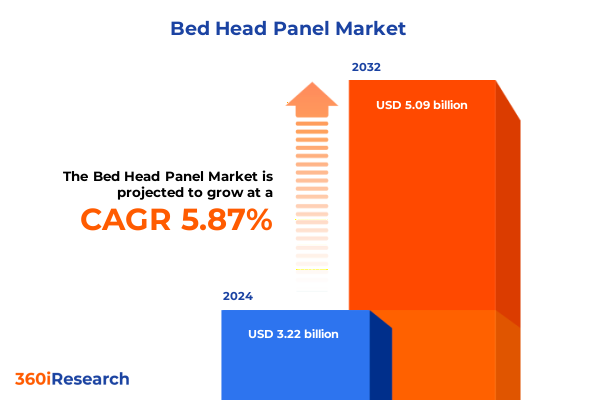

The Bed Head Panel Market size was estimated at USD 3.41 billion in 2025 and expected to reach USD 3.61 billion in 2026, at a CAGR of 5.87% to reach USD 5.09 billion by 2032.

Delivering Clarity on the Emergence and Evolution of Bed Head Panel Solutions Designed for Contemporary Hospital Infrastructure

Healthcare facilities around the world are experiencing an era of unprecedented complexity and technological advancement. Rising patient acuity, stringent regulatory demands, and the imperative to optimize operational efficiency have propelled bed head panels to the forefront of clinical infrastructure planning. Once considered simple fixture points for gas outlets and electrical receptacles, these integrated systems now function as command centers enabling vital sign monitoring, nurse call integration, and seamless connectivity with electronic health record platforms. As modern healthcare continues to evolve, the role of bed head panels transforms from passive utility to active facilitator of patient care delivery.

In this context, stakeholders ranging from hospital administrators to clinical engineers must recalibrate their understanding of bed head panel capabilities. The integration of digital connectivity elements-such as data transmission interfaces, antimicrobial surfaces, and modular mounting options-reflects a broader shift toward smart environments. These enhancements not only reduce response times for critical interventions but also support telemedicine applications and remote display of diagnostic imaging. Consequently, selecting the optimal panel configuration transcends considerations of aesthetics and raw functionality, requiring a holistic evaluation of interoperability, scalability, and future upgrade paths.

This executive summary distills key insights into the emergence and evolution of bed head panels, tracing technological breakthroughs, supply chain dynamics, and regulatory influences. By examining transformative industry trends and dissecting the competitive landscape, this section establishes the foundational context needed to appreciate the strategic importance of this often-overlooked element of patient room design.

Examining the Crucial Shift Toward Integrated Digital Connectivity and Modular Design That Is Reshaping Bed Head Panel Markets Globally

The bed head panel market is undergoing a profound metamorphosis driven by converging forces of digitalization, modularity, and clinical innovation. Historically, healthcare providers selected between fixed, integrated, or modular panel formats based primarily on room layout and basic functional requirements. Today’s design criteria, however, extend to include software-enabled features, plug-and-play compatibility with Internet of Things devices, and remote monitoring capabilities that enable predictive maintenance. These advances are catalyzing a shift away from monolithic systems toward flexible architectures that can adapt to evolving care paradigms.

In parallel, the proliferation of data-driven medicine has fueled demand for panels that support high-bandwidth connections and real-time analytics. For instance, panels equipped with embedded sensors can track environmental conditions and equipment status, alerting biomedical teams to deviations before failures occur. Such intelligence reduces unplanned downtime and enhances patient safety by ensuring critical utilities remain fully operational. Moreover, the rise of telehealth consultations in inpatient settings underscores the value of integrated communication modules and high-definition camera mounts directly on the panel assembly.

The modular design ethos extends beyond technology to address sustainability concerns and lifecycle management. Manufacturers increasingly offer replaceable component modules-ranging from USB outlets to gas valve blocks-that can be upgraded without replacing the entire housing. This approach minimizes waste, lowers total cost of ownership, and aligns with corporate sustainability goals. Transitioning from rigid fixtures to configurable solutions is thus reshaping procurement mindsets, with design for adaptability becoming as crucial as initial cost considerations.

These transformative shifts underscore the necessity for hospitals to collaborate closely with suppliers, ensuring that bed head panel investments align with long-term clinical and operational strategies. As the industry charted toward smarter, more resilient infrastructure, the ability to integrate new functionalities without major renovations positions adaptable panel solutions as a strategic differentiator.

