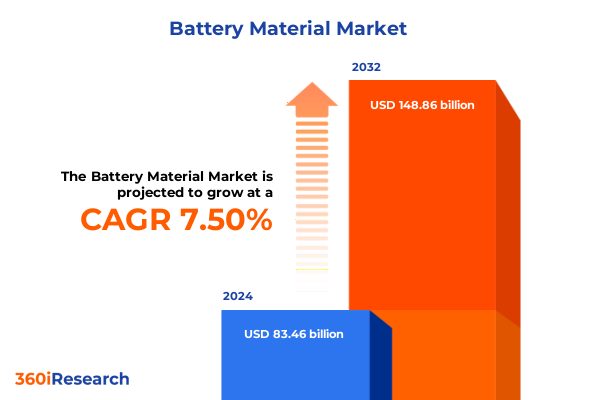

The Battery Material Market size was estimated at USD 88.96 billion in 2025 and expected to reach USD 94.83 billion in 2026, at a CAGR of 7.63% to reach USD 148.86 billion by 2032.

Exploring the Rapid Evolution of Battery Material Ecosystems Driven by Electrification, Sustainability Imperatives, and Technological Breakthroughs

The global demand for battery technologies has entered an unprecedented growth phase, with electric vehicle (EV) and energy storage system (ESS) deployments driving record levels of material consumption and innovation. In 2024, global battery demand surpassed 1 TWh for the first time, reflecting a 25% year-on-year increase driven principally by a surge in EV battery installations, which grew to over 950 GWh, and a near doubling of battery energy storage deployments globally. This rapid escalation in demand has been underpinned by accelerating EV sales, which collectively accounted for more than 25% of new car purchases in 2025, and by robust investment in grid-scale storage projects aimed at balancing intermittent renewable generation and strengthening electrified grid resilience

This dynamic landscape has been further shaped by transformative policy frameworks, such as the United States Inflation Reduction Act, which introduced advanced manufacturing production tax credits under Section 45X, providing up to a 10% credit for domestic electrode active materials production and significant incentives for cell and module manufacturing. These incentives are complemented by foreign entity of concern (FEOC) restrictions, mandating domestic content and limiting reliance on materials sourced from designated overseas suppliers, thereby compelling manufacturers to recalibrate supply chains and localize production. At the same time, evolving trade measures, including Section 301 tariffs on Chinese-origin battery parts and critical minerals, have spurred efforts to diversify raw material sourcing, accelerate vertical integration, and mitigate the cost pressures associated with import duties

Unveiling the Transformative Shifts Reshaping Battery Material Markets Through Chemistry Diversification and Supply Chain Decoupling

The battery materials market is experiencing profound shifts as stakeholders embrace a wider range of chemistries to meet diverse performance, cost, and sustainability objectives. Lithium iron phosphate (LFP) batteries have emerged as a cost-effective and stable alternative to traditional lithium nickel manganese cobalt (NMC) and nickel cobalt aluminum (NCA) chemistries, capturing nearly half of the global EV battery market in 2024. This rapid diversification reflects manufacturers’ strategic decisions to balance energy density requirements against long-term safety, life-cycle costs, and mineral supply considerations, with Chinese producers leading the charge by integrating LFP into more than 70% of their domestic battery output last year.

Simultaneously, pioneering efforts to commercialize solid-state batteries are gaining momentum, with major automakers targeting small-scale production by 2025 and mass deployment by the late 2020s. Industry leaders such as Honda and Toyota have announced pilot lines and R&D investments aimed at doubling EV driving range by leveraging solid-state electrolytes, while technology startups and established cell manufacturers are collaborating on anode-free and sulfide-based prototypes that promise higher energy density, faster charging, and enhanced safety profiles. These developments signal a transitional era in which conventional lithium-ion systems coexist alongside next-generation platforms set to redefine performance benchmarks by 2030.

These technological advances are unfolding against a backdrop of proactive government interventions designed to bolster domestic manufacturing and critical minerals processing. In late 2024, the U.S. Department of Energy announced a $3 billion investment across 25 projects to establish battery manufacturing, recycling, and critical mineral processing facilities in 14 states, reflecting a concerted effort to onshore value chain capabilities and reduce dependence on overseas supply sources. These initiatives are catalyzing new partnerships, joint ventures, and capacity expansions that will shape competitive dynamics throughout the battery materials ecosystem

Assessing the Consolidated Global and Domestic Effects of US Trade Measures on Battery Material Supply Chains and Cost Structures Through 2025

In response to mounting concerns over supply chain resilience and geopolitical risk, the United States has implemented a series of trade measures that cumulatively reshape the economics of battery material sourcing. Section 301 tariffs enacted in September 2024 imposed a 25% duty on Chinese-origin lithium-ion EV batteries, non-EV lithium-ion batteries, and battery parts, while extending 25% anti-dumping and countervailing duties on natural graphite imports slated for January 1, 2026. These measures are designed to level the playing field for domestic producers but have concurrently raised input costs for battery integrators and influenced procurement strategies.

