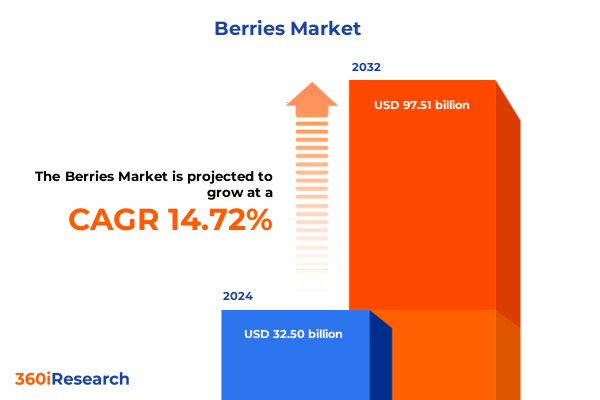

The Berries Market size was estimated at USD 36.69 billion in 2025 and expected to reach USD 41.42 billion in 2026, at a CAGR of 14.98% to reach USD 97.51 billion by 2032.

Exploring the Expanding World of Berries Through Consumer Trends, Nutritional Innovation, Supply Chain Complexity, and Emerging Market Dynamics

The global berry industry stands at a fascinating crossroads, fueled by rapidly evolving consumer preferences that prioritize health, convenience, and sustainability. In recent years, a surge in nutritional awareness has driven demand for antioxidant-rich fruits, with berries emerging as a superlative source of essential vitamins and phytochemicals. Concurrently, advancements in agricultural technology have unlocked new cultivation techniques such as precision irrigation and climate-adaptive breeding, enabling producers to meet year-round demand while preserving environmental integrity. These combined forces have transformed berries from a seasonal luxury into a staple ingredient across retail, foodservice, and wellness categories.

In parallel, the supply chain for berries has grown increasingly complex and interconnected. Global sourcing strategies leverage differences in harvest seasons across hemispheres, while cold-chain logistics innovations strive to minimize spoilage and maintain fruit quality during transit. Digital platforms now facilitate real-time tracking of produce from farm to fork, enhancing traceability and consumer confidence. As a result, stakeholders across the value chain-from growers and packers to distributors and retailers-must navigate a dynamic ecosystem where agility and data-driven decision-making are paramount.

Against this backdrop, this executive summary distills critical insights into key drivers, emerging segments, and regional dynamics shaping the berry landscape. By examining transformative trends, tariff impacts, segmentation strategies, and competitive responses, readers will gain a holistic understanding of market forces. This analysis is designed to equip decision-makers with a coherent framework for aligning operational plans and strategic initiatives with unfolding industry realities.

Revolutionary Transformations Reshaping Berry Cultivation, Distribution, Processing Technologies, and Consumer Engagement in Today’s Sustainable and Digital Ecosystem

The berry sector has undergone seismic shifts that are redefining production, distribution, and consumption paradigms worldwide. Climate-smart agriculture has emerged as a cornerstone of these changes, with precision sensing technologies and drought-resilient cultivars enabling farms to maintain yield stability amid escalating weather volatility. Simultaneously, biotechnology advances are driving the creation of disease-resistant berry varieties that reduce pesticide reliance and enhance shelf life. These strides in agriscience reflect an industry-wide pivot toward sustainable intensification, marrying yield optimization with ecological stewardship.

On the downstream side, digital transformation is revolutionizing how berries reach consumers. Blockchain-enabled traceability systems now verify provenance and quality attributes, while e-commerce platforms streamline purchasing experiences by offering on-demand home delivery and subscription models. In retail environments, immersive consumer engagement tools such as interactive packaging and augmented reality labeling enhance brand differentiation and foster loyalty. Meanwhile, growing consumer emphasis on clean label and organic credentials has pressured processors to innovate preservation methods that maintain nutritional profiles without synthetic additives.

Collectively, these transformative shifts are fostering a more resilient, transparent, and consumer-centric berry market. Industry players are compelled to integrate innovations across agronomy, logistics, and marketing to capitalize on emerging opportunities. By embracing these changes, stakeholders can future-proof their operations against disruption and deliver superior value propositions that resonate in a rapidly evolving marketplace.

