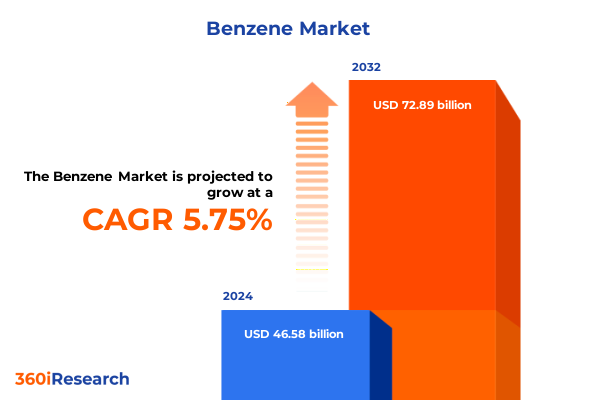

The Benzene Market size was estimated at USD 49.10 billion in 2025 and expected to reach USD 51.76 billion in 2026, at a CAGR of 5.80% to reach USD 72.89 billion by 2032.

Navigating the Complex Dynamics of the Global Benzene Market Amidst Supply Chain Disruptions and Sustainability Transformations

Benzene remains at the heart of global petrochemical operations, serving as a pivotal feedstock for a wide array of downstream applications including phenol, styrene, nylon intermediates, and linear alkylbenzene. As a fundamental building block, its performance directly influences the production costs and viability of essential chemicals used in automotive, construction, pharmaceuticals, and consumer goods sectors. Understanding how supply chain dynamics, feedstock availability, and regulatory pressures converge is critical for stakeholders seeking to maintain operational stability and competitive resilience.

Throughout early 2025, the U.S. market has grappled with fluctuating benzene prices driven by volatile crude and naphtha feedstock costs, combined with rising energy expenses. Mid-February witnessed notable price hikes as producers adjusted operating rates to manage tighter margins, while downstream buyers faced uncertainty in securing consistent volumes. These conditions have underscored the necessity for agile procurement strategies and deeper visibility into global supply networks.

Concurrently, a shift toward sustainability has begun to reshape industry priorities, with bio-based benzene pathways gaining traction. Governments are enacting stricter emissions targets and incentivizing renewable alternatives, prompting major chemical players to evaluate biomass-derived technologies and circular-economy solutions. As market participants navigate these cross-currents, the ability to integrate traditional petrochemical expertise with emerging green chemistry approaches will define the leaders of tomorrow.

In this executive summary, we outline the transformative forces influencing the benzene landscape, assess the cumulative impact of U.S. tariff measures, present nuanced segmentation analysis, and deliver region-specific insights-all designed to inform strategic decisions and foster long-term growth.

Emerging Transformative Shifts Redefining Benzene Production with Sustainability, Digital Innovation, and Circular Economy Breakthroughs in 2025

The benzene industry is experiencing a wave of transformative shifts rooted in technological innovation and evolving regulatory landscapes. At the forefront is the pursuit of bio-based production processes that convert biomass, lignin, and mixed plastic waste into renewable benzene. This trend not only addresses carbon intensity targets but also enhances feedstock diversification, reducing dependence on traditional petroleum streams. Companies are collaborating with biotechnology firms to scale up demonstration plants, setting the stage for broader commercial adoption in the coming years.

Advanced catalytic pathways and process intensification techniques are further driving efficiency gains. Innovations in enzymatic conversion and thermochemical methodologies have improved benzene yields and purity levels, enabling producers to lower energy consumption and operational costs. These technological breakthroughs are often paired with digital twins and real-time monitoring systems, empowering plant operators to simulate process modifications virtually and optimize output without disrupting existing operations.

Meanwhile, the circular economy framework is gaining momentum, compelling stakeholders to rethink end-of-life pathways for benzene derivatives. Chemical recycling initiatives, which deconstruct polymers back to monomers, offer a pathway to replenish benzene units within closed-loop systems. This approach aligns with global sustainability mandates and consumer demands for environmentally responsible supply chains.

Regulatory developments are acting as catalysts rather than impediments, as governments introduce incentives for low-carbon investments and grant exemptions for pilot projects that meet strict environmental criteria. The convergence of policy support, process innovation, and digital transformation is reshaping the benzene value chain, creating a more resilient and sustainable industry landscape.

