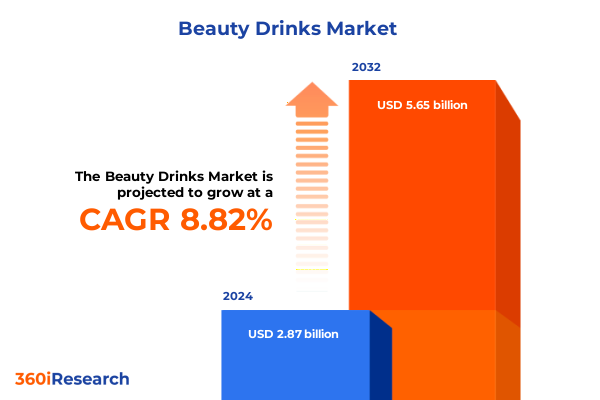

The Beauty Drinks Market size was estimated at USD 3.09 billion in 2025 and expected to reach USD 3.33 billion in 2026, at a CAGR of 8.97% to reach USD 5.65 billion by 2032.

Setting the Stage for the Beauty Drinks Market Through an Overview of Consumer Aspirations, Ingredient Innovation, and Regulatory Considerations

The beauty drinks sector has emerged at the intersection of the wellness revolution and consumer demand for functional benefits, redefining how individuals approach self-care and personal expression through beverages. No longer limited to basic hydration, these innovative formulations promise improvements in skin health, hair strength, and overall vitality while aligning with broader lifestyle aspirations. In this context, consumers view beauty drinks not merely as supplements but as part of a daily ritual that supports holistic wellbeing and reflects a growing desire for tangible, experience-driven products.

Behind this consumer embrace lies a surge in ingredient innovation, where collagen peptides, potent antioxidants, botanicals, vitamins, and minerals converge in synergistic blends designed to target specific beauty outcomes. Brands are experimenting with adaptogens like ashwagandha for stress management, collagen for structural support, and vitamins such as B-complex, vitamin C, vitamin E, and zinc for antioxidant and regenerative benefits, translating scientific insights into marketable value propositions.

Digital engagement has further accelerated market momentum, as brands leverage social media influencers, immersive content, and personalized e-commerce platforms to cultivate communities around beauty and wellness. This evolution has transformed point-of-purchase experiences, enabling targeted sampling, tailored subscription models, and data-driven product customization that strengthen consumer loyalty and deepen brand resonance.

Amidst this dynamism, regulatory considerations play a crucial role in shaping product development and marketing strategies. Adherence to FDA guidelines for Generally Recognized as Safe ingredients, accurate structure-function claims, and updated definitions of "healthy" ensures both consumer safety and compliance. These regulations, while complex, offer a framework within which innovators can confidently explore novel formulations and elevate category credibility.

Uncovering the Transformative Shifts Reshaping Beauty Drinks with Health Priorities, Digital Engagement, and Sustainability Imperatives

The landscape of beauty drinks is undergoing profound transformations driven by evolving consumer priorities and market forces. Increasingly, health and wellness have taken center stage, with consumers seeking products that deliver demonstrable beauty benefits alongside holistic well-being. This shift reflects a broader cultural movement toward self-optimization, where everyday routines are imbued with purpose and measurable outcomes.

Digital technologies have emerged as catalysts for change, redefining how brands connect, engage, and co-create with their audiences. From interactive social media campaigns and influencer partnerships to AI-powered personalization engines, beauty drink companies are leveraging digital touchpoints to build immersive, data-rich experiences that resonate with tech-savvy consumers and drive meaningful brand loyalty.

Simultaneously, sustainability imperatives are reshaping sourcing, packaging, and supply chain practices across the sector. Brands are exploring sustainable ingredient procurement, eco-friendly packaging formats, and circular economy models to align with environmentally conscious consumers. This convergence of health, digital engagement, and sustainability marks a fundamental shift that will define competitive advantage and long-term viability within the beauty drinks market.

