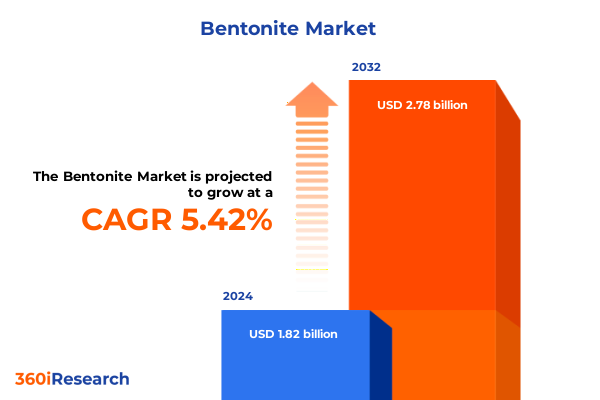

The Bentonite Market size was estimated at USD 1.91 billion in 2025 and expected to reach USD 2.01 billion in 2026, at a CAGR of 5.47% to reach USD 2.78 billion by 2032.

Uncovering the Versatile World of Bentonite Clay and Its Critical Role Across Industrial and Consumer Applications in Modern Markets

Bentonite clay, renowned for its exceptional absorbent and rheological properties, has evolved into an indispensable resource across a diverse set of industrial and consumer applications. Originating from volcanic ash deposits, bentonite’s unique composition-dominated by montmorillonite minerals-enables remarkable swelling behavior, making it a superior choice for drilling fluids, foundry sands, civil engineering sealants, and environmental remediation. In pharmaceutical and cosmetic formulations, the clay serves as a natural detoxifier and stabilizer, while in agriculture and animal feed, its binding capabilities enhance product performance. Moreover, consumer products such as cat litter and household spill kits rely on bentonite’s superior fluid retention and odor control attributes.

Over the last decade, the market has witnessed growing interest in bentonite’s ecological and performance advantages. Heightened environmental regulations have driven manufacturers and end users to seek sustainable, non-toxic materials, positioning bentonite as an effective, naturally derived solution. Simultaneously, technological improvements in processing and modification techniques have expanded its functional scope, with organo-modified variants offering tailored rheological profiles for advanced drilling operations. These converging forces underscore bentonite’s transition from a commoditized mineral to a high-value performance material in modern supply chains.

Exploring the Transformative Trends Shaping Innovation, Regulatory Dynamics, and Sustainable Practices in the Global Bentonite Industry Today

The global bentonite industry is undergoing a profound transformation propelled by intersecting trends in sustainability, technological innovation, and regulatory evolution. Advances in drilling technology, such as horizontal and deepwater operations, have heightened demand for high-performance mud systems, prompting increased adoption of both natural and organo-modified bentonite grades. For instance, leading energy companies in North American shale plays are integrating tailored organophilic clays to optimize wellbore stability under extreme conditions, demonstrating bentonite’s critical role in maximizing extraction efficiency and safety. Meanwhile, the coatings, adhesives, and sealants sectors are leveraging bentonite’s rheology-control properties to meet rising industrial standards, with manufacturers in Europe reporting a surge in orders for modified bentonite additives to enhance anti-sag performance in protective coatings applications.

Concurrently, sustainability initiatives are reshaping industry practices, as environmental concerns drive a shift away from synthetic alternatives toward environmentally benign minerals. In response to stricter standards under the European Union’s Green Deal, drilling companies have increasingly adopted biodegradable drilling fluids formulated with bentonite, signaling a broader move toward circular economy principles and reduced ecological impact. These developments have prompted bentonite producers to invest in wet and thermal processing innovations to improve dispersion and resource efficiency, paving the way for next-generation eco-friendly formulations. As a result, the market landscape is shifting from commodity-driven supply toward value-added, specialized solutions that meet both performance and sustainability targets.

Assessing the Cumulative Impact of Evolving United States Tariff Policies on Bentonite Imports, Origin-Specific Duties, and Supply Chain Resilience in 2025

U.S. import duties on bentonite reflect a blend of general trade policy and targeted measures. Under the Harmonized Tariff Schedule, imports classified under HTS 2508.10.00.00 are subject to a duty-free rate for general (Most-Favored Nation) trade, underscoring the material’s classification as an essential industrial input. However, imports specifically originating from Cuba and North Korea incur a special additional duty of $3.20 per metric ton, reflecting longstanding geopolitical trade restrictions.

On the other hand, bentonite sourced from the People’s Republic of China remains subject to supplementary 25 percent ad valorem duties under Section 301 of the Trade Act of 1974, aimed at addressing unfair technology transfer practices. This tariff, first imposed in July 2018, continues to apply to all HTS subheading 2508.10.00.00 imports from China unless covered by an approved exclusion. The cumulative effect of these measures has reshaped supply chain decisions, driving importers to diversify sourcing across domestic and non-Chinese suppliers to mitigate elevated landed costs and customs delays. As a result, U.S. end-users are increasingly establishing alternative supply agreements with producers in North America and third-country markets to safeguard against tariff-induced volatility.

