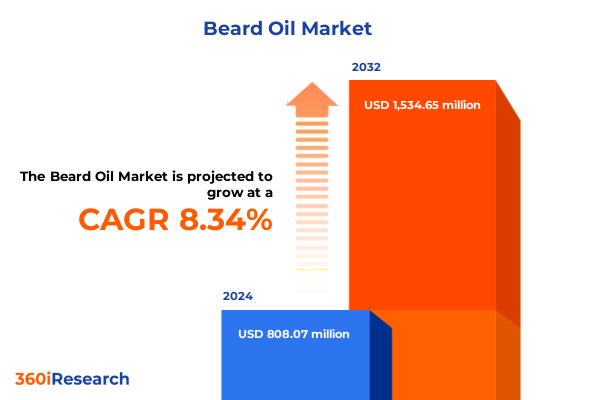

The Beard Oil Market size was estimated at USD 871.03 million in 2025 and expected to reach USD 941.59 million in 2026, at a CAGR of 8.42% to reach USD 1,534.65 million by 2032.

Unveiling the Dynamic Growth Landscape of the Global Beard Oil Market Driven by Shifting Grooming Rituals, Premium Self-Care Trends, and Consumer Lifestyle Evolution

The global beard oil market has undergone a period of remarkable transformation as grooming rituals evolve beyond mere maintenance to become expressions of personal style and self-care. Fueled by a growing emphasis on premium self-care products, the sector has matured into a vibrant ecosystem where innovation and consumer engagement converge. In this introduction, the underlying forces shaping market growth are explored, highlighting how lifestyle trends and shifting perceptions of masculinity have elevated beard oil from a niche offering to a mainstream essential in daily grooming routines.

As male grooming continues to garner attention from both consumers and established personal care players, the beard oil segment has emerged as a strategic focal point for brands looking to capture discerning audiences. Premiumization of ingredient sourcing, from cold-pressed argan to vitamin-enriched formulations, underscores the market’s pivot toward efficacious, transparent product experiences. Consequently, the landscape now features not only legacy herbalists but also digitally native brands leveraging social media influence to cultivate loyalty and drive trial among younger demographics.

Moreover, regulatory scrutiny around cosmetic claims, clean-label standards, and sustainability imperatives has prompted stakeholders to fortify their value propositions with verifiable certifications and eco-conscious packaging solutions. As consumer expectations continue to evolve, this report sets the stage by defining the critical market dynamics and outlining the broader opportunities and challenges that lie ahead for stakeholders invested in the future of beard oil.

Exploring the Convergence of Clean Beauty, D2C Innovation, and Sustainability Commitments That Are Redefining the Beard Oil Industry

Over the past few years, the beard oil industry has witnessed several transformative shifts that have redefined competitive strategies and consumer expectations. Initially characterized by artisanal, small-batch offerings, the market has since morphed into a space where advanced formulations, multifunctional benefits, and sensory experiences take center stage. This evolution has been catalyzed by the convergence of clean beauty principles with male grooming needs, resulting in a surge of natural, plant-based oils and nutrient-rich serums designed to deliver both aesthetic and wellness outcomes.

In parallel, the ascendancy of direct-to-consumer models has reconfigured distribution paradigms, empowering brands to establish deeper connections with end users through personalized messaging and subscription services. Digital channels now serve as critical touchpoints for education, styling inspiration, and community building, thereby fostering higher retention rates and amplified word-of-mouth advocacy. Consequently, traditional retail outlets are recalibrating their assortments to feature exclusive collaborations, curated gift sets, and experiential activations that mirror the online discovery journey.

Simultaneously, sustainability has emerged as a core differentiator, compelling manufacturers to adopt refillable packaging systems, carbon-neutral sourcing commitments, and fair-trade supply chains. As industry players navigate this new frontier, collaboration with ingredient innovators and regulatory bodies ensures that product integrity remains intact while meeting consumer demands for transparency. Collectively, these shifts illustrate a market in momentum-one in which adaptability and consumer-centric innovation will determine the next wave of leaders.

