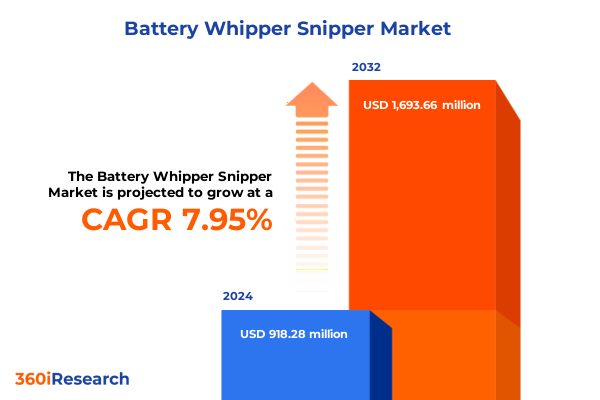

The Battery Whipper Snipper Market size was estimated at USD 986.02 million in 2025 and expected to reach USD 1,069.46 million in 2026, at a CAGR of 8.03% to reach USD 1,693.66 million by 2032.

Discovering the Next Generation of Sustainable Yard Maintenance with Innovative Battery-Powered Whipper Snipper Technologies and Market Dynamics

The landscape of powered lawn care equipment has shifted dramatically in recent years as battery technology innovations have unlocked new levels of performance, convenience and sustainability. Fuel-driven whipper snippers once dominated the outdoor tool market, yet rising emissions regulations, noise restrictions and consumer emphasis on eco-friendly solutions have propelled battery-powered alternatives to the forefront. Decision-makers in both commercial and residential segments now prioritize tools that deliver comparable cut quality without the environmental drawbacks. As battery chemistry advances have improved energy density and run times, users have begun to experience uninterrupted operations that rival gas models while dramatically reducing maintenance requirements and operational costs. Looking ahead, the surge in cordless tool adoption signals a golden era for portable, clean-energy landscaping equipment that aligns with global decarbonization goals and evolving user expectations.

Amid this momentum, manufacturers and channel partners are racing to refine motor designs, optimize battery management systems and expand voltage platforms capable of tackling heavy-duty trimming tasks. Sharp gains in brushless motor efficiency, coupled with modular battery packs that support cross-platform compatibility, are enabling seamless integration across a broader range of outdoor power tools. Consequently, the whipper snipper market is witnessing a fundamental transformation, driven by relentless R&D investment and strategic alliances between battery experts, motor suppliers and tool OEMs. This executive summary introduces key drivers, structural shifts and competitive imperatives shaping the next chapter of battery-powered whipper snipper innovation without divulging sensitive proprietary figures.

Analyzing Transformative Shifts Propelling the Battery-Powered Whipper Snipper Market into a New Era of Efficiency and Environmental Responsibility

Over the past several years, the transition from gas-powered to battery-operated whipper snippers has represented a seismic shift in the outdoor power equipment ecosystem. Early battery solutions suffered from limited run times and slow recharge cycles, but successive improvements in lithium-based chemistries-especially advances in iron phosphate and manganese-based formulations-have dramatically enhanced energy density and cycle life. As a result, professional landscapers now trust battery tools to clear dense overgrowth without interruption, supported by fast-charging systems that minimize downtime. In parallel, tightening emissions standards in key markets worldwide have compelled regulatory bodies to incentivize electrification and penalize high-polluting engines, further accelerating cordless market penetration.

Meanwhile, evolving consumer preferences are redefining product design priorities. Noise-sensitive residential neighborhoods, for instance, demand whisper-quiet operation that battery tools deliver, fostering broader acceptance among homeowners and reducing community pushback. Simultaneously, municipalities are integrating electric equipment into urban maintenance fleets to meet carbon neutrality pledges and reduce public exposure to exhaust fumes. This dual push from individual users and institutional buyers has forced OEMs to reconfigure supply chains, forge partnerships with battery cell manufacturers and invest in modular architectures capable of rapidly scaling. Collectively, these shifts underscore a new era of efficiency, reliability and environmental responsibility that will continue to reshape the trajectory of whipper snipper offerings in the near term.