Assessing the Comprehensive Impact of United States 2025 Tariffs on Berry Trade Flows, Domestic Production Costs, and Global Competitive Positioning

The introduction of targeted tariffs by the United States in 2025 on select berry imports has introduced a layer of complexity to the global trade equation. Designed to protect domestic producers, these duties have increased landed costs for foreign suppliers, prompting many importers to reassess sourcing strategies. As import prices rose at customs, margin pressures emerged across retail and foodservice channels, with a notable uptick in cost pass-through to end consumers. This development has generated debate within the industry about balancing protectionist measures with the imperative for supply chain diversification and price stability.

Domestic growers, while benefiting from reduced competition, have encountered rising production expenses owing to the need for expanded acreage and seasonal coverage investments. Many have accelerated adoption of mechanized harvesting and precision agronomy to maintain cost competitiveness. At the same time, some international suppliers have responded by forging new trade partnerships in regions not covered by the tariffs, leveraging free trade agreements to reroute shipments. Investors and financial institutions are scrutinizing farm-level credit terms more closely, recognizing that tariff-driven revenue fluctuations may heighten credit risk profiles.

Looking ahead, these tariff measures are likely to catalyze structural shifts in the berry value chain. Stakeholders will need to navigate evolving regulatory landscapes, explore alternative sourcing corridors, and invest in cost-mitigation tactics to uphold profitability. Understanding the cumulative impact of these duties is essential for calibrating supply agreements, managing working capital, and shaping long-term expansion plans within the U.S. market.

Dissecting Berry Market Segmentation to Reveal Actionable Insights Spanning Type, Form Variations, Distribution Channels, and End-Use Applications

Analyzing the berry market through multiple segmentation lenses uncovers distinct opportunities and challenges across core dimensions of product type, processing form, distribution channel, and end-use application. When viewed by berry variety, the segment encompassing blackberries, blueberries, raspberries, and strawberries reveals divergent cultivation climates, harvesting cycles, and consumer affinity profiles. Each of these fruit types commands unique shelf-life considerations and nutritional highlights, with blueberries often leading antioxidant claims while raspberries satisfy premium dessert segments. Transitioning from varietal distinctions to processing formats underscores another layer of complexity. Fresh berries remain the pinnacle of perceived quality, prized by retailers for their organic credentials and supply chain transparency, whereas frozen IQF and pureed forms extend usage occasions in smoothies and baked goods. The dried category-including powder derivatives and whole dehydrated fruit-caters to snack applications and nutritional supplement markets, and juiced formats span both concentrate offerings and ready-to-drink solutions that align with convenience and functional beverage trends.

Turning to distribution channels, berries flow through convenience stores offering impulse purchases, foodservice operations prioritizing reliable ingredient supply, online retail portals enabling subscription models, and supermarket hypermarkets that drive volume through promotional cycles. Each channel presents distinct margin structures, inventory management challenges, and consumer engagement touchpoints. Finally, applications bifurcate into commercial versus household end-uses. Commercial users such as ingredient formulators and food processors demand consistent specifications and volume assurances, while household consumers gravitate toward on-trend varieties and formats that support health-oriented consumption patterns. Synthesizing these segmentation insights illuminates the strategic levers available to suppliers and brand owners as they tailor product portfolios and distribution strategies to meet nuanced market demands.

This comprehensive research report categorizes the Berries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Distribution Channel

- Application

Unraveling Regional Dynamics Influencing Berry Demand and Supply Across the Americas, EMEA Territories, and the Asia-Pacific Growth Corridors

Regional analysis highlights divergent demand dynamics, supply capabilities, and regulatory frameworks across key geographies spanning the Americas, Europe-Middle East & Africa, and Asia-Pacific. In the Americas, robust infrastructure and established production hubs have positioned North America as both a leading consumer and exporter of berries. U.S. domestic output benefits from state-of-the-art cold-chain networks and high-yield cultivation zones, while Latin American growers extend the harvesting window by leveraging off-season climates, reinforcing the region’s status as a critical import corridor.

