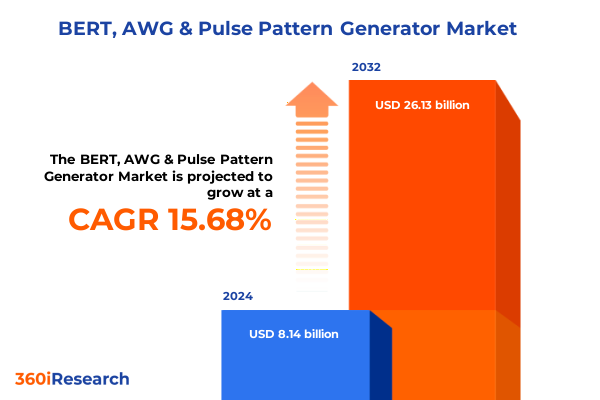

The BERT, AWG & Pulse Pattern Generator Market size was estimated at USD 9.40 billion in 2025 and expected to reach USD 10.86 billion in 2026, at a CAGR of 15.71% to reach USD 26.13 billion by 2032.

Defining the Critical Role of Bit Error Rate Testers Arbitrary Waveform Generators and Pulse Pattern Generators in Modern Communication Networks

The field of high-speed signal generation and error detection sits at the crossroads of technological innovation and market demand, driven by rapid advancements in telecommunications, data centers, and research laboratories. Bit Error Rate Testers, Arbitrary Waveform Generators, and Pulse Pattern Generators have evolved from niche laboratory instruments into indispensable tools for ensuring signal integrity, validating complex modulation schemes, and supporting next-generation connectivity standards. As digital ecosystems expand in complexity and throughput requirements, these instruments enable engineers to characterize performance limits, identify vulnerabilities, and optimize system architectures before deployment.

Advancements in semiconductor technology, propelled by miniaturization and the rise of heterogeneous integration, have amplified the need for precision instrumentation capable of generating and analyzing wideband signals with nanosecond accuracy. Moreover, the convergence of 5G networks, high-performance computing, and emerging applications such as autonomous vehicles and quantum communications has underscored the importance of rigorous error testing and flexible waveform synthesis. Consequently, solution providers have invested significantly in enhancing platform modularity, expanding frequency ranges, and integrating software-defined features to address diverse use cases.

This report offers an in-depth exploration of the technological drivers, regulatory influences, and competitive dynamics shaping the landscape of signal generation and error testing solutions. By examining transformative market shifts, tariff impacts, segmentation insights, and regional nuances, we aim to equip decision-makers with a comprehensive perspective on current trends and strategic imperatives. Subsequent sections will delve into the critical elements that define success in this rapidly evolving domain.

Exploring the Dramatic Technological and Market Transformations Shaping the Landscape of High-Speed Signal Generation and Error Testing Solutions

In recent years, the landscape of signal generation and error testing has experienced a series of profound transformations, fueled by the escalating demands of data-intensive applications and the proliferation of wireless technologies. High-bandwidth 5G deployments, especially those leveraging millimeter-wave frequencies, have compelled test instrument manufacturers to extend their frequency ranges and refine their synchronization capabilities. Simultaneously, the emergence of hyperscale data centers has driven requirements for multi-channel signal generation supporting advanced modulation formats and tighter timing tolerances.

Moreover, the expansion of automotive and aerospace sectors into connected and autonomous systems has introduced stringent reliability and environmental standards. Industry stakeholders now prioritize ruggedized instrumentation and real-time monitoring solutions capable of operating under extreme conditions. At the same time, growing interest in quantum computing and photonic communication has spurred demand for sub-picosecond pulse pattern generators and ultra-low-noise arbitrary waveform sources.

Meanwhile, software-defined instrumentation and modular hardware architectures have become indispensable, enabling rapid reconfiguration and integration with digital twins and machine-learning based diagnostics. The shift toward cloud-native measurement platforms has further enhanced remote collaboration and data analytics, allowing geographically dispersed teams to conduct joint test campaigns and streamline product validation cycles. These technological evolutions have redefined the benchmarks for performance, agility, and cost-effectiveness, setting the stage for the competitive narratives and strategic priorities detailed throughout this report.

Assessing the Comprehensive Impact of United States 2025 Tariff Measures on the Ecosystem of Signal Integrity and Test Instrumentation Suppliers

The introduction of new tariff measures by the United States in 2025 has had a multifaceted impact on the supply chain and cost structures associated with high-performance test instrumentation. Tariffs on raw semiconductor materials, critical components such as high-speed digital-to-analog converters, and even passive elements have elevated procurement expenses for original equipment manufacturers. This has prompted several vendors to reassess their production strategies, exploring opportunities for regional sourcing alternatives and diversifying their supplier base to mitigate exposure.

