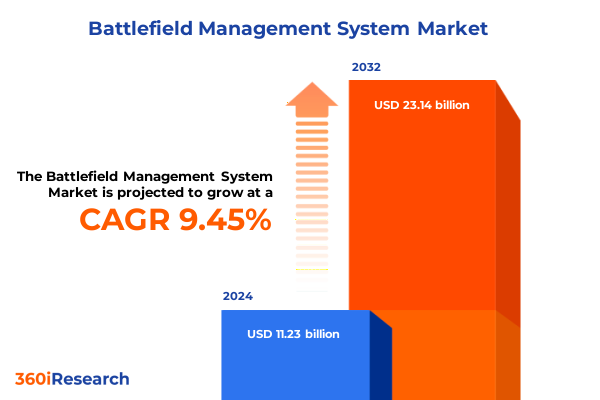

The Battlefield Management System Market size was estimated at USD 12.09 billion in 2025 and expected to reach USD 13.02 billion in 2026, at a CAGR of 9.71% to reach USD 23.14 billion by 2032.

Pioneering the Future of Integrated Battlefield Management Systems with Real-Time Command and Control Synchronization Across Air Land and Maritime Domains

The modern battlefield demands a level of integration and coordination previously unseen, driven by rapid advancements in connectivity, sensor technology, and data analytics. In this context, a comprehensive management system that harmonizes real-time information flows across all domains has become indispensable. From airborne platforms relaying high-resolution imagery to land-based units coordinating precision fires and maritime assets synchronizing fleet maneuvers, the ability to fuse these streams into a cohesive operational picture empowers commanders with unparalleled situational awareness and decision-making agility.

As threats become increasingly multi-dimensional, the imperative for interoperability across legacy systems and emerging technologies intensifies. This calls for an agile framework capable of ingesting heterogeneous sensor inputs, executing advanced processing routines, and distributing mission-critical directives without latency. Moreover, evolving doctrine emphasizes the convergence of intelligence, surveillance, reconnaissance, and command functions into a unified apparatus that can adapt to contested, degraded, or operationally constrained environments. Accordingly, the development and deployment of a robust battlefield management system lie at the heart of force modernization efforts, defining the next frontier of military effectiveness and resilience.

Revolutionary Shifts in Modern Warfare Driven by Cloud-Native Architectures and AI-Enabled Decision Support Transforming Real-Time Operational Awareness Globally

Rapid transformation in defense operations is being catalyzed by a convergence of cloud-native infrastructure, artificial intelligence, and edge computing. Network-centric principles have evolved to incorporate distributed architectures that can dynamically allocate computational resources closer to the point of need, reducing decision latency and improving system reliability. Simultaneously, AI-enabled analytics are revolutionizing how vast volumes of sensor data are interpreted, enabling automated threat detection, predictive maintenance, and enhanced mission planning.

Furthermore, open standards and modular design philosophies are fostering an ecosystem where hardware and software components can be seamlessly integrated or upgraded in response to emerging requirements. This shift toward plug-and-play interoperability is complemented by zero-trust security frameworks that safeguard critical data flows in contested networks. Additionally, advances in waveform management and resilient communications ensure connectivity under adversarial conditions, thereby sustaining the integrity of command processes. Consequently, these collective changes are reshaping the landscape of battlefield management, offering a strategic advantage to forces that can effectively harness these transformative trends.

Assessing the Comprehensive Implications of New U.S. Defense Tariffs on Supply Chains Technology Adoption and Strategic Procurement Operational Readiness

The introduction of new U.S. defense tariffs in early 2025 has exerted a profound ripple effect across the global supply chain for battlefield management solutions. By imposing duties on critical electronic subsystems and materials, these measures have triggered a reevaluation of sourcing strategies in both domestic and allied production networks. Defense prime contractors and specialized suppliers are now navigating a complex matrix of tariff classifications, seeking to mitigate cost impacts while maintaining compliance with strategic procurement guidelines.

In response, many organizations have accelerated investments in localized manufacturing capabilities and dual-use technology partnerships to reduce dependency on affected imports. This strategic pivot not only stabilizes the supply chain but also fosters greater innovation in resilient architectures and component design. At the same time, agencies are increasingly leveraging multilateral agreements to offset tariff burdens through cooperative defense industrial initiatives. As these developments unfold, stakeholders must balance the imperative of operational readiness with the shifting economic calculus imposed by tariff policy, ensuring that capability enhancements remain fiscally and logistically sustainable.

