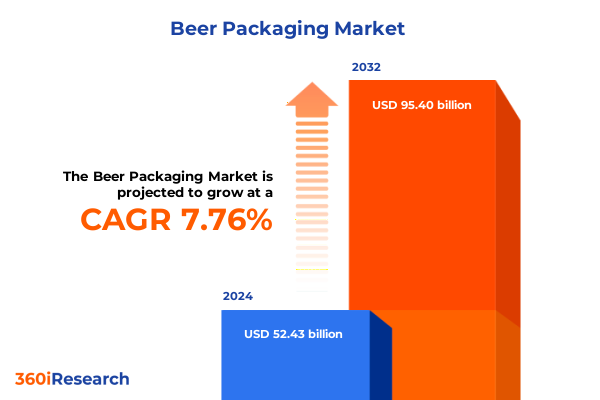

The Beer Packaging Market size was estimated at USD 56.59 billion in 2025 and expected to reach USD 60.59 billion in 2026, at a CAGR of 7.74% to reach USD 95.40 billion by 2032.

Unveiling the Dynamics Transforming Beer Packaging: Innovations, Challenges, and Strategic Opportunities in a Rapidly Evolving Industry

The beer packaging industry is undergoing a period of intense transformation as brands and suppliers navigate evolving consumer expectations, sustainability imperatives, and economic pressures. Packaging serves not only as a protective vessel for liquid but also as a powerful branding tool that can influence purchasing decisions in a crowded retail environment. Innovations in materials, digital printing, and smart label technologies are enabling brewers and packaging providers to differentiate their offerings and engage consumers in novel ways, while regulatory and cost considerations compel stakeholders to rethink supply chain strategies and material selections.

At the same time, global trade dynamics and domestic policy shifts have injected new complexity into sourcing decisions. Recent metal tariffs have prompted strategic pivots toward recycled feedstocks and alternative substrates to mitigate cost volatility and maintain profit margins. Emerging design trends emphasize minimalism and environmental transparency, challenging conventional packaging formats and driving experimentation with returnable, refillable, and compostable systems. Against this backdrop of rapid change, craft brewers, large-scale producers, and packaging suppliers must align innovation with operational resilience to capture growth opportunities and future-proof their portfolios.

How Sustainability Imperatives, Technological Breakthroughs, and Consumer Preferences Are Redefining the Beer Packaging Landscape for 2025 and Beyond

Sustainability is no longer a peripheral consideration but a central driver of packaging strategy, influencing material selection, design approach, and end-of-life management. Regulatory actions, such as state-level mandates for recyclable or compostable packaging by 2032, have galvanized investment in eco-friendly materials, including recycled aluminum and biodegradable polymers. Consumer surveys reflect a clear preference for packaging that aligns with personal values around environmental stewardship, creating a strong incentive for brands to integrate circularity principles and transparent labeling into their packaging ecosystems.

Simultaneously, technological advancements are reshaping how consumers interact with packaging and how brand owners gather market intelligence. The incorporation of QR codes, NFC chips, and augmented reality portals turns static labels into interactive experiences that deliver product origin stories, sustainability data, and personalized promotions directly to smartphones. These smart labels drive engagement, support anti-counterfeiting measures, and generate valuable first-party data, enabling brands to refine marketing strategies and strengthen customer relationships.

Premiumization and customization trends continue to gain momentum across market segments, as limited-edition series, full-wrap digital printing, and unique bottle geometries enhance shelf appeal and create strong emotional connections with consumers. Microbreweries leverage digital printing technologies to produce small runs of highly distinctive packaging, achieving substantial uplift in brand visibility despite tighter production margins. The convergence of sustainable materials and high-end design is redefining consumer expectations for packaging that looks as good as it performs.