Examining the Cumulative Impact of 2025 United States Tariffs on Supply Chains, Pricing Strategies, and Competitive Dynamics in Beauty Drinks

As 2025 ushered in a comprehensive tariff framework, beauty drink companies faced heightened import duties that reverberated across their supply chains. The U.S. government’s decision to impose elevated baseline tariffs substantially increased procurement costs for essential ingredients sourced from global markets. Economists have noted that these elevated tariff levels, combining universal duties with country-specific surcharges, represent the highest effective rates in decades, placing pressure on producers and triggering strategic recalibrations across the value chain.

Raw material inputs for beauty drinks, such as specialized botanicals and nutraceutical compounds, experienced significant cost escalations. Companies reliant on imported ingredients from key suppliers in Latin America, Southeast Asia, and Europe reported double-digit increases in procurement expenses. These surcharges extended to packaging inputs as well, with duties on food-grade aluminum, plastic films, and paperboard adding further cost burdens to ready-to-drink and sachet formats, driving manufacturers to explore alternative materials and domestic sourcing options.

Transportation and logistics also felt the impact of the new tariff environment. Stricter customs protocols and longer processing times at ports slowed cross-border movement of perishable and fragile beauty drink products, compelling companies to recalibrate inventory strategies for resilience. Many have accelerated investments in near-shoring and regional distribution centers to mitigate delays and buffer against supply chain volatility.

Despite these challenges, industry leaders have demonstrated adaptability by embracing cost-containment strategies, such as renegotiating supplier contracts and absorbing portions of tariff increases to maintain price stability. However, the cumulative effect of the 2025 tariffs continues to shape competitive dynamics, prompting brands to refine value propositions and reinforce supply chain agility to sustain growth under the new economic landscape.

Deriving Key Segmentation Insights from Ingredient Type, Distribution Channel, Packaging Format, and Consumer Age Group Dynamics

Understanding consumer preferences through ingredient type reveals that antioxidants, botanicals, collagen peptides, and a range of vitamins and minerals are at the core of beauty drink formulations. Within the vitamins and minerals segment, companies are tailoring blends of B-complex vitamins, vitamin C for collagen synthesis, vitamin E for its antioxidant properties, and zinc for immune support. These ingredient categories illustrate the diversity of functional propositions available, as well as the depth of formulation expertise brands must harness to deliver targeted beauty benefits.

Distribution strategies further differentiate market players and influence reach. Some brands have fostered direct-to-consumer channels that allow for personalized subscription models and custom bundling, while others leverage online retail platforms to tap into e-commerce growth. Traditional pharmacy and drugstore outlets remain vital for consumers seeking trusted health solutions, and specialty retail environments offer curated brand experiences. Supermarkets and hypermarkets provide broad exposure, balancing mass-market traction with promotional visibility.

Packaging formats play a critical role in consumer convenience and perception. Powdered beauty drink mixes appeal to those who value versatility and portability, while ready-to-drink options cater to on-the-go lifestyles and impulse purchasing. Sachets combine the benefits of single-serve dosing with compact design, reinforcing portions and freshness, which resonates with time-pressed consumers.

Demographic segmentation by age group underscores differing product preferences and marketing approaches. Younger adults aged 18–25 are drawn to bold, trend-driven formulations and social media buzz, while the 26–35 cohort often prioritizes premium ingredients and efficacy demonstrated through clinical claims. Consumers between 36 and 45 focus on comprehensive wellness solutions that integrate skin health with broader vitality, and those aged 46 and above emphasize targeted anti-aging and joint support benefits as they seek products aligned with mature skin and lifestyle needs.

This comprehensive research report categorizes the Beauty Drinks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Packaging Format

- Consumer Age Group

- Distribution Channel

- End User

Revealing Key Regional Insights Across the Americas, Europe Middle East and Africa, and Asia Pacific to Illuminate Diverse Beauty Drinks Landscapes

The Americas region continues to be a focal point for beauty drinks innovation and adoption, driven by strong consumer affinity for functional beverages and robust retail infrastructure. In North America, the U.S. market demonstrates high receptivity to premium, science-backed formulations, supported by well-established health and wellness channels. Latin American markets are gaining momentum, with rising disposable incomes and urbanization fueling demand for value-added beverages that align with beauty and self-care trends.

