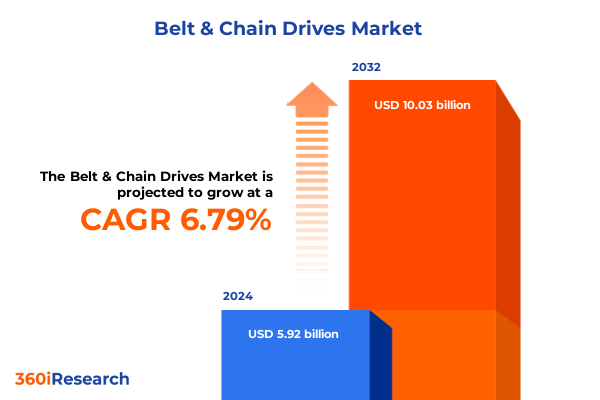

The Belt & Chain Drives Market size was estimated at USD 6.33 billion in 2025 and expected to reach USD 6.67 billion in 2026, at a CAGR of 6.79% to reach USD 10.03 billion by 2032.

Exploring the Critical Role of Belt and Chain Drives Across Industries Enabling Reliable Power Transmission and Operational Excellence

Belt and chain drives have long been the backbone of mechanical power transmission across diverse industrial domains where reliability efficiency and precision are paramount. From the agricultural fields where robust leaf chains power irrigation systems to high-speed manufacturing lines relying on synchronous belts for precise motion control the role of these components remains irreplaceable. By translating rotary motion into linear work belt and chain drives facilitate critical processes in sectors ranging from automotive assembly to food and beverage packaging. Their enduring significance arises from a combination of mechanical simplicity low maintenance requirements and adaptability to a broad spectrum of power ratings and environmental conditions.

As emerging technologies reshape how industries operate the foundational importance of belt and chain drive systems has never been more evident. Innovations in materials science and digital monitoring have augmented these traditional mechanisms enabling enhanced performance and predictive maintenance capabilities. At the same time evolving regulatory frameworks and shifting trade policies present both challenges and strategic inflection points for stakeholders across the global supply chain. This executive summary synthesizes the most pertinent developments transforming the belt and chain drive market in 2025 providing decision makers with a concise yet comprehensive understanding of the forces shaping future growth.

Understanding the Pivotal Technological Advancements and Market Dynamics Reshaping the Belt and Chain Drive Industry in Recent Years

Over the past several years the landscape for belt and chain drives has evolved profoundly as technological advancements converge with shifting market demands. Material innovations such as high-tensile steel alloys advanced polyurethane composites and enhanced rubber compounds have improved tensile strength reduced wear and extended service life. These breakthroughs have facilitated the development of ultra-narrow V belts and high-torque synchronous belts capable of maintaining performance under elevated loads and temperatures. Concurrently additive manufacturing techniques have enabled rapid prototyping of specialized pulleys sprockets and tensioners supporting faster customization and on-site replacement.

Beyond materials digital transformation has emerged as a pivotal driver of change. IoT-enabled tension monitoring systems now provide real-time feedback on belt alignment and chain lubrication status directly to centralized control platforms. This predictive maintenance capability drastically reduces unscheduled downtime and optimizes operating costs by scheduling interventions based on actual condition rather than predetermined intervals. Moreover environmental sustainability goals have spurred demand for energy-efficient designs and recyclable materials adding a new dimension to product development roadmaps. As a result industry leaders are integrating smart sensor arrays and lightweight compositions to meet stringent emissions targets while delivering the durability and reliability that end users expect.

Assessing How Recent Tariff Implementations in the United States Have Altered Supply Chains Pricing Structures and Competitive Balances in 2025

In early 2025 the United States government enacted a series of tariffs targeting imports of critical components including rubber belts steel chains and associated hardware. Cumulatively these measures have introduced significant shifts across the supply chain with immediate ripple effects on cost structures sourcing strategies and competitive positioning. Manufacturers heavily reliant on lower-cost imports experienced margin compression prompting many to reassess supplier relationships and explore domestic or near-shore alternatives.

The impact of these tariffs extends beyond pricing adjustments. Several original equipment manufacturers have accelerated joint development agreements with local producers to secure preferential access to components exempt from duties. These strategic partnerships have fostered technology transfer and localized production capabilities reducing vulnerability to future policy changes. At the same time distributors and end users have diversified their vendor portfolios to include non-tariffed sources in Asia Pacific and Eastern Europe cushioning supply disruptions. While the full repercussions will continue to unfold throughout 2025 the immediate consequence has been a greater drive toward vertical integration and supply chain resilience among industry players.

Unveiling Strategic Insights from Segmentation by Product Type Drive Type End User Power Rating Material and Sales Channel Dynamics

A nuanced understanding of belt and chain drive market segmentation reveals distinct trends shaping demand dynamics. When evaluating product types flat belts continue to be favored for light to medium-duty conveying applications with nylon core variants demonstrating superior flexibility while polyester core alternatives offer cost advantages. Leaf chains maintain a strong foothold in heavy-duty lifting and load-securing contexts where single leaf configurations dominate standard capacity needs but twin leaf constructions are gaining traction for enhanced strength. In parallel roller chains are differentiating between single strand options for general motion tasks and double strand designs required for higher load capacities. Synchronous belts segmented into GT2 for compact precision drives and HTD for power-dense applications address specific speed and torque requirements. V belts remain ubiquitous across diverse mechanical systems with classical types serving traditional installations while double and narrow V belts cater to space-constrained and high-efficiency scenarios.