The immediate effects of these tariff structures include higher landed material costs for cell manufacturers, which have led to renegotiated long-term supply agreements and the preemptive development of domestic graphite, lithium, and precursor processing facilities. Market participants are increasingly evaluating alternative anode active materials, such as synthetic graphite and silicon-based composites, to mitigate reliance on imported natural graphite and to adapt to the evolving duty landscape. At the same time, battery recyclers are positioning themselves to capture displaced feedstock by investing in black mass production and chemical refining capabilities. These strategic pivots underscore the compounding impact of trade policy on battery material supply chains and cost structures through 2025.

Looking ahead, stakeholders anticipate that elevated tariffs will persist as a tool to incentivize domestic capacity growth, prompting continued supply chain realignment and investment in localized conversion networks. While the immediate price pressures challenge profit margins, the long-term objective remains the establishment of a resilient, diversified sourcing model that can sustain the accelerated pace of battery deployment required for global decarbonization goals.

Deriving Actionable Insights From Multi-Dimensional Segmentation of Battery Materials by Type, Chemistry, Application, and Industry End-Use

A nuanced understanding of the battery materials market emerges when dissecting it across multiple segmentation dimensions, each revealing unique value propositions and growth trajectories. By battery type, the market spans from traditional lead acid systems-distinguished by flooded and sealed variants-to advanced lithium ion formats, including lithium cobalt oxide, lithium iron phosphate, nickel cobalt aluminum, and nickel manganese cobalt. Nickel metal hydride continues to serve niche applications, while solid-state platforms are entering pilot production. This layered spectrum highlights the coexistence of mature and nascent technologies, where each format aligns with distinct performance and cost imperatives.

Material-based segmentation further illuminates the market’s complexity, as anode, cathode, electrolyte, and separator components each command specialized supply chains and R&D pathways. Anode materials range from conventional graphite and lithium titanate to emerging silicon composites, whereas cathode active materials feature diverse metal-oxide chemistries. Electrolytes encompass gel polymers, liquid formulations, and solid-state variants, reflecting a balance between ionic conductivity and system stability. Separators, too, have evolved beyond polyethylene and polypropylene films to include ceramic-coated membranes that enhance thermal and mechanical resilience. These distinctions drive targeted investments, as producers focus on incremental performance gains and cost optimizations within each category.

Application segmentation underscores distinct demand patterns, with consumer electronics demanding compact, energy-dense cells that power laptops, smartphones, tablets, and wearables, while electric vehicles bifurcate into commercial and passenger categories with varying cycle life and safety priorities. Energy storage systems-spanning commercial, residential, and utility-scale deployments-drive demand for large-format modules optimized for longevity and low maintenance. Industrial applications, from uninterruptible power supplies to grid management functions, further diversify use cases and technical requirements, shaping component design and production scale.

Finally, the market’s end-use industry segmentation, encompassing automotive, consumer electronics, energy and utilities, healthcare, and industrial sectors, reveals broad-based adoption across legacy and emerging domains. The automotive sector, propelled by stringent emissions regulations and consumer demand for electrified mobility, dominates material consumption. Consumer electronics remain a steady, high-volume user of small-format cells, while the energy and utilities segment is rapidly scaling storage capacity in parallel with renewable energy integration. Healthcare and industrial end-users prioritize reliability and specific performance attributes, underscoring the importance of tailored material formulations to satisfy regulatory and operational specifications.

This comprehensive research report categorizes the Battery Material market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Type

- Material Type

- Application

- End-Use Industry

Revealing Critical Regional Dynamics Shaping Battery Material Demand and Supply Across the Americas, EMEA, and Asia-Pacific Regions

Regional analysis reveals distinct growth drivers and challenges shaping battery material markets across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific. In the Americas, the United States nearly matched Europe’s battery demand in 2024, achieving a 20% increase driven by domestic EV sales growth and expanded energy storage deployments. U.S. market momentum has been bolstered by tax credits and grants fueling gigafactory construction, though steel and aluminum tariffs and critical mineral supply constraints temper near-term cost gains. Latin American initiatives in lithium extraction, particularly in Argentina and Chile, are gaining traction as public-private partnerships seek to integrate upstream mineral production with downstream processing capacity, offering prospects for regional value capture and supply chain diversification.

