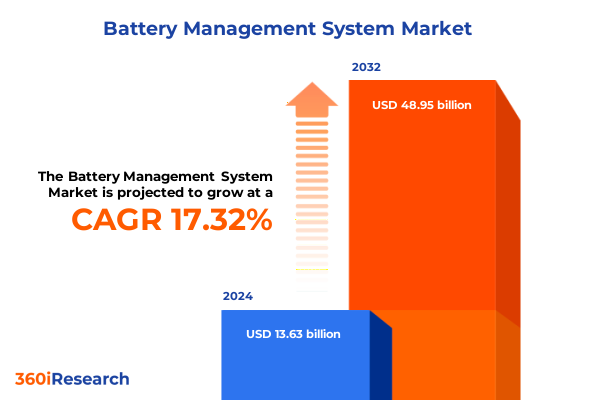

The Battery Management System Market size was estimated at USD 16.00 billion in 2025 and expected to reach USD 18.59 billion in 2026, at a CAGR of 17.31% to reach USD 48.95 billion by 2032.

Setting the Stage for Comprehensive Insights into the Evolving Battery Management System Industry Landscape and Strategic Imperatives

Battery management systems serve as the central nervous system of modern energy storage solutions. They monitor critical parameters such as state of charge, temperature, and voltage, ensuring optimal performance and lifespan. As electric mobility accelerates and renewable energy adoption scales, the BMS has transformed from a protective electronic module into a strategic enabler of system efficiency and safety. In this context, executives require a panoramic understanding of technological trends, regulatory shifts, and competitive dynamics that inform investment decisions and product roadmaps.

This executive summary synthesizes the key drivers shaping the BMS domain and identifies the market forces that demand adaptive strategies. By weaving together insights on materials science advances, software-driven diagnostics, and evolving policy frameworks, it provides a foundation for stakeholders to align organizational priorities with market realities. It offers a concise yet thorough overview of segmentation, tariff implications, regional nuances, and leading-edge initiatives that define today’s environment.

Emerging collaborations between automotive OEMs, energy storage providers, and semiconductor designers underscore the interdisciplinary nature of BMS innovation. As partnerships proliferate, the ability to integrate hardware, firmware, and cloud-based analytics becomes a critical differentiator. Executives must therefore navigate a landscape where technical proficiency intersects with strategic alliance-building, and where success hinges on the capacity to anticipate shifts in regulatory requirements and consumer expectations. By charting this landscape, the summary equips leaders with a clear view of where opportunities converge and where potential challenges may arise.

Uncovering the Forces Driving a Paradigm Shift in Battery Management Systems through Technological Innovation and Market Evolution

As electric mobility reaches unprecedented adoption rates, the battery management system has taken center stage in driving vehicle range, safety, and lifecycle cost optimization. Proliferating high-voltage packs in passenger and commercial applications have spurred demand for advanced cell supervision and thermal management modules capable of rapid fault detection and real-time calibration. Concurrently, automotive OEMs and suppliers are channeling significant R&D investments into next-generation sensing architectures that integrate cell-level diagnostics with holistic pack-level control, enabling rapid charging profiles without compromising longevity.

Parallel to automotive evolution, the convergence of industrial Internet of Things platforms and cloud-native architectures has redefined how battery performance data is processed and acted upon. BMS solutions increasingly embed secure communication interfaces that transmit granular operational metrics to centralized analytics engines. These engines leverage machine learning algorithms to forecast degradation pathways and prescribe maintenance interventions long before critical thresholds are breached. This shift from reactive maintenance to predictive service models enhances uptime and strengthens value propositions for fleet operators, grid storage assets, and consumer applications alike.

Regulatory momentum and environmental imperatives are further accelerating innovation trajectories. Legislations targeting zero-emission vehicles and stringent safety standards in grid-scale installations have raised the bar for functional safety certifications and performance benchmarks. In response, industry consortia are coalescing around open standards that foster interoperability between diverse component vendors. This collaborative ethos is fostering scalable, modular platforms that can be tailored to specific use cases, from residential energy kits to utility-scale frequency regulation services.

Finally, advances in materials characterization and second-life battery repurposing are reshaping lifecycle management. By coupling robust state-of-health estimation algorithms with circular supply chain frameworks, organizations can extend asset viability beyond primary applications. This holistic perspective not only mitigates environmental impact but also unlocks new revenue streams through refurbished energy storage systems. The cumulative effect of these transformative shifts underscores the imperative for stakeholders to embrace agile development models and cross-functional partnerships to navigate an increasingly complex BMS ecosystem.

