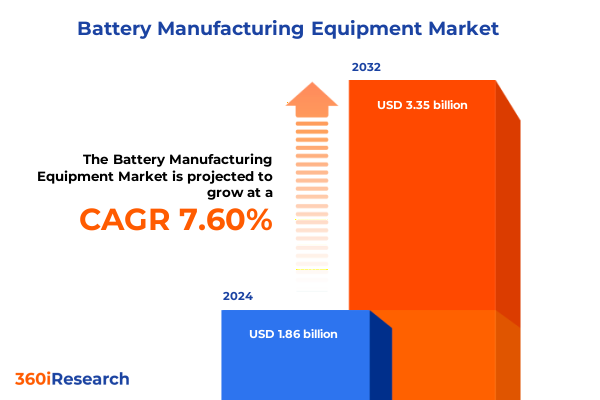

The Battery Manufacturing Equipment Market size was estimated at USD 1.99 billion in 2025 and expected to reach USD 2.14 billion in 2026, at a CAGR of 7.67% to reach USD 3.35 billion by 2032.

Setting the Stage for the Next Era of Battery Manufacturing Equipment with Unprecedented Growth Drivers and Innovation Dynamics

The global energy transition and escalating demand for electrification have made battery manufacturing equipment an indispensable pillar of modern industry. Rapid advancements in electric mobility, renewable energy storage, and portable electronics have converged to heighten the stakes for equipment providers and end users alike. As industry participants invest in next-generation production lines, the integration of sophisticated machinery from cell assembly to testing and inspection becomes a critical differentiator for operational excellence and cost efficiency.

Against this dynamic backdrop, original equipment manufacturers, integrators, and component suppliers are challenged to keep pace with evolving battery chemistries and form factors. The interplay between innovative electrode coating processes, precision winding techniques, and advanced formation and aging protocols underscores the complexity of today’s manufacturing environment. Moreover, the intensifying focus on sustainability is prompting stakeholders to refine mixing methodologies and adopt inspection solutions that minimize material waste and energy consumption.

In light of these multifaceted developments, this executive summary lays the groundwork for understanding how transformative forces are reshaping the landscape of battery manufacturing equipment. It offers a coherent introduction to the technologies, strategic imperatives, and competitive dynamics that will define the industry’s trajectory in the years ahead.

Exploring the Wave of Digitalization, Robotics, and Sustainable Innovations Transforming Battery Manufacturing Equipment

The battery manufacturing equipment sector is undergoing seismic shifts driven by digitalization, sustainability mandates, and the relentless pursuit of cost optimization. Across assembly lines, artificial intelligence and machine learning are being woven into inspection and testing workflows to reduce defect rates and accelerate throughput. Meanwhile, the rise of dry electrode coating is challenging traditional wet processes by delivering higher energy densities and faster cycle times while curbing solvent usage.

Concurrently, advanced robotics are rewriting the rules of cell stacking, tab welding, and winding. Collaborative robots are operating alongside human technicians to enhance flexibility, while fully automated lines are scaling up to meet the demands of gigafactories. Integration of digital twin technology is facilitating real-time performance monitoring and predictive maintenance, enabling equipment operators to preempt unplanned downtime and preserve product quality.

Sustainability remains a powerful catalyst for innovation, with manufacturers exploring eco-friendly mixing protocols that utilize low-energy planetary mixers and dry processes to reduce carbon footprints. At the same time, formation and aging equipment is evolving to accommodate pulse forming cycles that optimize cell longevity without compromising throughput. These converging trends are propelling the industry into a new era of adaptive, intelligent, and green manufacturing.

Assessing How the 2025 United States Trade Policies Have Catalyzed Domestic Production and Supply Chain Resilience for Battery Equipment

In 2025, a series of tariff measures introduced by the United States government have recalibrated global supply chains and reshaped competitive dynamics within the battery manufacturing equipment market. Duties imposed on imported cell assembly modules and critical electrode coating machinery have driven stakeholders to reassess sourcing strategies and consider localized production to mitigate cost pressures. These tariffs have served as both an economic lever and a strategic impetus for nearshoring investments in North America.

The cumulative impact of these trade policies has manifested in accelerated capital outlays for domestic equipment fabrication and assembly. Manufacturers and integrators, seeking to preserve margin structures, are forging partnerships with local suppliers to secure tariff-exempt components. At the same time, equipment designers are innovating modular platforms that can be assembled stateside with minimal imported content, thereby reducing exposure to ongoing trade volatility.

While tariffs have introduced initial cost headwinds, they have also catalyzed a renaissance in U.S. manufacturing competitiveness. Research collaborations between government, academia, and industry consortia are facilitating the development of next-generation machinery that leverages indigenous supply chains. As a result, the Biden-era trade framework has yielded a more resilient and self-sufficient domestic ecosystem for battery production equipment.

