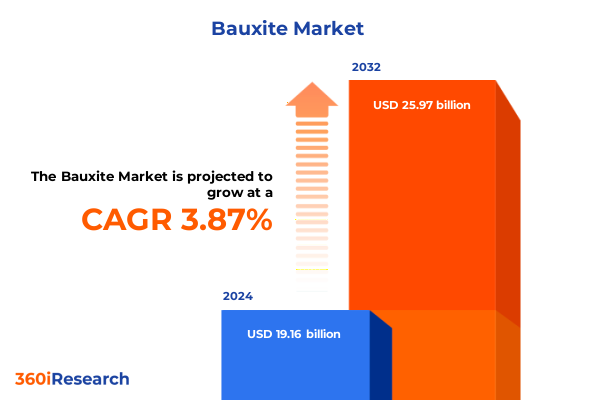

The Bauxite Market size was estimated at USD 19.90 billion in 2025 and expected to reach USD 20.48 billion in 2026, at a CAGR of 3.87% to reach USD 25.97 billion by 2032.

Charting the Critical Role of Bauxite in Meeting Global Aluminum Demand Amidst Sustainability and Supply Chain Challenges

Bauxite, the principal ore of aluminum, underpins modern industrial economies by serving as the foundational feedstock for alumina production and, ultimately, primary aluminum. Over the course of the last century, bauxite extraction and processing have supported the growth of critical sectors such as transportation, construction, and energy, positioning aluminum as a lightweight, durable, and infinitely recyclable material of choice. In parallel, rising global demand for aluminum-intensive applications-from electric vehicles to renewable energy infrastructure-has placed bauxite at the center of a complex global value chain characterized by capital-intensive mining operations, long-distance logistics, and multi-stage refining processes.

Against this backdrop, stakeholders in mining, refining, and end-use industries face a rapidly evolving competitive environment shaped by supply security concerns, shifting geopolitical dynamics, and escalations in environmental scrutiny. Historically, bauxite has been sourced predominantly from a handful of resource-rich regions, yet recent discoveries and expansions across Africa, South America, and Asia-Pacific are diversifying the supply base. Transitioning toward more sustainable practices further intensifies the spotlight on bauxite producers to adopt best-in-class environmental management and community engagement strategies. Consequently, industry participants must reconcile the imperative of expanding production with the obligation to meet increasingly stringent environmental, social, and governance expectations, laying the groundwork for the transformative shifts examined in this report.

Unveiling the Paradigm Shifts Reshaping Bauxite Mining from Technological Innovation to Environmental and Circular Economy Imperatives

The landscape of bauxite mining is undergoing a profound metamorphosis driven by breakthroughs in digitalization, automation, and process innovation. Mining operators are deploying advanced sensor networks and machine learning algorithms to optimize ore quality assessment, reduce energy consumption, and streamline extraction workflows. Meanwhile, hydrometallurgical advancements are emerging as viable alternatives to the traditional Bayer process, promising lower carbon footprints and enhanced resource recovery. Such technological evolution is further invigorated by partnerships between mining companies and technology providers, fostering open innovation models that accelerate the commercialization of digital mine platforms and next-generation refining technologies.

Concurrently, circular economy principles are reshaping industry norms, with producers investing in closed-loop water management systems, residue valorization initiatives, and reclamation technologies to minimize environmental impacts. Red mud, the bauxite residue generated during alumina production, is increasingly recognized as a potential feedstock for rare earth element extraction and cementitious applications, illustrating the strategic imperative to convert liabilities into value. These shifts are compounded by evolving regulatory regimes that mandate carbon intensity reporting and impose stricter land stewardship requirements. As a result, market participants are redefining operational excellence to encompass not only cost competitiveness but also environmental resilience and social license to operate. This confluence of innovation, sustainability, and regulatory pressures marks a new era for bauxite mining, compelling industry leaders to adopt integrated strategies that balance productivity with long-term stewardship.

Assessing the Far-Reaching Implications of 2025 United States Tariffs on Bauxite Trade Security and Raw Material Availability in North America

In early April 2025, the United States enacted a 38% reciprocal tariff on imports from Guyana, under an executive order aimed at addressing bilateral trade imbalances. Notably, aluminum ore, commonly known as bauxite, was explicitly exempted from these duties through a dedicated annex to the proclamation, thereby safeguarding critical raw material flows to domestic alumina refineries and primary aluminum smelters. Although this exemption insulated U.S. refiners from immediate cost shocks, the broader tariff landscape-coupled with potential retaliatory measures-has injected volatility into supply chain planning and procurement strategies.