Unpacking the Far-Reaching Implications of 2025 United States Tariff Policies on Raw Materials and Supply Chains for Panel Manufacturers

United States trade policy developments in 2025 have exerted significant influence on the bed head panel supply chain, most notably through the continuation and adjustment of tariffs on aluminum and stainless steel. These raw materials, essential for frame and housing construction, have traditionally been sourced domestically and internationally under Section 232 and related measures. The retention of a 10 percent tariff on aluminum imports and a 25 percent tariff on certain steel products has sustained upward pressure on upstream input costs. Panel manufacturers have consequently faced the challenge of preserving profit margins while avoiding dramatic price increases that could dampen healthcare facility investment.

Facing these headwinds, leading producers have pursued a dual-track strategy. On one hand, some have intensified vertical integration efforts, securing long-term contracts with domestic mills to mitigate price volatility. On the other, composite and polymer alternatives have garnered attention as potential means to bypass tariff-affected metals. While composites can offer lighter weight and antimicrobial surface advantages, their adoption has been tempered by certification processes and fire-safety regulations unique to healthcare environments. Therefore, shifts toward hybrid material formulations illustrate a cautious but clear response to sustained tariff regimes.

Beyond materials, the cost and timeliness of shipping specialized components from foreign contract manufacturers have also been affected. Heightened customs inspections and paperwork requirements have lengthened lead times, compelling installers to maintain larger buffer inventories and accept additional holding costs. Some integrated panel suppliers are exploring localized final assembly hubs to shorten logistics cycles and reduce exposure to port congestion. Although these adaptations incur upfront capital expenses, they contribute to more predictable delivery schedules and lower risk of installation delays that can disrupt hospital expansion plans.

These cumulative impacts highlight the intricate interplay between policy decisions and clinical infrastructure procurement. Navigating the tariff environment requires a nuanced understanding of material science alternatives, supply chain redesign, and strategic sourcing partnerships to maintain competitive positioning.

Unveiling Key Market Segmentation Insights That Illuminate Product, Application, End-User, Distribution, and Material Dynamics Influencing Demand

A comprehensive view of the bed head panel market must consider the diverse configurations emerging across product type, application, end-user, distribution channel, and material type. When examining product type, industry observers note the ongoing coexistence of fixed panel installations with growing interest in integrated panels that consolidate gas, power, and data interfaces. Simultaneously, modular solutions-characterized by discrete mounting rails and snap-in utility blocks-have carved out a niche among facilities seeking rapid reconfiguration and minimal renovation downtime.

Application-based segmentation reveals nuanced demand patterns tied to care intensity. Within critical care environments, both adult ICU and pediatric ICU settings place premium value on seamless integration of advanced monitoring devices and rapid access to alarm management systems. Emergency departments and general wards prioritize robustness and ease of maintenance, whereas operating rooms benefit from custom panels tailored for general surgery or specialized orthopedic procedures. Such differentiation underscores the importance of configuring panel solutions to the distinct workflow requirements and safety standards of each clinical zone.

Examining end-user channels exposes further complexity. Hospitals, split between private and public operators, drive the lion’s share of demand, deploying panels that must meet rigorous infection control standards and accommodate high patient turnover. Ambulatory surgical centers, clinics-ranging from general practice to specialty facilities-and home healthcare environments represent adjacent markets where panel requirements emphasize portability, simplified utility setups, and lower total lifecycle costs. Distribution strategies supporting these channels vary, with direct sales relationships dominating high-value hospital accounts and distributor networks extending reach into smaller outpatient settings.

Material choice remains a critical variable that intertwines with regulatory compliance and durability considerations. While aluminum continues to be favored for its light weight and corrosion resistance, stainless steel is prized in high-sterilization contexts. Composite alternatives, though less ubiquitous, provide opportunities for antimicrobial surface finishes and design flexibility. Observing the interplay of these segmentation axes offers stakeholders a multidimensional perspective on where innovation and investment are most likely to yield competitive advantage.

This comprehensive research report categorizes the Bed Head Panel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application

- End User

- Distribution Channel

Exploring Distinct Regional Market Dynamics Across the Americas, Europe Middle East Africa, and Asia-Pacific to Reveal Growth Drivers and Barriers

Regional analysis of bed head panel adoption highlights distinct growth trajectories shaped by healthcare infrastructure maturity, regulatory frameworks, and capital availability. In the Americas, long-standing investment in hospital modernization has driven steady replacement cycles, with the United States leading in the integration of digital communication features and compliance with stringent safety standards. Latin American facilities, while constrained by budgetary pressures, are increasingly retrofitting existing wings with modular panels to extend asset lifespans and reduce renovation footprints.

