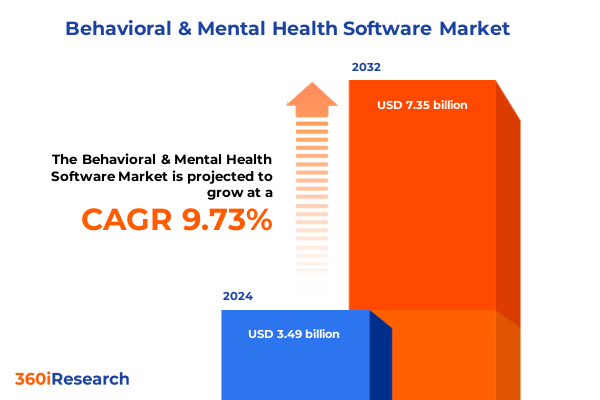

The Behavioral & Mental Health Software Market size was estimated at USD 3.83 billion in 2025 and expected to reach USD 4.18 billion in 2026, at a CAGR of 9.72% to reach USD 7.35 billion by 2032.

Unveiling the Rising Imperative for Innovative Behavioral and Mental Health Software Solutions to Address Expanding Demand and Transform Clinical Outcomes

The behavioral and mental health software sector has become an essential driver of innovation in modern healthcare delivery. As mental health conditions continue to rise in prevalence globally, providers and payers alike seek scalable digital solutions to bridge gaps in access, enhance patient engagement, and improve clinical outcomes. Regulatory bodies are increasingly recognizing the importance of telehealth parity, prompting organizations to adopt digital platforms that seamlessly integrate with existing electronic health record systems and meet stringent security and privacy standards. Consequently, software vendors are racing to develop intuitive, data-driven applications that support not only therapy and counseling services but also preventive care, population health management, and analytics-driven decision making.

In today’s healthcare landscape, the convergence of policy momentum and technological advancement has created a fertile environment for next-generation mental health platforms. The integration of artificial intelligence capabilities-such as natural language processing for symptom tracking and predictive analytics for crisis intervention-has the potential to transform traditional workflows, enabling clinicians to deliver personalized care at scale. Meanwhile, the shift toward value-based reimbursement models underscores the necessity for software solutions that can demonstrate measurable outcomes and operational efficiencies. Through this executive summary, we introduce the key trends, challenges, and opportunities that define the market, setting the stage for a deeper exploration of transformative shifts, tariff implications, segmentation insights, and strategic recommendations.

Navigating the Transformational Shifts Redefining Behavioral and Mental Health Software Adoption Driven by Telehealth Expansion and AI-Enabled Clinical Insights

The behavioral and mental health software domain has undergone rapid transformation driven by pivotal shifts in care delivery, technology adoption, and regulatory reform. Telehealth expansion, catalyzed by the pandemic, remains a cornerstone, with providers extending virtual access beyond crisis care to ongoing therapy, medication management, and community support. This extension has accelerated the adoption of integrated platforms that unite video consultations, secure messaging, and digital assessments, empowering clinicians to assemble comprehensive patient profiles in real time. Simultaneously, the infusion of artificial intelligence and machine learning into clinical workflows has enabled more accurate risk stratification, early detection of relapse, and tailored intervention pathways, elevating the standard of care.

Beyond digital front doors, interoperability has emerged as a critical focus. Industry stakeholders now demand seamless data exchange across electronic health record systems, wearables, and patient engagement applications. Standardized APIs and interface engines facilitate bi-directional communication, reducing administrative burden and enhancing care coordination. In parallel, data privacy regulations-such as enhancements to HIPAA and state-level telehealth mandates-have introduced new compliance obligations, prompting vendors to fortify encryption measures and audit capabilities. Consequently, the market has shifted from standalone telepsychiatry offerings to comprehensive, end-to-end platforms that prioritize scalability, security, and outcome measurement.