Analyzing the Ramifications of United States Cosmetic Tariff Policies on Supply Chain Strategies, Cost Structures, and Ingredient Innovation in 2025

In 2025, the United States implemented a series of targeted tariffs on imported cosmetics and personal care raw materials, fundamentally altering the cost structure for beard oil manufacturers. With import duties applied to a range of oils, botanical extracts, and specialized packaging components, companies have faced upward pressure on input costs, prompting strategic reassessments across procurement and pricing strategies. As a result, several brands have accelerated efforts to localize their supply chains, forging partnerships with domestic growers of jojoba and argan analogs, and investing in regional contract manufacturing to mitigate exposure to tariff volatility.

The cumulative impact of these tariffs extends beyond cost considerations to broader supply chain resilience. Firms have initiated comprehensive risk assessments to identify critical dependencies, diversify supplier portfolios, and optimize inventory buffers. In tandem, pricing models have been adjusted to safeguard margin integrity while preserving affordability for end consumers. Premium-tier brands have absorbed a significant portion of increased costs in order to maintain brand equity, whereas value-oriented players have explored leaner formulations and streamlined packaging to minimize price escalations.

Despite these challenges, the tariff environment has also spurred innovation. Companies are exploring novel feedstocks such as sustainably farmed marula and moringa oils to circumvent duty classifications, and leveraging advanced cold-pressing technologies to enhance yield efficiency. Collectively, these measures illustrate how the industry is adapting to regulatory headwinds by reengineering its operational blueprint and reaffirming its commitment to product quality and consumer trust.

Decoding Consumer Behavior Through Multifaceted Segmentation Across Gender Identities, Formulations, Distribution Paths, Generational Preferences, and Price Tiers

Diving deeper into market composition reveals nuanced consumer behaviors and product preferences across various demographic and product dimensions. When analyzing gender-based segmentation, it becomes clear that while the male cohort remains the core audience for beard care, there is an emerging female segment drawn to unisex formulations for hair nourishment and styling versatility. In this context, brands are crafting gender-neutral narratives and multipurpose oils that appeal to a broader audience without diluting the product’s efficacy.

Product form segmentation further underscores the importance of tailored formulations. Oil-based blends represent the backbone of the portfolio, with variants formulated around argan oil for intense hydration, coconut oil for hair strengthening, and jojoba oil for scalp health. Concurrently, balm offerings bifurcate into gel-based textures for light, matte finishes and wax-based options for robust hold and styling control. Meanwhile, advanced serums-both multi-compound blends and vitamin-enriched concentrates-address specialized concerns such as follicle stimulation and beard density enhancement.

Channel dynamics also play a pivotal role in market access. The continued expansion of online retail channels has enabled niche brands to achieve global reach, while pharmacies and drugstores serve as trusted outlets for consumers seeking dermatologist-recommended options. Specialty retailers curate premium assortments that highlight artisanal heritage and ingredient provenance, and supermarkets offer convenient, competitively priced essentials that cater to value-seeking shoppers.

Age remains a defining lens through which purchase behavior is interpreted. Younger consumers in the 18 to 24 bracket gravitate toward digital-first, influencer-endorsed micro-brands, whereas the 25 to 34 cohort seeks a balance of performance and prestige. Those aged 35 to 44 prioritize wellness benefits and ingredient transparency, and the 45-plus demographic focuses on ease of use and hair health maintenance. Price tier segmentation reveals a stratified landscape where luxury offerings command aspirational appeal, premium labels deliver a blend of efficacy and design, mid-market products drive mass adoption, and value-priced lines ensure accessibility across income levels.

This comprehensive research report categorizes the Beard Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Age Group

- Distribution Channel

Mapping the Diverse Growth Trajectories of the Beard Oil Market Across the Americas, Europe Middle East Africa, and Asia Pacific Regions

Regional dynamics illustrate diverse market trajectories shaped by localized consumer preferences, regulatory regimes, and competitive ecosystems. In the Americas, the market is characterized by strong digital penetration and a penchant for innovative, functional ingredients sourced through transparent supply chains. The rise of grooming salons offering dedicated beard services and the popularity of men’s lifestyle content have reinforced category visibility, making North America a bellwether for new product introductions and retail partnerships. Latin American markets, meanwhile, reflect a growing middle class that values premiumization, with domestic manufacturers beginning to replicate global trends in branded grooming concepts.

