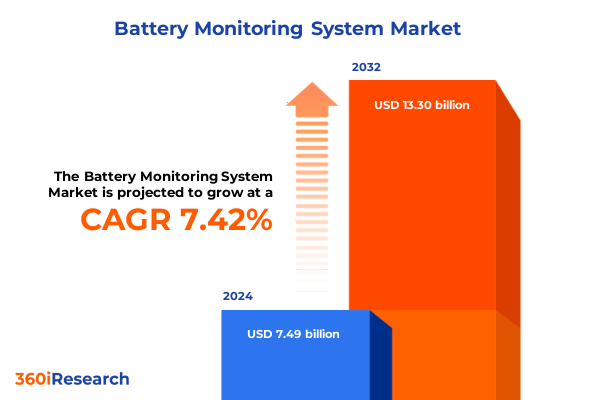

The Battery Monitoring System Market size was estimated at USD 7.93 billion in 2025 and expected to reach USD 8.40 billion in 2026, at a CAGR of 7.65% to reach USD 13.30 billion by 2032.

Setting the Stage with a Comprehensive Overview of Evolving Battery Monitoring Systems Driving Industrial and Consumer Energy Reliability

Battery monitoring systems have become indispensable in ensuring the optimal performance, safety, and reliability of modern energy storage assets. Historically confined to basic charge and health indicators, these platforms have evolved into sophisticated networks of sensors, embedded software, and analytics engines that deliver comprehensive visibility across entire storage ecosystems. They not only track voltage, current, and temperature, but also harness advanced algorithms to predict cell degradation, balance energy distribution, and prevent critical failures. This transformation has been accelerated by the rapid adoption of electric vehicles, the integration of renewable energy sources into the grid, and the surging demand for uninterrupted backup power in data centers, telecom networks, and critical infrastructure. As a result, organizations across sectors are increasingly investing in monitoring solutions to maximize uptime, extend asset lifespan, and comply with stringent safety and environmental regulations.

Building on this technological foundation, the market is witnessing a decisive shift toward cloud-enabled architectures and real-time intelligence. Compact edge computing modules now interface directly with individual battery cells to capture granular performance metrics, while centralized platforms aggregate data from distributed fleets of energy storage units. Predictive analytics built on machine learning techniques leverage historical performance trends to flag potential anomalies before they escalate, thereby minimizing unplanned downtime and lowering maintenance overhead. Concurrently, hardware innovations such as integrated management units and modular sensor arrays have reduced installation complexity and scaled more cost-effectively. This convergence of hardware evolution and software sophistication is reshaping the competitive landscape, favoring providers that offer seamless, end-to-end solutions combining robust physical components with flexible software-as-a-service models.

Against this backdrop, this executive summary provides a concise yet comprehensive introduction to the current state of battery monitoring systems. The following sections explore transformative shifts influencing market dynamics, analyze the impact of recent United States tariff implementations on supply chain economics, highlight critical segmentation perspectives across battery types, monitoring technologies, applications, and end users, and distill regional nuances shaping demand. Further sections synthesize the strategic moves of leading industry players, present actionable recommendations for stakeholders, outline the research methodology employed, and conclude with forward-looking insights designed to equip decision-makers for a rapidly evolving energy landscape.

Unveiling the Pivotal Transformative Shifts Redefining the Battery Monitoring Systems Ecosystem Across Technologies and Use Cases

The battery monitoring systems ecosystem is undergoing pivotal transformative shifts, driven by advances in digitalization, connectivity, and analytics. Key among these is the integration of Internet of Things (IoT) frameworks that enable real-time data streaming from geographically dispersed storage assets. Sensors embedded within each battery cell feed high-resolution telemetry into cloud platforms, where machine learning algorithms apply predictive maintenance models refined by large-scale data sets. This evolution in architecture has elevated system intelligence, transitioning from reactive fault detection to proactive performance optimization. Moreover, the standardization of communication protocols is fostering interoperability, allowing diverse components from multiple vendors to operate harmoniously and simplifying deployment across complex installations.

In parallel, the industry is witnessing a shift toward hybrid edge-cloud approaches. Edge computing modules process latency-sensitive data locally to ensure immediate protective actions, while cloud-based analytics deliver strategic insights and historical trend analyses. This balance enhances resilience against connectivity disruptions and optimizes bandwidth usage, all while facilitating remote monitoring and centralized management. Additionally, modular hardware designs have emerged, enabling users to scale monitoring capabilities incrementally as their energy storage portfolios grow. These modular platforms reduce upfront capital requirements and allow for easier upgrades as technology standards evolve.