Assessing the Cumulative Consequences of Recent United States Metal Tariffs on Beer Packaging Supply Chains, Costs, and Material Strategies Through 2025

U.S. trade policies in 2025 have significantly influenced the economics of beer packaging, particularly through the imposition of steep tariffs on imported steel and aluminum inputs. Under successive proclamations, tariff rates on a range of metal imports rose to as high as 50%, driving up costs for metal-based packaging and compelling manufacturers to reevaluate sourcing and design choices. These measures have disrupted established supply chains and heightened emphasis on domestic capacity and recycled feedstocks.

Beer producers and packaging manufacturers reliant on aluminum cans have faced cost increases that are partially offset by the use of high-recycled-content scrap, which is not subject to the same duties. Nevertheless, the need to balance cost, performance, and sustainability goals has prompted experimentation with aseptic cartons, glass, plastic pouches, and hybrid materials. Broader adoption of alternative substrates remains constrained by logistical complexity, capital investment requirements, and brand equity considerations, but these shifts underscore the market’s growing material versatility.

Domestic recycling rates play a critical role in mitigating the cumulative impact of tariffs. Industry data indicate that more than 70% of aluminum used in U.S. beverage cans is sourced from recycled content, creating a closed-loop advantage that shields can makers from full tariff exposure and bolsters circular economy credentials. This dynamic has reinforced the strategic importance of domestic scrap collection systems and investments in recycling infrastructure.

Decoding Beer Packaging Market Insights Through Detailed Analysis of Packaging Types, Materials, Sizes, and Closure Options Driving Strategic Decisions

Packaging format choices influence everything from consumer perceptions to distribution efficiencies, with each format offering distinct advantages. Bottles excel in premium positioning and flavor preservation, driving their sustained prominence among craft and specialty brands. Cans deliver lightweight transport benefits, rapid chill times, and robust branding canvases, making them the format of choice for high-volume producers. Draught systems, including kegs and growlers, support on-premise consumption and deliver sustainability benefits through reuse and reduced material waste. Kegs serve large-volume accounts and festival circuits, offering cost efficiencies while reinforcing brand authenticity through direct-to-tap experiences.

Material selection further differentiates packaging applications and aligns with distinct performance and sustainability objectives. Standard and slim aluminum cans cater to varying brand narratives and portion preferences, while amber and clear glass bottles balance barrier properties and visual aesthetics. High-density polyethylene and PET formats offer shatter resistance and lightweight advantages for growlers and small-batch presentations, with post-consumer recycled content emerging as a key metric in material sourcing decisions. Each material category presents trade-offs in weight, barrier performance, recyclability, and cost, requiring holistic evaluation to align with brand values and logistical realities.

Package sizes range from up to 330 ml single-serve offerings designed for on-the-go convenience to above-750 ml shareable bottles and kegs tailored to gatherings and draft dispensers. Intermediate formats like 331–500 ml and 501–750 ml strike a balance between premium presentation and affordability, enabling brands to address diverse consumption occasions. Decision-makers consider package size strategies as levers for price positioning, promotional activities, and inventory optimization. Closing mechanisms such as crown caps, pull tabs, and screw caps influence user experience, resealability, and production line compatibility, adding another dimension to packaging configuration discussions.

This comprehensive research report categorizes the Beer Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Material

- Package Size

- Closure Type

Geographical Perspectives on Beer Packaging Evolution: Key Regional Drivers, Market Nuances, and Strategic Opportunities Across the Americas, EMEA, and Asia-Pacific

The Americas region continues to lead global beer packaging innovation, driven by robust aluminum can adoption, advanced recycling infrastructure, and the influence of major North American policy shifts. In the United States, the interplay of sustainability targets and trade policy has heightened focus on recycled metal content, while Canada’s deposit-return systems propel high recovery rates. Central and South American markets are rapidly modernizing packaging formats, with rising demand for value-oriented cans alongside glass bottles in established beer-producing countries.