Evaluating the Cumulative Effects of 2025 United States Tariffs on the Battery Whipper Snipper Industry’s Supply Chains and Cost Structure

In early 2025, the United States enacted a slate of tariffs on imported components and finished battery-operated power tools aimed at bolstering domestic manufacturing and safeguarding intellectual property. These measures, including 25% duties on key battery cell imports and assembly imports from select jurisdictions, have had a pronounced cumulative effect on cost structures across OEMs and distributors. As procurement costs rose, many manufacturers absorbed a portion of the tariff burden to maintain competitive end-user pricing, while selectively passing through the remainder to channel partners. This cost absorption strategy, however, squeezed margins and forced tighter inventory management practices as firms sought to avoid sudden price escalations during restocking cycles.

In response, a growing number of tool producers have accelerated investments in U.S.-based assembly lines and capacity expansions, aiming to localize value creation and hedge against future punitive measures. Strategic partnerships with domestic battery pack integrators and motor suppliers have become tactical priorities, enabling better control over component sourcing and lead times. Concurrently, some midsize players have shifted production to Southeast Asia’s tariff-exempt nations for specific subcomponents, balancing logistical complexities against tariff savings. As a consequence, the market is entering a new equilibrium in which trade policy influences product roadmaps, supplier network configurations and pricing strategies, underscoring the importance of agile supply chain resilience.

Unlocking Strategic Market Segmentation Insights to Drive Targeted Innovation and Growth across Diverse User Profiles in Battery Whipper Snipper Applications

A nuanced understanding of user requirements and channel dynamics is critical to capturing growth opportunities within the battery-powered whipper snipper segment. When evaluating end-user profiles, commercial operators are split between traditional landscaping services and municipal maintenance teams, each demanding high-performance tools that deliver sustained run times and minimal maintenance. Conversely, residential users comprise single-family homeowners who value ease of use and noise reduction, and multi-family dwellings where building managers weigh total cost of ownership and shared equipment reliability. Distribution patterns further reflect divergent purchasing behaviors: direct-to-consumer engagements offer brand-led bundling opportunities reflecting loyalty incentives, while big box retailers and warehouse clubs provide scale pricing and extensive in-store experiential zones. At the same time, online retail channels have blossomed through brand-owned websites and e-commerce marketplaces that facilitate broad product visibility, while specialty stores with a focus on garden equipment and small engine expertise cater to enthusiasts seeking hands-on advice.

On the technology front, battery chemistry segmentation reveals that lithium-ion platforms-spanning cobalt-based, iron phosphate-based and manganese-based variants-play a dominant role, with nickel metal hydride solutions persisting in entry-level tools that emphasize cost-effectiveness. Motor architectures are evolving too: brushless systems, especially high-efficiency brushless designs, are displacing traditional brushed configurations thanks to superior torque management and reduced energy loss. Voltage stratification defines performance tiers, with high-voltage 40 V and 56 V models excelling in heavy-duty applications, medium-voltage 18 V, 24 V and 36 V units balancing run time and weight, and low-voltage offerings at 12 V and 14.4 V appealing to light-duty consumers. Complementing voltage choices, power ratings from below 250 W for delicate trimming up to above 1,250 W for rigorous weed clearing allow users to match tool capacity precisely to the task. The application matrix spans orchard and crop maintenance under agriculture, home and ornamental gardening for property beautification, and professional landscaping or turf maintenance services that demand industrial-grade performance. Finally, price tiers range from economy products under $50 to premium tools exceeding $400, ensuring broad market coverage across cost-sensitive buyers and performance-focused professionals.