Revealing Key Market Segmentation Insights Across Applications, Industries, Product Types, Forms, Technologies, Features, and Demand Sectors

Segmenting the bentonite industry by application reveals distinct value pools that guide product development and commercialization strategies. In waste management and pet care, the Cat Litter segment comprises both clumping and non-clumping grades, optimized for rapid moisture absorption and odor control. Civil Engineering applications leverage bentonite’s sealing and waterproofing characteristics in soil stabilization and barrier systems. Within drilling muds, the market bifurcates into oil-based, synthetic-based, and water-based fluid systems, each demanding tailored rheology modifiers and thermal stability. Foundry sands utilize bentonite for iron casting, non-ferrous casting, and steel casting binders, where precise granulometry and bonding strength are critical.

Analyzing End-User Industries further uncovers varied consumption profiles. Agricultural uses span animal feed enhancement and crop protection formulations that rely on bentonite’s toxin absorption and soil conditioning properties. In Construction, bentonite is integral to commercial building waterproofing, infrastructure tunneling, and residential basement sealants. The Cosmetics sector adapts bentonite for color cosmetics, haircare, and skincare products that benefit from the clay’s natural detoxification. Oil and Gas operations, across upstream, midstream, and downstream phases, employ bentonite in fracturing fluids and drilling additives. Pharmaceutical uses are found in ointments and tablet manufacturing, capitalizing on bentonite’s binding and controlled-release capabilities.

Product Type segmentation highlights distinct preferences for Calcium Bentonite, primarily used as a bleaching agent and dietary supplement, versus Sodium Bentonite, preferred for its high swelling power in high-performance drilling and sealing applications. The Form landscape presents granules, pellets, and powder, catering to ease of handling and dispersion requirements. Processing Technology innovations-spanning dried, thermal, and wet processing, with subtechniques such as mechanically dried, calcination, flocculation, and sedimentation-drive product differentiation. Feature-based segmentation addresses electrolyte reduction, high absorption, purification, clarification, and thickening agent applications-with thickening agents further divided between anticaking and stabilizer properties. Finally, Demand Sector analysis underscores diverging consumption in the Consumer Sector, encompassing household and personal care, versus the Industrial Sector, spanning construction and manufacturing.

This comprehensive research report categorizes the Bentonite market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Functionality

- Application

- Distribution Channel

Highlighting Key Regional Insights into Bentonite Demand Drivers and Industry Dynamics Across Americas, Europe Middle East & Africa, and Asia Pacific

Examining regional market dynamics reveals differentiated drivers that shape bentonite utilization across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, the surge in shale gas and tight oil exploration has propelled demand for specialized drilling muds, with leading operators in U.S. basins integrating organo-modified bentonite to optimize borehole stability and reduce non-productive time. High-performance clay formulations are likewise essential to the region’s expansive civil engineering projects, including tunneling and dam construction, where moisture-barrier applications ensure structural integrity and regulatory compliance.

Across Europe Middle East & Africa, stringent environmental and waste-management regulations have stimulated uptake of bentonite-based sealants, absorbents, and filtration media. European infrastructure mandates and Middle Eastern oil and gas expansions both rely on bentonite’s non-toxic profile to meet stringent EU REACH standards and Gulf Cooperation Council environmental guidelines. Civil engineering initiatives, such as metro expansions in major European capitals, further underscore the region’s reliance on bentonite for soil stabilization and groundwater control.

In the Asia Pacific, robust infrastructure development and agricultural modernization are fueling bentonite consumption. Indian producers are expanding refining capacity to support surging demand for industrial-grade clays, while Southeast Asian cosmetic manufacturers blend bentonite into high-end skincare and haircare formulations. Notably, manufacturers in Gujarat have announced capital investments to increase bentonite activation and milling output, ensuring a secure supply for regional energy and manufacturing hubs and reducing dependence on imports.

This comprehensive research report examines key regions that drive the evolution of the Bentonite market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Providing Strategic Perspectives on Leading Bentonite Market Players and Their Competitive Positioning Across Global Value Chains

Leading companies in the bentonite space have carved out strategic positions through resource control, process innovation, and global distribution networks. India’s Ashapura Group commands a top position with extensive calcium and sodium bentonite reserves and integrated activation facilities, supporting diverse industrial segments from drilling muds to pharmaceuticals. Clariant AG leverages its global adsorbents business unit to convert raw bentonite into high-purity specialty grades, serving regulatory-driven markets in water treatment and personal care. Halliburton maintains a significant presence in oilfield applications through its Baroid division, developing proprietary organo-modified clays that enhance fluid stability under extreme downhole conditions.

