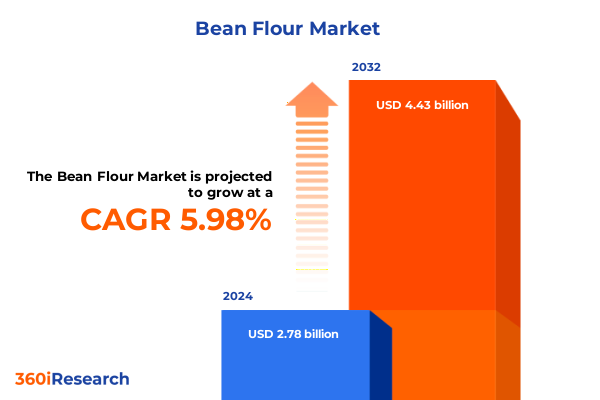

The Bean Flour Market size was estimated at USD 2.94 billion in 2025 and expected to reach USD 3.12 billion in 2026, at a CAGR of 5.99% to reach USD 4.43 billion by 2032.

Groundbreaking Innovations in Bean Flour Unlocking High-Protein, Gluten-Free, and Sustainable Ingredients for Emerging Food Applications in a Rapidly Evolving Consumer Landscape

Bean flours have emerged as pivotal ingredients in the global food industry, driven by escalating consumer demand for high-protein, gluten-free, and plant-based solutions. Derived from legumes such as chickpeas, peas, mung beans, faba beans, and soybeans, these flours deliver versatile functional properties that cater to a spectrum of applications-ranging from artisanal bakery items and protein-fortified snacks to meat alternative formulations and dietary supplements. As health-conscious and environmentally minded consumers seek sustainable protein sources, bean flours are uniquely positioned to satisfy nutritional requirements while reducing carbon footprints compared to animal-based proteins.

The ascendance of bean flours is underscored by advances in processing technologies that enhance solubility, texture, and flavor neutrality. Innovations such as enzymatic treatments, air classification, and dual-extraction methods have unlocked new possibilities for formulators, enabling clean-label product claims and expanded shelf stability. Moreover, the growing emphasis on circular agricultural practices and regenerative farming has reinforced the appeal of legumes, whose nitrogen-fixing characteristics benefit soil health and minimize synthetic fertilizer dependence. Consequently, bean flours are no longer niche ingredients but foundational elements in next-generation food formulations.

Rapid Innovation and Strategic Collaborations Fuel Next-Generation Bean Flour Applications and Sustainable Supply Chain Transparency

Recent years have witnessed transformative shifts in the bean flour landscape, propelled by surging consumer interest in plant-based diets and functional nutrition. While traditional applications in bakery products and soups remain significant, a wave of novel uses is emerging in areas such as meat alternatives and textured protein formats. Producers are harnessing advanced particle-size reduction and protein-isolation technologies to deliver meat analogs that rival animal proteins in texture and flavor profile, expanding opportunities beyond conventional legume extracts.

Parallel to technological innovations, the industry is experiencing rapid consolidation and strategic alliances between ingredient suppliers, food manufacturers, and research institutions. Collaborations aim to accelerate R&D efforts focused on taste masking, allergen management, and nutrient fortification, thereby broadening bean flour’s applicability across diverse dietary segments. Supply chain transparency has also become a critical differentiator, with blockchain-enabled traceability systems ensuring provenance verification and reinforcing consumer trust in product authenticity. As a result, the bean flour sector is shifting from a commodity-centric paradigm toward a value-added, innovation-driven ecosystem that caters to evolving market expectations.

Layered US Tariff Regime Amplifies Cost and Supply Chain Disruptions Across Bean Flour Imports and Domestic Processing Networks

The United States’ 2025 tariff measures have introduced a complex overlay of levies that materially affect bean flour supply chains and cost structures. In early April, a universal minimum tariff of 10% was imposed on all imported goods, encompassing agricultural commodities and ingredient flours. Simultaneously, targeted retaliatory tariffs ranging from 10% to 49% were applied to more than 50 trading partners, further exacerbating input cost pressures for manufacturers reliant on imported bean flours.