In-Depth Segmentation Revealing Platform Component End User Application and Deployment Mode Dynamics Shaping Battlefield Management Adoption

A nuanced understanding of market segmentation reveals that battlefield management systems must cater to varied operational contexts and technical requirements. Platforms operating in the skies demand lightweight, high-throughput communication modules and specialized sensors capable of weather-resistant performance at altitude, whereas terrestrial units require ruggedized processors and robust networking to function amid electromagnetic interference. Naval installations place a premium on secure, long-range connectivity and integration with existing combat management suites aboard surface and subsurface vessels.

On the component front, hardware elements extend beyond traditional communication modules, encompassing next-generation processors designed for edge processing and multi-sensor fusion, along with advanced electro-optical and radar sensors. Service offerings are equally critical, ranging from systems integration and lifecycle support to mission planning and operator training. Software solutions, encompassing both open and proprietary frameworks, facilitate seamless data visualization, situational modeling, and automated workflow orchestration. Moreover, adoption varies by end user: air forces often prioritize high-speed data links and AI-assisted targeting, ground armies emphasize real-time ground troop coordination, naval forces focus on blue-water situational awareness, and special forces seek highly portable, secure command interfaces tailored to expeditionary missions.

In parallel, application-driven demands influence feature sets: comprehensive command and control architectures must coexist with dedicated communication support layers, while intelligence, surveillance, and reconnaissance modules require end-to-end security and low-latency processing. Finally, the choice between on-premise deployments and cloud-based solutions hinges on factors such as network reliability, data sovereignty, and rapid scalability, with many defense organizations opting for hybrid models that can flex between local processing and elastic cloud resources.

This comprehensive research report categorizes the Battlefield Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Component

- End User

- Application

- Deployment Mode

Regional Analysis Uncovering Diverse Operational Priorities and Adoption Patterns across the Americas EMEA and Asia-Pacific Strategic Theaters

Regional dynamics play a pivotal role in shaping the requirements and adoption rates of battlefield management systems. In the Americas, defense agencies are driving innovation through a strong emphasis on domestic production, high-bandwidth satellite communications, and integrated training environments that simulate complex joint operations. Collaboration between industry and government-funded research labs fosters rapid prototyping of next-generation sensors and networking solutions, reflecting a strategic focus on interoperability with NATO allies.

Across Europe, the Middle East, and Africa, the landscape is characterized by a diverse array of security challenges and procurement capabilities. European nations often pursue collaborative acquisition programs to share development costs and standardize command frameworks, while Middle Eastern countries leverage expansive budgets to field cutting-edge technologies with unique customization requirements. In Africa, the priority often lies in lightweight, rapidly deployable systems that can address both conventional and asymmetric threats, with an emphasis on long-endurance surveillance and robust encryption.

The Asia-Pacific theater presents its own complexities, marked by significant investments in advanced electronics manufacturing and indigenous defense ecosystems. Partnerships with local technology firms are accelerating the deployment of AI-driven analytics and autonomous sensor platforms. Additionally, regional interoperability initiatives are being established to support joint exercises and humanitarian assistance missions, underscoring the need for flexible, multi-domain command and control architectures that can adapt to varying infrastructure and operational doctrines.

This comprehensive research report examines key regions that drive the evolution of the Battlefield Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Defense and Technology Firms Driving Innovation Interoperability and Competitive Differentiation within Battlefield Management System Ecosystems

Global leadership in battlefield management systems is increasingly concentrated among a handful of defense and technology firms that have demonstrated both technical prowess and agile program management. These organizations are distinguished by their end-to-end solution portfolios, encompassing hardware innovations such as software-defined radios and multi-sensor arrays, combined with modular software suites that enable rapid integration with existing command environments. Strategic partnerships between major primes and specialized technology vendors have further enhanced their competitive differentiation, allowing for the seamless embedding of proprietary algorithms and custom encryption protocols into standardized architectures.

Moreover, these companies are investing heavily in research collaborations with leading academic institutions and national laboratories, driving continuous improvement in areas like machine learning-based target recognition and predictive maintenance. Their ability to leverage comprehensive support networks-ranging from global field service teams to secure DevSecOps pipelines-ensures that deployed solutions remain mission-ready and resilient against evolving cyber threats. In sum, these market leaders set the benchmark for performance, scalability, and security, compelling industry peers and new entrants to continuously elevate their offerings to meet exacting defense requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battlefield Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aselsan A.Ş.