Europe, the Middle East, and Africa present a mosaic of maturity levels and regulatory frameworks. Western Europe is distinguished by rigorous cosmetic regulations and high consumer expectations for sustainability credentials, driving demand for organic and cruelty-free beard oils. In the Middle East, a cultural heritage of traditional grooming rituals coexists with a burgeoning appetite for modern formulations, especially in urban centers where luxury shopping destinations accentuate brand prestige. African markets are in the early stages of category development, but increasing urbanization and rising disposable incomes have prompted leading personal care companies to pilot localized beard oil lines that incorporate indigenous botanical extracts.

Across the Asia-Pacific region, rapid urban growth and escalating interest in male grooming have converged to create significant opportunity. East Asian markets emphasize minimalistic, multifunctional personal care products that integrate skincare benefits, while South Asian consumers blend tradition with innovation by incorporating ayurvedic ingredients into contemporary oil formulations. In Australasian territories, eco-conscious packaging and clean-label messaging resonate strongly, further propelled by robust e-commerce infrastructures that facilitate cross-border brand discovery. These varied regional narratives underscore the importance of tailored go-to-market strategies and localized value propositions.

This comprehensive research report examines key regions that drive the evolution of the Beard Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unpacking Competitive Dynamics and Strategic Positioning Among Independent Artisanal Labels, Digital-First Brands, and Corporate Personal Care Giants

Competitive intensity within the beard oil segment is defined by a spectrum of legacy family-owned companies, digitally native challengers, and established personal care conglomerates venturing into male grooming. Leading independent brands distinguish themselves through proprietary ingredient blends and artisanal craftsmanship, often spotlighting small-farm collaborations for exotics such as argan and moringa oils. In contrast, digitally born enterprises leverage social media ecosystems to cultivate evangelical followings, deploying user-generated content campaigns that convert engaged audiences into loyal customers.

Major consumer goods companies are extending their portfolios to encompass beard care lines, leveraging global distribution networks and economies of scale to secure prime shelf placements in both bricks-and-mortar outlets and online marketplaces. These incumbents often drive category education through multimedia advertising and strategic retail alliances, while innovating with hybrid formats that blend beard oil benefits with complementary skincare functionalities. Furthermore, mergers and acquisitions have surfaced as a key strategic lever, with well-funded players acquiring niche grooming brands to accelerate time to market and expand their demographic reach.

Regardless of scale, top industry participants share a commitment to ongoing product innovation. Mastery of scent profiles-ranging from earthy woodsy accords to subtle citrus-infused compositions-has become a hallmark of differentiation alongside evidence-backed claims around hair density improvement and scalp conditioning. Collectively, these competitive dynamics illustrate a market in which agility, authenticity, and distribution prowess are critical for sustained leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beard Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acticon Life Sciences Pvt. Ltd.

- Aveolabs Global Private Limited

- Ayurgen Herbals Pvt. Ltd.

- Beardbrand, Inc.

- Beardo Personal Care Pvt. Ltd.

- Bossman Brands, LLC

- Cremo Company, LLC

- Glamcos Lifestyle Private Limited

- Grave Before Shave, LLC

- Harrods Health Private Limited

- Honest Amish Beard Care, LLC

- Horace SAS

- Jack Black, LLC

- Mamaearth Pvt. Ltd.

- Man Arden Pvt. Ltd.

- Mountaineer Brand, Inc.

- Procter & Gamble Company

- Pura D’or, LLC

- Scientify Orgichem Private Limited

- Smooth Viking, Inc.

- Suryaveda Cosmeceuticals Private Limited

- The Beard Club, Inc.

- Viking Revolution, LLC

- Wild Willies Products, LLC

Formulating a Future-Ready Playbook Centered on Ingredient Innovation Digital Engagement Diversified Sourcing and Sustainability Leadership

To capitalize on emerging opportunities, industry leaders should prioritize ingredient innovation that aligns with consumer demands for natural, multifunctional formulations and transparent sourcing narratives. Investing in research partnerships with agricultural cooperatives and biotechnology firms can yield proprietary extracts that offer differentiated benefits while reinforcing supply chain resilience. Furthermore, expanding digital engagement through immersive experiences-such as augmented reality grooming tutorials or personalized regimen recommendations-can deepen brand affinity and foster higher lifetime value.

