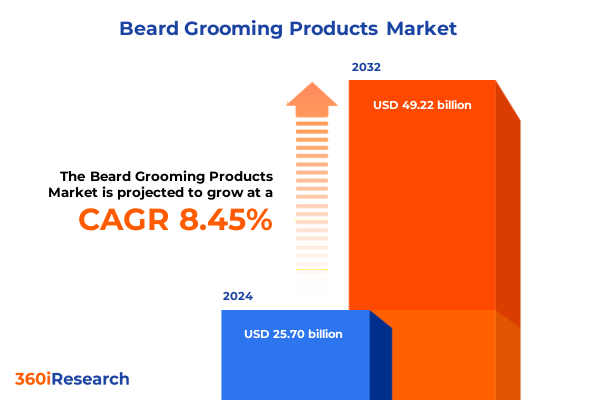

The Beard Grooming Products Market size was estimated at USD 27.88 billion in 2025 and expected to reach USD 30.08 billion in 2026, at a CAGR of 8.45% to reach USD 49.22 billion by 2032.

Unveiling the Rising Momentum in Beard Grooming Culture and Understanding the Driving Forces Shaping Consumer Preferences and Industry Trajectory

Beard grooming has transcended its traditional role as mere personal maintenance to become a distinct lifestyle marker reflecting broader shifts in male self-expression. Consumers are no longer satisfied with one-size-fits-all solutions; they expect formulations that deliver targeted benefits such as enhanced growth, conditioning, and styling control. Innovative ingredients like plant-derived oils, bioactive peptides, and fortified vitamins are meeting these needs while fostering a perception of wellness-oriented care. Consequently, grooming routines are maturing into curated rituals that merge functionality with a sensory experience.

This evolution is underpinned by a growing convergence of grooming and beauty, wherein men increasingly prioritize skin health alongside beard styling. Such integration has fueled demand for hybrid formulations featuring moisturizing agents and anti-inflammatory extracts, bridging the gap between beard-specific products and broader skincare regimens. As a result, brands that seamlessly blend performance with an elevated user experience are gaining traction among discerning consumers.

With heightened attention on personal appearance amplified by social media and digital communities, the industry finds itself at a pivotal juncture. Against this backdrop, stakeholders require a nuanced understanding of consumer motivations, ingredient preferences, and channel dynamics to craft compelling value propositions. This report lays the groundwork by introducing key factors shaping the modern beard grooming market.

Examining How Technological Innovation, Shifting Grooming Rituals, and Evolving Male Beauty Standards Are Redefining the Beard Care Market Landscape Globally

The beard grooming landscape is undergoing transformative shifts driven by rapid technological advancements, changing consumer rituals, and evolving definitions of masculinity. Research and development investing heavily in ingredient science has led to formulations with improved bioavailability and targeted efficacy. Such breakthroughs are enabling brands to tout verifiable benefits like accelerated hair microcirculation and enhanced cuticle repair, redefining product benchmarks and fueling competitive differentiation.

Simultaneously, grooming rituals are being reimagined as consumers seek bespoke experiences that blend care with self-indulgence. Digital platforms are democratizing access to expert styling tips, fostering micro-communities around artisan brands, and elevating obscure grooming techniques to mainstream popularity. The resulting cultural momentum is prompting established players to adopt agile, consumer-centric models, integrating user feedback loops into product development cycles for greater responsiveness.

Finally, shifting male beauty standards are expanding the notion of grooming from a niche pursuit to a universal expression of personal identity. As more men embrace grooming as an essential component of self-care, the industry’s scope is broadening to encompass holistic solutions. This redefinition of market boundaries underscores the importance of staying attuned to cultural undercurrents, ensuring that product portfolios resonate with both traditional and emerging consumer archetypes.

Analyzing the Ripple Effects of 2025 United States Import Tariffs on Supply Chains, Cost Structures, and Competitive Dynamics in the Beard Grooming Sector

The introduction of significant United States import tariffs in 2025 has produced far-reaching consequences for the beard grooming industry’s supply chains, cost structures, and competitive dynamics. Manufacturers reliant on imported raw materials such as specialty oils, botanical extracts, and packaging components are confronting elevated landed costs. This has triggered a wave of supplier renegotiations and accelerated efforts to secure alternative sources in tariff-exempt jurisdictions.

In response, many brands are reevaluating production footprints and forging localized partnerships to mitigate duty burdens. Packaging strategies are likewise under review, as companies seek lightweight and compliant solutions that reduce import liabilities. These shifts are creating new centers of excellence, particularly in North America and select Asia-Pacific hubs, where tariff exposure is less acute.

