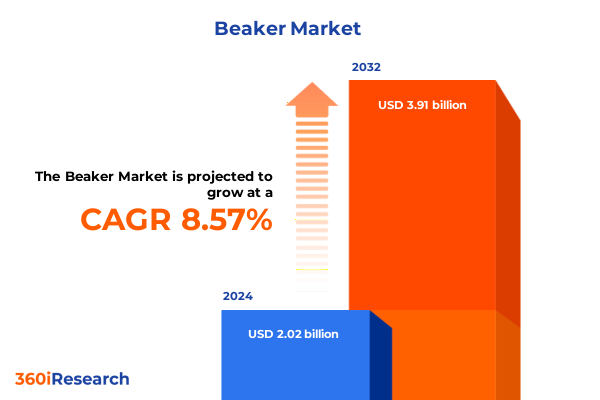

The Beaker Market size was estimated at USD 2.20 billion in 2025 and expected to reach USD 2.39 billion in 2026, at a CAGR of 8.56% to reach USD 3.91 billion by 2032.

Unveiling the Critical Drivers Behind Market Dynamics Amid Shifting Regulatory and Technological Paradigms

The current technology ecosystem is characterized by rapid change, shifting regulatory imperatives, and evolving customer expectations. In this environment, decision-makers must stay ahead of emerging trends to capitalize on impending opportunities and mitigate unforeseen risks. This executive summary sets the stage for understanding how recent policy shifts, technological breakthroughs, and market dynamics are converging to redefine traditional business models.

By grounding our analysis in a multidimensional framework, we unpack the interconnected forces that are shaping strategic agendas across hardware, software, and services. Our aim is to equip stakeholders with a nuanced perspective on the competitive landscape, highlighting the interplay between innovation, regulation, and customer demand. In doing so, we establish a foundation for the in-depth exploration that follows, ensuring readers can contextualize each subsequent section within a coherent strategic narrative.

Exploring How Regulatory Reforms and Technological Breakthroughs Are Catalyzing Unprecedented Market Realignment

Over the past year, the convergence of policy realignments and technological breakthroughs has sparked seismic shifts in the competitive landscape. Companies that once relied on linear growth models are reevaluating their strategies to foster resilience and adaptability. Key developments, such as the maturation of artificial intelligence tools and the proliferation of hybrid cloud architectures, have accelerated demand for integrated solutions that span hardware, services, and software domains.

Simultaneously, regulatory bodies have introduced new compliance frameworks that emphasize data sovereignty and supply chain transparency. These measures are compelling organizations to reassess vendor relationships and invest in solutions that offer enhanced traceability. The net effect is a market undergoing transformative reconfiguration, where legacy incumbents and agile entrants compete on the basis of innovation velocity and compliance readiness. As these shifts unfold, the ability to anticipate downstream effects and to pivot resource allocation accordingly will determine market leadership.

Analyzing the Extensive Effects of Recent United States Tariff Policies on Technology Supply Chains and Cost Structures

Recent tariff adjustments by the United States government have introduced complex ripples across global supply chains, particularly in the technology sector. Hardware vendors have faced increased import duties on networking and server components, prompting a wave of near-shoring and supplier diversification. This has led organizations to reexamine procurement strategies, balancing the short-term cost pressures against long-term resilience and geopolitical risk mitigation.

In parallel, the software segment has experienced indirect effects as elevated hardware costs filter downstream into total solution pricing. Service providers offering consulting and integration have had to reprice engagements to reflect the new operating baseline, often absorbing portions of these costs to maintain competitive positioning. As a result, buyers are demanding greater transparency into cost drivers and are increasingly prioritizing solutions that can deliver rapid return on investment despite heightened tariff-induced expenses. The cumulative impact of these tariffs underscores the strategic imperative of supply chain agility and cost management in an era of policy volatility.

Delineating How Diverse Product Types, User Verticalities, and Delivery Channels Shape Distinct Market Trajectories

A nuanced examination of market segmentation reveals distinct value propositions across product categories, end-user verticals, distribution channels, applications, and company sizes. Hardware offerings encompass networking, servers, and storage, each with unique performance characteristics and deployment models. Services divide into consulting and integration, reflecting the growing complexity of multi-vendor environments. Software, whether deployed in cloud or on-premise models, increasingly prioritizes modular architectures that support private and public cloud delivery.

End users in banking, financial services and insurance, healthcare, manufacturing, retail, and telecommunications exhibit differentiated adoption patterns based on regulatory exposure and digital maturity. Distribution channels range from direct sales to distributor networks, online platforms, and brick-and-mortar retail, each channel influencing customer engagement and support models. Applications such as analytics, customer relationship management, data management, and security drive procurement priorities as organizations seek solutions that can extract actionable insights while safeguarding critical assets. Finally, large enterprises and small-and-medium enterprises diverge in decision-making processes and budgetary constraints, with larger organizations focusing on enterprise-scale deployments and smaller firms seeking cost-effective, plug-and-play options.

This comprehensive research report categorizes the Beaker market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Capacity Range

- Reusability

- Sales Channel

- End-Use Industry

- Application

Examining the Varied Adoption Patterns and Growth Catalysts Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Geographically, the Americas continue to lead innovation adoption, driven by robust capital allocation in North America and accelerated digital transformation initiatives in Latin America. Europe, the Middle East and Africa exhibit heterogeneous maturity levels, with Western Europe focusing on stringent data protection regulations and the Middle East investing heavily in smart city infrastructure. Africa presents nascent opportunities, particularly in mobile-first deployments.