Meanwhile, amendments to Section 232 of the Trade Expansion Act raised aluminum tariffs from 10% to 25% effective March 12, 2025, and terminated existing product exclusions, signaling an assertive stance on protecting the domestic aluminum sector. While this directive did not encompass raw bauxite, downstream producers have been compelled to navigate fluctuating input costs and logistic uncertainties tied to shifting trade policy. Against this backdrop, industry executives are reassessing long-term supply commitments and diversifying offtake arrangements to mitigate geopolitical risk. In turn, bauxite exporters are exploring new markets and value-added partnerships to offset potential disruptions in traditional trade corridors. The cumulative impact of these 2025 tariff measures underscores the imperative for dynamic sourcing models and agile commercial structures to sustain feedstock availability and cost competitiveness.

Deciphering Bauxite Market Dynamics through Application, Grade, Product Type, End Use Industry, and Mining Method Segmentation Perspectives

Segmented analysis reveals distinct dynamics across application domains, with abrasive uses in grinding wheels and sandblasting commanding specialized bauxite grades that emphasize hardness and friability, while the cement sector values fine particle size for performance enhancement in clinker production. The chemicals segment bifurcates into ferric alum and hydrate production, each requiring tailored ore specifications to optimize conversion yields. At the same time, refractory applications-encompassing high-strength firebrick and insulating boards-demand alumina-rich feedstock to withstand extreme thermal conditions without compromising structural integrity.

Grade considerations further stratify the market: high alumina content ores are sought after for premium smelting operations, whereas medium and low Al₂O₃ content grades serve as cost-effective alternatives for less exacting industrial uses. In parallel, the product type classification distinguishes between calcined and uncalcined bauxite. High-purity calcined material finds usage in specialized abrasives and refractories, while standard purity variants are directed to bulk alumina conversion. Uncalcined bauxite, with abrasive, metallurgical, and refractory grade categorizations, underpins a broad spectrum of downstream applications. Finally, end-use segmentation highlights growing demand pockets in automotive lightweighting, construction composites, and electronics substrates, even as mining method distinctions-open pit and underground operations-inform resource development strategies, capital intensity, and environmental footprint profiles across project lifecycles.

This comprehensive research report categorizes the Bauxite market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Product Type

- End Use Industry

- Mining Method

- Application

Evaluating Regional Strengths and Market Drivers for Bauxite in the Americas, Europe Middle East Africa, and the Asia-Pacific to Guide Strategy

Regional considerations shape competitive positioning, with the Americas supplying a diverse range of ore qualities from open pit deposits in South America and Caribbean territories to underground operations in North America, all supported by integrated shipping corridors that service alumina refineries and primary smelters across the continent. Within Europe, Middle East & Africa, evolving environmental regulations and land use constraints are prompting producers to invest in beneficiation and residue management technologies to comply with stringent sustainability standards while maintaining output levels. The Asia-Pacific region, meanwhile, remains the largest consumer and producer of bauxite, driven by massive downstream alumina complexes in China and India and abundant resource endowments in Australia and Southeast Asia. Here, infrastructure throughput and port expansions are accelerating to meet surging demand, even as governmental stakeholders enforce rigorous rehabilitation mandates and community engagement frameworks. As such, regional strategies must account for macroeconomic policy, logistics infrastructure maturity, and environmental governance to optimize supply security and extract maximum value from bauxite reserves.

This comprehensive research report examines key regions that drive the evolution of the Bauxite market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Initiatives and Operational Excellence of Leading Bauxite Producers Shaping the Future of the Global Value Chain

Leading bauxite producers are advancing strategic initiatives to secure resource longevity and drive operational efficiency. Rio Tinto, for example, initiated early works and final engineering studies for the Kangwinan expansion at its Amrun site in Queensland, which aims to add up to 20 million tonnes of annual production capacity by the end of the decade. This project underscores a commitment to sustaining long-term feedstock supply for integrated alumina and aluminum operations while collaborating with Traditional Owner communities to ensure culturally responsible development. In parallel, the company’s Q1 2025 results highlighted record bauxite output and monthly production milestones, reflecting ongoing debottlenecking efforts and digital optimization across its Cape York operations.

Alcoa has navigated a challenging tariff environment, with its U.S. operations absorbing increased costs following the reinstatement of 25% aluminum import duties; executives estimate a $100 million impact from tariffs announced in March 2025, amplifying the urgency to diversify sourcing and advocate for reciprocal trade relief. The company’s focus on securing high-grade bauxite approvals in Australia and optimizing residue management through Elysis carbon reduction partnerships demonstrates a strategic pivot toward value-added and sustainable solutions. Collectively, these corporate actions reflect a broader industry emphasis on capital discipline, vertical integration, and environmental stewardship to fortify competitive positioning amid volatile market conditions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bauxite market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcoa Corporation

- Alumina Limited

- Aluminum Corporation of China Limited

- BHP Group plc

- Compagnie des Bauxites de Guinée

- Compagnie des Bauxites de Kindia

- Emirates Global Aluminium PJSC

- Grafit Madencilik A.Ş.