Evaluating the Far-Reaching Consequences of Recent United States Tariffs on Global Battery Management System Supply Chains and Competitiveness

In 2025, the United States implemented a series of tariffs targeting imported battery cells, critical raw materials, and associated electronic components, significantly altering the landscape for battery management system supply chains. The imposition of levies on cells and related subassemblies has led manufacturers to reassess global sourcing strategies and production footprints. As a result, companies are evaluating the cost-benefit trade-offs of maintaining existing partnerships with overseas suppliers versus investing in domestic manufacturing capabilities to mitigate tariff exposure.

The immediate consequence of these measures has been an uptick in landed costs for imported modules, compelling original equipment manufacturers and tier-one suppliers to renegotiate contracts and explore alternative suppliers in tariff-exempt jurisdictions. This shift has introduced greater fragmentation in procurement channels, demanding more sophisticated inventory management and dynamic pricing models. Moreover, it has elevated the importance of supply chain resilience, prompting organizations to diversify component suppliers and to develop localized packaging and integration facilities.

Looking ahead, the long-term implications of sustained tariff pressure are likely to include deeper industry consolidation and strategic alliances designed to achieve economies of scale in domestic production. Investments in state-of-the-art assembly lines, advanced automation, and workforce training are gaining prominence as companies seek to offset increased production overhead. Simultaneously, policy incentives and grant programs at the federal and state levels are emerging to support reshoring initiatives, although such measures often require extended lead times to realize tangible capacity expansions.

In essence, the cumulative impact of the 2025 tariff regime has catalyzed a fundamental reconfiguration of global BMS supply chains, thrusting domestic production capabilities to the fore and compelling stakeholders to navigate a more complex procurement environment. As market participants adapt to these structural changes, prioritizing strategic supply chain mapping and proactive logistics optimization will be critical to maintaining competitiveness in a tariff-influenced market landscape.

Deconstructing Critical Segmentation Dimensions to Illuminate Varied Market Dynamics across Chemistry, Solutions, Voltage, Capacity, and End-User Profiles

Emerging applications and performance requirements in the battery management sector reveal differentiated demand across multiple segmentation axes. In terms of cell chemistry, traditional lead acid solutions remain relevant in cost-sensitive, low-power applications, while nickel metal hydride systems continue to serve specific industrial niches. Yet lithium-ion technology commands the forefront of most modern deployments due to its superior energy density and rapid charge capabilities, driving innovation in cell supervisory algorithms and thermal regulation techniques.

When examining solution type, the market dissects into three broad domains: the hardware layer, service offerings, and software platforms. Within the hardware category, designers focus on advanced battery controllers that orchestrate cell balancing, secure communication interfaces that ensure interoperability across modules, and sensors and switches that deliver critical environmental feedback. The services component encompasses consulting engagements that guide system architecture, integration services that ensure seamless deployment, and maintenance programs that extend operational life. Complementing these elements, software suites range from analytics tools that mine performance data for actionable trends, diagnostic applications that pinpoint emergent faults, to real-time monitoring dashboards that provide continuous visibility into key metrics.

Voltage range considerations further stratify the market into low-voltage systems suited for portable consumer electronics, medium-voltage platforms typically found in residential energy storage, and high-voltage solutions powering electric vehicles and utility-scale installations. Capacity range likewise segments opportunities into cell groups below 1000 milliampere-hours, mid-tier configurations between 1000 and 5000 mAh, and high-capacity clusters exceeding 5000 mAh, each presenting unique thermal management and balancing challenges.

End-user segmentation illuminates the distinct requirements of automotive, consumer electronics, energy storage, and industrial verticals. Within automotive, commercial vehicles demand enhanced durability and fast-charge capabilities, whereas passenger vehicles prioritize range optimization and safety certifications. In energy storage, residential installations emphasize compact designs and user-friendly interfaces, commercial systems balance modular scalability with performance monitoring, and utility-scale deployments require robust grid integration and regulatory compliance. Industrial applications, by contrast, mandate ruggedized solutions capable of withstanding harsh environments and continuous duty cycles.

This comprehensive research report categorizes the Battery Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cell Chemistry

- Solution Type

- Battery Voltage Range

- Capacity Range

- End User

Revealing Distinct Regional Dynamics and Growth Catalysts Shaping Adoption of Battery Management Systems across Key Global Markets

Battery management system adoption follows a varied trajectory across global regions, driven by unique policy landscapes and sectoral priorities. In the Americas, the United States and Canada have instituted ambitious electric vehicle incentives and renewable portfolio standards that fuel demand for advanced pack management solutions. Domestic manufacturers are racing to develop localized supply chains to capitalize on government subsidies and to buffer against import tariffs. Latin America, meanwhile, is emerging as a resource-rich supplier of critical minerals, spurring early-stage ecosystem development but facing challenges in downstream processing capacity.