Asia-Pacific remains a hotbed of growth, fueled by large-scale government-backed digital initiatives in China and India, as well as the rapid uptake of Industry 4.0 solutions in Southeast Asia. Regional supply chain realignments, including near-shoring strategies, are reshaping manufacturing hubs and driving demand for localized services and support. This regional mosaic underscores the need for market participants to tailor go-to-market approaches, balancing global standards with local regulatory and cultural nuances.

This comprehensive research report examines key regions that drive the evolution of the Beaker market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unpacking Strategic Moves by Top Industry Players to Forge Partnerships, Expand Portfolios, and Elevate Market Leadership

Leading companies are differentiating through strategic partnerships, R&D investments, and ecosystem orchestration. Hardware specialists are forming alliances with chip designers to optimize performance and reduce dependency on constrained supply channels. Service providers are embedding automated toolchains within integration workflows to accelerate deployment and minimize human error. Software vendors are expanding modular portfolios to support both cloud-native and on-premise environments, meeting diverse customer requirements.

Beyond innovation, market leaders are leveraging data analytics to anticipate customer needs and inform product roadmaps. They are also fostering developer communities to cultivate loyalty and drive platform extensibility. Through targeted acquisitions, these companies are broadening their solution spectrum, addressing adjacent application domains such as security and data management. The strategic moves of these organizations highlight a trend toward end-to-end solution delivery, where the ability to offer comprehensive, integrated stacks becomes a key competitive differentiator.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beaker market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ace Glass Incorporated

- Avantor, Inc.

- Bellco Glass, Inc.

- BOROSIL Glass Works Limited

- Brand GmbH + Co. Kg

- Cole-Parmer Instrument Company LLC

- Corning Incorporated

- DWK Life Sciences GmbH

- Eckert & Ziegler Strahlen- und Medizintechnik AG

- Ecroskhim Co., Ltd.

- Eisco Scientific

- Foxx Life Sciences

- Gerresheimer AG

- Goel Scientific Glass works Ltd.

- Hach Company by Danaher Corporation

- Humboldt Mfg. Co.

- IndoSurgicals Private Limited

- Kartell S.p.A.

- Karter Scientific Labware Manufacturing Co.

- Kimble Chase Life Science and Research Products LLC

- Lapmaster Wolters GmbH

- Medline Scientific Limited

- Merck KGaA

- METASYS Medizintechnik GmbH

- Narang Medical Limited

- NDS Technologies, Inc.

- Quark Glass by Andrews Glass

- Saint-Gobain S.A.

- Technical Glass Products, Inc.

- Thermo Fisher Scientific Inc.

Formulating Proactive Strategies to Enhance Resilience, Boost Compliance, and Accelerate Time to Market

Industry leaders should prioritize supply chain resilience by diversifying sourcing strategies and investing in near-shore manufacturing partnerships. By realigning procurement models to include alternative suppliers, organizations can mitigate tariff-driven cost pressures and minimize operational disruptions. In addition, embedding advanced analytics and automation within service delivery frameworks will enhance execution efficiency and reduce error rates.

Moreover, firms must strengthen their compliance postures by adopting transparent traceability solutions and by integrating regulatory monitoring into governance protocols. Embracing modular software architectures that seamlessly operate across cloud and on-premise infrastructures will unlock scalability while preserving security. Finally, building robust partner ecosystems-through co-innovation programs and developer engagement-will accelerate time to market and foster customer stickiness in a market defined by rapid evolution.

Detailing a Rigorous Multi Source Research Framework Combining Executive Interviews, Policy Reviews, and Data Triangulation

This analysis is grounded in a multi-source research methodology combining primary and secondary data collection. Primary insights derive from in-depth interviews with industry executives, technology architects, and procurement specialists. These conversations provided qualitative perspectives on strategic priorities, pain points, and emerging technology adoption patterns.

Secondary research encompassed a systematic review of regulatory filings, policy briefs, white papers, and industry journals to validate macroeconomic trends and policy impacts. Data triangulation was achieved by cross-referencing supply chain reports, vendor press releases, and financial disclosures. The integration of qualitative and quantitative inputs ensures a comprehensive view of the market landscape, enabling data-backed strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beaker market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beaker Market, by Material

- Beaker Market, by Capacity Range

- Beaker Market, by Reusability

- Beaker Market, by Sales Channel

- Beaker Market, by End-Use Industry

- Beaker Market, by Application

- Beaker Market, by Region

- Beaker Market, by Group

- Beaker Market, by Country

- United States Beaker Market

- China Beaker Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesis of Policy, Technological, and Customer Trends Highlighting the Imperative for Strategic Agility and Operational Excellence

In summary, the intersection of policy shifts, technological advances, and evolving customer demands is redefining competitive boundaries. Organizations that proactively adjust supply chain strategies, harness modular architectures, and deepen partner collaboration stand to capture disproportionate value. Navigating this dynamic environment requires a holistic understanding of segmentation nuances and regional variations, guided by robust research and data-driven insights.

As stakeholders contemplate next steps, the ability to translate these insights into operational action will determine market success. The subsequent full report offers deeper dives into each area of interest, providing the granular intelligence needed to support critical decision-making and to chart a course toward sustainable growth.

Unlock Exclusive Strategic Insights and Expert Guidance on Navigating Rapid Industry Transformation with a Tailored Market Research Report

We invite you to deep dive into the full breadth of insights, strategic recommendations, and granular analysis provided in this comprehensive market research report. Connect with Ketan Rohom, Associate Director, Sales & Marketing, to discuss how these findings can inform your strategic priorities and investment decisions. Reach out today to secure your copy and gain a competitive edge in today’s dynamic technology landscape.

- How big is the Beaker Market?

- What is the Beaker Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?