Additionally, the increased duties on imported test and measurement equipment have translated into higher acquisition costs for end users, particularly those in sectors with thin margin structures such as telecom service providers and semiconductor foundries. Some organizations have delayed capital expenditure plans or modified their project timelines in response, seeking to balance quality requirements with budget constraints. In parallel, domestic manufacturers have responded by ramping up localized assembly capabilities and negotiating volume contracts to counterbalance the tariff pressures.

Furthermore, the broader geopolitical environment and evolving trade policies have underscored the importance of regulatory compliance and forward-looking risk management. Industry leaders are now prioritizing detailed cost-benefit analyses to inform their procurement cycles, while lobbying efforts and coalition-building activities aim to shape future policy decisions. As a result, the interplay between tariffs and market demand has become a critical factor in strategic planning, influencing product roadmaps, channel partnerships, and inventory management practices. Subsequent discussions will examine how these shifts are reflected in segmentation performance and regional dynamics.

Unveiling Critical Market Segmentation Perspectives Across Application Product Type End Users Channel Count and Data Rate Dimensions

Market segmentation offers a lens through which to understand varied growth trajectories and technological priorities within the broader domain of signal generation and error testing. When categorized by application, the industry spans data communication, telecommunications, and specialized testbed and R&D environments, with telecommunications further subdivided to address 5G, 5G millimeter-wave, and LTE use cases. Each application segment imposes distinct performance benchmarks, from ultra-low bit error rates in long-haul fiber links to wideband waveform synthesis for next-generation mobile access.

Examining the product type dimension reveals a landscape comprised of arbitrary waveform generators, bit error rate testers, and pulse pattern generators. The arbitrary waveform generator segment emphasizes versatility and spectral purity, catering to advanced modulation and emulation requirements. Bit error rate testers focus on quantitative reliability assessments, offering high-speed error detection and statistical analysis. Pulse pattern generators deliver precise timing and amplitude control, underpinning compliance testing and jitter analysis for serial data interfaces.

The end-user segmentation highlights aerospace and defense applications, semiconductor manufacturers, and telecommunication service providers. Within semiconductor manufacturing, discrete branches including foundries and integrated device manufacturers adopt specialized test instrumentation for wafer-level characterization and device qualification. Channel count segmentation further differentiates solutions into single-channel and multi-channel platforms, the latter subdivided into dual-channel and quad-channel architectures to accommodate parallel testing workflows and multi-lane signaling standards.

Finally, the data rate classification distinguishes between devices supporting up to ten gigabits per second and those operating beyond this threshold. Instruments targeting higher data rates integrate advanced digital processing and ultra-fast DAC/ADC modules, whereas up-to-10-Gbps solutions focus on cost-effective deployment across enterprise and research applications. Through these interconnected dimensions, stakeholders can pinpoint the ideal configuration of test and measurement resources to address specific performance, throughput, and budgetary objectives.

This comprehensive research report categorizes the BERT, AWG & Pulse Pattern Generator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Channel Count

- Data Rate

- Application

- End User

Revealing Regional Dynamics and Emerging Opportunities Across Americas Europe Middle East Africa and Asia Pacific Test Equipment Markets

Regional dynamics play a pivotal role in shaping competitive landscapes and investment priorities in signal generation and error testing technologies. Within the Americas, developments in telecommunication infrastructure, including large-scale 5G rollouts and hyperscale data center expansions, have driven demand for high-bandwidth instrumentation. North American vendors often benefit from proximity to leading research institutions and defense contractors, while South American markets are witnessing a gradual uptick in R&D activities related to digital broadcast and satellite communications.

In Europe, the Middle East, and Africa, a diverse set of drivers influences technology adoption. Western European nations emphasize stringent quality standards and compliance testing for automotive radar, fiber optics, and industrial automation. The Middle East’s investments in smart city initiatives and satellite connectivity underscore appetite for advanced signal synthesis, whereas select African markets are beginning to integrate mixed-signal test solutions for expanding broadband access. Collaborative initiatives between academic consortia and industrial partners have catalyzed localized innovation hubs, further diversifying regional demand profiles.

Asia-Pacific stands out for its robust electronics manufacturing ecosystems and aggressive deployment of next-generation wireless networks. Countries such as South Korea, Japan, and China lead with significant investments in 5G mmWave infrastructure and semiconductor fabrication capacity. Meanwhile, emerging economies in Southeast Asia are gradually increasing test instrument adoption to support local device makers and telecommunications operators. This region’s emphasis on cost competitiveness and rapid technology cycles has driven vendors to develop scalable platform designs and region-specific service models.