Europe, the Middle East, and Africa exhibit diverse regulatory landscapes that shape packaging strategies. Western European nations emphasize deposit infrastructure and lightweight glass innovation, with refillable bottle models gaining traction in regions such as Scandinavia. Southern Europe’s craft beer renaissance drives premium bottle designs and bespoke closures, while the Middle East focuses on cans to circumvent heat-related spoilage in hot climates. African markets, though smaller in consumption volume, are exploring flexible aseptic cartons and pouches to meet logistical and cost constraints.

Asia-Pacific is characterized by rapid craft beer growth and evolving consumer tastes, fueling demand for premium packaging across diverse markets. In Australia and New Zealand, stringent recycling mandates and high consumer awareness underpin glass and can innovations. Southeast Asia’s brewing scene is embracing full-wrap digitally printed cans and PET growlers for portability, while Northeast Asian markets prioritize technological integration, such as NFC-enabled labels, to support digital engagement initiatives. This regional mosaic underscores the importance of tailored packaging approaches that address local regulations, infrastructure, and consumer preferences.

This comprehensive research report examines key regions that drive the evolution of the Beer Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Beer Packaging Innovators and Strategic Collaborators Shaping the Future of Packaging Through Innovation, Sustainability, and Supply Chain Excellence

Major packaging providers and brewing conglomerates are playing pivotal roles in defining the trajectory of beer packaging innovation. Ball Corporation continues to lead the aluminum can segment, leveraging advanced digital printing and full-wrap designs to support microbreweries and large brands alike. Its specialty craft can offerings have demonstrated notable lift in shelf engagement, underscoring the value of flexible, small-batch runs.

Crown Holdings has distinguished itself through sustainability leadership, earning recognition as a Net Zero Leader for its Twentyby30 initiative and deploying CrownSmart™ technology to integrate augmented reality experiences directly into can tabs. These efforts reflect a holistic approach that combines environmental targets with consumer-centric innovation.

Ardagh Glass Packaging’s solar-powered glass facilities and 100% recyclable cullet usage exemplify the premium glass narrative, catering to craft brewers seeking to align sustainable credentials with premium aesthetics. Meanwhile, Amcor’s pledge to design all packaging for recyclability or reuse by 2025, reinforced by its merger with Berry and focused R&D investments, highlights the strategic consolidation and resource pooling occurring among flexible packaging leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beer Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpha Packaging

- Amcor Plc

- Ardagh Group S.A.

- Avery Dennison Corporation

- Ball Corporation

- Berlin Packaging LLC

- Berry Global Inc.

- CCL Industries Inc.

- Crown Holdings Inc.

- DS Smith Plc

- G3 Enterprises

- Gerresheimer AG

- Graphic Packaging Holding Company

- International Paper Company

- Krones AG

- MULTIVAC Group

- O-I Glass Inc.

- Plastipak Holdings Inc.

- SIG Combibloc Group AG

- Silgan Holdings Inc.

- Smurfit Kappa Group Plc

- Tetra Pak International S.A.

- TricorBraun Inc.

- Vidrala S.A.

- WestRock Company

Strategic Imperatives for Industry Leaders to Capitalize on Beer Packaging Trends, Mitigate Risks, and Drive Growth Through Innovation and Operational Excellence

Industry leaders should prioritize the integration of recycled and renewable materials across packaging portfolios to align with evolving regulations and consumer expectations. Establishing strategic partnerships with recycling organizations and investing in closed-loop supply chains will enhance resilience against tariff-driven cost fluctuations and deliver demonstrable sustainability credentials that resonate with eco-conscious consumers.

Operational agility can be enhanced by adopting modular production technologies such as digital printing and agile fill-and-label systems. These capabilities enable rapid iteration of packaging designs, support limited-edition releases, and minimize inventory risk, thereby maximizing responsiveness to seasonal campaigns and emerging consumption trends.

To capitalize on smart label potential, companies should pilot NFC and QR code implementations linked to unified customer data platforms. This investment will facilitate deeper consumer insights, personalized marketing, and improved traceability. Ensuring cross-functional collaboration between supply chain, marketing, and data analytics teams will be critical to unlocking the full value of connected packaging.