This comprehensive research report categorizes the Battery Whipper Snipper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Type

- Motor Type

- Power Rating

- Application

- End User

- Distribution Channel

Mapping Key Regional Dynamics Shaping Adoption Patterns and Market Opportunities for Battery-Powered Whipper Snipper Solutions Worldwide

Regional demand dynamics for battery-operated whipper snippers exhibit distinctive characteristics across the Americas, Europe, Middle East & Africa and Asia-Pacific. In the Americas, the United States and Canada lead with robust adoption rates driven by pro-environmental legislation, strong DIY cultures and commercial landscaping service growth. Widespread availability through big box retail channels and the rise of e-commerce platforms have further deepened market penetration, while infrastructure incentives for electrification at state and provincial levels continue to lower barriers for end users.

Across Europe, the Middle East & Africa, stringent emissions regulations and noise ordinances in key European jurisdictions are fueling institutional procurement of cordless units for municipal and professional applications. The Middle East’s luxury property developments are increasingly opting for premium battery tools to maintain aesthetic standards quietly, whereas emerging African markets are witnessing nascent interest lighted by agricultural mechanization programs. In the Asia-Pacific region, rapid urbanization in countries like China, Japan and Australia has expanded the addressable market for both residential and commercial segments. Government-driven clean energy policies and incentives to reduce petroleum imports are catalyzing demand, particularly for mid- and high-voltage battery platforms capable of addressing large-scale turf and landscaping requirements.

This comprehensive research report examines key regions that drive the evolution of the Battery Whipper Snipper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Landscape and Strategic Initiatives of Leading Players in the Battery Whipper Snipper Market Evolution

The competitive arena of battery-powered whipper snippers is shaped by companies that have invested heavily in proprietary battery ecosystems, motor innovation and channel partnerships. A leading global outdoor equipment manufacturer has leveraged a broad battery platform to deliver cross-compatible cordless solutions, pairing brushless motor systems with advanced thermal management for consistent power delivery. A second major player, recognized for its robust distribution network, has deepened its brushless tool portfolio while expanding exclusive dealer support to ensure superior service and maintenance coverage. A disruptor focused on dedicated battery technology has captured attention by introducing high-cycle-life chemistries and rapid-charge capabilities that appeal to professionals with minimal tolerance for downtime.

Meanwhile, a renowned power tool OEM has intensified its emphasis on platform interoperability, offering a unified battery pack across 18 V and 36 V tools that streamlines user investment and strengthens brand loyalty. In the value-oriented segment, an established garden equipment specialist has driven growth through a direct-to-consumer e-commerce strategy, promoting economy and midrange models that balance cost and performance. Lastly, a heritage manufacturer known for integrated power and irrigation systems has entered the cordless trimming space with premium, high-voltage whipper snippers, positioning them as flagship offerings in commercial and luxury residential applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery Whipper Snipper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Andreas Stihl AG & Co. KG

- Chervon (Holding) Limited

- ECHO Incorporated

- Einhell Germany AG

- Greenworks Tools, LLC

- Husqvarna AB

- Makita Corporation

- MTD Products Inc.

- Positec Tool Corporation

- Robert Bosch GmbH

- Stanley Black & Decker, Inc.

- Techtronic Industries Co. Ltd.

- The Toro Company

Delivering Actionable Strategic Recommendations to Foster Competitive Advantage and Sustainable Growth for Industry Leaders in Battery Whipper Snipper Segment

To thrive amid intensifying competition and shifting regulatory frameworks, industry leaders must take decisive action to align product development and go-to-market strategies with evolving end-user demands. First, investing in next-generation brushless motors and multi-chemistry battery packs will unlock superior power-to-weight ratios while bolstering tool longevity. Simultaneously, expanding fast-charging infrastructure and partnering with battery cell manufacturers can reduce recharge times and alleviate operator downtime.

Moreover, organizations should pursue strategic alliances with channel partners across both online and brick-and-mortar outlets to enhance product accessibility and service quality. By establishing comprehensive training programs for specialized store personnel and equipping commercial service teams with demonstration units, brands can elevate user confidence and drive premium adoption. On the pricing front, a tiered value proposition encompassing economy, midrange and premium offerings will cater to a spectrum of budget profiles while safeguarding margin integrity. Lastly, incorporating modular design principles that facilitate future battery-platform upgrades or accessory integrations will ensure sustainable product roadmaps adaptable to emerging technological breakthroughs.