Assessing the Cumulative Impact of the 2025 United States Tariffs on Benzene Supply Chains, Cost Structures, and Downstream Industry Competitiveness

Since early 2025, the U.S. government has introduced a series of tariff measures affecting benzene import sources. On March 4, a 25% ad valorem duty was applied to imports from Canada and Mexico, while Chinese shipments faced a cumulative 20% levy after successive tariff increases. These actions were framed as national security measures, targeting broader trade balances but significantly influencing the cost structure for benzene feedstocks that domestic refiners and naphtha crackers rely upon.

In addition to these enacted tariffs, proposals unveiled in July 2025 call for a 25% duty on benzene and related aromatics imported from Japan and South Korea, effective August 1. South Korea, previously the top source of U.S. imports of benzene, toluene, and mixed xylenes, now faces heightened cost pressures that may prompt buyers to reposition supply chains or explore alternative origins. The dual impact of increased duties and potential retaliatory measures adds complexity for importers seeking to secure stable volumes at predictable prices.

Domestic producers are navigating this new tariff landscape with a mix of cautious optimism and pragmatic adjustment. While higher import duties can bolster local production margins, many operators lack the flexibility to rapidly scale naphtha cracking capacity. As a result, corporations are reevaluating feedstock sourcing strategies, negotiating long-term contracts, and exploring investments in propane dehydrogenation and other onshore benzene pathways.

Industry associations have voiced concerns about supply chain disruptions and higher downstream costs, urging policymakers to consider phased implementation and targeted exemptions for energy inputs. The evolving tariff environment underscores the need for proactive risk management, supply diversification, and close engagement with regulatory bodies to mitigate unintended consequences.

Illuminating Key Benzene Market Segmentation Dynamics and Insights Across Derivatives, Processes, Materials, Packaging, Functions, Applications, and Distribution

The benzene market can be segmented across a diverse set of lenses, each offering critical insights into operational dynamics and growth trajectories. From a derivatives perspective, products such as alkylbenzene, aniline, chlorobenzene, cumene, cyclohexane, ethylbenzene, maleic anhydride, and nitrobenzene serve as value-added intermediates, with variations in demand driven by downstream applications and pricing differentials. Aniline, for instance, is pivotal in polyurethane manufacture, whereas ethylbenzene feeds into styrene production, illustrating how shifts in one derivative can cascade through multiple value chains.

Examining the production process dimension reveals distinctions among biomass-derived benzene, catalytic reformation, coal carbonization, and steam cracking. Biomass-derived routes offer environmental benefits and circularity, whereas steam cracking remains the predominant industrial platform, valued for its economies of scale. Coal carbonization, while less widespread in Western markets, persists in regions with coal-rich reserves, reflecting how resource endowments shape regional process adoption.

Raw material segmentation highlights the divide between biomass and petroleum-based feedstocks. Within the biomass category, cellulose-derived compounds and lignin are emerging as alternative carbon sources, whereas petroleum-based equivalents rely on naphtha and toluene fractions. Packaging type segmentation provides further nuance, with drums, intermediate bulk containers, and iso tanks selected based on shipment volumes, handling requirements, and regional logistics infrastructure.

Functional differentiation underscores uses in chemical intermediates, explosives, lubricants, pesticides, solvents, and surfactants, each aligned to specific industrial sectors. Application insights span agriculture, automotive, chemical manufacturing, construction, electronics, oil & gas, pharmaceuticals, printing & packaging, rubber & plastics, and textile end-markets. Distribution channels bifurcate into traditional offline sales and online platforms, the latter including company portals and e-commerce marketplaces. Understanding the interplay among these segmentation dimensions is essential for identifying niche opportunities and optimizing product portfolios.

This comprehensive research report categorizes the Benzene market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Derivatives

- Production Process

- Packaging

- Distribution Channel

- End-Use Industry

Uncovering Regional Benzene Market Insights Highlighting Demand Drivers, Regulatory Landscapes, and Growth Opportunities Across Americas, EMEA, and Asia-Pacific Territories

The Americas region continues to anchor global benzene consumption, fueled by robust chemical manufacturing hubs in the United States and Canada. While domestic shale production offers a steady stream of lighter feedstocks, refiners remain reliant on imported naphtha and heavier crudes to optimize benzene yields. Mid-2025 price adjustments have tested North American supply chains, prompting contractual renegotiations and closer collaboration between producers and end-users to secure volume commitments and maintain production stability.

