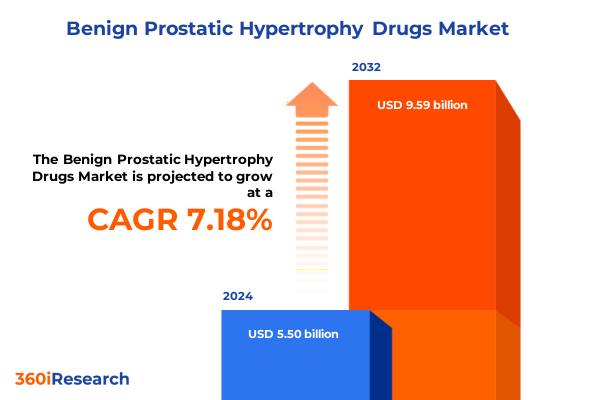

The Benign Prostatic Hypertrophy Drugs Market size was estimated at USD 5.89 billion in 2025 and expected to reach USD 6.29 billion in 2026, at a CAGR of 7.20% to reach USD 9.59 billion by 2032.

Setting the Stage for Strategic Understanding of Benign Prostatic Hypertrophy Therapeutic Dynamics and Stakeholder Priorities in a Shifting Clinical Environment

The benign prostatic hypertrophy (BPH) therapeutic landscape has reached a pivotal juncture, where evolving patient profiles, technological advances, and shifting regulatory priorities converge to redefine treatment paradigms. Long regarded as a condition affecting aging male populations, BPH is now subject to heightened scrutiny as healthcare systems worldwide focus on optimizing long-term patient outcomes through personalized intervention strategies. This report’s introduction offers a clear contextual foundation, unpacking how demographic transitions-particularly increases in life expectancy-are intensifying demand for highly effective, well-tolerated pharmacotherapies.

Meanwhile, clinical guidelines have steadily embraced a broader spectrum of therapeutic modalities, reflecting the need for balanced efficacy and safety. Digital tools for remote monitoring and adherence support are gaining traction, underscoring the value of patient-centric frameworks that integrate real-world evidence with traditional clinical measures. Through this lens, the following sections explore the convergence of scientific breakthroughs, competitive forces, and policy shifts that together set the stage for strategic engagement within the BPH drug domain.

Uncovering Pivotal Transformations Reshaping the BPH Treatment Arena and Emerging Therapeutic Models Driving Enhanced Patient Outcomes Across the Landscape

In recent years, the BPH treatment landscape has undergone a marked transformation driven by breakthrough combination regimens, refinements in phytotherapeutic formulations, and the integration of precision medicine principles. Therapeutic combinations that leverage the synergistic mechanisms of 5-alpha reductase inhibitors alongside selective alpha blockers have demonstrated enhanced symptomatic relief, reshaping prescriber preferences. At the same time, there is renewed interest in phytotherapy agents such as beta-sitosterol and Pygeum extracts, propelled by patient demand for natural alternatives and supportive evidence of safety advantages when administered alongside conventional drugs.

Concurrently, advances in digital health have introduced robust platforms for remote patient monitoring, enabling real-time assessment of urinary symptom scores and treatment adherence. These technologies facilitate more dynamic, data-driven therapeutic adjustments and strengthen the connection between providers and patients. Moreover, the emergence of minimally invasive procedural options continues to inform the dialogue on long-term management strategies, fostering an environment where pharmacological innovation coexists harmoniously with procedural evolution to deliver holistic care solutions.

Assessing the Ripple Effects of 2025 United States Tariff Policies on BPH Therapeutic Supply Chains and Industry Cost Structures in a Changing Trade Framework

The implementation of new tariff measures by the United States in 2025 has introduced additional layers of complexity across BPH drug supply chains. Imported active pharmaceutical ingredients (APIs) and finished goods have encountered elevated duties, compelling manufacturers to reassess sourcing strategies and production footprints. In response, leading players are evaluating localized manufacturing partnerships and dual‐sourcing arrangements to mitigate cost volatility and secure uninterrupted supply. These strategic supply chain realignments underscore the necessity of agile procurement and contractual frameworks that can adapt to shifting trade regulations.

Furthermore, the downstream consequences of tariff-induced cost pressures are influencing pricing strategies and payer negotiations. Pharmaceutical companies are proactively engaging reimbursement authorities with value dossiers that emphasize long-term economic benefits such as reduced hospitalization rates and improved quality of life. This emphasis on health-economic outcomes serves not only to offset rising input costs but also to solidify the clinical and financial rationale for premium therapy options. As a result, industry stakeholders must continuously monitor developments in trade policy and refine their market access schemes to sustain competitive advantage.

