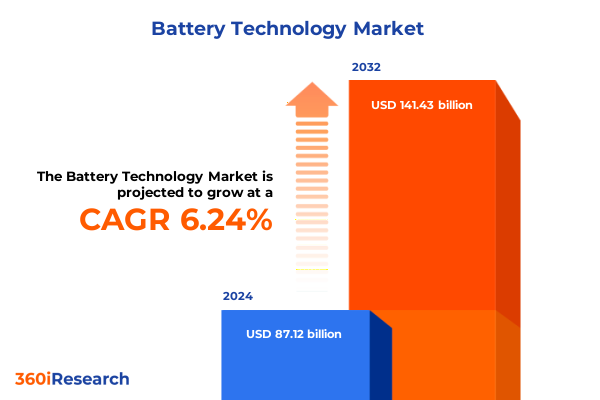

The Battery Technology Market size was estimated at USD 92.22 billion in 2025 and expected to reach USD 97.78 billion in 2026, at a CAGR of 6.29% to reach USD 141.43 billion by 2032.

Examining How Breakthroughs in Battery Technology Are Shaping a Cleaner, More Resilient Energy Ecosystem Across Transportation and Industry

Battery technologies have undergone remarkable evolution in recent years as the world accelerates towards cleaner energy and electrified mobility. Innovations in cell chemistry, design, and manufacturing are enabling higher energy densities, faster charging times, and enhanced safety profiles. As demand for electric vehicles, grid-scale storage, and portable electronics continues to rise, striking the balance between performance, cost, and sustainability has become the industry’s defining challenge.

The urgency of decarbonization initiatives has spurred unprecedented investment in research and development. Governments and private enterprises alike are channeling resources into next-generation concepts, spanning solid-state architectures promising greater energy density to lithium iron phosphate formulations valued for cost advantages and thermal stability. Simultaneously, supply chain considerations are reshaping strategic priorities, with critical materials such as lithium, cobalt, and nickel commanding both attention and debate among stakeholders.

This executive summary offers an overview of the most salient trends and developments shaping the battery sector, presenting insights into market segmentation, regional variations, major industry players, and policy impacts. By examining the cumulative effects of recent tariff measures, dissecting key segmentation perspectives, and profiling leading innovators, this document equips decision-makers with actionable intelligence to inform strategic planning and investment decisions in the coming years.

Uncovering the Pivotal Technological Advances and Market Forces Redefining Energy Storage Solutions for the Next Generation of Mobility and Power Infrastructure

From the rise of lithium iron phosphate batteries offering cost-effective safety profiles to breakthroughs in solid-state electrolyte design, the battery landscape is experiencing several high-impact shifts. The increasing adoption of nickel-rich cathode materials has driven higher energy densities but has also intensified the focus on thermal management and long-term material sustainability. Concurrently, the mainstream expansion of portable energy storage systems has catalyzed demand for scalable manufacturing approaches and modular cell-to-pack designs that optimize both space utilization and system-level cost reductions.

Advanced production methods, including dry electrode coating, laser welding, and precision robotics, are enhancing throughput while reducing defect rates. These manufacturing innovations are complemented by digital integration, in which embedded battery management systems leverage predictive algorithms to forecast cell degradation, extend service lifecycles, and ensure operational safety. At the same time, recycling and second-life initiatives are gaining momentum, embedding circular economy principles to bolster raw material resilience and mitigate environmental impact.

Transportation and infrastructure trends further underscore the transformative nature of the market. Automakers are exploring novel form factors and skateboard architectures tailored to electric propulsion, while commercial fleets are electrifying buses, delivery vans, and last-mile vehicles, creating demand for application-specific cell chemistries optimized for heavy duty cycles. Together, these shifts are redefining energy storage solutions and setting the stage for the next phase of sustainable electrification.

Analyzing the Far-Reaching Consequences of 2025 United States Battery Import Tariffs on Supply Chains, Costs, and Domestic Manufacturing Strategies

Since early 2025, the United States government has implemented a series of heightened tariffs on imported battery cells and essential precursor materials, marking one of the most significant trade measures in the sector’s history. Section 301 duties on lithium-ion cell imports from key producing nations have surged from baseline rates of 7.5 percent to levels exceeding 25 percent, accompanied by universal levies that cumulatively approach 65 percent for certain Chinese-origin cells. These measures extend beyond cell assemblies to cover critical chemicals such as lithium carbonate and cobalt sulfate, which now face additional duties ranging from 10 to 34 percent depending on product classification.