These regional landscapes highlight the necessity for solution providers to adapt their go-to-market strategies, offering tailored financing options, local technical support, and modular product designs that align with distinct regulatory and operational requirements. Subsequent sections will explore how leading companies navigate these complexities and drive innovation across these diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the BERT, AWG & Pulse Pattern Generator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Driving Advancements in Bit Error Rate Testing Arbitrary Waveform Generation and Pulse Pattern Technologies

A cadre of leading technology providers has propelled advancements in signal generation and error testing through continuous investment in research, product development, and strategic partnerships. Among these, long-established instrumentation specialists have expanded their portfolios to include modular platforms with software-defined capabilities, enabling rapid customization for emerging applications. Concurrently, agile upstarts have introduced niche solutions optimized for specific use cases such as quantum-safe waveform generation and millimeter-wave networking validation.

Innovations in digital signal processing and high-speed semiconductor design have become core differentiators. Some vendors focus on integrating application programming interfaces and open-source software frameworks that facilitate easy automation and integration into DevOps pipelines. Others emphasize hardware co-design strategies, collaborating closely with chipset manufacturers to co-develop custom DAC and ADC modules that maximize signal fidelity while minimizing latency and jitter. These partnerships often extend to joint validation facilities and shared testbed infrastructures, accelerating time-to-market for both instrumentation providers and their customers.

Furthermore, strategic acquisitions and alliances have reshaped competitive positioning. Major players have absorbed complementary startups to enhance multi-channel capabilities or incorporate advanced analytics engines, while regional distributors have forged value-added reselling agreements to bolster localized support. This dynamic ecosystem has stimulated the emergence of end-to-end solution bundles, combining instrumentation hardware with cloud-based data analysis and remote monitoring services.

Overall, the interplay between established incumbents and innovative newcomers has fostered a fertile environment for technological breakthroughs, driving more versatile, scalable, and cost-effective test solutions. Market participants that leverage cross-industry collaborations and invest in future-proof architectures are best positioned to address the evolving complexities of signal integrity and error testing.

This comprehensive research report delivers an in-depth overview of the principal market players in the BERT, AWG & Pulse Pattern Generator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anritsu Corporation

- B&K Precision Corporation

- Berkeley Nucleonics Corporation

- Chroma ATE Inc.

- EXFO Inc.

- Fluke Corporation

- Gigatronics, Inc.

- Good Will Instrument Co., Ltd.

- Keysight Technologies, Inc.

- National Instruments Corporation

- Pico Technology Limited

- RIGOL Technologies, Inc.

- Rohde & Schwarz GmbH & Co KG

- Siglent Technologies Co., Ltd.

- Spirent Communications plc

- Tektronix, Inc.

- Teledyne LeCroy, Inc.

- VIAVI Solutions Inc.

- Yokogawa Electric Corporation

Actionable Strategies for Industry Leaders to Enhance Testbed Capabilities Optimize Supply Chains and Capitalize on Next Generation Signal Integrity Trends

To maintain a leadership position in the evolving landscape of high-speed signal generation and error testing, industry stakeholders should prioritize investment in scalable, modular platforms that can be rapidly reconfigured for diverse use cases. By adopting open standards and interoperable software architectures, equipment providers can accelerate integration with emerging wireless, photonic, and quantum test environments. At the same time, end users must implement comprehensive qualification protocols that leverage multi-channel testing scenarios to validate complex multi-lane interfaces under real-world conditions.

Supply chain resilience remains a paramount concern. Organizations are advised to diversify component sourcing and establish strategic partnerships with regional assemblers to mitigate tariff exposure and transportation disruptions. Engaging in long-term procurement agreements and collaborative forecasting initiatives can also stabilize pricing and ensure timely access to critical semiconductors and passive components. Parallel efforts to develop reverse-engineering and in-house calibration capabilities will further strengthen operational agility.

Moreover, the convergence of artificial intelligence and test instrumentation presents new opportunities to enhance predictive maintenance, automate error root-cause analysis, and optimize signal calibration routines. Industry leaders should explore pilot deployments of machine-learning modules within their testbeds and track key performance indicators to evaluate ROI. Finally, fostering cross-functional collaboration between R&D, manufacturing, and field-service teams can shorten feedback loops, inform product roadmaps, and drive continuous improvement in test methodologies.

By implementing these strategic measures, both vendors and end users can extract maximum value from their instrumentation investments, respond more nimbly to technological shifts, and secure a sustainable competitive edge in an increasingly complex test and measurement ecosystem.

