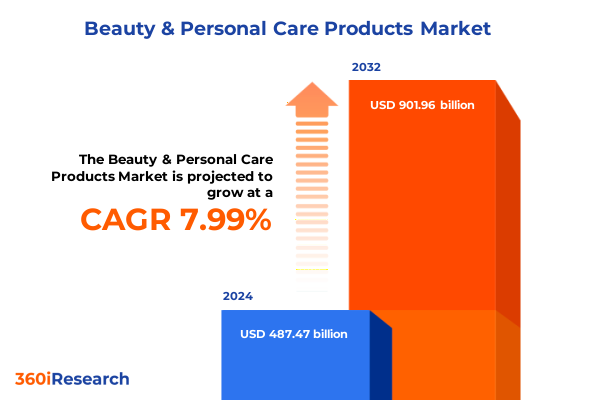

The Beauty & Personal Care Products Market size was estimated at USD 523.73 billion in 2025 and expected to reach USD 563.43 billion in 2026, at a CAGR of 8.07% to reach USD 901.96 billion by 2032.

Navigating Unprecedented Consumer Demand Shifts and Technological Innovations Redefining the Beauty and Personal Care Industry Today

As consumer expectations continue to evolve with unprecedented speed, beauty and personal care brands find themselves at a pivotal juncture where innovation, agility, and authenticity are no longer optional. Emerging digital touchpoints, from immersive live-stream shopping to AI-driven personalized regimens, have fundamentally altered the way individuals discover, evaluate, and purchase products. In parallel, the shift toward wellness-oriented formulations has expanded the scope of traditional beauty narratives to encompass holistic self-care rituals that blend efficacy with emotional well-being. This intersection of technology and wellness is driving a new chapter in which product launches are measured not only by aesthetic appeal or fragrance but by demonstrable benefits, clean ingredient transparency, and sustainable impact.

Examining the Convergence of Sustainability Mandates, Digital Commerce Revolution, and Inclusive Beauty Demands Shaping Market Trajectories

The modern beauty and personal care sector is undergoing transformative shifts as sustainability mandates converge with the digital commerce revolution and the pursuit of inclusive definitions of beauty. Increasing regulatory scrutiny on single-use plastics and carbon emissions has pushed brands to adopt renewable materials and carbon-neutral manufacturing, turning environmental stewardship from a niche virtue into a business imperative. Simultaneously, digitally native brands have leveraged social media ecosystems and direct-to-consumer models to bypass traditional retail gatekeepers, offering hyper-personalized experiences that resonate with today’s mobile-first consumers. At the same time, the demand for representational equity-from diverse shade ranges to gender-fluid grooming products-has expanded the industry’s scope, compelling legacy players and startups alike to recalibrate their R&D pipelines and marketing narratives to embrace a broadened view of beauty.

Assessing How 2025 United States Tariff Adjustments Are Reshaping Supply Chains, Cost Structures, and Competitive Dynamics in Beauty and Personal Care

In 2025, the imposition of revised United States tariffs on imported cosmetics and personal care ingredients has introduced a new dynamic into global supply chains and pricing structures. Key packaging inputs such as aluminum aerosol cans and glass jars are now subject to elevated duties, prompting manufacturers to reassess agreements with offshore suppliers and explore domestic glassworks and recycled material partnerships. As a direct consequence, cost pressures have rippled through ingredient sourcing, from botanical extracts arriving from South America to exotic essential oils imported from Asia-Pacific hubs. Many brands have begun strategically passing incremental expenses to end users, while others are absorbing portions of the surcharge to preserve competitive positioning in premium segments.

Unveiling Distinct Behavior Patterns Across Product Categories, Formulations, Packaging Formats, Distribution Channels, and Consumer Demographics in Beauty and Personal Care