The immediate consequence has been a broad-based increase in cost structures for electric vehicle manufacturers and energy storage system integrators operating in North America. Anticipating further escalation, leading suppliers accelerated pre-tariff inventory accumulation, resulting in pronounced stockpiling ahead of effective dates. Automakers have adjusted pricing strategies and production schedules to absorb or offset the tariff burden, while utilities and independent power producers reevaluate procurement timelines and project budgets in light of revised cost projections.

Responding to the altered trade environment, supply chain realignment is underway. Cell assembly operations have shifted toward facilities in Mexico, Vietnam, and South Korea to leverage preferential trade agreements, while domestic production ramp-up efforts have intensified under the incentives of the Inflation Reduction Act. Nevertheless, the interplay of reciprocal duties and potential escalation scenarios continues to inject uncertainty, underscoring the strategic imperative for policy dialogue and operational flexibility in the evolving battery technology market.

Illuminating Critical Market Segmentation Perspectives Across Battery Chemistry, Component Roles, Technology Types, Capacity Classes, Industry Applications, and End User Dynamics

Critical insights emerge from examining the market through multiple segmentation lenses. When considering battery chemistries, the diversity spans consumer-grade alkaline units and industrial lead-acid solutions to advanced lithium iron phosphate and lithium-ion cells, with legacy nickel metal hydride and nickel-cadmium technologies persisting in specialized use cases. Each chemistry presents distinct trade-offs in energy density, lifecycle durability, cost structure, and thermal stability, shaping both supplier strategies and end-user adoption patterns.

A functional dissection of component roles reveals that innovations in anode materials, cathode formulations, and electrolyte systems collectively drive performance breakthroughs. High-nickel cathodes target elevated capacity, novel solid-state electrolyte compositions enhance safety, silicon-doped anodes improve charge kinetics, and advanced electrolyte chemistries ensure operational reliability across broad temperature ranges. This component-level evolution underpins the competitive differentiation of cell designs tailored to specific applications.

Considering technology types highlights the coexistence of primary, non-rechargeable batteries in low-power consumer devices alongside the meteoric growth of rechargeable systems for electric mobility and grid storage. Capacity segmentation further illuminates how small-format cells support wearable electronics, medium-sized modules serve automotive powertrains, and large-format assemblies enable utility-scale energy reserves. Application-oriented segmentation spans high-qualification aerospace and defense platforms, high-power automotive drivetrains, compact consumer electronics, distributed energy storage clusters, and industrial machinery with bespoke endurance demands.

Finally, the end-user perspective underscores varied procurement dynamics-from commercial fleet operators and government entities to residential adopters seeking home backup solutions. Within manufacturing customers, the spectrum includes dedicated battery assembly services and original equipment integrators, while the utilities domain encompasses large energy providers and emerging microgrid developers deploying localized storage networks. This multi-dimensional segmentation framework illuminates the competitive and innovation pathways shaping the future of battery technology markets.

This comprehensive research report categorizes the Battery Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Type

- Component

- Technology

- Battery Capacity

- Application

- End-User

Revealing Regional Priorities and Development Trends in the Americas, Europe Middle East & Africa, and Asia Pacific for Battery Technology Deployment and Innovation

Across the Americas, Europe Middle East & Africa, and Asia Pacific regions, distinct dynamics are shaping the battery technology market. In the Americas, policy initiatives promoting clean energy and direct incentives for electric vehicles have catalyzed domestic manufacturing growth and robust end-user demand. Federal and state-level tax credits alongside streamlined permitting processes have accelerated gigafactory projects, while Canada’s rich lithium and cobalt reserves are advancing resource-to-cell supply chain integration within North America.

In Europe Middle East & Africa, regulatory emphasis on carbon neutrality and responsible sourcing has spurred collaborative ventures among automotive OEMs, technology partners, and mining interests. The European Union’s stringent emissions targets and content requirements have underpinned consortium-driven cell production facilities, while Middle Eastern nations are pairing large-scale solar developments with grid-scale battery systems to stabilize renewables-driven grids. Across Africa, innovative deployment of modular storage containers is electrifying remote communities and underpinning emerging microgrid networks.