Competitive positioning is also being reexamined, with incumbents and new entrants alike adjusting pricing frameworks and value propositions. Brands that can absorb or offset incremental costs through premiumization or operational efficiencies are solidifying their market standing, while those unable to adapt risk margin erosion. Consequently, understanding the evolving tariff landscape and its operational implications has become indispensable for strategic planning and sustained market success.

Uncovering Core Consumer and Trade Segments in Beard Grooming Through In-Depth Analysis of Product Types, End Users, and Distribution Channels

A nuanced view of the market emerges by exploring segmentation across product type, end user, and distribution channel. Product type analysis reveals divergent growth patterns: beard balms command attention for conditioning rituals, beard oils appeal through lightweight nourishment, beard wash and conditioner formulations cater to holistic cleansing, beard wax supports precision styling, and grooming kits offer convenience for both novices and enthusiasts.

Examining end user dynamics uncovers the interplay between personal use rituals and professional grooming services. Personal users value formulations that integrate seamlessly into daily self-care routines, whereas professional stylists prioritize robust performance, consistency, and package sizes that support high-volume applications in barbershop settings. Aligning product innovation with the distinct criteria of these user cohorts is critical for broad market penetration.

Assessing distribution channel strategies highlights the importance of reach and customer engagement. Barbershops and salons offer curated expert recommendations that drive trial, mass merchandisers enable visibility across mainstream audiences, online retail provides customization and subscription models that build loyalty, and specialty stores deliver niche curation for devoted enthusiasts. A channel-agnostic approach that balances breadth with differentiated experiences ultimately underpins sustained brand growth.

This comprehensive research report categorizes the Beard Grooming Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Distribution Channel

Mapping Regional Nuances and Growth Drivers Across the Americas, EMEA, and Asia-Pacific to Reveal Emerging Hotspots and Consumer Preferences

Regional nuances underscore the significance of tailoring strategies to local market idiosyncrasies. In the Americas, a blend of mainstream retail penetration and digital direct-to-consumer models has created fertile ground for premium and mass segments alike. Consumer familiarity with elaborate grooming routines and willingness to invest in high-performance ingredients have positioned this region as a bellwether for innovation adoption.

Europe, Middle East & Africa (EMEA) presents a mosaic of regulatory frameworks and cultural grooming traditions. Western European markets emphasize natural and clean-label positioning, whereas emerging economies in the region are experiencing rapid expansion of professional barbershop networks. Meanwhile, Middle Eastern consumers are gravitating toward luxury formulations that blend heritage botanicals with contemporary science, highlighting the value of localized ingredient storytelling.

Asia-Pacific continues to evolve as a dynamic arena characterized by rapid urbanization and digital commerce uptake. Markets like Japan and South Korea lead in advanced grooming regimens, often introducing multifunctional products that address skin and hair in tandem. At the same time, Southeast Asia is witnessing grassroots growth of micro-brands leveraging social media influencers to engage younger demographics, signaling the importance of agile marketing approaches.

This comprehensive research report examines key regions that drive the evolution of the Beard Grooming Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves by Leading Beard Care Companies and Their Innovations Shaping Competitive Positioning and Future Industry Dynamics

Key industry participants are differentiating through a combination of product innovation, strategic partnerships, and brand storytelling. Established beauty conglomerates have leveraged their R&D capabilities and distribution scale to introduce premium beard care lines that align with advancing consumer expectations. These entrants are capitalizing on cross-category synergies, integrating beard formulations into broader personal care portfolios.

Simultaneously, nimble specialist brands are carving out leadership in niche segments by embracing agile product development cycles and direct-to-consumer frameworks. They are engaging communities through content-driven marketing, harnessing user-generated feedback to refine formulations and accelerate time-to-market. This grassroots approach is fostering striking loyalty and word-of-mouth advocacy among enthusiasts.

Collaborative ventures are also emerging, as companies partner with ingredient innovators, packaging specialists, and retail networks to optimize operations and expand market access. Licensing agreements and co-branded launches are proliferating, offering fresh growth vectors while mitigating development risks. These collective efforts are reshaping competitive positioning and underscoring the value of strategic alliances in a crowded landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beard Grooming Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baxter of California

- Beardbrand

- Billy Jealousy

- Cremo Company

- Duke Cannon Supply Co.

- Edgewell Personal Care

- Every Man Jack

- Grave Before Shave

- Hawkins & Brimble

- Honest Amish

- Jack Black

- L'Oréal S.A.