Drive type delineation underscores the enduring prevalence of belt drives in applications prioritizing quiet operation and minimal lubrication alongside chain drives in settings demanding high tensile capabilities and abrasion resistance. End user analysis highlights robust demand from agriculture where puncture-resistant chains withstand harsh field conditions, automotive assembly lines that rely on precision belts for conveyor systems, construction equipment requiring heavy-duty leaf chains, and food & beverage facilities where hygiene-compliant synchronous belts ensure safe product handling. Manufacturing plants across sectors leverage both belt and chain solutions to optimize varied machinery configurations while mining and oil & gas industries depend on corrosion-resistant materials and high-torque chains to manage extreme environments.

Power rating insights reveal an even distribution of applications across under 5 kW solutions for small-scale machinery, 5–30 kW offerings suited to moderate industrial processes, 30–75 kW drives powering large conveyors and heavy equipment, and above 75 kW systems used in major energy-intensive installations. Material preferences follow performance criteria with plastic belts chosen for light-duty and low-cost projects, polyurethane variants balancing durability and flexibility, rubber ensuring broad temperature tolerance, and steel chains offering unmatched tensile strength. Lastly distribution through offline channels remains dominant due to direct technical support whereas online sales channels are gaining momentum for standardized belt and chain offerings facilitating rapid procurement.

This comprehensive research report categorizes the Belt & Chain Drives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Drive Type

- Power Rating

- Material

- End User

- Sales Channel

Analyzing Regional Variations in Belt and Chain Drive Demand and Innovation Across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics within the belt and chain drive market exhibit pronounced variation driven by divergent industrial priorities and infrastructure developments. In the Americas modern manufacturing corridors in the United States and Canada emphasize lean production techniques favoring advanced synchronous belts integrated with condition-monitoring systems. Meanwhile Latin American markets are experiencing incremental upgrades to agricultural and mining equipment where robust leaf chains and roller chains designed for high wear resistance play pivotal roles in sustaining productivity amid challenging environments.

Across Europe the Middle East and Africa automotive manufacturing hubs enforce stringent quality and safety standards necessitating precision-engineered V belts and silent chains for assembly lines. Investments in renewable energy projects in regions such as North Sea wind farms and Middle East solar installations have spurred demand for high-output gearing solutions where high-torque belt drives and corrosion-resistant chain drives must withstand cyclic loading. African mining operations rely extensively on heavy-duty roller chains and leaf chains as they navigate the continent’s growing mineral extraction initiatives.

Asia-Pacific remains the largest growth engine fueled by rapid industrialization and expanding automation in China, India and Southeast Asia. Textile and packaging sectors in this region continue to adopt cost-effective flat belt drives for high-speed conveyors while heavy machinery manufacturers integrate narrow V belts and synchronous belts into compact drive systems. Government incentives for manufacturing modernization in East Asia further accelerate the adoption of digitally enabled chain drives and smart belt tensioning solutions underscoring the region’s commitment to productivity optimization and equipment longevity.

This comprehensive research report examines key regions that drive the evolution of the Belt & Chain Drives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Approaches Competitive Strengths and Collaborative Initiatives of Leading Manufacturers in the Belt and Chain Drive Sector

Leading players in the belt and chain drive sector are advancing their market positions through targeted investments in research development and strategic collaborations. Major manufacturers have diversified their portfolios by enhancing product lines with premium materials and smart monitoring capabilities while optimizing production footprints via greenfield expansions in key industrial clusters. Collaborative partnerships between component suppliers and industrial automation providers have yielded integrated drive systems that streamline installation and ensure seamless compatibility with emerging digital infrastructure.

In addition to organic growth initiatives companies are leveraging mergers and acquisitions to broaden geographic reach and consolidate supply chains. Strategic acquisitions of regional distributors and specialty belt producers have enabled international firms to strengthen local support networks and expedite order fulfillment. These alliances also foster technology transfer enhancing the collective capacity for innovation in areas such as noise-reduction treatments and advanced surface coatings that extend belt and chain lifespan.

Competitive differentiation further arises from comprehensive after-sales service offerings including predictive maintenance platforms and training programs that empower end users to optimize drive performance. By coupling proactive technical support with modular product designs manufacturers are positioning themselves as full-service partners capable of addressing the evolving needs of diverse industries.

This comprehensive research report delivers an in-depth overview of the principal market players in the Belt & Chain Drives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arntz Optibelt Group GmbH

- Bando Chemical Industries, Ltd.

- Bridgestone Corporation

- Colmant & Cuvelier NV

- Continental AG

- Dayco Products, LLC

- Diamond Chain Company

- Fenner PLC

- Gates Corporation

- Hutchinson SA

- IWIS Motorsysteme GmbH & Co. KG

- KMC Chain Industrial Co., Ltd.

