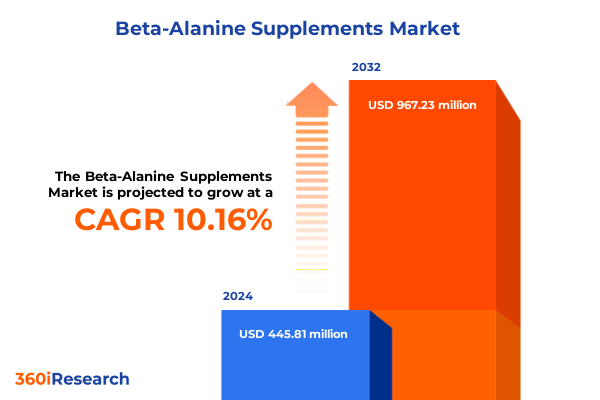

The Beta-Alanine Supplements Market size was estimated at USD 490.23 million in 2025 and expected to reach USD 541.07 million in 2026, at a CAGR of 10.19% to reach USD 967.23 million by 2032.

Unveiling the Strategic Importance of Beta-Alanine Supplements in Modern Sports Nutrition and Consumer Health

Beta-alanine has emerged as a cornerstone ingredient in sports nutrition, renowned for its ability to buffer muscle acidity and improve high-intensity exercise performance. As consumers deepen their understanding of pre-workout formulations, this non-essential amino acid has transcended niche usage to become a mainstream component in daily fitness regimens. Scientific validation and athlete testimonials have both contributed to a surge in awareness, underscoring its efficacy in delaying muscle fatigue and enhancing overall endurance. Consequently, companies across the value chain are intensifying efforts to refine delivery mechanisms, amplify bioavailability, and differentiate formulations.

Moreover, the convergence of fitness technology and personalized nutrition is fueling consumer demand for evidence-based supplements. Health enthusiasts now expect precise dosing, transparent labeling, and seamless integration with digital platforms that track performance metrics. This shifting landscape prompts manufacturers to innovate beyond traditional powder forms, experimenting with encapsulated formats and ready-to-drink options that cater to on-the-go lifestyles. In parallel, regulatory bodies continue to monitor ingredient claims, compelling brands to adhere to stringent quality controls and substantiation standards.

As the ingredient’s reputation expands beyond hardcore athletes to casual gym-goers and wellness-driven consumers, beta-alanine supplements are positioned for robust market relevance. Stakeholders must therefore align product development with evolving consumer preferences, scientific advances, and compliance requirements to capitalize on the momentum driving this category forward.

How Innovations in Delivery Technologies and Consumer Engagement Are Reshaping the Beta-Alanine Supplement Sector

Over the past few years, the beta-alanine supplement sector has witnessed transformative shifts driven by technological advancements and changing consumer mindsets. Ingredient innovation now extends to microencapsulation techniques that optimize release profiles, while synergistic blend formulations combine beta-alanine with complementary ergogenic aids such as citrulline malate and caffeine. This evolution reflects a broader trend toward multi-functional supplements that deliver holistic benefits rather than single-claim products. Consequently, companies are reimagining traditional supply chains to accommodate specialized ingredient sourcing and proprietary delivery technologies.

Concurrently, the rise of direct-to-consumer platforms has disrupted conventional retail models, empowering boutique brands to cultivate dedicated followings through social media, influencer partnerships, and subscription-based services. This paradigm shift has compelled established players to reevaluate their distribution strategies, enhancing e-commerce capabilities and forging strategic alliances with digital marketplaces. Furthermore, data analytics tools now enable granular tracking of purchase behaviors and product performance, facilitating agile decision-making and targeted marketing initiatives.

Looking ahead, sustainability and ethical sourcing are gaining prominence as consumers weigh environmental and social impact alongside functional benefits. From eco-friendly packaging solutions to responsibly sourced raw materials, industry leaders are integrating sustainability into core value propositions. This reorientation not only resonates with younger demographics but also fortifies brand reputation in an increasingly conscientious marketplace. In essence, these transformative shifts underscore the sector’s drive toward innovation, consumer centricity, and long-term resilience.