The Asia Pacific region remains the epicenter of global cell manufacturing and raw material processing, with China, South Korea, and Japan commanding the majority of production capacity. Substantial investments in next-generation solid-state prototypes and lithium-metal research are complemented by the emergence of Southeast Asian assembly hubs that benefit from competitive labor markets and regional trade frameworks. Infrastructure modernization plans across island and archipelagic nations are increasingly incorporating utility-scale storage to enhance grid resilience and integrate renewable sources, illustrating the varied deployment paradigms within the Asia Pacific landscape.

This comprehensive research report examines key regions that drive the evolution of the Battery Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Battery Technology Innovators and Strategic Players Driving Momentum in Electric Vehicle and Energy Storage Markets Globally

Leading companies continue to steer the trajectory of battery technology through strategic investments, partnerships, and innovation. Contemporary Amperex Technology Co., Limited (CATL) maintains its position at the forefront of electric vehicle and energy storage cell production, leveraging a portfolio that spans lithium iron phosphate and nickel-rich NMC chemistries. Its rapid capacity expansions across Asia, Europe, and North America underscore ambitions to preserve global leadership.

LG Energy Solution has demonstrated significant financial resilience by front-loading shipments ahead of tariff introductions and diversifying output toward energy storage system batteries. The company’s expansion of lithium iron phosphate cell production in domestic facilities reflects a strategic pivot to capitalize on government incentives. Panasonic, through its partnership with major automotive OEMs, continues to supply nickel-cobalt-aluminum cylindrical cells-most notably the industry-standard 2170 format-driving volume production for high-performance electric vehicle platforms.

BYD applies a vertically integrated model to achieve cost efficiencies, successfully deploying its proprietary blade battery technology in medium-range electric vehicles. Samsung SDI and SK On are intensifying research into solid-state and high-nickel cathode formulations while forging alliances with European manufacturers to diversify their supply chain footprints. In stationary storage, Johnson Controls and Tesla Energy set benchmarks in system integration, combining sophisticated battery management software with scalable rack-and-module solutions. Collectively, these strategic players are elevating performance, safety, and sustainability standards across a rapidly evolving market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AESC Group Ltd.

- BYD Company Limited

- EnerSys

- GS Yuasa International Ltd.

- Hitachi, Ltd.

- Leclanché SA

- LG Energy Solution, Ltd.

- Mitsubishi Electric Corporation

- Murata Manufacturing Co., Ltd.

- NEC Corporation

- Northvolt AB

- Panasonic Holdings Corporation

- Saft Groupe S.A.

- Samsung SDI Co., Ltd.

- SK Innovation Co., Ltd.

- SVOLT Energy Technology Co., Ltd.

- TDK Corporation

- Tesla, Inc.

- Toshiba Corporation

- VARTA AG

Presenting Strategic, Actionable Guidance for Industry Stakeholders to Navigate Disruption and Capitalize on Emerging Battery Technology Opportunities

In response to accelerating technological innovation and shifting policy landscapes, industry stakeholders should prioritize strategic diversification of supply chains to mitigate geopolitical risks. Forming partnerships across multiple regions will secure access to critical raw materials and manufacturing capacity, while leveraging preferential trade agreements can optimize cost structures. Implementing flexible production architectures that allow rapid reconfiguration of cell chemistry lines for both electric mobility and stationary storage applications will enhance resilience against demand fluctuations and regulatory shifts.

Investing in next-generation research on solid-state electrolytes, high-nickel cathode compositions, and silicon-doped anode materials will be instrumental in achieving the performance breakthroughs necessary for mass electrification. Concurrently, companies should amplify circular economy initiatives by scaling advanced recycling processes to recover lithium, cobalt, and nickel, thereby reducing primary material dependence and environmental footprint.

Engaging proactively with policymakers to advocate for consistent regulatory frameworks-encompassing stable tariff regimes and long-term subsidy programs-will bolster investment confidence. Deploying advanced digital battery management systems that integrate predictive analytics can extend service lifecycles, ensure safety compliance, and deliver quantifiable operational value to end users. Finally, aligning corporate growth strategies with emerging market segments-ranging from electrification of public transport to the development of grid-balancing services-will enable organizations to capitalize on high-growth opportunities and contribute to a more sustainable energy ecosystem.