Detailing the Rigorous Research Methodology Underpinning Objective Analysis of High Performance Signal Generation and Error Testing Markets

Our research process commenced with an extensive review of publicly available technical papers, regulatory filings, and patent databases to map the evolution of key technologies within the signal integrity and error testing domain. This baseline was supplemented by in-depth interviews with engineers, procurement specialists, and C-level executives across leading telecommunications operators, semiconductor fabricators, aerospace firms, and academic research institutions. These primary insights provided a granular understanding of performance benchmarks, procurement cycles, and risk management practices.

To ensure a robust analytical foundation, we employed a data triangulation approach that cross-validated findings from multiple sources. Vendor catalogs, application notes, and product release histories were correlated with end-user feedback and secondary literature, enabling us to reconcile potential discrepancies and capture nuanced market signals. Additionally, we analyzed regulatory developments, trade policy announcements, and standardization roadmaps to assess external drivers shaping capital expenditure decisions.

Quantitative data points were integrated through a bottom-up compilation of technology adoption trends and vendor shipment statistics, while qualitative assessments were structured around thematic frameworks such as technology readiness levels and value chain positioning. Emphasis was placed on transparency and replicability, with all assumptions and data sources meticulously documented. Finally, subject-matter experts conducted peer reviews at each stage to validate the accuracy, consistency, and relevance of our conclusions, ensuring that the report delivers actionable insights anchored in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our BERT, AWG & Pulse Pattern Generator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- BERT, AWG & Pulse Pattern Generator Market, by Product Type

- BERT, AWG & Pulse Pattern Generator Market, by Channel Count

- BERT, AWG & Pulse Pattern Generator Market, by Data Rate

- BERT, AWG & Pulse Pattern Generator Market, by Application

- BERT, AWG & Pulse Pattern Generator Market, by End User

- BERT, AWG & Pulse Pattern Generator Market, by Region

- BERT, AWG & Pulse Pattern Generator Market, by Group

- BERT, AWG & Pulse Pattern Generator Market, by Country

- United States BERT, AWG & Pulse Pattern Generator Market

- China BERT, AWG & Pulse Pattern Generator Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Comprehensive Conclusions Highlighting Core Insights and Strategic Implications for Signal Integrity and Test Instrumentation Stakeholders

Our comprehensive exploration has illuminated the intricate interplay between technological evolution, regulatory dynamics, and competitive forces within the high-speed signal generation and error testing landscape. From the transition to software-defined instrumentation and modular hardware architectures to the heightened scrutiny of supply chain resilience in light of new tariff regimes, the ecosystem continues to evolve in response to both technical imperatives and broader economic trends.

Segmentation analysis revealed that each dimension-from application-specific requirements in 5G mmWave networks and long-haul fiber communications to channel count configurations and data rate thresholds-carries distinct implications for product design and go-to-market strategies. Similarly, regional insights underscored the varied drivers and adoption patterns in the Americas, EMEA, and Asia-Pacific, highlighting the importance of localized support models and regulatory alignment.

Key vendors have distinguished themselves through strategic partnerships, targeted acquisitions, and investments in advanced digital processing capabilities, while end users are increasingly leveraging artificial intelligence and cloud-based analytics to enhance testbed performance and predictive maintenance. These converging trends point to a future where flexibility, data-driven insights, and integrated hardware–software ecosystems will dictate competitive advantage.

Ultimately, organizations that embrace open architectures, cultivate diversified supply chains, and adopt proactive R&D and procurement strategies will be best positioned to navigate the complexities of next-generation connectivity and maintain leadership in signal integrity and test instrumentation.

Engaging with Ketan Rohom to Acquire In-Depth Market Research Insights on Signal Generation and Error Testing Solutions Tailored to Your Strategic Objectives

To explore bespoke insights and secure a competitive advantage, we invite you to coordinate directly with Ketan Rohom, the Associate Director of Sales & Marketing, to arrange a tailored consultation. Ketan Rohom can guide your team through the comprehensive scope and proprietary methodologies underlying the report, ensuring you access the precise data and strategic recommendations needed to drive innovation and market leadership. Connect with Ketan to obtain customized sample chapters, discuss enterprise licensing options, or organize an executive briefing that aligns the report’s findings with your strategic imperatives. Taking this step will equip your organization with the actionable intelligence required to accelerate development cycles, optimize capital allocations, and capitalize on emerging opportunities in signal integrity and test instrumentation. Reach out now to transform insights into impactful outcomes and position your enterprise at the forefront of technological advancement.

- How big is the BERT, AWG & Pulse Pattern Generator Market?

- What is the BERT, AWG & Pulse Pattern Generator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?