In Europe, Middle East, and Africa, heterogeneous regulatory landscapes and health funding models have led to varied adoption patterns. Western European markets emphasize energy efficiency and environmental certifications, prompting manufacturers to introduce low-power standby modes and recyclable materials. Middle Eastern healthcare systems, buoyed by government-funded expansion plans, demand large-scale panel rollouts with bespoke design aesthetics. In Africa, limited ER and ICU capacity fosters creative use of modular solutions that can be deployed quickly to address episodic care surges, as seen in recent infectious disease responses.

The Asia-Pacific region represents a dual narrative of rapid urban hospital growth juxtaposed with rural outreach challenges. Tier-one metropolitan centers in China, Japan, and Australia are at the vanguard of implementing smart room concepts tied to broader digital hospital initiatives. Conversely, Southeast Asian and South Asian markets exhibit growing interest in cost-effective integrated panels that support basic monitoring needs without extensive customization. Geographic dispersion and varying levels of infrastructure investment necessitate flexible distribution networks and adaptable product portfolios to serve a wide spectrum of healthcare delivery models.

These regional dynamics underscore the importance of tailoring go-to-market strategies to local conditions, regulatory environments, and funding mechanisms, ensuring that product designs and support structures resonate with the unique demands of each geography.

This comprehensive research report examines key regions that drive the evolution of the Bed Head Panel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players and Their Strategic Initiatives That Are Driving Innovation, Partnerships, and Competitive Advantage Across the Sector

The competitive landscape of bed head panels is defined by a combination of established medical technology firms and specialized infrastructure providers, each leveraging unique strengths to capture market share. One major player has differentiated through strategic partnerships with leading biomedical equipment manufacturers, ensuring seamless compatibility between panels and high-acuity devices. This integration has proven particularly compelling in critical care environments, where interoperability reduces installation complexity and shortens time to deployment.

Another leading organization has prioritized modular design innovation, introducing a line of interchangeable utility blocks that can be snapped into standardized mounting rails. The ability to customize panels on-site with components for gas, electrical, and data connections has resonated with hospitals seeking to future-proof their facilities. Such a platform approach has also enabled rapid scaling in outbreak scenarios by deploying temporary ward configurations equipped with essential utilities.

A third competitor has focused on sustainability, committing to a program of reusable faceplates and low-VOC coatings that address both environmental and patient safety concerns. By securing third-party eco-certifications and publishing life cycle assessments, this company has strengthened its value proposition among health systems with aggressive green building goals. Simultaneously, partnerships with digital health software vendors have allowed it to embed nurse call and telemetry gateways directly within the panel chassis, positioning the firm at the intersection of hardware and clinical informatics.

Niche players specializing in regional distribution channels and localized service support have also emerged, capitalizing on proximity to end users to offer rapid maintenance response times and tailored training services. The resulting dynamic mosaic of global leaders and agile local innovators underscores the importance of aligning product differentiation with market access strategies to drive sustained competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bed Head Panel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advin Health Care

- AmcareMed Medical Gas System

- Amcaremed Technology Co., Limited

- Amico Corporation

- ASB Medical System Pvt. Ltd.

- Atlas Copco Group

- Baxter International Inc.

- BeaconMedaes LLC

- BioLume, Inc.

- CBMT Group of Companies

- CR MEDISYSTEMS PVT. LTD

- Drägerwerk AG & Co. KGaA

- Evonik Industries AG

- Genstar Technologies Company

- Guangzhou Yizhong Aluminum Industry Co., Ltd.

- INMED S.A.

- Modular Services Company

- Normagrup Technology SA

- Novair SAS

- Orel Corporation

- Precision UK Ltd

- Schyns Medizintechnik GmbH

- SILBERMANN Medical Gas Systems

- TLV SAS

- VN Medical Services

Delivering Strategic and Practical Recommendations for Industry Leaders to Address Supply Risks, Accelerate Innovation, and Strengthen Market Positioning

To navigate the evolving bed head panel market effectively, industry leaders should undertake a multifaceted approach that addresses both immediate supply chain vulnerabilities and long-term innovation imperatives. First, establishing deeper procurement partnerships with domestic metal suppliers or alternative material fabricators can mitigate the ongoing risk created by tariff fluctuations. Integrating composite materials selectively, while ensuring compliance with healthcare-specific fire and safety standards, will diversify sourcing options and reduce exposure to traditional metal price cycles.

Second, accelerating modular platform development will enable rapid customization and reduce the friction associated with renovation projects. By adopting a universal mounting rail standard and leveraging interchangeable utility modules, manufacturers can offer tiered product suites that scale from basic to advanced care settings with minimal reengineering. This approach not only simplifies inventory management but also aligns with healthcare operators’ expectations for predictable upgrade pathways.