- BAE Systems plc

- Collins Aerospace

- Elbit Systems Ltd.

- General Dynamics Corporation

- Indra Sistemas, S.A.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rheinmetall AG

- RTX Corporation

- Saab AB

- Thales S.A.

Strategic Imperatives for Industry Leaders to Enhance Interoperability Modernize Capabilities and Strengthen Resilient Supply Chains in Battlefield Management

Industry leaders should prioritize the implementation of open architecture frameworks that allow for the rapid integration of next-generation sensors and applications without extensive reconfiguration. By doing so, program managers can mitigate obsolescence risks and accommodate emerging capabilities such as unmanned system coordination and cognitive electronic warfare. In tandem, establishing secure multi-domain data fabrics will ensure that critical information flows seamlessly between airborne, land, and maritime units while preserving end-to-end encryption in contested environments.

Furthermore, organizations must cultivate resilient supply chains through diversified sourcing strategies, strategic buffer stockpiling, and engagement with allied manufacturing consortia. This approach not only hedges against tariff-induced disruptions but also accelerates the prototyping and fielding of mission-specific kits. From a workforce perspective, investing in cross-disciplinary training-covering both systems engineering and cybersecurity disciplines-will enhance operator proficiency and foster a culture of continuous improvement. By aligning these strategic imperatives, decision-makers will secure a robust, future-proof battlefield management capability that adapts swiftly to shifting operational demands.

Robust Research Methodology Combining Primary Expert Interviews Secondary Source Triangulation and Rigorous Validation Protocols Ensuring Data Credibility

This analysis is grounded in a robust research framework combining qualitative and quantitative methods. Primary data was collected through structured interviews with senior defense officials, system integrators, and technology specialists, supplemented by site visits to integration facilities and demonstration events. These firsthand insights were cross-referenced against authoritative governmental publications and defense white papers to ensure contextual accuracy.

Secondary research involved an exhaustive review of academic journals, patent filings, and think tank reports, facilitating the triangulation of key trends and technological progressions. All data points were subject to rigorous validation protocols, including peer reviews by independent subject-matter experts and consistency checks against open-source intelligence feeds. This multi-layered approach ensures that the findings and recommendations presented herein are both credible and actionable for stakeholders seeking to navigate the complex battlefield management ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battlefield Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battlefield Management System Market, by Platform

- Battlefield Management System Market, by Component

- Battlefield Management System Market, by End User

- Battlefield Management System Market, by Application

- Battlefield Management System Market, by Deployment Mode

- Battlefield Management System Market, by Region

- Battlefield Management System Market, by Group

- Battlefield Management System Market, by Country

- United States Battlefield Management System Market

- China Battlefield Management System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Conclusion Highlighting the Critical Role of Adaptive Integrated Battlefield Management Systems in Future Conflict Scenarios and Strategic Decision Making

The landscape of battlefield management is entering an era defined by speed, adaptability, and cross-domain integration. As defense organizations confront an array of evolving threats, the capacity to synthesize dispersed sensor inputs and orchestrate agile command responses will distinguish mission success from operational failure. The interplay of cloud-native systems, artificial intelligence, and resilient communications architectures will continue to redefine the parameters of situational awareness and decision superiority.

Looking ahead, interoperability between legacy infrastructure and emerging technologies will remain a focal challenge, driving demand for modular open systems that can evolve in concert with doctrinal shifts. Organizations that invest in holistic integration strategies-encompassing hardware, software, and supply chain resilience-will be best positioned to capitalize on these advancements. Ultimately, the dynamics explored in this report underscore the imperative for a unified battlefield management approach, one that is as agile and multifaceted as the modern threat environment it is designed to address.

Take Action Today to Secure Comprehensive Insights and Expert Guidance on Battlefield Management System Trends and Strategies with Ketan Rohom

If the dynamic complexities of integrated command and control systems have captured your strategic interest, don’t delay in deepening your understanding of the evolving battlefield management landscape. Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, for a personalized discussion on how this comprehensive report can inform your decision-making and operational planning. His expertise will guide you in leveraging cutting-edge insights and practical recommendations to stay ahead of emerging threats and technological breakthroughs. Secure priority access to this valuable resource now to empower your organization with the actionable intelligence necessary for future mission success.

- How big is the Battlefield Management System Market?

- What is the Battlefield Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?