American Colloid Company’s CETCO unit, now part of Minerals Technologies Inc., leads the geosynthetics segment with its Volclay liners and bentonite waterproofing systems deployed in major infrastructure projects. Bentonite Performance Minerals LLC and Black Hills Bentonite focus on North American markets, optimizing distribution through regionally located processing plants to serve foundry, drilling, and cat litter applications. Wyo-Ben, with a history dating back to 1951, remains a key U.S. supplier of sodium bentonite, supplying essential materials for drilling fluids, iron ore pelletizing, and environmental sealants from its Billings, Montana headquarters. Imerys, Tolsa Group, and S&B leverage extensive mining assets and specialty processing capabilities to address global demand, with each innovating in applications ranging from food-grade additives to high-performance binder systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bentonite market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Black Hills Bentonite LLC

- Charles B. Chrystal Co. Inc.

- Cimbar Performance Minerals, Inc.

- Clariant AG

- Dantonit A/S

- Delta Corp Sdn Bhd.

- Dimacolor Industry Group Co., Ltd

- Elementis PLC

- Halliburton Energy Services, Inc.

- Imerys S.A.

- Kemira Oyj

- Kunimine Industries Co., Ltd

- Laviosa Chimica Mineraria S.p.A.

- Maxworth International Pty. Ltd.

- MIDPOINT Chemicals Company

- Minerals Technologies Inc.

- Schlumberger Limited

- Thermo Fisher Scientific, Inc.

- Volclay Japan Co., Ltd.

- Wyo-Ben, Inc.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in the Bentonite Market

Industry leaders should prioritize investment in next-generation processing technologies that boost performance while reducing environmental impact. By adopting advanced wet and thermal activation methods, producers can develop customized formulations with enhanced adsorption and rheological profiles, meeting the precise demands of oilfield, construction, and personal care end users. Concurrently, strengthening supply chain resilience through diversified sourcing agreements-particularly in geopolitically sensitive regions-can shield operations from tariff-driven cost spikes and logistical disruptions.

Collaboration between clay producers and end-use innovators will be key to unlocking new applications. Joint R&D partnerships focusing on biodegradable modifiers and closed-loop processing can advance circular economy principles and capture premium pricing for eco-certified products. Digital transformation of manufacturing and logistics, including real-time quality monitoring and blockchain-enabled provenance tracking, will further bolster transparency and satisfy increasingly stringent sustainability standards. Furthermore, proactive engagement with regulatory bodies to shape compliance frameworks and secure product approvals-especially in high-growth markets such as pharmaceuticals and food additives-will accelerate market entry and mitigate time-to-market risks.

Outlining the Comprehensive Research Methodology Employed to Analyze Global Bentonite Market Trends, Segments, and Competitive Landscapes

This analysis leverages a multi-tiered research approach to ensure data integrity and comprehensive coverage of the bentonite value chain. The methodology began with extensive secondary research, including examination of trade publications, regulatory filings, and customs data to map tariff structures, regional demand patterns, and application trends. Primary research entailed in-depth interviews with industry stakeholders, such as mineral producers, end-use manufacturers, and trade association representatives, to validate market drivers and supply chain dynamics.

Quantitative data underwent triangulation via multiple sources, including customs import records, company financial disclosures, and technical papers on bentonite processing technologies. Qualitative insights were cross-checked through expert panels to refine segmentation frameworks and competitive benchmarks. All information was synthesized following rigorous data-validation protocols, ensuring the report’s findings accurately reflect current market conditions and anticipate shifts in demand, regulatory environments, and technological advancements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bentonite market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bentonite Market, by Product Type

- Bentonite Market, by Form

- Bentonite Market, by Functionality

- Bentonite Market, by Application

- Bentonite Market, by Distribution Channel

- Bentonite Market, by Region

- Bentonite Market, by Group

- Bentonite Market, by Country

- United States Bentonite Market

- China Bentonite Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing the Executive Findings, Emerging Opportunities, and Future Outlook of the Bentonite Market Landscape for Strategic Decision-Making

This executive summary has highlighted bentonite’s evolving role from a traditional mineral commodity to a versatile performance material across industries. We have examined transformative trends-ranging from sustainability-driven formulations and advanced drilling technologies to shifting tariff landscapes and strategic segmentation-that are redefining market dynamics. The analysis of import duties underscores the importance of diversified sourcing strategies, while the segmentation and regional insights illuminate key value pools and growth opportunities.

Strategic collaboration between producers, technology developers, and end-users will remain essential for innovation and competitive differentiation. By adopting advanced processing technologies, engaging in proactive regulatory dialogue, and implementing robust supply chain mitigations, stakeholders can harness bentonite’s full potential. Moving forward, sustained investment in R&D and digital infrastructure will be critical to capture emerging applications and ensure resilience amid evolving market conditions.

Engage with Ketan Rohom to Secure Your Access to the Comprehensive Bentonite Market Research Report and Drive Strategic Growth Initiatives

To explore the full depth of insights, forecasts, and strategic analysis presented in this bentonite market research report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you through tailored solutions and demonstrate how this comprehensive report will empower your organization to navigate evolving market dynamics, seize emerging opportunities, and optimize strategic initiatives. Engage with Ketan today to secure your access and ensure your decisions are grounded in the most robust market intelligence available.

- How big is the Bentonite Market?

- What is the Bentonite Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?