In light of ongoing tariff pressures, companies must continue to diversify supplier networks and pursue nearshore manufacturing to stabilize input costs and enhance responsiveness. Developing modular production platforms capable of accommodating alternative oil feedstocks will minimize operational disruptions and enable swift adaptation to regulatory changes. Parallel to this, adopting a tiered pricing architecture-where premium, mid-range, and value propositions coexist under a unified brand umbrella-will allow firms to serve distinct consumer segments without compromising positioning.

Additionally, strategic collaborations with professional grooming salons and dermatological clinics can validate efficacy claims and amplify credibility, particularly for medically inclined formulations targeting beard health. Engaging micro-influencers across key markets will support targeted penetration in both urban centers and emerging regions. Lastly, embedding sustainability across business practices-ranging from refillable packaging initiatives to carbon offset programs-will not only meet regulatory expectations but also resonate with the eco-conscious consumer base that increasingly influences purchasing decisions.

Employing an Integrated Approach of Primary Interviews Secondary Data Analysis and Expert Validation to Deliver Rigorous Market Intelligence

This research integrates both quantitative and qualitative methodologies to ensure robust and reliable insights. Primary data collection involved in-depth interviews with industry veterans, ingredient suppliers, and retail channel executives, complemented by structured surveys administered to a representative sample of end consumers. These engagements provided firsthand perspectives on evolving preferences, pricing sensitivities, and unmet needs across demographic cohorts.

Secondary research encompassed a comprehensive review of trade publications, regulatory databases, and proprietary patent filings to track product innovations, distribution agreements, and legislative developments. Market intelligence platforms were analyzed to validate historical trend trajectories and benchmark performance metrics across key players. Data triangulation techniques were applied to reconcile discrepancies between sources and refine the analytical framework, ensuring the findings reflect an accurate synthesis of the most credible information available.

Finally, an expert validation panel was convened, incorporating perspectives from cosmetic scientists, supply chain analysts, and retail strategists to vet assumptions and contextualize emerging themes. This iterative process enhanced the rigor of the research, enabling a holistic understanding of market dynamics, risk factors, and growth enablers. Limitations pertaining to geopolitical shifts and unforeseen regulatory amendments are addressed, with recommendations for ongoing monitoring to maintain relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beard Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beard Oil Market, by Product Form

- Beard Oil Market, by Age Group

- Beard Oil Market, by Distribution Channel

- Beard Oil Market, by Region

- Beard Oil Market, by Group

- Beard Oil Market, by Country

- United States Beard Oil Market

- China Beard Oil Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Summarizing Critical Market Imperatives Synthesizing Growth Drivers Challenges and Strategic Pathways for Future Leadership

In summary, the beard oil market stands at a pivotal juncture characterized by potent growth drivers and evolving challenges. Consumer appetite for premium, efficacious formulations has elevated industry standards, while digital innovation and sustainability imperatives continue to reshape competitive landscapes. Tariff-induced cost pressures underscore the importance of agile supply chain strategies and strategic ingredient diversification. Concurrently, the complex interplay of demographic preferences and regional nuances demands tailored approaches to product development, pricing, and channel strategy.

Looking ahead, stakeholders that successfully navigate these complexities will be those who combine deep consumer understanding with operational flexibility and a clear purpose-driven narrative. By investing in research-backed innovation, cultivating data-driven engagement models, and reinforcing commitments to transparency and environmental stewardship, market participants can secure a durable advantage within this dynamic sector. Ultimately, the confluence of creativity, strategic foresight, and rigorous execution will determine who leads the next wave of growth in the beard oil industry.

Secure Exclusive Access to the Complete Beard Oil Market Research Report Through Direct Engagement With Our Associate Director of Sales and Marketing

For a deeper dive into the comprehensive findings, customized analysis, and strategic recommendations tailored to leadership priorities, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, who will guide you through the process of acquiring the full market research report and unlock the actionable insights your organization needs for competitive advantage.

- How big is the Beard Oil Market?

- What is the Beard Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?