Assessing the Cumulative Impact of 2025 United States Tariff Adjustments on Behavioral and Mental Health Software Provision Models and Associated Technology Costs

In early 2025, adjustments to United States tariffs on imported technology components introduced novel considerations for behavioral and mental health software providers. While digital solutions themselves remain intangible and free from direct duties, platforms that require on-premises hardware appliances-such as telemedicine kiosks, biometric sensors, and dedicated server infrastructure-have witnessed incremental cost pressures. Cloud-based deployments have largely evaded these effects, leading vendors to accelerate the migration of hybrid architectures toward fully managed public cloud offerings. As a result, many service providers have opted to reduce their reliance on imported edge devices, instead leveraging domestic hardware partners or cloud-native tools that minimize exposure to tariff fluctuations.

Moreover, the rising cost of peripheral equipment has prompted a reassessment of support and maintenance strategies. Organizations reliant on consulting engagements for on-site deployments are now negotiating new contract models that emphasize virtual commissioning and remote monitoring. Consequently, pure-play software vendors have responded with expanded professional services portfolios, embedding device-as-a-service options that bundle hardware, software, and perpetual updates into a single subscription. Although these adaptations have mitigated the financial impact of tariff revisions, stakeholders continue to monitor policy developments closely, prioritizing geographies and vendor partnerships that offer stability and tariff resilience.

Deep Diving into Market Segmentation Revealing Deployment Modes Components End Users and Applications Shaping the Behavioral and Mental Health Software Landscape

Evaluating the behavioral and mental health software market through the lens of deployment models reveals a clear preference for cloud adoption driven by cost efficiency and scalability. Private cloud systems appeal to organizations with stringent data residency and customization needs, while public cloud solutions provide rapid provisioning and elastic resource allocation to meet fluctuating user demand. Although on-premises implementations still serve enterprises with legacy infrastructure or specific compliance mandates, the trajectory favors cloud-centric distribution due to reduced capital expenses and streamlined upgrade cycles.

Consideration of the software versus services dichotomy further illuminates market dynamics. Extensive support and maintenance arrangements, alongside consulting engagements, help clients navigate implementation complexities and regulatory compliance. In contrast, the software suite itself bifurcates into clinical and non-clinical modules. Clinical solutions focus on therapeutic workflows, assessments, and care planning, whereas non-clinical applications emphasize administrative tasks and operational efficiencies.

By examining end-user verticals, it becomes evident that hospitals and ambulatory care centers dominate adoption volumes, leveraging integrated platforms to coordinate multidisciplinary care teams. At the same time, individual users access subscription-based mobile applications for self-care and guided therapy exercises. Telehealth providers, including community mental health agencies and virtual-first clinics, also rely on software architectures that support robust video conferencing and real-time data analytics.

Application-level segmentation emphasizes key functionalities that drive buyer preferences. Solutions offering electronic health record integration-through scalable APIs and HL7 interface modules-ensure seamless data exchange across clinical systems. Patient engagement features, such as appointment scheduling and medication management tools, promote adherence and reduce no-show rates. Practice management capabilities address resource allocation through dynamic scheduling and billing engines. Finally, telehealth modules deliver on-demand connectivity between patients and providers, complemented by remote monitoring and secure messaging services.

This comprehensive research report categorizes the Behavioral & Mental Health Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Component

- End User

- Application

Examining Key Regional Dynamics in the Behavioral and Mental Health Software Market across the Americas Europe Middle East Africa and Asia-Pacific Powerhouses

A regional perspective on the behavioral and mental health software market underscores varied adoption curves and regulatory frameworks. In the Americas, the United States leads with expansive telehealth infrastructure, aggressive reimbursement policies, and an entrenched network of private health systems. Canada’s focus on public healthcare has catalyzed province-led digital mental health initiatives, while Latin American nations are progressing through pilot programs that leverage low-cost mobile solutions to bridge resource gaps.

Across Europe, Middle East and Africa, the landscape is equally diverse. Western European countries benefit from unified regulatory standards like GDPR and established national health services that integrate digital mental health platforms at scale. In the Middle East, public–private partnerships drive investment in telepsychiatry, particularly in urban centers grappling with workforce shortages. African markets often bypass traditional on-premises deployments by favoring cloud and mobile-first applications, enabling rapid outreach in rural communities where infrastructure limitations prevail.