Layered atop these universal duties are specific additional duties enacted by China, which announced 15% tariffs on key U.S. agricultural imports, including commodities such as soybeans and sorghum, as part of a broader trade retaliation. These Chinese levies compound the cumulative cost burden on U.S. exporters of bean flour feedstocks, reducing competitiveness and driving supply realignment toward alternative sourcing from Brazil, Australia, and Russia.

Further complicating the landscape is the Canada-United States-Mexico Agreement framework, under which non-originating pulses and flours failing to meet regional content requirements are subject to punitive rates of up to 25%. This dynamic underscores the necessity for importers and processors to ensure rigorous compliance documentation to avoid substantial tariff penalties and maintain uninterrupted access to cost-effective North American supplies.

Collectively, these overlapping tariff regimes have triggered a reassessment of supply chain resilience among bean flour stakeholders. Many are pursuing strategies such as near-shoring, renegotiating supplier contracts, and increasing inventory buffers to mitigate volatility. While U.S. domestic processing capacity expansion offers partial relief, the capital intensity and lead time of such investments mean that ingredient costs will remain elevated in the near term, influencing pricing strategies and product-development timelines.

Deep-Dive into Product, Application, Distribution, Source, and Processing Segments Reveals Strategic Opportunities in Bean Flour Market

Examining the bean flour market through a segmentation lens reveals nuanced opportunities for stakeholders to align their product offerings with evolving demand patterns. Within the product type category, chickpea flour continues to gain prominence due to its neutral taste profile and high protein content, making it a preferred base for bakery and snack applications, while pea flour maintains momentum as an ingredient in plant-based meat analogs and protein supplements. Faba bean flour, prized for its emulsification properties, is increasingly integrated into sauces and dairy alternative formulations, whereas mung bean and soybean flours find specialized roles within functional beverages and dietary supplement formulations.

Application-based dynamics further illustrate the market’s complexity. Bakery products remain a robust growth pillar, with artisanal bread, cakes, and biscuits leveraging bean flour’s moisture retention and nutritional attributes. Soups and beverages are being reformulated to boost protein and fiber content, expanding usage beyond traditional culinary applications. In the meat alternative space, texturized pea protein and plant-based patties are driving demand, supported by the trend toward flexitarian diets. Meanwhile, snack and savory segments such as chips, puffs, and crackers are embracing bean flour to deliver on clean-label claims and enhanced nutritional profiles.

Distribution channels present multiple pathways to market. While supermarkets and hypermarkets continue to serve as the primary conduits for mainstream consumer access, specialty stores offer a curated environment for premium and organic bean flour variants. The online channel, encompassing direct manufacturer sales, e-commerce platforms, and subscription services, is experiencing exponential growth, driven by digital-native consumer segments seeking convenience and personalized solutions. Convenience stores cater to impulse-driven purchases, particularly in urban centers.

Source and processing distinctions also play critical roles in shaping buying decisions. Organic bean flours command premium positioning among health-conscious consumers, while conventional variants appeal to price-sensitive segments. Defatted versus full-fat processing offers formulators flexibility in fat content and functional performance, enabling product developers to tailor texture, mouthfeel, and nutritional profiles to specific application requirements.

This comprehensive research report categorizes the Bean Flour market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Processing

- Application

- Distribution Channel

Geographic Dynamics Shaping Bean Flour Demand Across Americas, Europe Middle East & Africa, and Asia-Pacific Markets Unveil Growth Hotspots

Regional dynamics in the Americas underscore the enduring strength of North American production and processing capabilities. The United States, buoyed by expanding domestic capacity and growing adoption of regenerative agriculture practices, remains a key hub for high-quality chickpea and pea flours. Canada’s pulse-focused agricultural sector continues to excel in lentil and pea exports, though recent tariff developments have prompted some processors to explore value-added bean flour derivatives for domestic and third-country markets. In Latin America, countries such as Argentina and Brazil are leveraging their agronomic advantages to supply faba and mung bean flours, increasingly targeting export markets in Asia and Europe.