Analyzing the Broad-Scale Effects of 2025 United States Import Tariffs on Beta-Alanine Supplement Supply Chains

The imposition of new tariffs in early 2025 has introduced significant complexities to the beta-alanine supply chain, particularly for companies reliant on imported active pharmaceutical ingredients. With raw material costs spiking due to the 15 percent import duty levied on amino acid precursors, manufacturers are navigating a delicate balance between preserving margins and maintaining competitive retail prices. These increased overheads have necessitated operational adjustments, including renegotiated supplier agreements and strategic stockpiling ahead of tariff escalations.

In response to elevated costs, firms have accelerated localization efforts, exploring domestic production partnerships and alternative sourcing regions with favorable trade arrangements. This pivot has the dual benefit of mitigating exposure to tariff volatility and reducing lead times, yet it also requires stringent quality assurance measures to uphold product integrity. Simultaneously, distribution partners are reassessing pricing structures and promotional calendars to adapt to input cost pressures, with many opting for phased price adjustments to minimize consumer backlash.

Ultimately, the cumulative impact of these tariffs extends beyond cost considerations to influence product innovation and market positioning. As brands contend with increased unit economics, there is a renewed emphasis on premiumization-offering value-added formulations with differentiated delivery systems or combined ingredients that justify higher price points. These strategic shifts underscore the sector’s adaptability in the face of regulatory headwinds and highlight the importance of agile supply chain management in sustaining growth momentum.

Uncovering the Complex Interplay of Formulations, Channels, and Consumer Profiles Driving Beta-Alanine Market Dynamics

A comprehensive examination of market segmentation reveals nuanced dynamics across different facets of the beta-alanine category. The form of delivery-whether as capsules, liquids, or powders-significantly influences consumer perception and usage occasions. Capsules provide precise dosing and portability, appealing to athletes seeking convenience, while liquid formulations cater to rapid absorption scenarios favored by high-intensity trainers. Powder remains the dominant format, offering customizable dosing and cost efficiency for habitual users and fitness communities.

Distribution channels further shape accessibility and consumer reach, with online retail platforms emerging as a highly dynamic space. Brand websites, global e-commerce marketplaces, and subscription-based models are driving tailored purchasing experiences, personalized promotions, and recurring revenue streams. Meanwhile, traditional brick-and-mortar outlets like chain pharmacies, independent drug stores, health food shops, and specialized sports nutrition retailers continue to serve established customer segments that value in-store consultations and immediate product availability.

End-user distinctions highlight varied motivational drivers, from professional athletes seeking clinically validated performance gains to fitness enthusiasts focused on incremental improvements, and bodybuilders targeting muscle endurance. Each group’s preferences feed into application categories, whether health and wellness regimens emphasizing daily maintenance or sports nutrition protocols centered around pre-workout stimulation and post-exercise recovery. Finally, packaging design-ranging from bulk vessels to single-serve packets-affects consumer trial rates, portability, and perceptions of product freshness, underscoring its role in influencing purchase decisions.

This comprehensive research report categorizes the Beta-Alanine Supplements market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Application

- Packaging

- End User

- Distribution Channel

Illustrating Diverse Regional Growth Drivers and Consumer Trends Shaping the Global Beta-Alanine Supplements Market

Regional analysis of the global beta-alanine market uncovers divergent growth trajectories shaped by economic, cultural, and regulatory factors. In the Americas, well-established fitness cultures and mature retail ecosystems underpin sustained demand for performance-enhancing supplements. Regulatory clarity from authorities has fostered trust, while high disposable incomes and widespread digital adoption bolster e-commerce growth. North American markets in particular demonstrate robust interest in premium formulations and value-added blends.