Revealing Intricate Segmentation Patterns Illuminating Diverse Therapeutic Categories, Formulations, Channels, and Brand Differentiation in the BPH Drug Market

A nuanced understanding of BPH drug market segmentation is essential for discerning the strategic priorities of key players and aligning product innovation with unmet clinical needs. When examining drug class distinctions, five‐alpha reductase inhibitors such as dutasteride and finasteride continue to anchor many treatment algorithms, frequently complemented by selective alpha blockers including tamsulosin and silodosin to address dynamic urinary symptoms. The rise of combination therapies, particularly coformulations of dutasteride plus tamsulosin or finasteride plus tamsulosin, highlights the industry’s commitment to comprehensive symptom control. In parallel, the resurgence of phytotherapeutic compounds such as saw palmetto extract has introduced an alternative pathway for patients seeking integrative care approaches.

Differentiation also emerges through considerations of generic versus branded status. High‐profile brands like Avodart, Flomax, Jalyn, and Proscar maintain strong prescriber loyalty, leveraging established safety profiles and patient familiarity. Conversely, generic formulations have accelerated affordability and broadened access, prompting branded manufacturers to reinforce value propositions through patient support services and real‐world evidence. Distribution channel analysis reveals that hospital pharmacies, online pharmacies, and retail pharmacy outlets each contribute unique dynamics to product availability, patient engagement, and pricing models. Finally, dosage form innovations-ranging from extended‐release capsules to immediate‐release tablets and convenient oral solutions-allow for tailored dosing regimens that optimize therapeutic adherence and minimize adverse events.

This comprehensive research report categorizes the Benign Prostatic Hypertrophy Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Generic Status

- Dosage Form

- Distribution Channel

Highlighting Regional Nuances in BPH Therapeutic Adoption and Market Evolution Across Americas, Europe Middle East Africa, and Asia Pacific Landscapes

Exploring regional market behaviors provides critical perspective on how BPH therapies are adopted and adapted within varied healthcare ecosystems. In the Americas, established reimbursement frameworks and robust healthcare infrastructure drive steady uptake of both innovative branded therapies and cost-effective generic alternatives. Managed care protocols emphasize value-based arrangements, incentivizing stakeholders to demonstrate tangible improvements in patient‐reported outcomes and long-term cost efficiency. Digital health initiatives further bolster patient monitoring and adherence support, reinforcing the region’s leadership in integrated care models.

In contrast, Europe, the Middle East, and Africa present a mosaic of regulatory and reimbursement environments, where reimbursement policies and national formularies often diverge significantly. While countries with centralized health systems may favor guideline-endorsed, cost-effective treatments, others encourage premium formulations that align with local prescribing habits. There is a particular affinity for phytotherapeutic compounds across certain European markets, reflecting cultural preferences for natural remedies. Meanwhile, Asia-Pacific markets display rapid growth potential driven by increasing disease awareness, expanding healthcare access, and the proliferation of telehealth platforms. Local manufacturing capacity and public–private partnerships are key drivers in reducing dependence on imports and accelerating treatment adoption in emerging economies.

This comprehensive research report examines key regions that drive the evolution of the Benign Prostatic Hypertrophy Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders and Innovative Collaborations Fueling Competitive Differentiation and Portfolio Advancement in BPH Therapeutics

The competitive landscape for BPH therapeutics is defined by a mix of established pharmaceutical powerhouses and agile specialty players. Companies with blockbuster brands such as Avodart and Proscar have leveraged extensive clinical data and patient support programs to sustain prescribing momentum. Meanwhile, providers of branded tamsulosin formulations like Flomax and combination products such as Jalyn continue to invest in marketing initiatives that underscore differentiation based on patient convenience and tolerability. As patents expire, generic manufacturers are capitalizing on cost-sensitive segments, deploying aggressive pricing strategies and broad distribution networks to capture volume share.

Strategic collaborations and licensing agreements also feature prominently in company playbooks. Joint ventures between multinational corporations and regional generic producers facilitate faster market entry and local footprint expansion. At the same time, major biopharma firms are actively exploring next-generation pipeline candidates, including novel receptor modulators and innovative delivery systems that promise improved patient adherence. These diverse approaches-spanning cost leadership, premium branding, and forward-looking R&D-illustrate how leading stakeholders are positioning themselves to navigate evolving patient expectations and regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Benign Prostatic Hypertrophy Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc

- Astellas Pharma Inc

- Bayer AG

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Endo Pharmaceuticals Inc

- GlaxoSmithKline plc

- Ipsen S.A

- Johnson & Johnson

- Kaken Pharmaceutical Co Ltd

- Kissei Pharmaceutical Co Ltd

- Merck & Co Inc

- Novartis AG

- Pfizer Inc

- Sanofi S.A

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd

- Viatris Inc

Articulating Targeted Strategic Initiatives to Navigate Competitive Pressures, Regulatory Shifts, and Patient Engagement Trends in the BPH Drug Sector

To effectively address mounting competitive pressures and evolving payer requirements, industry leaders must pursue targeted initiatives that reinforce therapeutic value and operational resilience. Prioritizing R&D investments in novel combination regimens and advanced formulation technologies can deliver differentiated efficacy while addressing adherence challenges. Concurrently, companies should forge strategic alliances with contract manufacturers and logistics partners to bolster supply chain flexibility and minimize exposure to trade policy disruptions.

