to reach double digits, underscoring the urgency for supply chain recalibration.

In response to the elevated duties, industry players are re-evaluating sourcing strategies and exploring reshoring initiatives. Several startups and established firms have announced plans to adjust their manufacturing footprint, shifting to tariff-exempt regions or forging partnerships with domestic suppliers. While these maneuvers can mitigate exposure to import duties, they also introduce logistical complexities, capacity constraints, and potential delays as new production lines come online. Venture investors and technology firms alike are closely monitoring these developments to balance cost containment with the need for scalable supply networks.

Collectively, the cumulative impact of the 2025 U.S. tariff increases underscores the importance of strategic sourcing, supply chain resilience, and agile manufacturing practices. Companies that proactively adapt their procurement and production models stand to protect profit margins and maintain competitive positioning in the evolving battery-free sensor market.

In-Depth Segmentation Insights Highlighting How Applications Energy Harvesting Methods Communication Protocols Sensor Types and End Users Drive Market Evolution

A granular analysis of the battery-free sensor ecosystem reveals that application-driven segmentation is foundational to understanding value propositions and adoption trajectories. In aerospace and defense, condition-based maintenance and structural health monitoring applications demand robust, battery-free sensors capable of operating in high-vibration, temperature-extreme environments. Similarly, agriculture utilizes crop and soil monitoring sensors that harvest solar and thermal energy to enable precision irrigation and yield optimization without the need for battery replacements.

From an energy-harvesting perspective, electromagnetic induction solutions offer dependable power generation in proximity to alternating magnetic fields, making them suitable for industrial machinery monitoring. Radiofrequency harvesting supports low-power tags for logistics and asset tracking, while solar-driven modules enable outdoor environmental monitoring. Thermal gradients and vibration-based harvesters further expand deployment scenarios across manufacturing and transportation networks.

Communication technology choices shape connectivity, interoperability, and deployment scale. Bluetooth Low Energy is prominent in consumer electronics and wearable healthcare devices due to its low overhead, whereas RFID and NFC provide secure, short-range data exchange for inventory management and access control. Ultra-wideband facilitates precise location tracking in retail and logistics, and Wi-Fi integration enables high-throughput data collection in smart building automation.

Sensor type selection aligns closely with end-user requirements. Accelerometers and motion sensors underpin predictive maintenance in automotive and industrial sectors, pressure and temperature sensors drive environmental and process monitoring, while proximity and humidity sensors support smart retail shelving and agricultural condition tracking. Each sensor modality is optimized for specific power budgets and communication protocols.

End users, including automotive OEMs and healthcare providers, are increasingly driving system-level integration of battery-free sensors to enhance product reliability and reduce total cost of ownership. Retailers implement smart shelving to automate restocking processes, and manufacturing firms deploy passive environmental sensors to improve safety and operational efficiency. These diverse end-user engagements collectively propel the market’s evolution toward fully autonomous, maintenance-free sensing networks.

This comprehensive research report categorizes the Battery-free Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Energy Harvesting Technology

- Communication Technology

- Sensor Type

- End User

Strategic Regional Perspectives Illustrating Key Drivers Opportunities and Adoption Trends Across Americas Europe Middle East and Africa and Asia-Pacific

Regional dynamics play a pivotal role in shaping the trajectory of battery-free sensor adoption, with the Americas leading in early commercial deployments driven by robust industrial automation and IoT initiatives. The United States, in particular, benefits from supportive regulatory frameworks for sustainable technology and strong investment in smart manufacturing infrastructure. Cross-sector collaborations between technology providers and end users are accelerating pilot programs across logistics, healthcare monitoring, and smart city applications.

In the Europe, Middle East & Africa region, government-led initiatives in renewable energy and defense modernization are key catalysts for battery-free sensor uptake. European nations are funding large-scale trials of passive environmental monitoring networks to meet stringent carbon reduction targets, while Middle Eastern and African markets are leveraging these sensors for remote asset tracking in logistics corridors and critical infrastructure monitoring.