In Europe, Middle East and Africa, regulatory landscapes vary significantly, challenging brands to navigate diverse ingredient approvals and labeling requirements. Western European markets, notably the U.K., France, and Germany, exhibit sophisticated consumer bases seeking clean-label beauty drinks, while emerging markets across the Middle East and Africa show potential for growth as modern retail expands and local production capabilities evolve.

The Asia-Pacific region emerges as a dynamic growth frontier for beauty drinks, propelled by cultural emphasis on skincare and wellness. East Asian markets like Japan and South Korea are recognized as trend incubators, where novel ingredients and premium formulations gain quick traction. Southeast Asian consumers are increasingly embracing wellness-oriented beverages, supported by digital retail proliferation. Meanwhile, Australia and New Zealand mirror global trends in sustainability and health consciousness, further consolidating the region’s role as a key contributor to global beauty drink innovation.

This comprehensive research report examines key regions that drive the evolution of the Beauty Drinks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Companies’ Competitive Strategies through Innovation Portfolios, Partnership Models, and Brand Positioning in the Beauty Drinks Sector

The competitive beauty drinks arena features a mix of established consumer wellness brands and agile newcomers that continue to reshape category dynamics. One notable entrant, Pretty Tasty, has disrupted conventional collagen delivery by launching ready-to-drink collagen tea blends. These products utilize high-quality collagen peptides combined with natural stevia and botanical extracts to create appealing flavors that integrate seamlessly into daily routines, reflecting a consumer desire for mess-free and flavorful beauty rituals.

Meanwhile, Vital Proteins, a leader in collagen-based wellness, has expanded its portfolio beyond powdered peptides with ventures into capsule-based offerings and sustainable packaging initiatives. The introduction of bovine colostrum supplements underscores the brand’s commitment to gut and immune health, while its transition to paper-based canisters highlights a strategic focus on environmental stewardship that resonates with eco-conscious consumers.

Global personal care conglomerates are also active in the space, exploring collaborations and in-house product development. Companies such as Shiseido leverage their cosmetic expertise to infuse beauty-centric ingredients into functional beverages, while major beverage groups form joint ventures to amplify distribution scale and innovation capabilities.

Additionally, niche players with targeted formulas-ranging from adaptogen-based mood support drinks to probiotic-infused collagen shots-continue to emerge, intensifying competitive pressures and driving continual product differentiation. As these companies accelerate R&D investments and strategic partnerships, the landscape remains both dynamic and fragmented, rewarding those who can combine scientific rigor with compelling brand storytelling.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beauty Drinks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AmorePacific Corporation

- Beiersdorf AG

- Big Quark LLC

- CJ CheilJedang Corp.

- Coty Inc.

- DyDo DRINCO, Inc.

- Johnson & Johnson

- Kao Corporation

- Kyowa Hakko Bio Co., Ltd.

- Lacka Foods Ltd.

- LG Household & Health Care Ltd.

- L’Oréal S.A.

- Nestlé S.A.

- Procter & Gamble Co.

- Rohto Pharmaceutical Co., Ltd.

- Sappe Public Company Limited

- Shiseido Co., Ltd.

- The Coca-Cola Company

- The Estée Lauder Companies Inc.

- Unilever PLC

- Vital Proteins LLC

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Opportunities, Mitigate Risks, and Enhance Market Penetration in Beauty Drinks

Industry leaders seeking to thrive in the beauty drinks sector must proactively align product development with evolving consumer needs. Emphasizing ingredient transparency and scientifically supported claims can build consumer trust, particularly when substantiated by third-party validation or clinical research. By collaborating with academic institutions or contract research organizations, brands can strengthen product credibility and differentiate offerings.