In Europe, the Middle East, and Africa, regulatory frameworks exert a profound influence on market behavior. Stricter emissions standards and carbon pricing mechanisms are accelerating investments in bio-based and recycled benzene applications, with several leading producers piloting carbon capture and utilization projects alongside downstream innovation centers. These efforts underscore the region’s dual focus on environmental stewardship and industrial competitiveness, as stakeholders navigate a complex tapestry of policy incentives and sustainability benchmarks.

The Asia-Pacific landscape exhibits the fastest growth trajectory, driven by rapid industrialization and rising demand for benzene derivatives in electronics, automotive, and construction sectors. China, Japan, South Korea, and India have expanded their refining and petrochemical capacities, often through integrated refinery-cracker complexes. In particular, China’s phenol and acetone facilities, powered by extensive benzene conversion units, illustrate the scale at which APAC markets shape global trade flows. Meanwhile, Southeast Asian nations are emerging as key transshipment hubs, leveraging strategic port infrastructure to facilitate interregional exchanges.

This comprehensive research report examines key regions that drive the evolution of the Benzene market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Benzene Market Players and Their Strategic Initiatives Driving Technological Innovation, Sustainability, and Competitive Advantage in 2025

A cohort of multinational energy and chemical corporations dominates the benzene market, spearheading both production capacity and technological innovation. BASF has leveraged its integrated value chain to optimize styrene and ethylbenzene outputs while advancing circular economy initiatives; the company has issued green bonds to fund recycling operations and expanded its footprint across Europe, Asia, and North America. Its focus on low-carbon benzene derivatives exemplifies the strategic pivot toward sustainable solutions.

Royal Dutch Shell has intensified efforts to decarbonize its chemical processes, investing in carbon capture and utilization projects and enhancing process efficiency across its global refineries. Shell’s research collaborations aim to scale bio-aromatic production and improve catalyst performance for renewable feedstocks, signaling a long-term commitment to cleaner benzene streams.

Sinopec Shanghai Petrochemical Company has embarked on a multi-billion-dollar capacity upgrade, replacing aging units with state-of-the-art facilities that boost ethylene and downstream benzene derivative production while embedding environmental controls and energy-saving technologies. These enhancements position Sinopec to meet growing domestic demand and strengthen its export competitiveness.

Emerging players such as Anellotech are challenging traditional paradigms by commercializing lignin-to-benzene processes at pilot scale. Their innovative approach underscores the expanding competitive set and highlights how technology entrants can reshape market dynamics through targeted niche applications and partnerships with established chemical producers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Benzene market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arsol Aromatics GmbH & Co. KG

- BASF SE

- Borealis AG

- Chevron Phillips Chemical Company

- China Petrochemical Corporation

- Covestro AG

- Dow Chemical Company

- ENEOS Corporation

- Exxon Mobil Corporation

- Flint Hills Resources, LLC by Koch Industries, Inc.

- Huntsman Corporation

- Indian Oil Corporation Limited

- Ineos Group

- LG Chem, Ltd.

- LyondellBasell Industries N.V.

- Marathon Petroleum Corporation

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- Nippon Steel Chemical & Material Co., Ltd.

- Reliance Industries Limited

- Repsol, S.A.

- Saudi Basic Industries Corporation

- Shell PLC

- TotalEnergies SE

Actionable Recommendations for Industry Leaders to Navigate Benzene Market Volatility, Embrace Sustainability, and Mitigate Regulatory Constraints

Industry leaders should prioritize supply chain diversification to mitigate the evolving risk landscape shaped by tariff measures and feedstock volatility. Establishing strategic alliances with multiple feedstock suppliers, including biomass-derived and alternative hydrocarbon sources, enhances resilience and reduces exposure to single-source disruptions. Concurrently, exploring shared infrastructure models and joint-venture partnerships can spread capital expenditure burdens while securing priority access to processing capacity.