Delving into the Multifaceted Segmentation of Battery Manufacturing Equipment to Illuminate Distinct Market Priorities

The battery manufacturing equipment landscape is multifaceted, with each segmentation prism offering unique insight into market dynamics. When equipment types are considered, cell assembly processes such as stacking, tab welding, and winding reveal the critical role of precision robotics and alignment systems. Electrode coating technologies, spanning dry and wet processes, underscore the imperative of achieving uniform deposition at high throughput. Formation and aging platforms differentiated by constant current, constant voltage, and pulse forming methods highlight the trade-offs between cycle efficiency and cell performance. Moreover, mixing solutions-whether ball mills, double cone mixers, or planetary mixers-demonstrate how material homogeneity translates into energy storage consistency. Testing and inspection stages, driven by electrical testing, leakage detection, and visual inspection equipment, ensure that each cell meets stringent quality benchmarks.

Turning to battery chemistries, lithium-based systems dominate the discourse, with lithium iron phosphate, lithium nickel manganese cobalt oxide, lithium manganese oxide, and lithium nickel cobalt aluminum oxide each presenting distinct handling requirements for equipment engineers. Flow, lead-acid, and nickel metal hydride formats retain relevance in niche applications, necessitating tailored mixing and formation strategies. Cell form factors-cylindrical, pouch, and prismatic-drive variations in winding and stacking apparatus to accommodate diverse mechanical and thermal profiles.

End-use industries such as automotive for BEV, HEV, and PHEV applications; consumer electronics; energy storage systems across commercial, residential, and utility domains; and industrial sectors collectively dictate the throughput and customization of manufacturing lines. Production capacities ranging from small-scale pilot lines to large-scale gigafactories shape the modularity and automation levels required, from manual workstations to semi-automated and fully automated installations. Each segmentation axis reveals nuanced priorities that equipment providers must address to serve a heterogeneous customer base.

This comprehensive research report categorizes the Battery Manufacturing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Battery Type

- Cell Form Factor

- Production Capacity

- Automation Level

- End Use Industry

Comparing the Unique Regional Dynamics Shaping Demand for Advanced Battery Manufacturing Equipment Across Key Geographies

Regional dynamics exhibit pronounced variation in how demand for battery manufacturing equipment is unfolding. In the Americas, supportive policy frameworks and incentives have sparked a wave of investment in large-scale gigafactories, driving robust requirements for fully automated assembly and formation systems. Equipment providers in this region are emphasizing end-to-end integration services and turnkey solutions to streamline installation and commissioning.

Meanwhile, Europe, the Middle East, and Africa are navigating a diverse set of regulatory landscapes and energy transition goals. European OEMs are prioritizing sustainable equipment designs that minimize solvent emissions and energy consumption, while Middle Eastern stakeholders are exploring strategic partnerships to develop local manufacturing ecosystems. Across Africa, pilot projects are testing modular production lines aimed at off-grid energy storage and rural electrification, underscoring the need for flexible, medium-scale solutions.

In the Asia-Pacific region, a mature supply chain infrastructure and well-established battery manufacturing hubs have made it the epicenter of equipment demand. Leading providers are expanding capacity in Southeast Asia, Japan, and South Korea, with a growing focus on next-generation electrode coating and formation equipment. The interplay between rapid industrialization and evolving environmental standards is fostering a competitive landscape where innovation and cost optimization go hand in hand.

This comprehensive research report examines key regions that drive the evolution of the Battery Manufacturing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategies and Collaborations Fueling Competitive Advantage Among Top Battery Equipment Manufacturers

A cohort of leading companies is driving innovation and competitive differentiation within the battery manufacturing equipment sector. Established multinational equipment suppliers are expanding their portfolios through strategic acquisitions and in-house R&D, focusing on digitalization and green technologies. Emerging specialized players are carving out niches by introducing modular, scalable systems that cater to both pilot-scale laboratories and full-scale production facilities.

Collaborations between equipment providers and battery cell manufacturers are proliferating, with joint development agreements aimed at co-optimizing cell designs and manufacturing processes. Technology alliances with semiconductor and automation companies are delivering integrated control platforms that unify process analytics, machine vision, and robotics orchestration. In addition, software vendors are partnering with machinery OEMs to embed predictive maintenance modules and production planning algorithms directly into control panels.

As competition intensifies, firms are differentiating through service offerings, including remote monitoring, rapid spare-parts provisioning, and operator training programs. The race to deliver lifecycle support and continuous performance upgrades underscores the sector’s shift from transactional equipment sales to long-term partnerships that drive mutual value creation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery Manufacturing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A123 Systems LLC

- AMETEK, Inc.

- Applied Materials, Inc.

- Battery Technology Source Co., Ltd.

- Bühler AG

- Contemporary Amperex Technology Co., Limited

- Duracell Inc.

- Ecopro BM Co., Ltd.

- GEA Group AG

- Hirano Tecseed Co., Ltd.

- IPG Photonics Corporation

- Johnson Controls International plc

- Komax Holding AG

- Manz AG

- Nordson Corporation

- Readco Kurimoto, LLC

- Sakamura Machine Co., Ltd.