Sustainability imperatives are also reshaping market offerings. As circular economy principles gain traction, battery monitoring systems are being adapted to support second-life applications and end-of-life recycling processes. Digital twins are employed to model degradation trajectories and optimize repurposing strategies, thereby extending the service life of battery packs beyond their primary use in electric vehicles or grid storage. This convergence of digital innovation, modular scalability, and sustainability-driven design is redefining what end-to-end battery monitoring solutions must accomplish in a rapidly evolving energy environment.

Examining the Broad Repercussions of 2025 United States Tariff Implementations on the Battery Monitoring System Supply Chain and Cost Dynamics

The introduction of targeted tariffs by the United States in early 2025 has exerted significant pressure on the supply chain economics of battery monitoring system components. Duties imposed on electronic sensors, printed circuit assemblies, and specialized semiconductor chips have elevated procurement costs for many solution providers. Stakeholders reliant on manufacturing hubs in certain regions have experienced pronounced increases in landed component prices, prompting a reassessment of sourcing strategies. In response, several companies have intensified efforts to qualify alternative suppliers in Southeast Asia, Europe, and North America to mitigate the effects of trade restrictions and maintain continuity of supply.

These cost pressures have, in turn, influenced pricing strategies across the market. Original equipment manufacturers have engaged in renegotiations with key customers to partially offset rising input expenses, while technology providers are exploring design adjustments that reduce dependency on tariff-affected parts. In some cases, legacy systems built around high‐duty components have been phased down in favor of newer architectures that leverage domestically produced or tariff-exempt materials. Beyond immediate pricing concerns, lead times for specialized sensors and integrated management chips have lengthened, creating challenges for just-in-time inventory models and project schedules.

Looking ahead, the tariff landscape is expected to drive medium-term shifts toward localized manufacturing and strategic partnerships. Several leading players have announced plans to invest in regional assembly facilities or to co-locate production alongside major end-user installations in order to circumvent import duties. Moreover, alliances between semiconductor manufacturers and system integrators are being forged to develop custom chips optimized for battery monitoring applications that fall under more favorable tariff classifications. These adaptive strategies underscore the industry’s resilience and its capacity to navigate evolving trade policies while continuing to innovate and scale.

Deriving Critical Insights from Diverse Battery Monitoring System Segmentation Spanning Types Technologies Applications and User Profiles

Understanding the full spectrum of battery monitoring system offerings requires a deep dive into segmentation by battery type, monitoring technology, application, end user, communication technology, and battery voltage. Beginning with battery type, the market is studied across traditional lead acid chemistries-including AGM, flooded, and gel configurations-alongside lithium ion variants such as LFP, NCA, and NMC, as well as nickel metal hydride solutions. Each chemistry presents unique monitoring requirements, from temperature sensitivity in lithium ion cells to electrolyte maintenance in flooded lead acid units. This breadth of battery technologies demands adaptable monitoring platforms capable of interpreting diverse performance parameters.

Turning to the technologies underpinning monitoring solutions, offerings range from cloud-enabled platforms and on-premise software suites to dedicated hardware modules. Cloud-based systems emphasize predictive analytics and real-time visibility, allowing remote operators to monitor distributed energy storage assets, while hardware-based configurations focus on integrated management units and sensor modules that deliver critical data at the point of installation. Software-based solutions, whether hosted in external datacenters or deployed on corporate networks, provide customizable dashboards and reporting tools that support compliance and maintenance workflows.

Applications further diversify the landscape: in the automotive sector, monitoring systems manage battery packs for electric vehicles, hybrid drivetrains, and internal combustion engine support, whereas in data centers, they safeguard backup power systems serving both uninterruptible power supply and long-duration backup requirements. Renewable energy installations use these systems to optimize hydro, solar, and wind storage assets, and the telecom industry employs monitoring solutions to protect power at base stations and switching equipment.

End users span commercial data centers, healthcare facilities, and telecom operators to industrial manufacturing plants, oil and gas operations, and utility-scale energy producers. Residential adoption includes both single-family homes and multi-unit dwellings seeking enhanced energy independence and resiliency. Communication technologies range from wired interfaces such as CAN Bus, Ethernet, and RS-485 to wireless protocols like Bluetooth, cellular networks, and Wi-Fi. Finally, battery voltage tiers-below 48 volts, between 48 and 300 volts, and above 300 volts-shape system design and safety considerations, influencing sensor selection, enclosure ratings, and compliance with regional electrical standards.

This comprehensive research report categorizes the Battery Monitoring System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Type

- Monitoring Technology

- Communication Technology

- Battery Voltage

- Application

- End User

Highlighting Distinct Regional Characteristics Influencing Battery Monitoring System Adoption Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a central role in shaping the adoption and evolution of battery monitoring systems worldwide. In the Americas, robust government incentives for electric vehicles and renewable energy projects have fueled demand for advanced monitoring solutions, with the United States and Canada leading large-scale deployments in utility and commercial sectors. Meanwhile, Latin American markets are gradually embracing grid modernization initiatives, driven by a need to improve reliability and integrate solar and wind assets into aging infrastructure. In all cases, a strong regulatory focus on safety standards and environmental compliance informs procurement decisions and underscores the importance of vendor certifications.