Analysis of product-level performance reveals that consumer interest in specialized baby and kids personal care, particularly gentle lotions, shampoos, and protective creams, continues to rise as young families prioritize formulations free of harsh surfactants and synthetic fragrances. Bath and body offerings, including mineral-rich salts, invigorating shower gels, and artisanal soaps, have found renewed demand through experiential at-home spa rituals. Meanwhile, the multifaceted hair care category-encompassing color treatments, nutrient-rich oils and serums, styling agents, and everyday cleansing systems-demonstrates robust innovation as brands tailor solutions to diverse hair types and texture profiles. Fragrances and makeup are witnessing a symbiotic evolution, with scent layering trends and inclusive shade expansions catering to a kaleidoscopic spectrum of preferences. Men’s grooming, led by advanced beard treatments and precision shaving systems, is capitalizing on modern masculinity archetypes, while oral care innovations, including fortified toothpastes and refreshing mouth rinses, underscore rising awareness of comprehensive wellness. In the skincare domain, body lotions, facial essences, and lip balms infused with bioactive peptides and botanical extracts have surged under the clean beauty banner. Segmentation by formulation type reveals that organic proposition lines are outpacing conventional offerings in consumer perception, even as the latter retain large volumes through mass-market channels. Packaging analysis highlights that pumps and dispensers command a hygiene advantage, tubes optimize toothpaste and lip care experiences, sachets enable single-dose trial units, and roll-on applicators simplify fragrance and targeted treatment delivery. Distribution channel differentiation remains pronounced: offline specialty retailers and department stores deliver sensory engagement and expert consultations, whereas online platforms provide subscription models, rapid replenishment, and data-driven personalization. End-user insights show that women continue to dominate overall consumption, though growth vectors are strongest among men seeking grooming solutions and parents investing in gentle child-care regimens.

This comprehensive research report categorizes the Beauty & Personal Care Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Type

- Packaging Type

- Distribution Channels

- End-User

Delineating Regional Market Preferences and Growth Drivers Across North and South America, EMEA Territories, and Asia-Pacific Beauty and Personal Care Sectors

Regional variations illuminate how macroeconomic and cultural influences shape beauty and personal care preferences. In the Americas, North American markets lead adoption of prestige skincare innovations and wellness-driven hair care, while Latin American consumers exhibit an affinity for vibrant fragrances and at-home spa treatments as economic conditions recover. Across Europe, Middle East and Africa, stringent EU regulations on ingredient transparency and microplastics have spurred clean-label launches, while digital marketplaces in the Middle East drive high-velocity growth for luxury makeup brands. African markets are responding to tailored hair care solutions that address unique texture and scalp health requirements. In Asia-Pacific, advanced anti-aging serums, K-beauty-inspired essence formulations, and multifunctional sun care products sustain a leadership position, complemented by rapid expansion of online-to-offline retail models in Southeast Asia. Regional distribution networks also exhibit contrast: the Americas leverage omnichannel mass retailers and specialty chains; EMEA features strong penetration of pharmacy-based beauty counters; and Asia-Pacific underscores mobile commerce and social commerce integrations.

This comprehensive research report examines key regions that drive the evolution of the Beauty & Personal Care Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders’ Strategic Initiatives, Innovation Pipelines, and Competitive Positioning Driving Value Creation in the Global Beauty Arena

Leading industry players are driving competitive intensity through a combination of product innovation, strategic acquisitions, and cross-sector collaborations. Many global conglomerates have intensified research efforts into bioactive ingredients and advanced delivery systems, while expanding their clean and inclusive beauty portfolios. At the same time, emerging digital-first brands are forging partnerships with technology firms to integrate augmented reality try-on tools and AI-enabled skin diagnostics directly into e-commerce platforms. Mergers and acquisitions have become a cornerstone of growth strategies, as larger players seek to acquire niche natural and organic brands with deeply engaged follower bases. Simultaneously, private equity investment continues to invigorate mid-market challengers, injecting capital into expansion of manufacturing capabilities and global distribution networks. Against this backdrop, innovation pipelines are increasingly oriented toward multifunctional formulations, adaptive color technologies, and biodegradable packaging solutions, underscoring the industry’s shift from siloed product lines to integrated self-care ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beauty & Personal Care Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amorepacific Corporation

- Avon Products Inc. by Natura & Co Holding S.A.

- Beiersdorf AG

- Chanel, Inc.

- Church & Dwight Co., Inc.

- Clarins Group

- Colgate-Palmolive Company

- Coty Inc.

- Dow Inc.

- Henkel AG & Co. KGaA

- Himalaya Wellness Company

- International Flavors & Fragrances Inc.

- Johnson & Johnson Services, Inc.

- Kao Corporation

- Koninklijke Philips N.V.

- L'Oréal S.A.

- Oriflame Holding AG

- PLUM GLOBAL LIMITED

- Procter & Gamble Company

- Reckitt Benckiser Group PLC

- Revlon Consumer Products Corporation

- Shiseido Company, Limited

- The Deconstruct

- The Estée Lauder Companies Inc.

- The Goodkind Co.

- The Honest Company, Inc.

- TONYMOLY USA

- Unilever PLC

- WISHCOMPANY Inc.