Across EMEA, battery demand in 2024 stagnated relative to other advanced economies, hampered by supply chain disruptions and delayed incentive programs. Nevertheless, Europe’s robust policy frameworks, including carbon border adjustment mechanisms and battery passport regulations, are catalyzing investments in cathode active material and black mass recycling facilities. The Middle East is emerging as a new energy storage hub, with utility-scale projects leveraging solar generation capacity to underwrite grid stability, while Africa’s nascent battery sector is centered on nickel and cobalt mining initiatives in South Africa and the Democratic Republic of Congo, where infrastructure development remains a critical bottleneck.

In the Asia-Pacific region, China continues to dominate cell manufacturing and active material production, commanding more than 60% of global capacity in 2024. Chinese producers achieved nearly 30% battery pack price reductions compared to the United States and Europe, reinforcing their competitive advantage. Southeast Asia, India, and Brazil are accelerating domestic capacity expansions, supported by government incentives and resource endowments-most notably in Indonesia’s nickel processing sector, which is attracting Chinese and Japanese investments. Japan and South Korea remain innovation leaders, advancing next-generation cell chemistries and securing strategic partnerships to solidify their positions in the global supply chain.

This comprehensive research report examines key regions that drive the evolution of the Battery Material market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players Driving Innovation and Market Positioning in the Global Battery Materials Value Chain

Albemarle, a leading global lithium producer, has navigated recent pricing volatility and trade policy headwinds by securing tariff exemptions for lithium and critical minerals, maintaining its 2025 financial outlook despite a 34% drop in lithium prices and a $340,000 net loss in Q1. The company emphasized cost reduction and operational efficiency, achieving record lithium salt production and reducing capital expenditures by over 50% year-over-year, underscoring its capacity to adapt to market fluctuations and sustain supply commitments amid heightened regulatory scrutiny.

LG Energy Solution, facing an anticipated slowdown in EV battery demand due to new U.S. tariffs and the impending end of federal EV purchase subsidies, has pivoted to bolster energy storage system production. The company is converting EV battery lines for ESS applications and expanding its Michigan LFP battery facility, aiming to increase ESS capacity from 17 GWh to over 30 GWh by 2026, reflecting a strategic realignment that capitalizes on growing demand for grid-scale storage while mitigating tariff-driven cost pressures in the passenger vehicle segment.

Belgian materials specialist Umicore reported a 99% plunge in half-year core profit for its battery materials division, prompting a €1.6 billion impairment and a strategic mid-term roadmap focused on strict capital discipline and operational efficiency. The company plans a 50% reduction in capex for battery cathode materials through 2028, alongside potential partnerships to recover value and achieve positive adjusted EBITDA by 2026. These measures illustrate the challenges faced by European producers amid Chinese cathode oversupply and underscore the imperative for resilient, lean business models.

Johnson Matthey, after exiting its battery materials business due to insufficient returns and escalating commoditization, executed a £1.8 billion sale of its catalyst technologies unit to Honeywell. This divestiture generated net proceeds of approximately £1.6 billion, reinforcing the company’s pivot toward high-margin core businesses and highlighting the difficult trade-offs incumbent on chemical producers balancing investment intensity against market maturity and competitive pressures in the battery sector.

BASF has commissioned Europe’s largest commercial black mass plant in Schwarzheide, Germany, with a 15,000 ton annual processing capacity, enabling recovery of lithium, nickel, cobalt, and manganese from end-of-life batteries and production scrap. This facility integrates black mass production with automated cathode active material synthesis, positioning BASF as a key circular economy enabler and strengthening regional supply security in alignment with EU battery regulations and sustainability objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery Material market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- BTR New Energy Materials Co., Ltd.

- BYD Company Ltd.

- Contemporary Amperex Technology Co., Ltd.

- Ganfeng Lithium Co., Ltd.

- Johnson Matthey plc

- LG Energy Solution, Ltd.

- Mitsubishi Chemical Corporation

- Panasonic Energy Co., Ltd.

- POSCO Future M Co., Ltd.

- Samsung SDI Co., Ltd.