Engagement with key opinion leaders and patient advocacy groups is essential for shaping clinical narratives and reinforcing market access strategies. By generating robust real-world evidence and cost-utility data, sponsors can strengthen payer dialogues and secure favorable formulary positioning. Furthermore, deploying digital patient support platforms that incorporate teleconsultation, symptom tracking, and adherence reminders will heighten brand loyalty and improve long-term outcomes. Together, these actions form a cohesive playbook for sustaining market leadership and delivering tangible benefits to patients and healthcare systems alike.

Detailing Rigorous Research Methodologies Underpinning Robust Insights Through Triangulated Data, Expert Validation, and Comprehensive Analytical Frameworks

This analysis derives from a rigorous, multi-tiered research framework combining both qualitative and quantitative methodologies. Secondary research efforts included exhaustive reviews of peer-reviewed journals, clinical trial registries, patent filings, and regulatory guidance documents. These insights were triangulated with real-world data sources, encompassing prescription trends and payer reimbursement records, to ensure a comprehensive understanding of market dynamics. The synthesis of diverse data streams supports a holistic assessment of therapeutic performance, competitive positioning, and regional nuances.

Primary research was conducted through in-depth interviews with urology specialists, payer representatives, and leading industry executives, providing firsthand perspectives on clinical unmet needs, formulary considerations, and strategic imperatives. All findings underwent thorough validation via an internal expert review panel, ensuring robustness and consistency across analytical outputs. This meticulous approach delivers a dependable foundation for decision making, equipping stakeholders with actionable intelligence and clear visibility into the complex forces shaping the benign prostatic hypertrophy treatment landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Benign Prostatic Hypertrophy Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Benign Prostatic Hypertrophy Drugs Market, by Drug Class

- Benign Prostatic Hypertrophy Drugs Market, by Generic Status

- Benign Prostatic Hypertrophy Drugs Market, by Dosage Form

- Benign Prostatic Hypertrophy Drugs Market, by Distribution Channel

- Benign Prostatic Hypertrophy Drugs Market, by Region

- Benign Prostatic Hypertrophy Drugs Market, by Group

- Benign Prostatic Hypertrophy Drugs Market, by Country

- United States Benign Prostatic Hypertrophy Drugs Market

- China Benign Prostatic Hypertrophy Drugs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding Insights on the Evolving BPH Therapeutic Environment and Key Imperatives Guiding Future Market Engagement and Value Creation Strategies

The benign prostatic hypertrophy drug environment stands at the confluence of scientific innovation, regulatory evolution, and shifting stakeholder expectations. Transformative combination therapies and digital health enablement are redefining care protocols, while tariff adjustments underscore the imperative of resilient supply chains. Segmentation analysis highlights the diverse patient and channel pathways-from branded extensions and generics to hospital, online, and retail pharmacy conduits-reinforcing the need for tailored strategies. Regional distinctions further emphasize that localized market access approaches and partnership models are indispensable for sustained growth.

Competitive positioning within this landscape is shaped by the interplay of established brands, emerging generics, and forward-looking pipeline assets. Industry leaders must harness rigorous real-world evidence, invest in novel formulations, and engage proactively with payers and providers to fortify their value propositions. By aligning strategic priorities with patient centricity and operational agility, stakeholders can capitalize on new opportunities and deliver meaningful outcomes. These insights collectively form the strategic imperative for navigating the next evolution of BPH therapy.

Engage with Ketan Rohom to Secure Comprehensive BPH Therapeutics Market Intelligence and Empower Strategic Decision Making with Expert Support

Unlock unparalleled insights into the benign prostatic hypertrophy therapeutic arena by partnering with Ketan Rohom, Associate Director, Sales & Marketing, to obtain your comprehensive market research report. As a seasoned expert with deep domain knowledge, Ketan Rohom stands ready to guide you through the intricate findings, ensuring you capitalize on emerging opportunities and mitigate evolving risks. Reach out today to secure this essential intelligence, enhance your strategic decision making, and drive sustainable growth in the BPH drug sector. Elevate your market positioning with tailored support from an authoritative resource committed to your success

- How big is the Benign Prostatic Hypertrophy Drugs Market?

- What is the Benign Prostatic Hypertrophy Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?