Across Europe, the Middle East, and Africa, divergent regional drivers present both opportunities and challenges. European nations pursue aggressive decarbonization targets that encourage smart energy storage integration, while Middle Eastern economies invest heavily in oil and gas infrastructure modernization, including hybrid energy systems with extensive monitoring requirements. In Africa, expanding telecom networks and off-grid renewable installations are creating niche markets for modular, low-cost monitoring platforms tailored to variable grid conditions. These varied use cases underscore the need for adaptable system designs capable of addressing diverse regulatory environments and infrastructure maturities.

In the Asia-Pacific region, dynamics are equally nuanced. China continues to dominate manufacturing and R&D for battery technologies and is rapidly scaling domestic monitoring system deployments to support its vast electric vehicle and grid storage ambitions. In contrast, emerging markets such as India and Southeast Asia are in an earlier stage of infrastructure rollout, prioritizing cost-effective solutions for solar hybrid systems and telecommunications backup power. Japan and South Korea lead in high-precision monitoring applications, leveraging local expertise in semiconductor sensors and digital electronics. Across all APAC markets, a common thread is the pursuit of operational efficiency and remote management capabilities to mitigate labor constraints and ensure system reliability under challenging environmental conditions.

This comprehensive research report examines key regions that drive the evolution of the Battery Monitoring System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Key Strategic Insights from Leading Global Players Shaping Innovation Partnerships and Competitive Dynamics in Battery Monitoring Systems

Leading players in the battery monitoring system landscape are strategically positioning themselves through technology development, partnerships, and market expansion. Global automation and energy management firms have invested in proprietary analytics platforms that integrate seamlessly with broader industrial control systems. Collaborations between semiconductor manufacturers and system integrators are delivering custom sensor arrays optimized for high-density energy storage applications. In parallel, specialized start-ups are carving out niches by focusing on modular, plug-and-play solutions that lower barriers to entry for mid-market end users. These varied approaches illustrate the competitive dynamism driving rapid product innovation and service differentiation.

Partnerships are central to competitive positioning. Technology vendors are forming alliances with electric vehicle manufacturers to embed monitoring solutions directly into battery packs at the point of assembly, while data center operators are co-developing bespoke analytics modules tailored to their unique reliability standards. Additionally, joint ventures between renewable energy project developers and monitoring system suppliers are resulting in integrated offerings that combine hardware, software, and lifecycle services into unified packages. Such collaborative models accelerate time to market and enhance value propositions by combining domain expertise across the value chain.

From a strategic perspective, differentiation rests on the ability to deliver actionable insights, rapid deployment, and scalable service models. Providers with global support networks and localized technical resources are winning contracts in mission-critical sectors, while those emphasizing open standards and API-driven architectures are attracting customers seeking interoperability across heterogeneous equipment landscapes. As the market matures, the next wave of competitive advantage will derive from investments in cybersecurity measures, artificial intelligence capabilities, and outcome-based service contracts that align vendor incentives with customer performance objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery Monitoring System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- AVL List GmbH

- BTECH (couldn’t verify a formal legal entity under this name)

- BYD Company Ltd.

- Contemporary Amperex Technology Co., Ltd.

- Eagle Eye Power Solution (could not confirm exact legal name)

- Eaton Corporation plc

- Eberspächer Group GmbH & Co. KG

- Ficosa Internacional, S.A.

- HBL Engineering Limited (formerly HBL Power Systems Ltd.) ([Business Standard][1])

- Infineon Technologies AG

- LG Energy Solution, Ltd.

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- Texas Instruments Incorporated

Crafting Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends Risks and Growth Opportunities in Battery Monitoring Systems

Industry leaders seeking to capitalize on the rapidly evolving battery monitoring system market should prioritize the adoption of flexible architectures that support both centralized cloud analytics and edge processing. By combining local fault mitigation with remote predictive capabilities, organizations can optimize performance while ensuring resilience against network disruptions. Equally important is the diversification of supply chains to hedge against geopolitical and trade uncertainties; establishing relationships with multiple component suppliers across distinct regions can safeguard production schedules and enable agile responses to tariff changes or shipping constraints.