Finally, scenario planning that accounts for shifting trade policies, raw material price volatility, and sustainability regulations will strengthen strategic decision-making. Embedding rigorous risk assessment frameworks and maintaining transparent stakeholder communication will position organizations to pivot effectively in response to geopolitical and environmental developments.

Comprehensive Research Methodology Combining Primary Interviews, Secondary Data Synthesis, and Rigorous Analytical Frameworks to Ensure Robust Beer Packaging Insights

This analysis draws upon a multifaceted research approach that combines primary and secondary data collection with a robust analytical framework. Primary inputs include interviews with packaging executives, procurement directors, and sustainability experts across key breweries and packaging firms, providing firsthand insights into strategic priorities, operational challenges, and innovation roadmaps.

Secondary research entailed comprehensive review of industry publications, trade association reports, corporate sustainability disclosures, and regulatory filings to validate market drivers, material performance characteristics, and policy impacts. Credible news sources, sector databases, and technical journals were synthesized to ensure up-to-date coverage of tariff developments, material innovations, and consumer engagement trends.

Quantitative analysis leveraged data segmentation by packaging type, material, size, and closure format to identify growth vectors and under-served niches, while cross-regional comparative assessments illuminated unique regulatory landscapes and infrastructure capabilities. Qualitative scenario modeling was applied to evaluate potential shifts in trade policy and raw material availability, informing risk mitigation strategies.

The research methodology prioritizes transparency and reproducibility, with all data sources and analytical assumptions documented in an appendix. Triangulation of diverse data streams ensures the integrity and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beer Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beer Packaging Market, by Packaging Type

- Beer Packaging Market, by Material

- Beer Packaging Market, by Package Size

- Beer Packaging Market, by Closure Type

- Beer Packaging Market, by Region

- Beer Packaging Market, by Group

- Beer Packaging Market, by Country

- United States Beer Packaging Market

- China Beer Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Implications to Navigate Beer Packaging Dynamics and Unlock Sustainable and Profitable Growth in a Competitive Market

The convergence of sustainability mandates, technological innovation, and dynamic consumer preferences is reshaping the beer packaging landscape, driving stakeholders toward more circular, digitally enhanced, and agile packaging strategies. The expanded use of recycled materials and the rise of smart label functionalities underscore the dual imperative of environmental responsibility and consumer engagement.

Trade policy shifts and material cost pressures have accelerated reconsideration of traditional metal packaging reliance, while robust domestic recycling infrastructure provides a critical buffer against tariff exposure. The strategic adoption of diverse substrates and modular production technologies positions industry participants to respond nimbly to evolving market conditions and regulatory requirements.

Key regional differences in infrastructure, regulatory frameworks, and consumer behavior highlight the necessity of tailored packaging approaches, while collaboration between packaging innovators and brewers fosters a collective advancement of sustainable, premium, and data-driven packaging solutions.

By aligning organizational priorities with these industry dynamics and leveraging the actionable recommendations outlined, companies can optimize packaging configurations, reinforce brand distinctiveness, and unlock profitable growth in an increasingly competitive and conscientious beer market.

Connect Directly with Ketan Rohom to Access Exclusive Beer Packaging Market Intelligence and Drive Strategic Growth

To gain a competitive advantage and unlock the full potential of the beer packaging market, contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive beer packaging market research report. This report delivers granular insights into emerging materials, regional trends, and strategic best practices, equipping your organization to optimize packaging innovation, navigate tariff disruptions, and accelerate sustainable growth.

Elevate your strategic decision-making with rigorous analysis, expert commentary, and actionable data curated specifically for packaging and brewing decision-makers. Reach out to Ketan Rohom to discuss how this report can be tailored to your company’s unique objectives and support your next-generation packaging strategies.

- How big is the Beer Packaging Market?

- What is the Beer Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?