Across Europe, the Middle East and Africa, stringent emissions regulations and aggressive decarbonization targets underpin BMS deployment in both transportation and grid-storage applications. The European Union’s regulatory framework mandates high safety and interoperability standards, encouraging adoption of modular, scalable BMS architectures. In parallel, the Middle East is investing heavily in utility-scale solar-plus-storage projects, requiring high-voltage management systems optimized for arid conditions. Africa’s uptake remains nascent but shows promise as microgrid initiatives expand in off-grid and rural electrification programs.

In Asia-Pacific, market dynamics are influenced by established manufacturing hubs in China, Korea and Japan. China leads in large-scale cell production and is integrating BMS technologies into smart grid applications and electric mobility fleets. Japan’s focus on battery chemistry breakthroughs and robust thermal management research continues to drive incremental improvements, while Korea’s semiconductor companies push sensor integration and high-speed communication interfaces. Southeast Asian economies are gradually building localized assembly capabilities, buoyed by investment incentives and regional trade agreements that facilitate component exchange.

This comprehensive research report examines key regions that drive the evolution of the Battery Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Driving Innovation, Strategic Partnerships, and Competitive Differentiation within the Battery Management Landscape

Navigating the competitive battery management landscape requires close attention to the strategic moves of leading stakeholders across hardware, software, and service domains. Tesla, with its vertically integrated model, continues to push boundaries in pack-level thermal management and proprietary supervisory algorithms, reinforcing its position in electric mobility and energy storage applications. Panasonic’s collaboration with automotive OEMs underscores its commitment to high-density cell and integrated control modules, while LG’s advanced BMS hardware platforms cater to diverse voltage and capacity requirements across global markets.

Tier-one automotive suppliers such as Bosch and Denso are leveraging their deep domain expertise to bundle hardware controllers with embedded firmware optimized for real-time diagnostics and safety compliance. Meanwhile, semiconductor companies like Infineon and NXP are capitalizing on the shift toward centralized BMS architectures by providing scalable microcontroller units and secure communication interfaces that meet stringent ISO safety standards. These partnerships between component manufacturers and software developers are accelerating time-to-market for next-generation systems.

In the software realm, specialized analytics vendors are emerging as critical enablers of predictive maintenance and performance optimization. By integrating granular telemetry from cell-level sensors, these platforms offer prescriptive insights that can extend pack longevity and reduce total cost of ownership. Service providers are also differentiating through customized consulting and integration programs that address region-specific regulatory landscapes and installation environments.

Recent strategic alliances have further reshaped the field. Notably, collaborations between energy storage project developers and BMS providers ensure holistic system design from grid integration to end-of-life recycling. These multi-stakeholder initiatives highlight the importance of cross-industry cooperation in navigating evolving performance benchmarks and environmental mandates, positioning leading companies to capture growth across emerging electric mobility, renewable energy, and industrial automation sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Continental AG

- Denso Corporation

- Eberspaecher Vecture GmbH

- Elithion Inc.

- Infineon Technologies AG

- Johnson Controls International plc

- Leclanché SA

- Lithium Balance A/S

- NXP Semiconductors N.V.

- Panasonic Corporation

- Preh GmbH

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Valence Surface Technologies

- Vecture Inc.

Outlining Strategic Imperatives for Industry Leaders to Enhance Resilience, Innovation, and Market Penetration in Battery Management Systems

To thrive in the rapidly evolving battery management system sector, industry leaders should prioritize the integration of advanced digital capabilities across hardware, firmware, and cloud-native platforms. Investing in secure, low-latency communication protocols and machine learning-driven analytics will enable proactive diagnostics and adaptive controls, which can drive operational efficiencies and unlock premium service revenue models. Equally critical is the diversification of supply chains to mitigate exposure to geopolitical disruptions and tariff fluctuations; building strategic inventories and forging relationships with alternative raw material providers can enhance procurement agility.

Forging cross-sector partnerships represents another key imperative. By collaborating with semiconductor innovators, software developers, and renewable energy integrators, organizations can co-create modular solutions that seamlessly address end-to-end performance, safety, and interoperability requirements. Such alliances also accelerate knowledge transfer, reducing development cycles and strengthening intellectual property portfolios. Concurrently, companies should cultivate a robust regulatory intelligence function to navigate evolving safety standards, emissions mandates, and energy policy incentives; early engagement with regulatory bodies can inform product roadmaps and ensure compliance.

Talent development must remain a cornerstone strategy. As BMS complexity increases, multidisciplinary teams encompassing electrical engineers, data scientists, and systems architects become indispensable. Establishing in-house training programs and tapping academic partnerships can foster the specialized skill sets required to design next-generation management systems. Finally, embedding sustainability principles into system design and lifecycle management-through second-life reuse strategies, recyclable materials, and energy-efficient architectures-will align offerings with corporate environmental goals and meet rising stakeholder expectations for responsible innovation.