Another critical action is the cultivation of strategic partnerships. Engaging with electric vehicle manufacturers, grid operators, and renewable energy developers to co-design monitoring solutions can accelerate product innovation and unlock new revenue streams. Furthermore, embracing open communication standards and developing robust application programming interfaces will facilitate ecosystem integration, allowing third-party analytics and service providers to extend core functionalities. This interoperability-centric approach can drive customer loyalty by enabling seamless expansion and minimizing vendor lock-in.

In parallel, firms must embed cybersecurity protocols into every layer of their monitoring offerings. As connected energy assets become increasingly attractive targets for malicious actors, protecting data integrity and ensuring system availability are non-negotiable priorities. Implementing secure authentication, encryption, and anomaly detection capabilities will bolster trust and support compliance with emerging regulatory requirements.

Finally, companies should explore outcome-based service contracts that align vendor compensation with customer performance improvements. By sharing risk and rewarding efficiency gains-whether through reduced downtime, extended asset life, or optimized energy usage-vendors can differentiate their value proposition and foster long-term partnerships.

Detailing a Robust Mixed Methods Research Methodology Ensuring Data Integrity Validity and Insight Depth in Battery Monitoring System Analysis

This analysis employs a rigorous mixed-methods research methodology designed to ensure data integrity, validity, and depth of insight. The secondary research phase includes an exhaustive review of industry white papers, technical journals, regulatory filings, and published standards from safety and environmental agencies. These sources provide a foundational understanding of evolving technological capabilities, compliance requirements, and macroeconomic factors influencing market dynamics.

Complementing secondary data, the primary research phase involves structured interviews with key stakeholders across the battery monitoring ecosystem. Conversations with design engineers, procurement managers, project developers, and C-level executives offer firsthand perspectives on technology preferences, operational challenges, and strategic priorities. In addition, an online survey distributed to end-users captures quantitative data regarding feature adoption rates, deployment timelines, and satisfaction levels, facilitating cross-validation with interview insights.

Data validation procedures include triangulation of findings across multiple sources, peer debriefing among research analysts, and follow-up interviews to clarify ambiguous or conflicting information. Analytical frameworks such as PESTEL, Porter’s Five Forces, and value-chain analysis underpin the evaluation of external drivers, competitive pressures, and system-level economics. Furthermore, case study reviews of representative deployments illustrate best practices and highlight lessons learned.

Research limitations are addressed through transparent documentation of data gaps, response biases, and assumptions. By acknowledging these factors, this report strengthens its credibility and provides a clear context for interpreting the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery Monitoring System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery Monitoring System Market, by Battery Type

- Battery Monitoring System Market, by Monitoring Technology

- Battery Monitoring System Market, by Communication Technology

- Battery Monitoring System Market, by Battery Voltage

- Battery Monitoring System Market, by Application

- Battery Monitoring System Market, by End User

- Battery Monitoring System Market, by Region

- Battery Monitoring System Market, by Group

- Battery Monitoring System Market, by Country

- United States Battery Monitoring System Market

- China Battery Monitoring System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Concluding Observations on the Future Trajectory of Battery Monitoring Systems Emphasizing Integration Sustainability and Technological Evolution

Battery monitoring systems stand at the intersection of energy, digital, and sustainability revolutions, poised to deliver unparalleled reliability and efficiency across diverse applications. The integration of advanced IoT architectures, coupled with sophisticated analytics and modular hardware designs, is accelerating the transition from reactive maintenance to proactive performance optimization. As regulatory imperatives and environmental goals intensify, stakeholders will increasingly demand solutions that support circular economy principles, such as second-life battery repurposing and end-of-life recycling.

Looking ahead, seamless interoperability among disparate components and systems will be fundamental, underscoring the need for open standards and API-driven ecosystems. Furthermore, the growing emphasis on cybersecurity will drive innovation in secure communication protocols and anomaly detection capabilities. By staying attuned to these converging trends-technological evolution, sustainability mandates, and digital integration-organizations can harness battery monitoring systems to unlock new levels of operational resilience and value creation.

Collectively, the insights in this executive summary lay the groundwork for informed decision-making, equipping industry leaders with the context and strategic direction necessary to navigate a rapidly evolving energy landscape.

Engaging Customized Consultation to Unlock the Full Potential of Battery Monitoring System Insights with Expert Guidance from an Associate Director

For personalized guidance and to access the full breadth of insights contained in this market research report, contact Ketan Rohom, Associate Director, Sales & Marketing. He will arrange a tailored consultation to discuss available packages and demonstrate how these findings can be applied to your unique organizational goals. Engage in a one-on-one conversation to explore in-depth data breakdowns, visualizations, and strategic recommendations that align with your roadmap for energy reliability and performance optimization. Secure your access today to leverage expert-driven analysis and position your operations at the forefront of battery monitoring system innovation.

- How big is the Battery Monitoring System Market?

- What is the Battery Monitoring System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?