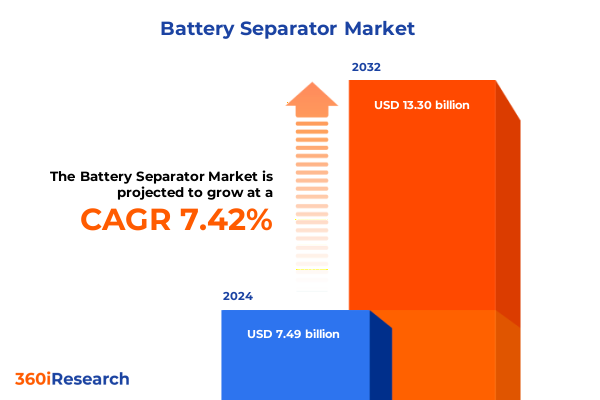

The Battery Separator Market size was estimated at USD 7.93 billion in 2025 and expected to reach USD 8.40 billion in 2026, at a CAGR of 7.65% to reach USD 13.30 billion by 2032.

Unveiling the Critical Role of High-Performance Battery Separators in Powering the Next Generation of Electric Vehicles and Energy Storage Systems

Battery separators serve as the essential microporous membranes that prevent direct electrode contact while enabling ion transport, making them indispensable components in lithium-ion batteries. Among polymer materials, polyethylene maintains the leading role, capturing a substantial share of separator usage in 2025 due to its balance of affordability, mechanical strength, and electrochemical stability. However, as manufacturers seek enhanced safety and performance, advanced materials incorporating ceramic coatings are increasingly adopted to improve thermal stability and reduce the risk of thermal runaway, particularly in electric vehicles and grid-scale energy storage applications

Transformative Innovation and Market Dynamics Redefining Battery Separator Technologies Across Automotive and Energy Storage Frontiers

The rapid acceleration of electric vehicle adoption and expansion of energy storage systems has propelled battery separator innovation to the forefront of industry transformation. Automakers and battery producers preemptively increased inventory throughout 2025 in response to anticipated shifts in trade policy and lucrative incentives under the U.S. Inflation Reduction Act, underscoring how policy and market forces are converging to reshape supply chain strategies. Beyond passenger vehicles, the pivot toward stationary energy storage is driving major producers to repurpose EV battery lines for grid applications, reflecting a broader demand for flexible, high-performance separators capable of supporting diverse use cases.

Simultaneously, evolving policy frameworks and subsidy structures are redefining competitive landscapes. The scheduled phase-out of certain federal tax credits and the imposition of new tariff measures are compelling global suppliers to recalibrate investment plans and accelerate regional manufacturing expansions. These developments are prompting industry stakeholders to strengthen domestic production capabilities, minimize exposure to cross-border disruptions, and capitalize on emerging incentives to future-proof supply chains.

Technologically, the market is witnessing a shift toward lithium-iron-phosphate (LFP) chemistries coupled with multilayer and ceramic-coated separator architectures that deliver superior safety margins and energy density trade-offs. Advanced coating processes, digitalized quality control systems, and next-generation nonwoven materials are enhancing product reliability and throughput. As a result, battery separator manufacturers are collaborating with equipment suppliers and research institutions to refine manufacturing processes and set new benchmarks for separator porosity, mechanical resilience, and thermal performance.

Assessing the Broad-Spectrum Impact of Recent United States Tariff Measures on the Battery Separator Supply Chain and Cost Structures

Recent U.S. trade actions are imposing substantial levies on Chinese-made battery components. Under consideration are tariffs approaching 150% on Chinese imports, which would drive domestic prices for lithium-ion energy storage systems upward despite declining raw material costs. These measures include potential increases of the Section 301 duty from the current 7.5% to as much as 25%, Section 232 duties adding another 25%, and legislation proposing universal minimum tariffs of 35% on Chinese goods.

In parallel, reciprocal tariffs newly effective in 2025 are adding an incremental 34% duty on Chinese lithium-iron-phosphate cells, compounding existing rates to nearly 65% and set to rise further under planned escalations. With over 90% of U.S. stationary storage cells sourced from China, these levies are reshaping procurement strategies, incentivizing safety stocks, and accelerating the commissioning of alternative production facilities in North America and Southeast Asia to mitigate import dependencies.

Trade tensions have also targeted Canada and Mexico, with 25% tariffs on imports from these NAFTA partners (10% on energy items) levied in early 2025. Although temporarily suspended pending negotiations, these reciprocal measures underscore the heightened risk of cross-border supply interruptions for raw materials such as nickel and other critical precursors used in separator fabrication. Collectively, these policy shifts are driving stakeholders to diversify supply chains, localize manufacturing footprints, and adopt strategic inventory management to safeguard production continuity and cost structures.