Asia-Pacific represents the fastest-growing region, underpinned by substantial investments in smart agriculture, consumer electronics manufacturing, and 5G-enabled IoT networks. Countries such as Singapore, Japan, and South Korea are integrating battery-free sensors within urban mobility and smart home frameworks, whereas China and India are piloting large-scale precision farming projects that utilize energy-harvesting sensors for irrigation control and soil monitoring. The convergence of government support, high-volume semiconductor production, and rapid digital transformation positions Asia-Pacific as a pivotal market for future growth.

This comprehensive research report examines key regions that drive the evolution of the Battery-free Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Driving Innovation Through Strategic Developments Partnerships and Technological Breakthroughs in the Battery-Free Sensor Ecosystem

The competitive landscape of the battery-free sensor market is defined by companies that blend sensor design expertise with advanced energy-harvesting and wireless technologies. ON Semiconductor Corporation has introduced a new family of industrial IoT sensors that rely solely on harvested RF and thermal energy for power, positioning itself as a leader in ultra-low-power semiconductor integration. Farsens S.L. specializes in ultra-thin substrate sensors tailored for asset tracking and consumer electronics, leveraging its patented microelectromechanical systems (MEMS) platforms.

Axzon Inc. has secured significant venture capital to accelerate development of its smart passive sensing technology for healthcare and wearable devices, emphasizing biocompatible form factors and reliable energy-harvesting performance. Powercast Corporation’s long-range RF power transfer solutions extend operational ranges for battery-free sensors in logistics and warehouse management. Inductosense Ltd. is pioneering ultrasonic sensing for non-destructive testing in aerospace applications, demonstrating high sensitivity without battery dependency.

Phase IV Engineering Inc. and Cypress Semiconductor Corporation are advancing multi-modal harvesters that combine solar, vibration, and thermal sources to maximize energy availability in unpredictable environments. Infineon Technologies AG and Texas Instruments Incorporated continue to enhance their ultra-low-power microcontroller units and power management ICs, enabling efficient energy conversion and data processing. Analog Devices, Inc. rounds out the competitive group with precision analog front ends designed for low-power sensor interfaces across diverse industrial and consumer scenarios.

Together, these companies exemplify the strategic blend of technological innovation, partnerships, and targeted product development necessary to drive widespread adoption of battery-free sensor solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery-free Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Brands, Inc.

- Advantech Co., Ltd.

- Arrow Electronics, Inc.

- Axzon

- Bridg by Cardlytics, Inc.

- CAEN RFID S.r.l.

- DCO Systems Limited

- Distech Controls Inc. by Acuity Brands, Inc.

- EnOcean GmbH

- Everactive, Inc.

- Farsens S.L.

- Fuji Electric Co., Ltd.

- General Electric Company

- Identiv, Inc.

- Impinj, Inc.

- Inductosense Ltd.

- Infineon Technologies AG

- Metalcraft, Inc.

- Phase IV Engineering, Inc.

- Powercast Corporation

- Securitag Assembly Group Co., Ltd.

- Semiconductor Components Industries, LLC

- Texas Instruments Incorporated

- Wiliot Ltd.

- Zebra Technologies Corp.

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Battery-Free Sensor Opportunities in Diverse Industry Segments

Industry leaders seeking to capitalize on battery-free sensor opportunities should prioritize the diversification of energy-harvesting modalities within their product portfolios. By integrating dual or multi-modal harvesters that leverage solar, RF, thermal, and vibrational energy sources, companies can ensure reliable sensor operation across a broad spectrum of use cases. Cultivating partnerships with specialized semiconductor suppliers and energy-harvesting module providers will accelerate time-to-market and reduce integration complexity.

Strengthening supply chain resilience through regional manufacturing alliances and vendor diversification is essential to mitigate the impact of global tariff shifts and logistical disruptions. Organizations should evaluate the feasibility of localized assembly and component sourcing to maintain competitive cost structures while adhering to evolving trade policies. Concurrently, active participation in industry consortia and standardization bodies will facilitate interoperability, streamline certification processes, and build market confidence in passive sensing deployments.