Transitioning to Europe, the Middle East, and Africa, market participants encounter a complex tapestry of trade regulations, phytosanitary standards, and consumer preferences. Western European markets exhibit a pronounced appetite for organic and locally sourced berries, spurring investments in greenhouse technologies and regional cooperative initiatives. In contrast, Middle Eastern importers rely heavily on refrigerated shipments from Europe and South America to meet demand peaks, while African producers are gradually scaling output for both local consumption and export, navigating infrastructure constraints through public-private partnerships.

In Asia-Pacific, dynamic economic growth and shifting dietary patterns are intensifying demand for premium berry varieties. Countries such as China, Japan, and South Korea are investing heavily in high-tech greenhouse operations and postharvest technologies to reduce import reliance. Southeast Asian nations are emerging as both production and processing centers, capitalizing on favorable climatic conditions and burgeoning consumer markets. The unique attributes of each region underscore the need for tailored market entry approaches and strategic partnerships that account for regulatory nuances and infrastructure landscapes.

This comprehensive research report examines key regions that drive the evolution of the Berries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Berry Industry Players Driving Innovation, Strategic Partnerships, Vertical Integration, and Sustainability Initiatives Across the Value Chain

A handful of leading companies are steering innovation, forging strategic alliances, and scaling sustainability programs that set the tone for the broader berry ecosystem. Driscoll’s has solidified its leadership by integrating advanced breeding programs that deliver proprietary berry varieties optimized for flavor, yield, and disease resistance. Its vertically integrated model spans breeding, propagation, and distribution, enabling rigorous quality control and rapid commercialization of new cultivars. Complementing this, Naturipe Farms has pursued a consolidation strategy, acquiring regional growers to expand its geographic footprint while enhancing supply consistency through synchronized harvest scheduling.

On the processing and value-added front, companies such as The Berry Company have differentiated through product innovation in functional beverage blends and cold-pressed juices, while smaller agile players are collaborating with contract manufacturers to launch niche offerings like organic freeze-dried powders targeting the nutraceutical space. Infrastructure specialists like FreshPoint Logistics are deploying state-of-the-art refrigerated transportation and digital inventory platforms to reduce spoilage rates and enhance delivery reliability for both retail and foodservice clients. Collectively, these industry leaders are setting new benchmarks for traceability, sustainability certification, and consumer engagement, effectively shaping competitive norms and investment priorities across the value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Berries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGRANA Beteiligungs‑AG

- Berry Gardens Ltd.

- BerryMex S.A. de C.V.

- BerryWorld Ltd

- California Giant, Inc.

- Camposol Holding PLC

- Conagra Brands, Inc.

- Costa Group Holdings Limited

- Dole Food Company, Inc.

- Driscoll’s, Inc.

- Fresh Del Monte Produce Inc.

- Greenyard N.V.

- Hortifrut S.A.

- JBT Corporation

- Naturipe Farms, LLC

- Olam International Limited

- Sahyadri Farms Pvt. Ltd.

- San Miguel Produce Inc.

- Sun Belle, LLC

- The Dole Food Company, Inc.

- The Summer Berry Company

- Wish Farms, LLC

- Wyman’s of Maine, Inc.

Formulating Actionable Strategies for Industry Leaders to Accelerate Growth, Optimize Operations, Enhance Sustainability, and Capitalize on Emerging Consumer Trends

Industry stakeholders seeking to strengthen market positioning should adopt a multi-pronged strategy that balances short-term agility with long-term resilience. First, integrating end-to-end digital traceability platforms will enable growers and processors to validate sourcing claims, optimize inventory turnover, and meet rigorous regulatory requirements. By leveraging blockchain and IoT sensors, organizations can unlock granular visibility into every stage of the production cycle, from orchard to retail shelf. Subsequently, diversifying sourcing corridors beyond traditional suppliers can mitigate tariff exposure and buffer against climatic disruptions; this entails establishing partnerships in emerging production hubs and exploring joint venture arrangements to secure reliable off-season capacity.

Operational excellence should be underpinned by investments in advanced agronomic practices. Precision application of nutrients, predictive disease modelling, and mechanized harvest technologies can drive cost efficiencies and sustain yield per acre. Concurrently, embedding sustainability across procurement protocols-through regenerative farming initiatives, water stewardship programs, and third-party certifications-will resonate with eco-conscious consumers and unlock premium pricing opportunities. Finally, innovation in product development and packaging is vital for capturing evolving consumer demands. Piloting formats such as freeze-dried snack mixes, functional beverage infusions, and convenient single-serve pouches can generate incremental revenue streams while reinforcing brand differentiation.