Detailing the Robust Research Methodology Employed to Ensure Accuracy and Credibility in the Battery Whipper Snipper Market Analysis

This analysis draws on a comprehensive methodology designed to deliver unbiased and validated insights into the battery-powered whipper snipper market. We conducted in-depth secondary research across publicly available regulatory filings, patent databases and technical journals to map the evolution of battery chemistries, motor technologies and tariff policies. Concurrently, primary interviews with executives from leading OEMs, battery cell suppliers and distribution partners provided firsthand perspectives on strategic priorities and operational challenges. We also surveyed landscaping professionals and residential users to gauge satisfaction levels, performance requirements and purchase drivers.

Data triangulation techniques were employed to reconcile findings from different sources, ensuring consistency between qualitative feedback and quantitative trends. To further enhance reliability, a panel of independent industry experts reviewed our segmentation framework covering end user, distribution channel, battery and motor types, voltage, power rating, application and price range. Finally, regional demand assessments were validated against macroeconomic indicators and policy developments, resulting in a robust, multi-dimensional view of market dynamics that supports strategic decision-making without disclosing proprietary market estimates.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery Whipper Snipper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery Whipper Snipper Market, by Battery Type

- Battery Whipper Snipper Market, by Motor Type

- Battery Whipper Snipper Market, by Power Rating

- Battery Whipper Snipper Market, by Application

- Battery Whipper Snipper Market, by End User

- Battery Whipper Snipper Market, by Distribution Channel

- Battery Whipper Snipper Market, by Region

- Battery Whipper Snipper Market, by Group

- Battery Whipper Snipper Market, by Country

- United States Battery Whipper Snipper Market

- China Battery Whipper Snipper Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Concluding Insights Drawn from Comprehensive Evaluation of Technological Trends Market Drivers and Future Trajectory in Battery Whipper Snipper Domain

As battery-powered whipper snippers transition from emerging technology to mainstream landscaping staple, the confluence of advanced battery systems, brushless motor architectures and supportive regulatory frameworks has rewritten the rules of outdoor maintenance. Shifting tariffs in 2025 have introduced new imperatives for supply chain agility and local manufacturing investments, while user segmentation insights highlight the need for tailored offerings across diverse commercial, municipal and residential contexts. Regional analysis underscores differential adoption drivers-ranging from emissions legislation in Europe to rapid urbanization in the Asia-Pacific-and spotlights opportunities for strategic expansion.

Looking forward, the ability to anticipate chemical breakthroughs, optimize platform interoperability and refine channel partnerships will dictate which organizations lead this competitive field. By embracing a multi-tiered product strategy that balances cost, performance and sustainability, manufacturers can satisfy evolving customer requirements while maintaining healthy margins. In essence, the battery whipper snipper market stands at the nexus of innovation and demand, poised for continued growth as end users prioritize eco-friendly, high-performance tools that deliver on the promise of cordless freedom.

Engage with Ketan Rohom to Access Exclusive Battery Whipper Snipper Market Intelligence and Propel Your Strategic Decisions with Expert Guidance

To gain a competitive edge and unlock the full potential of insights tailored specifically for executives in the battery-powered whipper snipper space, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a deep understanding of lawn care tool dynamics coupled with strategic expertise in translating data-driven findings into actionable business growth plans. His firsthand experience in guiding decision-makers through market complexities ensures that your organization will receive bespoke guidance grounded in the latest industry intelligence. Reach out to Ketan to schedule a personalized consultation and learn how our comprehensive analysis can empower your next strategic move. Act now to secure early access to the full battery whipper snipper market research report and start driving sustainable innovation and profitability in your product lineup today

- How big is the Battery Whipper Snipper Market?

- What is the Battery Whipper Snipper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?