- YUNI Beauty

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends, Mitigate Tariff Impacts, and Drive Sustainable Growth in Beauty and Personal Care

To thrive amid tariff headwinds and heightened consumer scrutiny, beauty and personal care organizations must fortify their supply chains by diversifying ingredient sourcing and engaging in strategic vendor partnerships that prioritize resilience and sustainability. It is essential to accelerate digital transformation efforts, deploying data-driven personalization engines and seamless omnichannel experiences that resonate with increasingly discerning end users. Companies should prioritize reformulation initiatives that reduce environmental impact and adhere to evolving regulatory standards, while transparently communicating efficacy and ethical credentials. Furthermore, dedicating resources to underserved market segments-such as premium men’s grooming and specialized baby and kids care-will unlock new revenue streams. Proactive investment in biodegradable and reusable packaging formats can also serve as a powerful differentiation lever. Finally, forging alliances with technology innovators for augmented reality try-on and AI-enabled diagnosis will reinforce brand loyalty, reduce return rates, and pave the way for agile product development informed by real-time consumer feedback.

Elucidating Robust Research Frameworks, Data Collection Protocols, and Analytical Approaches Underpinning In-Depth Insights into the Beauty and Personal Care Market

This analysis is underpinned by a rigorous research methodology combining primary and secondary intelligence. In the primary phase, in-depth interviews were conducted with senior executives from brand owners, key ingredient suppliers, packaging manufacturers, and leading retailers, ensuring direct access to strategic perspectives on market drivers and challenges. Quantitative surveys of thousands of consumer respondents across demographic cohorts provided a statistical foundation for segmentation insights. On the secondary side, extensive review of trade association reports, regulatory filings, and patent literature facilitated identification of innovation trajectories and compliance trends. Research streams were triangulated through multiple validation workshops with subject-matter experts to confirm data consistency and interpretive accuracy. Data modeling techniques were applied to elucidate correlations among tariff policy shifts, cost structures, and price elasticity, while scenario planning exercises helped visualize potential market responses under varying regulatory and economic conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beauty & Personal Care Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beauty & Personal Care Products Market, by Product

- Beauty & Personal Care Products Market, by Type

- Beauty & Personal Care Products Market, by Packaging Type

- Beauty & Personal Care Products Market, by Distribution Channels

- Beauty & Personal Care Products Market, by End-User

- Beauty & Personal Care Products Market, by Region

- Beauty & Personal Care Products Market, by Group

- Beauty & Personal Care Products Market, by Country

- United States Beauty & Personal Care Products Market

- China Beauty & Personal Care Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings on Market Dynamics, Strategic Opportunities, and Future Trajectories to Guide Stakeholder Decision-Making in Beauty and Personal Care

The cumulative analysis highlights a beauty and personal care industry at the crossroads of sustainability, digitization, and inclusivity. Brands that embrace transparent, eco-driven formulations and invest in digital engagement will outperform peers whose strategies remain rooted in legacy practices. Tariff-induced cost pressures necessitate agile supply chain designs that safeguard margin integrity without passing undue burden to consumers. Segment-specific playbooks-tailored to the unique dynamics of baby and kids care, hair treatments, skincare regimens, and men’s grooming-will be instrumental in capturing emerging growth pockets. Regional nuances underscore the importance of localized innovation and distribution strategies, from EMEA’s regulatory-driven clean beauty surge to Asia-Pacific’s mobile commerce-led expansion. Ultimately, success in this evolving landscape will hinge on an organization’s ability to synthesize strategic foresight with operational excellence, positioning itself as a trusted partner in consumers’ holistic well-being journeys.

Engage with Ketan Rohom to Unlock Comprehensive Beauty and Personal Care Market Insights Tailored to Propel Strategic Growth and Investment Decisions

To explore the comprehensive insights, in-depth analysis, and strategic recommendations contained in this market research report, you can reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through the key findings and facilitate your access to the full deliverables. By engaging with an expert liaison dedicated to supporting your organization’s decision-making, you will obtain tailored consultancy on how to leverage these insights to optimize product portfolios, navigate evolving regulatory landscapes, and capture high-value growth opportunities across diverse consumer segments. Contact the sales team and arrange a discussion with Ketan Rohom to secure the definitive resource that will enable you to stay ahead of competitor moves, refine your go-to-market strategies, and drive long-term value creation in the dynamic beauty and personal care industry

- How big is the Beauty & Personal Care Products Market?

- What is the Beauty & Personal Care Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?