- Mountaineer Brand

- Murdock London

- Shear Revival

- The Art of Shaving

- The Procter & Gamble Company

- Unilever PLC

- Uppercut Deluxe

- Viking Revolution

Empowering Industry Leaders with Tactical Recommendations to Capitalize on Market Opportunities and Navigate Emerging Challenges in Beard Grooming

Industry leaders looking to outpace competition should prioritize a multi-pronged strategy that blends product excellence with consumer-centric engagement. Investing in R&D to formulate differentiated blends infused with validated functional ingredients will drive both premium perception and repeat usage. In parallel, developing customizable offerings that resonate with individual grooming rituals can foster deeper brand affinity.

Enhancing digital touchpoints is equally critical. By leveraging data-driven insights from e-commerce interactions and social platforms, companies can tailor communications, refine targeting, and anticipate emerging trends. Complementary investments in subscription models and loyalty programs will sustain recurring revenue while delivering personalized experiences.

Furthermore, forging sustainable partnerships across the value chain-from ethically sourced raw material suppliers to eco-conscious packaging innovators-will reinforce brand trust. Aligning with evolving regulatory and environmental standards preemptively can secure long-term resilience. Ultimately, actioning these recommendations in an integrated manner will enable industry leaders to optimize growth, reduce vulnerability to external shocks, and maintain a competitive advantage.

Detailing the Robust Research Framework Employed to Ensure Credible Data Collection, Analytical Rigor, and Comprehensive Insights into Beard Grooming Dynamics

This report’s insights are grounded in a comprehensive research framework integrating primary and secondary methodologies. Primary research involved in-depth interviews with industry executives, formulators, and channel partners to capture qualitative perspectives on innovation drivers and distribution dynamics. Complementing these dialogues, expert surveys provided quantitative validation of emerging preferences and market momentum.

Secondary research leveraged reputable publications, trade journals, and regulatory filings to contextualize trends and consolidate historical data. This phase also included a review of patent databases, ingredient registries, and competitive intelligence reports to map the innovation landscape. Data triangulation ensured the corroboration of findings and minimized biases.

Analytical rigor was maintained through a structured approach to data synthesis, including cross-segmentation comparisons and scenario-based analyses. Consistent quality checks and peer reviews were employed to verify the report’s integrity. The combination of robust data collection, exhaustive validation, and proprietary analytical models underpins the credibility and actionability of the strategic insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beard Grooming Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beard Grooming Products Market, by Product Type

- Beard Grooming Products Market, by End User

- Beard Grooming Products Market, by Distribution Channel

- Beard Grooming Products Market, by Region

- Beard Grooming Products Market, by Group

- Beard Grooming Products Market, by Country

- United States Beard Grooming Products Market

- China Beard Grooming Products Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Synthesizing Key Findings to Illuminate the Path Forward for Stakeholders Seeking Strategic Advantage and Sustainable Growth in the Beard Grooming Arena

The evidence compiled throughout this report underscores a clear mandate for innovation, agility, and consumer-centricity in the beard grooming sector. Technological progress is enabling the development of sophisticated formulations that transcend traditional product boundaries, while shifting cultural norms are expanding the definition of male self-care. These dynamics point to sustained momentum for brands that can navigate the interplay of ingredients, rituals, and channels.

Navigating external pressures such as tariff adjustments and evolving regulations will demand strategic foresight and operational flexibility. Meanwhile, the stratification of market segments-across product types, end-user applications, and distribution networks-highlights the imperative of tailored strategies. Brands that effectively integrate regional considerations, align with consumer values, and cultivate partnerships will be best positioned to capture emerging opportunities.

Taken together, these insights affirm that success hinges on a balanced approach: relentless innovation, rigorous market intelligence, and an unwavering focus on value creation. By synthesizing these principles, stakeholders can chart a path toward sustainable growth and lasting brand equity in an increasingly competitive landscape.

Engage with Ketan Rohom to Secure Detailed Insights with a Tailored Beard Grooming Market Research Report That Drives Strategic Decision-Making

For organizations poised to harness in-depth market intelligence and identify actionable strategies tailored to the dynamic beard grooming sector, connecting directly with Ketan Rohom, Associate Director of Sales & Marketing, will unlock bespoke guidance and prioritized insights. By engaging with Ketan Rohom, decision-makers can secure a comprehensive market research report designed to support critical choices around product innovation, channel expansion, and competitive positioning. This report, enriched with granular analysis and expert interpretation, delivers the clarity needed to navigate evolving consumer preferences and regulatory landscapes.

Readers are encouraged to arrange a personalized consultation to explore specific market drivers, emerging growth pockets, and strategic differentiators highlighted within the report. Whether seeking to refine product formulations, expand distribution networks, or optimize pricing frameworks, Ketan Rohom will facilitate access to tailored data sets, strategic briefs, and implementation roadmaps. Reach out to initiate an exploratory discussion and ensure your organization stays at the forefront of the beard grooming market.

- How big is the Beard Grooming Products Market?

- What is the Beard Grooming Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?