Detailing Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Quantitative Validation to Ensure Unbiased and Comprehensive Berry Market Insights

The research underpinning this executive summary is grounded in a rigorous methodological framework designed to ensure objectivity, reliability, and relevance. Primary data collection involved structured interviews with senior executives across leading farming cooperatives, processing facilities, distribution networks, and retail chains. These interviews provided qualitative insights into strategic priorities, operational challenges, and emerging innovation pipelines directly from decision-makers. To complement these perspectives, a comprehensive review of secondary information sources-including industry association reports, trade journal articles, and publicly available corporate disclosures-offered quantitative context regarding supply chain dynamics and consumer behavior shifts.

Data triangulation was achieved by cross-verifying interview findings with macroeconomic indicators, trade statistics, and regulatory filings. Advanced analytical techniques such as scenario modelling and sensitivity analysis were applied to assess the potential impacts of tariff changes and sustainability mandates on production costs and trade flows. Quality control measures included peer validation of key assumptions and iterative feedback sessions with subject matter experts. This robust methodological approach ensures that insights are not only empirically grounded but also reflective of the latest market realities, providing a trustworthy foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Berries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Berries Market, by Type

- Berries Market, by Form

- Berries Market, by Distribution Channel

- Berries Market, by Application

- Berries Market, by Region

- Berries Market, by Group

- Berries Market, by Country

- United States Berries Market

- China Berries Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Executive Summary Emphasizing Key Discoveries, Strategic Implications, and Forward-Looking Perspectives for Stakeholders in the Evolving Berry Market

The dynamic analysis of the berry industry reveals a sector undergoing profound transformation driven by technological innovation, shifting regulatory landscapes, and evolving consumer preferences. The segmentation framework demonstrates that opportunities exist across varietal types, processing forms, distribution channels, and application contexts, each demanding specialized strategies to unlock value. Regional insights underscore the necessity for localized market entry approaches that navigate diverse infrastructure capabilities, trade regulations, and consumption patterns. Furthermore, the assessment of 2025 tariff implementations highlights the critical importance of proactive risk management and supply chain diversification in preserving competitive advantage.

Leading companies have illustrated the impact of integrated breeding programs, strategic acquisitions, and value-added product innovation in securing market leadership. Meanwhile, actionable recommendations emphasize the centrality of digital traceability, precision agronomy, and sustainability commitments in shaping future success. Collectively, these findings offer a coherent roadmap for stakeholders to align operational excellence with consumer-centric offerings, ensuring resilience in an increasingly competitive and complex landscape. As the berry market continues to evolve, informed strategic choices grounded in robust research will be the cornerstone of sustainable growth and differentiation.

Encouraging Decision-Makers to Secure Comprehensive Berry Market Research with Associate Director Sales & Marketing to Support Strategic Investments

For executives seeking a complete, data-driven understanding of the berry market’s transformative dynamics, connecting with Associate Director of Sales & Marketing Ketan Rohom is the pivotal next step. Engaging directly with Ketan Rohom will grant tailored access to a meticulously structured report that combines incisive market analysis, strategic insights, and actionable recommendations. This collaboration empowers stakeholders to align investment strategies, product development roadmaps, and go-to-market initiatives with the latest industry intelligence. By partnering with Ketan Rohom, leaders will receive customized briefings, priority insights into emerging growth vectors, and ongoing advisory support to translate research findings into tangible competitive advantages.

Securing this comprehensive research asset through Ketan Rohom unlocks an unparalleled suite of benefits, including expert guidance on navigating tariff complexities, optimizing supply chains, and capitalizing on evolving consumer preferences. Whether the focus is on launching novel berry-derived products, refining distribution models, or strengthening sustainability credentials, this tailored engagement ensures that strategic decisions are underpinned by robust evidence and forward-looking scenarios. Reach out to Ketan Rohom today to transform market intelligence into actionable growth strategies and elevate organizational performance in the dynamic berry industry.

- How big is the Berries Market?

- What is the Berries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?