Embracing digital transformation is essential for optimizing benzene operations. Implementing advanced analytics, real-time monitoring, and predictive maintenance through digital twins enables operators to fine-tune process parameters, reduce downtime, and lower energy consumption. Such investments not only drive cost efficiencies but also support sustainability targets by curbing emissions and resource usage.

Sustainability must be embedded into business models, with companies setting clear roadmaps for bio-based benzene integration and circular-economy solutions. Engaging with policymakers to secure incentives and navigate regulatory frameworks will facilitate pilot project deployment and long-term scalability. Moreover, transparent reporting on environmental performance can strengthen stakeholder confidence and unlock new market opportunities tied to green procurement standards.

Finally, proactive regulatory engagement and advocacy for balanced trade policies are critical. Industry associations and corporate leaders should collaborate to articulate the benefits of phased tariff implementations and targeted exemptions for energy-intensive inputs. By aligning technical expertise with policy development processes, companies can help shape a more predictable operating environment and ensure sustained competitiveness.

Comprehensive Research Methodology Detailing Data Sources, Analytical Frameworks, and Validation Processes Underpinning the Benzene Market Study

This analysis is founded on a structured research methodology that integrates both primary and secondary data sources. Primary research included in-depth interviews with C-level executives, procurement managers, and technical directors across leading petrochemical firms to capture real-world perspectives on feedstock selection, process optimization, and tariff impact scenarios.

Secondary research encompassed a comprehensive review of industry publications, regulatory filings, trade association reports, and company presentations. Key reference materials included regulatory alerts on U.S. trade measures, technology white papers on bio-based aromatic production, and sustainability reports from major producers.

Quantitative modeling was applied to assess supply-demand balances, cost-curve analyses, and tariff sensitivities. Data triangulation techniques ensured consistency across multiple inputs, while scenario planning evaluated the effects of alternative tariff rates, feedstock price fluctuations, and policy shifts on market equilibrium.

All findings were validated through peer reviews and expert workshops, ensuring accuracy and relevance. The regional segmentation and company profiles were cross-checked against recent industry disclosures and public filings to maintain an up-to-date reflection of the benzene market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Benzene market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Benzene Market, by Derivatives

- Benzene Market, by Production Process

- Benzene Market, by Packaging

- Benzene Market, by Distribution Channel

- Benzene Market, by End-Use Industry

- Benzene Market, by Region

- Benzene Market, by Group

- Benzene Market, by Country

- United States Benzene Market

- China Benzene Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Insights Emphasizing Strategic Imperatives and Future-Proofing the Benzene Market Amidst Evolving Industry Dynamics

The benzene market stands at a crossroads where traditional petrochemical paradigms intersect with sustainability imperatives and regulatory realignments. Supply chain disruptions and tariff implementations have highlighted vulnerabilities in feedstock sourcing, underscoring the need for diversified procurement strategies and enhanced operational agility.

Technological advancements in bio-based production, catalytic innovation, and digital integration are redefining benzene value-chain economics. Companies that successfully blend these emerging capabilities with established processing platforms will unlock competitive advantages and new growth avenues.

Region-specific dynamics-from North American shale feedstocks to Europe’s regulatory decarbonization mandates and Asia-Pacific’s capacity expansions-demand tailored approaches. Leading players are already repositioning portfolios, modernizing assets, and forging partnerships to meet evolving demand profiles.

As industry leaders chart a course forward, the intersection of policy engagement, sustainability commitments, and strategic investment will determine who thrives in this dynamic environment. The insights presented here offer a blueprint for navigating complexity and capturing value in the global benzene marketplace.

Empowering Your Benzene Market Strategy with Expert Guidance from Associate Director of Sales & Marketing to Secure Your Comprehensive Research Report Today

Ready to elevate your strategic decision-making with in-depth market intelligence? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure a tailored research package that delivers the granular insights you need. Whether you are seeking a comprehensive overview of benzene market dynamics, competitive benchmarks, or customized data modeling, this report offers the actionable guidance that will empower your team. Engage directly with Ketan to discuss special pricing, custom add-ons, and priority access to upcoming updates. Take the next step in transforming your market strategies by partnering with an expert who understands the intricacies of the benzene industry and can translate complex data into clear, strategic direction

- How big is the Benzene Market?

- What is the Benzene Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?