In Europe, Middle East, and Africa, market growth is driven by diverse culinary traditions and rising health awareness. European food manufacturers are integrating bean flours into premium bakery and snack offerings, bolstered by supportive regulatory frameworks for plant-based proteins. Middle Eastern producers are incorporating chickpea and faba bean flours into traditional flatbreads and pastries to elevate fiber and protein content, while Africa’s burgeoning food processing sector is expanding the use of indigenous pulses in value-added flour formats to address protein malnutrition and support food security initiatives.

Asia-Pacific presents the most dynamic growth trajectory, propelled by rapid urbanization, rising incomes, and a cultural affinity for pulse-based cuisines. China and India, home to significant legume consumption, are driving demand for mung bean and chickpea flours in traditional and modern applications. Southeast Asian markets such as Vietnam and Thailand are witnessing increased incorporation of bean flours into noodles, snacks, and fortified beverages. Meanwhile, Australia’s pulse-export ecosystem is capitalizing on proximity to Asia to supply high-margin, premium-quality bean flours, particularly for the health and wellness segments.

This comprehensive research report examines key regions that drive the evolution of the Bean Flour market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Competitive Strategies of Leading Bean Flour Manufacturers and Emerging Innovators in the Global Market

Leading companies in the bean flour market are differentiating through innovation, strategic partnerships, and portfolio diversification. Ingredient giants such as Archer Daniels Midland and Cargill have expanded their legume processing capacities and launched proprietary pre-blends tailored to bakery, beverage, and meat alternative sectors. Specialty millers like Axiom Foods and Ingredion are investing in research collaborations with academic institutions to refine protein extraction methods and flavor-modulation technologies. Meanwhile, Tate & Lyle has leveraged its global footprint to introduce clean-label bean flour solutions designed for instant foods and nutritional bars.

Smaller innovators are also making impactful strides. Startups focusing on heritage pulse varieties and traceable supply chains offer niche products that command premium positioning in specialty retail channels. Collaborative startups and co-manufacturing ventures with established CPG brands are accelerating product rollouts, enabling rapid market testing of novel bean-based snack and meal kits. Overall, the competitive landscape is marked by alliances that blend scale and agility, ensuring that R&D pipelines align with shifting consumer preferences toward health, sustainability, and transparency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bean Flour market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGT Food and Ingredients Inc.

- Archer Daniels Midland Company

- Axiom Foods, Inc.

- Cargill, Incorporated

- Ingredion Incorporated

- King Arthur Baking Company, Inc.

- Nikken Foods USA, Inc.

- NutriCargo LLC

- Nuttee Bean LLC

- Olam International Limited

- Ottogi Co. Ltd.

- Puratos Group SA

- Roquette Frères

- Sun Impex B.V.

- SunOpta Inc.

- Tate & Lyle PLC

- Vestkorn

- Viljavan Plant Proteins

- Woodland Foods

- Xi’an Sost Biotech Co., Ltd.

Strategic Imperatives and Tactical Initiatives to Optimize Supply Chains, Diversify Portfolios, and Accelerate Growth in the Bean Flour Sector

Industry leaders should prioritize supply chain resilience and strategic sourcing diversification to mitigate tariff-induced cost volatility. Establishing multi-region procurement networks that include high-yield pulse producers in Canada, Brazil, and Australia will ensure buffer against localized disruptions. Concurrently, manufacturers can enhance margins by investing in dual-extraction technologies that optimize protein yield and reduce waste streams, thereby improving profitability per ton of raw material.