Detailing a Robust, Multi-Method Research Framework Employed to Uncover Insights and Validate Findings in the Evolving Battery Technology Landscape

Our research methodology integrates qualitative and quantitative approaches to deliver comprehensive and reliable insights. The process began with a targeted review of publicly available technical literature, industry publications, and regulatory frameworks to establish a foundational understanding of cell chemistries, component innovations, and policy influences. This groundwork informed the design and execution of structured interviews with senior executives from electric vehicle manufacturers, battery cell producers, and energy utilities, capturing firsthand perspectives on market dynamics and operational challenges.

Complementing these interviews, we conducted in-depth case studies of manufacturing facilities and large-scale deployment projects to uncover best practices in cell assembly, quality assurance, and system integration. Quantitative data collection involved compiling production capacity figures, investment announcements, and tariff schedules, which were analyzed to identify trends in regional development and competitive positioning. To ensure accuracy and robustness, all findings were cross-verified through data triangulation with secondary sources, including trade reports and corporate disclosures.

To validate our conclusions, we convened a validation workshop with a panel of industry advisors representing policy institutions, material suppliers, equipment manufacturers, and end-user organizations. Their feedback refined our analysis and confirmed practical relevance. This multi-method research framework provides both depth and breadth in understanding the evolving battery technology market, delivering actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery Technology Market, by Battery Type

- Battery Technology Market, by Component

- Battery Technology Market, by Technology

- Battery Technology Market, by Battery Capacity

- Battery Technology Market, by Application

- Battery Technology Market, by End-User

- Battery Technology Market, by Region

- Battery Technology Market, by Group

- Battery Technology Market, by Country

- United States Battery Technology Market

- China Battery Technology Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Core Findings and Strategic Implications That Illuminate the Future Pathways for Battery Technology Adoption and Market Expansion

As demonstrated throughout this executive summary, battery technology is catalyzing a transformative era in both energy and mobility sectors. Breakthroughs in cell chemistries, advanced manufacturing techniques, and digital control systems are driving performance improvements and cost efficiencies, while evolving trade measures and policy incentives are reshaping global supply chains. The confluence of these factors underscores the imperative of agility and strategic foresight for organizations navigating this complex environment.

Key segmentation lenses reveal differentiated pathways for a spectrum of chemistries, components, and application niches, each presenting unique commercial and technological imperatives. Regional analysis highlights how the Americas, Europe Middle East & Africa, and Asia Pacific regions leverage distinct policy frameworks and resource advantages to cultivate localized growth ecosystems. Major industry players are redefining competitive benchmarks through capacity expansions, vertical integration strategies, and collaborative innovation, setting new standards for energy density, safety, and sustainability.

Going forward, companies that adopt flexible production systems, invest in next-generation materials research, and maintain constructive dialogue with policymakers will be best positioned to seize emerging opportunities. Amplifying circular economy practices and leveraging predictive analytics within battery management systems will further strengthen market resilience. Ultimately, the trajectory of battery technology will be determined by collective collaboration among manufacturers, regulators, and end users to advance sustainable, high-performance energy storage solutions.

Engaging Decision Makers with a Personalized Invitation to Secure In-Depth Battery Market Intelligence from Ketan Rohom to Propel Business Growth

To gain deeper insights and tailor strategies aligned with these market developments, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding organizations through the complexities of battery technology market analysis can provide you with the detailed intelligence necessary to inform investment decisions, partnership strategies, and product roadmaps. By engaging in a personalized consultation, you will access proprietary research findings, scenario modeling tools, and targeted recommendations that address your specific growth objectives.

Seize the opportunity to secure your competitive advantage in this rapidly evolving sector. Whether you are evaluating innovative cell chemistries, planning manufacturing capacity expansions, exploring strategic collaborations, or assessing regional market entry strategies, our tailored research solutions will empower your decisions. Contact Ketan Rohom to schedule a strategic briefing and explore how our comprehensive research offerings can support your business priorities. Let’s work together to unlock the full potential of battery technology for your organization’s success

- How big is the Battery Technology Market?

- What is the Battery Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?