- Samsung SDI Co., Ltd.

- Sony Energy Devices Corporation

- SOVEMA GROUP S.p.A.

- Toshiba Corporation

- ULVAC, Inc.

- Wirtz Manufacturing GmbH

- Wuxi Lead Intelligent Equipment Co., Ltd.

- Xiamen Lith Machine Limited

- Xiamen Tmax Battery Equipments Limited

Empowering Industry Leaders with Strategic Imperatives to Drive Agile, Sustainable, and Digitally Enabled Manufacturing

Industry leaders must adopt a proactive stance to navigate evolving market conditions and regulatory imperatives. First, investing in modular, fully automated solutions will enable rapid line reconfiguration in response to emerging cell chemistries and form factors, thereby preserving capital agility. Second, cultivating strategic partnerships with local component suppliers can mitigate tariff exposure and strengthen regional supply chains while unlocking co-innovation opportunities.

Embracing digital twins and predictive analytics is equally critical. By integrating real-time data streams with advanced modeling tools, manufacturers can anticipate maintenance needs, optimize production scheduling, and reduce unplanned downtime. Moreover, embedding sustainability criteria into equipment design-such as low-energy mixers and solvent-free coatings-will not only address environmental mandates but also resonate with end users’ corporate responsibility goals.

Finally, upskilling the workforce through targeted training initiatives and fostering collaboration between cross-functional teams will ensure that operational capabilities keep pace with technological advancements. By aligning organizational structures with the demands of high-volume, complex manufacturing environments, industry leaders can secure a competitive edge and deliver consistent quality at scale.

Outlining the Robust Mixed-Methods Research Approach Underpinning This Comprehensive Executive Summary

This research draws upon a rigorous methodology combining primary and secondary sources to ensure robust insights. Primary data was collected through in-depth interviews with key stakeholders, including equipment OEM executives, battery cell manufacturers, and technology integrators. These conversations provided firsthand perspectives on operational challenges, technology adoption trajectories, and regional policy impacts.

Secondary research involved a comprehensive review of industry publications, patent filings, government policy documents, and technical journals. Publicly available reports from industry associations and standard-setting bodies were also analyzed to validate trends in equipment innovation, automation, and sustainability benchmarks. Data triangulation techniques were employed to reconcile discrepancies and enhance the reliability of thematic findings.

Qualitative analysis frameworks guided the interpretation of market dynamics, while case studies of leading gigafactory deployments offered contextual depth. The research team adhered to strict validation protocols, including data cleansing, peer review, and consistency checks, to deliver an accurate and actionable overview of the battery manufacturing equipment landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery Manufacturing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery Manufacturing Equipment Market, by Equipment Type

- Battery Manufacturing Equipment Market, by Battery Type

- Battery Manufacturing Equipment Market, by Cell Form Factor

- Battery Manufacturing Equipment Market, by Production Capacity

- Battery Manufacturing Equipment Market, by Automation Level

- Battery Manufacturing Equipment Market, by End Use Industry

- Battery Manufacturing Equipment Market, by Region

- Battery Manufacturing Equipment Market, by Group

- Battery Manufacturing Equipment Market, by Country

- United States Battery Manufacturing Equipment Market

- China Battery Manufacturing Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Summarizing the Critical Intersection of Technology, Policy, and Regional Dynamics Defining the Future of Battery Production Equipment

In an era of rapid technological evolution and shifting policy landscapes, the battery manufacturing equipment market stands at a pivotal juncture. The interplay between automation, digitalization, and sustainability is rewriting operational paradigms, while trade policies are reshaping supply chain geographies. By understanding the nuances of equipment segmentation, regional dynamics, and competitive positioning, stakeholders can make informed investments and strategic decisions.

The insights presented herein underscore the importance of flexibility, resilience, and partnership in pursuing manufacturing excellence. As new chemistries and form factors emerge, and as demand continues to surge across electrified transportation and energy storage systems, the ability to adapt and innovate will define market leaders. This executive summary provides the critical perspective needed to navigate complexity and capture emerging opportunities in the global battery manufacturing equipment arena.

Unlock Exclusive Access to the Definitive Battery Manufacturing Equipment Market Report by Partnering Directly with Our Associate Director for Tailored Solutions

To gain the comprehensive insights and detailed analysis that will inform your strategic decisions and propel your organization ahead of the competition in the battery manufacturing equipment market, connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By engaging with Ketan, you will gain personalized guidance to secure access to the full research report, which encompasses a deep dive into emerging technologies, regional opportunities, and company competitive landscapes. Reach out to Ketan to explore tailored solutions and subscription options that align with your business needs and enable you to leverage the latest market intelligence effectively. Elevate your decision-making process today by partnering with Ketan for exclusive access to the most authoritative report in the battery manufacturing equipment industry.

- How big is the Battery Manufacturing Equipment Market?

- What is the Battery Manufacturing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?