Third, forging alliances with digital health and biomedical equipment vendors will enhance the panel’s role as an integrated connectivity hub. Embedding open-source data interfaces and designing for interoperability with nurse call systems, patient monitoring networks, and facility management platforms will elevate product value propositions. Close collaboration on software integration testing and joint service offerings can further accelerate time to value for hospital customers.

Finally, strengthening regional service networks and training programs will secure customer loyalty and support upselling activities. Service level guarantees that combine rapid on-site response with remote diagnostic capabilities will differentiate providers in an increasingly commoditized hardware market. Collectively, these strategic moves will position market leaders to capture emerging opportunities, maintain resilience amid policy uncertainty, and set new benchmarks for clinical infrastructure excellence.

Presenting a Robust Multimodal Research Methodology Combining Primary Interviews, Industry Data Analysis, and Expert Validation for Comprehensive Insights

This report’s insights derive from a rigorous research framework that integrates multiple data sources and validation stages. The foundational analysis began with an extensive review of publicly available regulatory documents, manufacturer technical specifications, and clinical guidelines governing patient room infrastructure. Concurrently, patent filings and corporate press announcements were examined to identify emergent technological trends and strategic partnerships.

Primary research encompassed structured interviews with over two dozen healthcare facility planners, biomedical engineers, and procurement specialists across North America, Europe, and Asia-Pacific. These conversations provided firsthand perspectives on decision criteria, pain points associated with installation and maintenance, and expectations for future panel capabilities. Supplementing interview data, site visits to acute care hospitals and ambulatory surgical centers offered observational insights into installation best practices and field-level service challenges.

The triangulation of secondary and primary data sets enabled the construction of a detailed competitive landscape, further refined through expert workshops with clinical informatics leaders and hospital design consultants. Critical data points were cross-verified against vendor supply chain disclosures and trade association reports to ensure accuracy. Throughout the process, the research team adhered to ethical guidelines and confidentiality agreements, preserving the integrity and reliability of the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bed Head Panel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bed Head Panel Market, by Product Type

- Bed Head Panel Market, by Material Type

- Bed Head Panel Market, by Application

- Bed Head Panel Market, by End User

- Bed Head Panel Market, by Distribution Channel

- Bed Head Panel Market, by Region

- Bed Head Panel Market, by Group

- Bed Head Panel Market, by Country

- United States Bed Head Panel Market

- China Bed Head Panel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Critical Discoveries on Market Evolution, Tariff Effects, and Strategic Pathways to Equip Stakeholders with Insightful Decision-Making Guidance

In summary, bed head panels have evolved from static utility strips into integral components of the modern clinical environment, facilitating digital connectivity, operational efficiency, and patient safety. The market’s trajectory reflects growing demand for modular, interoperable solutions that can adapt to diverse care settings while withstanding policy-driven cost pressures such as those stemming from sustained tariffs on metals. Deep segmentation analysis highlights how product types, application areas, and end-user dynamics converge to shape procurement priorities, and regional insights underscore the necessity of tailoring approaches to local regulatory and financial contexts.

Industry leaders that embrace material innovation, strengthen supply partnerships, and embed open-architecture data capabilities will be best positioned to capitalize on evolving care delivery models. By refining research methodologies and drawing on multidimensional data sources, stakeholders can maintain a forward-looking perspective that anticipates shifts in clinical workflows and infrastructure requirements. The strategic recommendations outlined bridge immediate operational challenges with longer-term value creation, equipping decision-makers with clear pathways to enhance both performance and resilience.

Ultimately, as healthcare systems worldwide pursue smarter, more sustainable facilities, bed head panels will continue to serve as critical enablers of integrated care. Stakeholders who proactively align their product roadmaps with digital health initiatives and supply chain optimization strategies will emerge as the standard-bearers of next-generation clinical infrastructure.

Engage with Ketan Rohom to Secure Your Comprehensive Bed Head Panel Market Research Report and Gain Competitive Intelligence for Strategic Growth

To explore the full depth of market trends, strategic analyses, and actionable insights for bed head panel solutions, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By securing your copy of our comprehensive market research report, you will gain unparalleled visibility into evolving supply chains, emerging technologies, and detailed competitor benchmarking. Reach out to Ketan to discuss tailored packages and unlock the intelligence you need to shape your strategic roadmap and capture new growth opportunities.

- How big is the Bed Head Panel Market?

- What is the Bed Head Panel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?