- SK On Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Toda Kogyo Corporation

- Umicore N.V.

Establishing Robust Integration, Innovation, and Advocacy Strategies to Drive Sustainable Competitiveness in Battery Materials

Industry leaders should prioritize vertical integration by investing in upstream critical minerals processing and establishing downstream conversion capabilities to secure raw material supplies, reduce tariff exposure, and capture greater value within the battery materials ecosystem. This entails strategic partnerships with mining companies, targeted acquisitions of processing facilities, and the development of in-house expertise in lithium, graphite, and precursor chemistry. Such integrated models can mitigate supply chain disruptions and optimize cost structures in the face of evolving trade policies and market volatility.

To capitalize on the rapid advancement of next-generation chemistries, stakeholders must allocate resources to pilot production and early commercialization of solid-state and silicon-dominant anode technologies. Collaborative R&D consortia-including automakers, cell manufacturers, and material suppliers-can accelerate scale-up timelines, share technical risk, and harmonize performance standards. Simultaneously, companies should expand recycling and black mass refining operations to establish closed-loop supply chains that reduce dependence on primary mining and align with circular economy mandates.

Finally, businesses should engage proactively with policymakers to shape incentive frameworks and trade regulations that support domestic manufacturing competitiveness without stifling innovation. By participating in multilateral dialogue, industry consortia can advocate for balanced tariff regimes, investment tax credits, and streamlined permitting processes for critical enablement projects. This dual approach-integrating commercial strategies with informed policy engagement-will enable organizations to navigate geopolitical uncertainties and ensure sustainable growth across global battery materials markets.

Employing a Rigorous Multi-Method Approach of Data Triangulation, Expert Validation, and Scenario Modeling for Precise Battery Materials Market Insights

Our research methodology combined extensive primary and secondary data collection with quantitative modeling and expert validation to deliver a rigorous assessment of the battery materials landscape. Secondary research included analysis of governmental policy documents, trade data, patent filings, and corporate disclosures to map current manufacturing capacities, tariff schedules, and incentive structures. This formed the foundation for scenario-based projections and sensitivity analyses.

Primary research consisted of structured interviews with C-level executives, R&D leaders, and supply chain managers from battery material producers, cell manufacturers, automotive OEMs, and independent industry experts. Insights from these discussions provided qualitative context around strategic priorities, technology roadmaps, and risk mitigation strategies. We also conducted site visits to selected processing and recycling facilities to observe operational best practices and validate capacity assumptions.

Quantitative modeling integrated historical shipment volumes, price indices, and tariff impact data to estimate cost trajectories and volume shifts across segmentation dimensions. We applied Monte Carlo simulations to capture parameter uncertainties and performed cross-validation with proprietary market intelligence databases. The findings were peer-reviewed by a panel of external advisors and stress-tested against alternative geopolitical and policy scenarios to ensure robustness and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery Material market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery Material Market, by Battery Type

- Battery Material Market, by Material Type

- Battery Material Market, by Application

- Battery Material Market, by End-Use Industry

- Battery Material Market, by Region

- Battery Material Market, by Group

- Battery Material Market, by Country

- United States Battery Material Market

- China Battery Material Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Market, Technology, and Policy Dynamics to Chart a Sustainable Path Forward in Battery Materials Development and Deployment

The battery materials market stands at a critical juncture where technological innovation, policy incentives, and trade dynamics converge to reshape value chains and competitive landscapes. Stakeholders that align strategic investments with diversification of chemistries, vertical integration, and circular economy models will be best positioned to navigate cost pressures and geopolitical uncertainties. Collaborative R&D initiatives and recycling infrastructure development will accelerate the transition. As the market evolves from commodity-driven cycles to differentiated technology platforms, agile and informed decision-making will underpin sustainable growth.

With robust methodologies and proprietary intelligence, this report equips decision-makers with actionable insights to anticipate market shifts, evaluate investment priorities, and engage critically with regulatory frameworks. The interplay of next-generation battery chemistries, strategic partnerships, and policy advocacy will define the competitive leaders of tomorrow’s energy transition.

Act Now to Unlock Critical Battery Materials Intelligence Through Direct Engagement with Our Associate Director of Sales & Marketing

To obtain comprehensive insights into the evolving battery material market and secure a competitive edge, contact Ketan Rohom, Associate Director of Sales & Marketing, to learn how our deep-dive analysis can inform your strategic decisions and accelerate time to value

- How big is the Battery Material Market?

- What is the Battery Material Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?