The Asia-Pacific region presents a dynamic mix of digital maturity and regulatory nuance. Nations such as Australia and New Zealand exhibit advanced telehealth reimbursement schemes and interoperability mandates, fueling robust vendor competition. Southeast Asian markets are witnessing accelerated uptake of AI-driven self-help applications, supported by widespread smartphone penetration. In contrast, emerging markets in South Asia emphasize affordable access, leading vendors to tailor lightweight, multilingual platforms that accommodate low-bandwidth environments.

This comprehensive research report examines key regions that drive the evolution of the Behavioral & Mental Health Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Competitive Differentiators among Leading Behavioral and Mental Health Software Providers in a Rapidly Evolving Marketplace

Leading technology providers in the behavioral and mental health software domain differentiate themselves through depth of clinical specialization, integration capabilities, and strategic partnerships. Established electronic health record vendors have expanded into mental health by embedding clinical assessment modules and telehealth integrations within broader care management suites. Meanwhile, digital-native companies have carved out niche segments, such as AI-based symptom tracking and peer support networks, that resonate with younger demographics and tech-savvy patient cohorts.

Partnership strategies also underscore competitive positioning. Collaborations with academic medical centers facilitate robust clinical validation of digital therapeutics, enhancing product credibility and accelerating regulatory approvals. Joint ventures with telecommunications firms enable optimized streaming performance and device bundling, particularly in regions with variable network quality. Moreover, investment arms of major healthcare conglomerates have initiated acquisition sprees, targeting innovative start-ups in remote patient monitoring and virtual reality–based behavioral interventions, thereby consolidating market share and broadening product portfolios.

Service delivery models constitute another axis of differentiation. Some vendors offer full-spectrum professional services, from implementation workshops to ongoing change management support, ensuring high customer retention rates. Others adopt a lean, self-service approach, empowering smaller practices and individual providers to deploy scalable solutions with minimal external assistance. Collectively, these strategic maneuvers illustrate a multi-faceted competitive tapestry characterized by both consolidation and entrepreneurial agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Behavioral & Mental Health Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvancedMD, Inc.

- BetterHelp, Inc.

- Calm.com, Inc.

- Carepatron Limited

- CounSol.com, LLC

- Eleanor Health, Inc.

- Ensora Health, Inc.

- Headspace Health, Inc.

- ICANotes, LLC

- Iris Telehealth, Inc.

- Lyra Health, Inc.

- Modern Health, Inc.

- NextGen Healthcare, Inc.

- Qualifacts Systems, LLC

- SimplePractice, LLC

- Spring Health, Inc.

- Talkspace, Inc.

- TherapyNotes, LLC

- Valant Medical Solutions, Inc.

- Woebot Health, Inc.

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends and Strengthen Behavioral and Mental Health Software Offerings

Industry leaders seeking to thrive in the behavioral and mental health software arena should prioritize a set of strategic imperatives. First, embracing cloud-native architectures and modular microservices will enable rapid feature rollouts and seamless scalability while mitigating exposure to hardware-related tariffs. Further, embedding advanced analytics tools that offer predictive insights and real-time performance dashboards can help customers demonstrate measurable outcomes and operational efficiencies to payers and regulators.

Additionally, forging strategic alliances with hardware manufacturers, telecommunication networks, and academic research centers will bolster product credibility and extend market reach. By co-developing integrated solutions-combining telepsychiatry kiosks with AI-driven diagnostic engines-vendors can differentiate their offerings and foster stickiness among enterprise buyers. It is also essential to cultivate a developer ecosystem through robust APIs and software development kits, empowering third-party innovators to create complementary modules that enrich the platform’s functionality.

Finally, vendors should adopt flexible commercial models, blending subscription-based pricing with device-as-a-service and outcome-based contracts. Such hybrid approaches align incentives across stakeholders, reduce procurement friction, and support long-term customer retention. By operationalizing these recommendations, industry players can not only navigate tariff headwinds and regulatory flux but also capitalize on the accelerating demand for digital mental health solutions.