- Gujarat Mineral Development Corporation Limited

- Hindalco Industries Limited

- Jamalco

- Metalcorp Group NV

- Mineração Rio do Norte SA

- National Aluminium Company Limited

- Norsk Hydro ASA

- Rio Tinto Group

- South32 Limited

- United Company RUSAL plc

- Vedanta Resources Limited

- Vimetco NV

Implementing Strategic Playbooks for Industry Leaders to Navigate Bauxite Market Volatility and Drive Sustainable Growth and Competitive Advantage

Industry leaders should accelerate investments in digital mine platforms and real-time analytics to enhance ore characterization, enabling more precise feedstock blending and reducing processing energy intensity. Collaborative research programs with academic institutions and technology firms can fast-track development of next-generation hydrometallurgical processes, positioning participants at the forefront of low-carbon alumina production. Moreover, embedding circular economy principles through red mud valorization partnerships can unlock alternative revenue streams, mitigate residue liabilities, and bolster social license to operate.

In response to tariff uncertainties and geopolitical risks, supply chain diversification is imperative; executives should secure long-term offtake agreements across multiple regions and consider strategic stockpiling of critical bauxite grades to buffer cost fluctuations. Engaging proactively with policymakers to shape transparent and stable trade frameworks will further support supply continuity. From an operational standpoint, enhancing water and energy efficiency through integrated resource management systems can deliver cost savings and reduce environmental footprints, meeting stakeholder expectations and preempting regulatory tightening. Finally, embedding ESG metrics in capital allocation and performance incentives will align organizational objectives with evolving investor priorities, ensuring resilience and driving sustainable value creation across the bauxite value chain.

Outlining a Rigorous Research Framework Leveraging Primary and Secondary Approaches to Deliver Insightful Bauxite Market Intelligence

This research integrates both primary and secondary methodologies to deliver a comprehensive view of the bauxite market. Primary research comprised structured interviews with senior executives across mining, refining, and end-use sectors, as well as consultations with technical experts in mineral processing and environmental management. Data from in-country site visits, regulatory filings, and proprietary cost models informed the qualitative and quantitative assessments of operational performance and project pipelines. Secondary research entailed rigorous analysis of trade data, academic publications, government reports, and industry association studies to triangulate findings and validate critical trends.

Analytical frameworks applied include Porter’s Five Forces to evaluate competitive intensity, SWOT analysis to identify project and corporate strengths and vulnerabilities, and scenario planning to stress-test the impact of regulatory and tariff developments. Environmental impact assessments leveraged geostatistical models to estimate soil and water resource implications under varying extraction scenarios. Throughout, data quality checks and workshop reviews with subject matter experts ensured methodological robustness. The resulting insights blend empirical rigor with strategic foresight, equipping stakeholders to navigate an increasingly dynamic bauxite landscape with confidence and precision.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bauxite market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bauxite Market, by Grade

- Bauxite Market, by Product Type

- Bauxite Market, by End Use Industry

- Bauxite Market, by Mining Method

- Bauxite Market, by Application

- Bauxite Market, by Region

- Bauxite Market, by Group

- Bauxite Market, by Country

- United States Bauxite Market

- China Bauxite Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Critical Findings to Illuminate the Path Forward for Stakeholders Engaged in the Bauxite Value Chain and Investment Decision Making

The examination of transformative technologies, evolving regulatory landscapes, and strategic corporate initiatives illustrates that the bauxite industry stands at a strategic inflection point. On one hand, accelerated digitalization and circular economy practices offer pathways to reduce environmental impacts, optimize resource utilization, and generate novel revenue streams. On the other, heightened tariff regimes and geopolitical uncertainties reinforce the need for agile supply chain architectures and diversified sourcing strategies. The interplay of these forces is shaping a future in which competitive advantage will hinge upon operational excellence, environmental stewardship, and adaptive commercial frameworks.

Looking forward, stakeholders who proactively integrate low-carbon processing innovations, engage in cross-sector collaborations, and embed ESG considerations into their core business models will be best positioned to capture value and sustain growth. As global demand for aluminum continues to escalate-driven by the energy transition, lightweight mobility, and infrastructure development-the reliability and quality of bauxite feedstocks will remain paramount. Ultimately, strategic foresight, disciplined capital allocation, and robust stakeholder engagement will define success in the next chapter of the bauxite value chain.

Connect Directly with Ketan Rohom to Secure Exclusive Bauxite Market Intelligence Reports and Unlock Actionable Insights for Strategic Advantage

To gain access to the full suite of bauxite market insights, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through tailored research deliverables. Engage in a conversation to explore customized data sets, strategic deep dives, and bespoke advisory services designed to equip your organization with the intelligence needed to outpace competitors. Reach out to secure your copy of the comprehensive market research report and discover how these insights can be leveraged to inform investment strategies, optimize supply chains, and drive sustainable growth across the bauxite value chain.

- How big is the Bauxite Market?

- What is the Bauxite Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?