Uncovering Key Segmentation Insights Revealing Material, Chemistry, Cell Architecture and Technology Trends Driving Market Differentiation

Material-type dynamics reveal that polymer separators-primarily polyethylene and polypropylene-remain foundational, with polypropylene’s high dimensional stability and thermal performance favored for cylindrical and prismatic cells. Yet the growth of ceramic-coated separators underscores demand for enhanced safety, as alumina coatings improve thermal shrinkage resistance by over 20%, enabling high-voltage cells to operate safely at elevated temperatures and faster charge rates.

Diverse battery chemistries further segment market requirements. Lead-acid applications in automotive SLI batteries prefer robust polypropylene separators treated for chemical resistance and long cycle life, emphasizing mechanical strength and consistent porosity. Nickel-metal-hydride systems leverage nonwoven polyolefin webs, often combining spunbond and melt-blown layers, to balance puncture strength greater than 6 newtons with pore sizes below 20 microns-ensuring resilience against electrode expansion during cycling. The dominance of lithium-ion separators, however, is propelled by consumer electronics and EV sectors seeking minimal thickness and optimal ion permeability to maximize energy density.

Manufacturing processes and cell form factors bring additional nuances. Dry-process separators offer lean production and environmental advantages, while wet-process methods, accounting for over 60% of polymer separator output, deliver superior pore uniformity. Cylindrical cells demand consistent film quality for automated winding, prismatic formats require edge integrity to prevent shorting, and pouch designs prioritize uniform thickness to support flexible packaging. Through these technological and application lenses, market differentiation emerges across material, chemistry, cell type, and production technique.

This comprehensive research report categorizes the Battery Separator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Battery Chemistry

- Cell Type

- Technology

- End-Use Industry

Dynamic Regional Variations Highlighting Crucial Growth Drivers and Strategic Opportunities in Americas, EMEA and Asia-Pacific Battery Separator Markets

The Americas region benefits from robust federal incentives and the Inflation Reduction Act, which have spurred capacity investments by both domestic and allied suppliers. North American manufacturers are scaling up wet-process facilities and forging joint ventures, underscoring the region’s strategic push to secure critical input supply chains and align with evolving EV tax credit requirements. This localized momentum is strengthening resilience against global trade volatility and fostering closer collaboration between automakers and separator producers.

In Europe, stringent sustainability and safety regulations-embodied in the EU’s Batteries Regulation-are raising the bar for recycling efficiency and material recovery targets by 2025. These rules are encouraging separator makers to integrate recycled content and design films for easier end-of-life disassembly. The emphasis on circularity is driving research into binders and nanomaterial-enhanced separators that maintain performance while facilitating robust material reclamation, positioning the EMEA market as a testbed for innovation under rigorous environmental mandates.

Asia-Pacific continues to dominate global volume, led by major manufacturing hubs in China, Japan, South Korea, and expanding arenas in Southeast Asia. National safety standards such as China’s GB 38031-2020 are accelerating adoption of ceramic-coated separators in vehicles exceeding 300 miles of range, while large-scale energy storage projects in Australia and India are boosting demand for cost-effective LFP separator variants. This confluence of regulatory impetus, local capacity growth, and diversified cell chemistries cements the region’s role as both volume engine and innovation catalyst in the battery separator market.

This comprehensive research report examines key regions that drive the evolution of the Battery Separator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Innovators and Strategic Partnerships Shaping the Competitive Landscape of Battery Separator Manufacturing Globally

Leading global producers are investing heavily to expand capacity and secure regional supply. Asahi Kasei and Honda formalized their joint venture in Canada to build a wet-process lithium-ion separator plant in Port Colborne, Ontario, with a planned annual output of 700 million square meters beginning in 2027. This facility represents Canada’s first large-scale wet-process operation, reinforcing North America’s role in the EV supply chain.

Global coating capacity is also on the rise. Asahi Kasei announced a ¥40 billion investment to install new Hipore™ separator coating lines in Charlotte, North Carolina; Hyūga, Japan; and Pyeongtaek, South Korea. These additions are scheduled to come online from mid-2026 onward, elevating total Hipore™ coating capacity to meet surging automotive demand.

On the heels of these investments, SK IE Technology is ramping several production bases aimed at achieving world-leading market share. The company’s Changzhou, China, and Poland plants-together targeting nearly 1.9 billion square meters of wet-process output by 2025-are complemented by conditional DOE backing of up to $1.2 billion for Entek’s Terre Haute, Indiana, facility to supply separators for up to 1.9 million EVs annually. SK IE Technology and Entek exemplify the strategic synergy between public funding and private investment driving separator capacity expansion across North America, Europe, and Asia.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery Separator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Corporation

- Bernard Dumas

- Celgard, LLC

- Entek International

- Freudenberg Performance Materials

- LG Chem

- Mitsubishi Chemical Corporation

- Shenzhen Senior Technology Material Co., Ltd.