Outlining a Robust Research Methodology Combining Qualitative and Quantitative Approaches to Deliver Comprehensive Insights into the Behavioral and Mental Health Software Domain

The research methodology underpinning this analysis integrated both qualitative and quantitative techniques to ensure comprehensive insights into the behavioral and mental health software landscape. Secondary research included an exhaustive review of regulatory filings, industry white papers, patent databases, and peer-reviewed studies to identify key drivers, barriers, and technological trends. Simultaneously, primary research was conducted through in-depth interviews with C-level executives, product managers, clinicians, and healthcare payers, enabling a granular understanding of vendor strategies and end-user requirements.

To validate market segmentation and regional dynamics, the study deployed a series of online surveys targeted at hospitals, ambulatory care centers, individual providers, and telehealth organizations across major geographies. Advanced statistical models were applied to cleanse the data, uncover correlations between deployment preferences and clinical outcomes, and project adoption trajectories under varying policy scenarios. Triangulation of these findings with real-world case studies-such as large-scale telepsychiatry implementations and AI-based risk assessment pilots-ensured robustness and mitigated potential biases.

Throughout the engagement, the research team adhered to rigorous quality management protocols, including dual-source data verification, iterative review cycles, and peer validation. This multi-layered approach underpins the report’s credibility and equips stakeholders with actionable, evidence-based intelligence to inform strategic decision making in one of healthcare’s most dynamic sectors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Behavioral & Mental Health Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Behavioral & Mental Health Software Market, by Deployment Mode

- Behavioral & Mental Health Software Market, by Component

- Behavioral & Mental Health Software Market, by End User

- Behavioral & Mental Health Software Market, by Application

- Behavioral & Mental Health Software Market, by Region

- Behavioral & Mental Health Software Market, by Group

- Behavioral & Mental Health Software Market, by Country

- United States Behavioral & Mental Health Software Market

- China Behavioral & Mental Health Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Perspectives on Future-Proofing Behavioral and Mental Health Software Strategies amid Technological Advances Regulatory Shifts and Evolving Care Delivery Models

As digital transformation reshapes behavioral and mental health care, software platforms stand at the forefront of enabling personalized, scalable, and data-driven interventions. The confluence of telehealth expansion, AI-driven clinical insights, and evolving reimbursement models promises to unlock new avenues for patient engagement and outcome measurement. Yet, stakeholders must remain vigilant to policy shifts-such as tariffs on ancillary hardware components and tightening data privacy regulations-that could influence cost structures and integration strategies.

Forward-looking organizations will differentiate themselves by embracing open architectures, fostering strategic partnerships, and adopting flexible commercial frameworks that align incentives across the care continuum. By focusing on interoperability, predictive analytics, and user-centric design, vendors can address the dual imperatives of clinical efficacy and operational efficiency. Ultimately, the software solutions that succeed will be those that seamlessly integrate into care pathways, deliver quantifiable value to payers and providers, and adapt agilely to the rapidly evolving demands of patients and regulators alike.

This executive summary sets the stage for a deeper dive into market dynamics and strategic imperatives. As you progress through the full report, you will uncover detailed segmentation analyses, company profiles, and scenario-based recommendations designed to equip your organization with the insights necessary to lead in the behavioral and mental health software arena.

Secure Your Competitive Advantage with a Tailored Behavioral and Mental Health Software Market Report Through Direct Engagement with Ketan Rohom Associate Director Sales Marketing

Leverage this indispensable market research to guide your strategic decisions and gain a clear view of the behavioral and mental health software horizon. Engage directly with Ketan Rohom Associate Director Sales & Marketing to unlock personalized guidance and access to the full research report. With expert insights at your fingertips you can confidently shape product roadmaps optimize investment priorities and stay ahead of evolving patient care models. Contact Ketan Rohom to arrange a tailored briefing and discover how this comprehensive analysis can drive growth within your organization today

- How big is the Behavioral & Mental Health Software Market?

- What is the Behavioral & Mental Health Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?