- Nitta Corporation

- Renold plc

- Rexnord Corporation

- Sempertrans Group a.s.

- SKF AB

- Sumitomo Riko Company Limited

- The Timken Company

- Tsubakimoto Chain Co., Ltd.

Providing Actionable Strategies for Industry Leaders to Optimize Supply Chains Innovate Product Portfolios and Mitigate Geopolitical and Regulatory Risks

Industry leaders seeking to navigate the rapidly evolving belt and chain drive landscape should prioritize a multifaceted approach centered on innovation resilience and strategic partnerships. Investing in digital monitoring systems for real-time condition assessment will enable predictive maintenance models that reduce total cost of ownership and enhance operational uptime. Concurrently exploring alternative materials such as recyclable polymers and high-performance composites can position organizations at the forefront of sustainability initiatives while meeting demanding performance criteria.

To counter geopolitical risks and tariff impacts developing a diversified supplier network spanning domestic near-shore and non-tariff regions is essential for maintaining continuity of supply. Engaging in collaborative product development agreements with tier-one OEMs can accelerate co-innovation efforts and secure long-term contracts that insulate against market volatility. Additionally adopting flexible manufacturing processes capable of accommodating multiple belt and chain specifications will support rapid configuration changes demanded by evolving end-user requirements.

Finally strengthening end-customer engagement through comprehensive training programs and digital support platforms will build loyalty and generate recurring service revenue. By fostering an ecosystem that integrates product development, supply chain optimization and customer success, companies can unlock sustainable growth pathways and establish lasting competitive advantages.

Detailing the Comprehensive Research Methodology Employed to Gather Analyze and Validate Critical Data Points in the Belt and Chain Drive Study

This study employs a rigorous multi-stage research methodology integrating primary and secondary data sources to ensure comprehensive market coverage and analytical depth. Primary research entailed in-depth interviews with executives engineers and procurement specialists across equipment manufacturers distributors and end-user organizations. These interactions provided qualitative insights into purchasing criteria technological preferences and regulatory compliance challenges influencing belt and chain drive adoption.

Secondary research encompassed a detailed review of company literature including annual reports white papers and technical bulletins alongside trade association publications and industry journals. Customs trade data and patent filings were analyzed to trace import export trends and identify emerging technological breakthroughs. Publicly available information from regulatory bodies informed the assessment of tariff measures and compliance requirements.

Collected data underwent rigorous triangulation using multiple analytical frameworks such as SWOT analysis to evaluate competitive positioning, PESTEL analysis to assess macro-environmental factors and Porter’s Five Forces to gauge industry attractiveness. Worksheet-level validation procedures were implemented to cross-check data points ensuring accuracy and consistency. The resulting dataset was synthesized into a structured taxonomy of segmentation categories enabling granular analysis across product types drive types end users power ratings materials and sales channels.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Belt & Chain Drives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Belt & Chain Drives Market, by Product Type

- Belt & Chain Drives Market, by Drive Type

- Belt & Chain Drives Market, by Power Rating

- Belt & Chain Drives Market, by Material

- Belt & Chain Drives Market, by End User

- Belt & Chain Drives Market, by Sales Channel

- Belt & Chain Drives Market, by Region

- Belt & Chain Drives Market, by Group

- Belt & Chain Drives Market, by Country

- United States Belt & Chain Drives Market

- China Belt & Chain Drives Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing Key Findings and Industry Implications to Guide Decision Makers Navigating an Evolving Landscape of Belt and Chain Drive Technologies

In summary recent advancements in materials science digitization and sustainability imperatives have propelled belt and chain drive systems into a new era of performance and reliability. The introduction of tariffs in the United States has catalyzed a shift toward supply chain resilience through localized production and diversified sourcing strategies. Segmentation analysis underscores distinct growth drivers and material preferences across varied end-use sectors while regional insights highlight the differentiated adoption patterns from the Americas through EMEA to Asia-Pacific.

Key manufacturers continue to consolidate through strategic investments in smart technologies after-sales services and collaborative partnerships that enhance both product offerings and customer support ecosystems. By embracing actionable recommendations focused on digital integration flexible sourcing and sustainable material development industry leaders can safeguard their operational models and capitalize on emerging opportunities. This executive summary distills critical findings that will guide decision makers in navigating the complexities of a dynamic belt and chain drive market landscape.

Engage Directly with Our Associate Director of Sales Marketing to Secure Your Comprehensive Belt and Chain Drive Market Research Report Today

To explore a tailored plan for leveraging our in-depth belt and chain drive market analysis, connect with Ketan Rohom Associate Director of Sales & Marketing at 360iResearch today and secure exclusive access to the full report. With his deep knowledge of industry trends and market drivers, Ketan can provide personalized guidance on interpreting data insights optimizing procurement strategies and identifying growth opportunities. Engage now to benefit from his strategic recommendations ensure your competitive edge and drive your organization toward operational excellence and sustained profitability.

- How big is the Belt & Chain Drives Market?

- What is the Belt & Chain Drives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?