- Sinoma Science & Technology Co., Ltd.

- SK Innovation Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- Toray Industries, Inc.

- UBE Corporation

- W-Scope Corporation

Actionable Strategic Recommendations to Guide Industry Leaders in Navigating Growth, Innovation, and Supply Chain Resilience in the Battery Separator Sector

Industry leaders should prioritize geographic diversification of production to mitigate tariff exposure and logistical disruptions. Establishing localized wet-process and coating facilities in key markets under supportive policy frameworks can ensure stable output and eligibility for regional incentives.

Investing in advanced separator technologies-such as ceramic coatings, nanocomposite films, and sequential stretching processes-will differentiate product offerings by addressing heightened safety, energy density, and fast-charge performance requirements. Collaborative R&D consortia involving equipment suppliers and OEMs can accelerate time-to-market for next-generation separator solutions.

Supply chain resilience hinges on strategic procurement of critical raw materials, including polymers, ceramic powders, and nonwoven fibers. Engaging in joint procurement alliances or long-term off-take agreements can stabilize pricing and availability. Simultaneously, aligning with regulatory mandates for circularity by designing separators optimized for end-of-life recycling will position companies to capitalize on tightening sustainability requirements.

Finally, digitalizing quality assurance through real-time monitoring of film porosity, thickness, and coating uniformity using inline sensors will enhance throughput and defect reduction. Integrating data analytics into manufacturing workflows can provide actionable insights to continuously refine process controls and maintain stringent safety standards in high-volume production environments.

Comprehensive Research Methodology Combining Primary Interviews, Secondary Data Analysis and Rigorous Validation for Battery Separator Market Intelligence

This study synthesizes insights from primary and secondary research. Primary data were gathered through interviews with battery OEM executives, separator manufacturing leads, and materials scientists, providing firsthand perspectives on supply chain challenges and emerging technologies.

Secondary research involved rigorous review of regulatory documents-such as the U.S. Tariff Orders, EU Batteries Regulation, and China GB 38031-2020-and analysis of corporate disclosures, press releases, and financial filings from key industry players. Market projections and technology trends were cross-verified against multiple reputable sources, including industry association reports and peer-reviewed publications.

Quantitative data were triangulated by comparing published capacity expansions, tariff schedules, and trade flows to ensure consistent modeling of regional supply scenarios. All estimates of production capacity, investment figures, and technology adoption are based on confirmed public announcements, with conservative assumptions applied where forward-looking statements lacked firm dates.

Research limitations include the evolving nature of trade policies and potential delays in facility start-ups. Ongoing monitoring of policy developments and corporate updates will be essential to maintain the relevance of these insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery Separator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery Separator Market, by Material Type

- Battery Separator Market, by Battery Chemistry

- Battery Separator Market, by Cell Type

- Battery Separator Market, by Technology

- Battery Separator Market, by End-Use Industry

- Battery Separator Market, by Region

- Battery Separator Market, by Group

- Battery Separator Market, by Country

- United States Battery Separator Market

- China Battery Separator Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Insights Underscore Critical Growth Catalysts and Strategic Imperatives for Future-Proofing Battery Separator Market Success

The battery separator market stands at a pivotal juncture, driven by the convergence of EV growth, energy storage demand, and geopolitically influenced trade policies. Material innovations-from ceramic coatings to nonwoven composites-are redefining safety and performance benchmarks, while tariff measures and incentives are reshaping supply chain geographies.

Key segmentation factors highlight the diverse requirements spanning polymer and ceramic materials, lithium-ion and legacy chemistries, cylindrical and prismatic cell formats, and wet versus dry process manufacturing. Regional insights underscore how policy frameworks in the Americas, Europe, Middle East & Africa, and Asia-Pacific catalyze distinct investment and innovation strategies.

Leading companies are responding with strategic capacity expansions, joint ventures, and public-private partnerships that leverage local incentives and DOE backing. To thrive in this dynamic environment, industry stakeholders must harmonize advanced R&D, supply chain diversification, regulatory compliance, and data-driven manufacturing excellence.

Ultimately, success in the battery separator market will hinge on the ability to anticipate policy shifts, adopt cutting-edge materials science, and forge resilient partnerships that secure critical inputs and meet escalating performance and sustainability standards.

Engage with Ketan Rohom to Unlock Exclusive Battery Separator Market Insights and Propel Your Strategic Decision-Making with Our Comprehensive Report

Don’t miss the opportunity to equip your team with in-depth market intelligence on battery separator innovations and supply chain dynamics. Connect with Ketan Rohom, Associate Director, Sales & Marketing, to explore how this report can empower your strategic initiatives, enhance your competitive edge, and accelerate your growth in the evolving battery separator landscape. Secure your copy today and lead the charge toward next-generation battery performance.

- How big is the Battery Separator Market?

- What is the Battery Separator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?