By systematically addressing these strategic dimensions-digital transformation, supply resilience, collaborative ecosystems, regulatory foresight, talent cultivation, and sustainability-industry leaders can position themselves to capture emerging opportunities and maintain competitive advantage in a marketplace defined by rapid technological progression and shifting policy landscapes.

Detailing a Rigorous, Multi-Faceted Research Approach to Deliver Reliable, Contextual Insights into the Battery Management System Sector

This report synthesizes insights derived from a comprehensive, mixed-method research framework designed to ensure both breadth of coverage and depth of understanding. The primary research component involved structured interviews with a diverse array of stakeholders, including system integrators, original equipment manufacturers, and regulatory authorities. These interviews yielded firsthand perspectives on emerging requirements, pain points, and investment priorities that inform the sector’s strategic direction.

Complementary secondary research encompassed an extensive review of technical white papers, industry standards documentation, and technology roadmaps from leading semiconductor manufacturers. By analyzing published patent filings and regulatory filings, the research team identified pivotal innovation trends and compliance benchmarks shaping system design and certification processes. In addition, vendor literature and case studies provided contextual examples of best-in-class implementations and proof-of-concept deployments.

To enhance objectivity and validate qualitative findings, the study employed data triangulation techniques by cross-referencing input from primary interviews with quantitative industry reports and open-source datasets. Expert panels convened to review preliminary insights and to challenge assumptions, ensuring that the final analysis accurately reflects market realities. Furthermore, a systematic quality assurance process was applied to cleanse and standardize the data, while maintaining full transparency of methodology for reproducibility.

Through this integrated approach-combining stakeholder engagement, technical literature analysis, and rigorous validation protocols-the research delivers actionable, contextually grounded findings that equip decision makers with the intelligence required to navigate the complex and dynamic battery management system landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery Management System Market, by Cell Chemistry

- Battery Management System Market, by Solution Type

- Battery Management System Market, by Battery Voltage Range

- Battery Management System Market, by Capacity Range

- Battery Management System Market, by End User

- Battery Management System Market, by Region

- Battery Management System Market, by Group

- Battery Management System Market, by Country

- United States Battery Management System Market

- China Battery Management System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Core Findings and Strategic Takeaways to Inform Decision-Making and Foster Sustainable Growth in Battery Management Technologies

The preceding analysis highlights that battery management systems have transitioned into strategic assets driving performance optimization, safety assurance, and lifecycle efficiency across electric mobility, renewable energy, and industrial applications. Technological breakthroughs in cell chemistry supervision, AI-powered diagnostics, and modular hardware architectures underpin the sector’s most transformative shifts, enabling stakeholders to meet elevated performance standards and comply with emerging regulations. At the same time, the 2025 tariff regime in the United States has accelerated supply chain realignment and stimulated domestic production initiatives, redefining competitive dynamics.

Segment-level insights reveal that lithium-ion BMS platforms dominate growth trajectories due to their compatibility with high-voltage and high-capacity applications, while specialized solutions for lead acid or nickel metal hydride persist in legacy deployments. The integration of hardware, services, and software has become a critical differentiator, offering end-to-end visibility from pack controller electronics to analytics-driven maintenance. Regionally, distinct drivers in the Americas, EMEA, and Asia-Pacific demand tailored approaches, from incentive-driven US markets and stringent European regulatory standards to large-scale manufacturing ecosystems in East Asia.

Leading stakeholders are forging partnerships and embedding digital capabilities to capitalize on these trends, while the report’s strategic recommendations emphasize the importance of supply chain resilience, cross-industry collaboration, talent development, and sustainability. By aligning organizational roadmaps with these imperatives, decision-makers can unlock new avenues of value creation and secure a competitive edge. This summary serves as a springboard for informed strategy discussions, underscoring the critical role of BMS innovation in the broader energy transition.

Seize the Opportunity to Leverage Comprehensive Battery Management System Insights by Connecting with Ketan Rohom for Tailored Research Solutions

To explore how these insights can drive strategic decisions in your organization, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in delivering tailored research solutions can help you align this report’s findings with your specific business objectives, enabling you to refine product strategies, identify partnership opportunities, and optimize supply chain configurations.

By engaging with Ketan, you gain access to custom consulting services, deeper market analytics, and expert briefings that translate the executive summary’s strategic imperatives into actionable roadmaps. Whether you seek in-depth segmentation analysis, regional market intelligence, or bespoke competitive benchmarking, Ketan will guide you through the process of acquiring the comprehensive report and integrating its insights into your planning cycle.

Reach out today to schedule a complimentary consultation and learn how the full battery management system market research report can empower your teams to make informed, future-ready decisions and maintain a leading position in this dynamic industry.

- How big is the Battery Management System Market?

- What is the Battery Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?