Expanding direct-to-consumer engagement through subscription services and personalized recommendation engines will enable brands to capture valuable first-party data, enhancing customer lifetime value and fostering deeper brand relationships. Integrating digital platforms with loyalty programs and content-driven education can further elevate consumer engagement and advocacy.

Sustainability should be embedded at every stage, from sourcing responsibly produced ingredients to adopting recyclable or compostable packaging solutions. Transparency around environmental impact and social responsibility initiatives can resonate with ethically minded consumers, driving preference and premium pricing opportunities.

Finally, organizations must cultivate supply chain resilience through diversified sourcing strategies and scalable manufacturing partnerships. By leveraging near-shore production and strategic inventory buffering, companies can mitigate tariff-induced volatility and logistical disruptions, maintaining consistent product availability and preserving brand reputation.

Outlining the Research Methodology Employed for Assessing Market Dynamics through Rigorous Qualitative and Quantitative Analytical Techniques

This research employs a robust methodology integrating both qualitative and quantitative techniques to ensure comprehensive market insights. Primary interviews were conducted with key industry stakeholders, including senior executives, product development specialists, and distribution partners, to capture firsthand perspectives on emerging trends and strategic priorities.

Secondary research involved an exhaustive review of trade publications, regulatory guidelines, and corporate disclosures to establish a contextual framework for the beauty drinks sector. Data triangulation was applied to align insights from multiple sources, reinforcing the validity and reliability of findings.

Market intelligence tools provided quantitative data points on consumption patterns, retail performance, and ingredient innovation. Expert panels and advisory consultations supplemented these analyses, offering deeper interpretation of complex market dynamics.

Finally, all data underwent rigorous quality checks and validation processes, ensuring that conclusions are grounded in factual evidence and reflective of the latest industry developments. This methodology underpins the strategic recommendations and sector outlook presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beauty Drinks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beauty Drinks Market, by Ingredient Type

- Beauty Drinks Market, by Packaging Format

- Beauty Drinks Market, by Consumer Age Group

- Beauty Drinks Market, by Distribution Channel

- Beauty Drinks Market, by End User

- Beauty Drinks Market, by Region

- Beauty Drinks Market, by Group

- Beauty Drinks Market, by Country

- United States Beauty Drinks Market

- China Beauty Drinks Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Drawing a Comprehensive Conclusion to Synthesize Strategic Implications, Market Learnings, and Future Outlook for the Beauty Drinks Industry

The beauty drinks market stands at a pivotal juncture, shaped by converging trends in health consciousness, digital innovation, and sustainability. Consumer demand for products that deliver tangible beauty outcomes has elevated the importance of transparent ingredient sourcing and evidence-based claims. At the same time, tariff-induced supply chain pressures underscore the need for strategic agility and resilient operational models.

Segmentation analysis reveals diverse consumer preferences across ingredient types, distribution channels, packaging formats, and demographic cohorts, highlighting opportunities for tailored value propositions. Regional insights emphasize the role of mature and emerging markets in driving category evolution, while competitive intelligence underscores the importance of collaborative partnerships and differentiated innovation.

Industry leaders equipped with data-driven strategies can capitalize on the momentum by prioritizing scientific validation, enhancing direct-to-consumer relationships, and embedding sustainability across all facets of operations. By aligning these strategic imperatives with consumer aspirations and regulatory requirements, brands can forge a path toward sustainable growth.

Collectively, these insights provide a comprehensive foundation for decision-makers to navigate the beauty drinks landscape with confidence, ensuring competitive advantage in a rapidly expanding and increasingly sophisticated market.

Driving Next Steps with a Personalized Call to Action for Engaging with Ketan Rohom to Secure the Full Beauty Drinks Market Research Report

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, offers you a direct pathway to unlocking the full breadth of insights and strategic guidance contained in the beauty drinks market research report. His expertise will ensure seamless access to comprehensive data, in-depth analysis, and tailored recommendations crafted to empower your decision-making and accelerate growth. Reach out today to secure your copy and position your organization at the forefront of the rapidly evolving beauty drinks landscape.

- How big is the Beauty Drinks Market?

- What is the Beauty Drinks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?