Finally, embedding advanced analytics and predictive algorithms at the sensor edge can unlock higher value propositions, enabling real-time decision support and autonomous system adjustments. Investing in scalable software platforms that integrate battery-free sensor data with cloud-based machine learning workflows will empower end users with actionable insights and differentiate offerings in a crowded technology landscape.

Comprehensive Research Methodology Detailing Primary and Secondary Data Collection and Analysis Approaches Underpinning Actionable Market Insights

This report is grounded in a rigorous research methodology combining comprehensive secondary research and in-depth primary engagements. Secondary data were collected from a wide array of reputable sources, including scientific publications, patent databases, corporate press releases, and regulatory filings. To complement these insights, primary research comprised detailed interviews with industry veterans, technical experts, and end-user representatives to validate assumptions and gather first-hand perspectives on emerging trends.

Data collection spanned quantitative and qualitative analyses, with triangulation techniques employed to cross-verify critical information. Market intelligence tools facilitated the mapping of global supply chains, while proprietary frameworks were used to assess competitive positioning and technology readiness levels. Findings were further corroborated through workshops with domain specialists and investor briefings to ensure alignment with real-world market dynamics.

By blending structured data collection with expert-driven validation, this methodology delivers a balanced and actionable view of the battery-free sensor landscape. It underpins the credibility of the strategic insights, segmentation analyses, and regional assessments presented throughout this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery-free Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery-free Sensors Market, by Energy Harvesting Technology

- Battery-free Sensors Market, by Communication Technology

- Battery-free Sensors Market, by Sensor Type

- Battery-free Sensors Market, by End User

- Battery-free Sensors Market, by Region

- Battery-free Sensors Market, by Group

- Battery-free Sensors Market, by Country

- United States Battery-free Sensors Market

- China Battery-free Sensors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Consolidating Critical Insights to Illuminate the Path Forward Toward Scalable and Sustainable Battery-Free Sensing Solutions Across Diverse Industries

As industries across the globe pivot toward sustainable, maintenance-free sensing solutions, battery-free sensor technologies are poised to become a cornerstone of next-generation IoT ecosystems. The convergence of advanced energy-harvesting mechanisms, miniaturized electronics, and low-power communication protocols is unlocking new deployment scenarios, from deep-embedded aerospace monitoring to ubiquitous environmental sensing in smart cities.

Navigating this evolving landscape requires a nuanced understanding of application-specific requirements, tariff-driven supply chain considerations, and regional market dynamics. Companies that embrace multi-modal energy harvesting, cultivate resilient sourcing strategies, and leverage strategic partnerships will be well-positioned to realize the full potential of battery-free sensors. Moreover, embedding analytics at the edge and aligning with industry standards will differentiate solutions and drive large-scale adoption.

In summation, the promise of battery-free sensors extends beyond mere power autonomy-it represents a fundamental shift toward more sustainable, intelligent, and self-sufficient sensing networks. Stakeholders who act decisively on the insights and recommendations outlined in this report can unlock new avenues for innovation and secure a competitive edge in the future of sensing technologies.

Engage with Ketan Rohom to Secure Expert Guidance and Exclusive Market Intelligence for Powering Your Battery-Free Sensor Strategy and Accelerating Growth

If you are seeking to stay ahead in the rapidly evolving battery-free sensor market, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to gain expert guidance and exclusive market intelligence. Ketan brings a wealth of experience in helping organizations navigate complex technology landscapes and devise strategies that harness the full potential of battery-free sensing solutions. By engaging directly with Ketan, your team can access tailored insights, benchmarks, and best practices that align with your business objectives and accelerate time-to-market. Don’t miss this opportunity to partner with a seasoned professional committed to empowering your organization’s success in the era of sustainable, maintenance-free sensing applications.

- How big is the Battery-free Sensors Market?

- What is the Battery-free Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?