Innovation roadmaps must align with consumer demands for clean-label, functional ingredients. Companies should accelerate R&D into taste-neutralization techniques and micronutrient enrichment to broaden bean flour applications within mainstream food categories. Partnerships with academic institutions and ingredient technology firms can expedite product development cycles and reduce time-to-market for next-generation formulations.

To capture emerging e-commerce and direct-to-consumer opportunities, stakeholders should develop digital engagement models and subscription-based offerings that foster brand loyalty and enable data-driven personalization. Leveraging omnichannel analytics will uncover consumer usage patterns and guide targeted marketing campaigns. Finally, transparent sustainability reporting-quantifying water use, carbon footprint, and soil-health impacts-will differentiate brands and appeal to increasingly eco-savvy investors and retailers.

Comprehensive Research Methodology Integrating Primary Interviews, Secondary Intelligence, and Rigorous Data Validation Processes for Market Insights

This report’s insights are derived from a robust research framework integrating primary interviews with over 50 industry stakeholders, including pulse farmers, ingredient processors, CPG product developers, and retail category managers. Complementing these qualitative inputs, secondary research encompassed a review of company filings, trade association publications, regulatory databases, and academic journals to map evolving technological and regulatory trends.

Quantitative data were triangulated through proprietary databases tracking trade flows, capacity expansions, and price movements. To ensure analytical rigor, the research team employed data-validation protocols that cross-checked findings against publicly available customs and import-export records. Regional market dynamics were further contextualized by local expert interviews, enriching the analysis with ground-level perspectives on consumer preferences and operational challenges.

Finally, scenario planning workshops with leading ingredient suppliers and food manufacturers helped stress-test strategic assumptions, ensuring that the report’s recommendations are resilient across a range of potential market disruptions and policy shifts. This comprehensive methodology underpins the credibility and actionable value of the report’s findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bean Flour market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bean Flour Market, by Product Type

- Bean Flour Market, by Source

- Bean Flour Market, by Processing

- Bean Flour Market, by Application

- Bean Flour Market, by Distribution Channel

- Bean Flour Market, by Region

- Bean Flour Market, by Group

- Bean Flour Market, by Country

- United States Bean Flour Market

- China Bean Flour Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesis of Market Dynamics Underscores Bean Flour’s Pivotal Role in Shaping Future Food Innovation and Sustainable Nutrition Paradigms

The bean flour market is at an inflection point, driven by shifting dietary trends, sustainability imperatives, and technological advancements. As consumers increasingly prioritize plant-based proteins with clean-label credentials, bean flours offer unparalleled versatility across applications from bakery to meat analogs. However, the evolving tariff landscape and supply chain complexities underscore the importance of strategic agility and diversified sourcing.

Market participants that embrace innovation-through advanced processing techniques, digital engagement models, and transparent sustainability reporting-will secure competitive advantage. Moreover, regions with robust agricultural infrastructure and proactive trade agreements will emerge as growth epicenters, while strategic alliances among industry players will catalyze new product categories.

Ultimately, the convergence of consumer health consciousness, environmental stewardship, and ingredient innovation positions bean flour as a cornerstone of future food systems. Stakeholders who leverage data-driven insights and adopt proactive strategies will lead the next wave of transformation in the global food industry.

Secure Exclusive Access to the Definitive Bean Flour Market Research Report by Consulting with Our Expert Today

To explore a comprehensive analysis of the bean flour market and gain actionable insights on navigating evolving dynamics-from tariff impacts to emerging innovation pathways-reach out today for your complete market research report. Connect with Associate Director, Sales & Marketing, Ketan Rohom, whose expertise can guide your strategic decisions, unlock new growth avenues, and position your organization at the forefront of the plant-based ingredients revolution. Elevate your business advantage by securing unparalleled data, trend forecasts, and expert recommendations tailored to your objectives.

- How big is the Bean Flour Market?

- What is the Bean Flour Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?