Across Europe, the Middle East, and Africa, varied regulatory landscapes and diverse consumer attitudes generate both challenges and opportunities. Western European markets exhibit sophisticated demand for clinically backed ingredients and sustainable packaging, whereas emerging markets within the region are characterized by price sensitivity and growing awareness. Middle Eastern countries show increasing appetite for sports nutrition products framed within holistic wellness narratives, and African markets present untapped potential driven by youth demographics and rising fitness adoption.

In Asia-Pacific, rapid urbanization, increasing health consciousness, and expanding distribution networks are fueling growth. Markets such as Australia and Japan prioritize product safety and scientific validation, while Southeast Asian countries embrace digital retail formats and influencer-led marketing. China and India stand out for their scale and evolving regulatory oversight, presenting both expansive opportunity and the necessity for compliance diligence. These regional insights delineate critical pathways for market entry and expansion, encouraging tailored strategies that resonate with local consumer expectations.

This comprehensive research report examines key regions that drive the evolution of the Beta-Alanine Supplements market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Players Leverage Innovation Partnerships and Strategic Collaborations to Dominate the Beta-Alanine Sector

Leading enterprises within the beta-alanine domain are differentiating through strategic innovation and robust partnership frameworks. Multinational nutrition conglomerates leverage extensive R&D capabilities to optimize ingredient purity and explore novel synergy combinations, reinforcing their leadership in premium segments. At the same time, nimble challenger brands are carving out niche positions by emphasizing natural sourcing, transparent supply chain storytelling, and direct engagement via digital marketing channels.

Ingredient suppliers specializing in amino acid extraction and purification are collaborating with formulation houses to co-develop proprietary delivery systems, thereby adding value beyond commodity raw materials. These alliances enable co-branding opportunities and cross-market penetration, especially in sectors such as pre-workout formulations and recovery products. Additionally, investment activity by private equity groups and strategic acquisitions has accelerated consolidation, enhancing economies of scale and facilitating geographic expansion.

Parallel to product-centric strategies, companies are investing in consumer education initiatives-from interactive digital platforms to expert-led webinars-to demystify beta-alanine’s role within training regimens. This customer-centric approach not only drives loyalty but also generates actionable insights that inform future product roadmaps. Collectively, these corporate maneuvers illustrate how leadership in this segment hinges on a balanced emphasis on scientific rigor, marketing excellence, and agile supply chain management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beta-Alanine Supplements market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Huaheng Biotechnology Co., Ltd.

- BPI Sports, LLC

- Bulk (UK) Ltd

- Glanbia plc

- GNC Holdings, Inc.

- KYOWA HAKKO BIO CO., LTD.

- Merck KGaA

- MusclePharm Corporation

- Naked Nutrition, Inc.

- Natural Alternatives International, Inc.

- Now Health Group, Inc.

- NutraBio Labs, LLC

- Prinova Group LLC

- PureBulk, Inc.

- Wuxi Jinghai Amino Acid Co., Ltd.

- Xinfa Pharmaceutical Co., Ltd.

Strategic Playbook for Elevating Product Differentiation and Strengthening Consumer Engagement in the Beta-Alanine Market

To harness evolving market opportunities, decision-makers should prioritize the optimization of product formulations by integrating advanced delivery technologies that enhance bioavailability and consumer convenience. Investing in microencapsulation or liposomal delivery methods can differentiate offerings and justify premium positioning. Alongside formulation enhancements, expanding omnichannel distribution footprints-particularly within subscription-based e-commerce models-will help capture recurring revenue streams and foster direct consumer relationships.

Organizations must also navigate tariff pressures through diversified sourcing strategies, including dual-sourcing agreements and strategic inventory management protocols. Establishing partnerships with regional raw material producers can reduce import exposure, while proactive regulatory monitoring ensures prompt adaptation to policy changes. Concurrently, embedding sustainability principles into packaging and supply chain operations can resonate with environmentally conscious consumers and strengthen brand equity over the long term.

Finally, market leaders should deepen engagement with target end users by developing tailored educational content and performance tracking tools that demonstrate product efficacy. Collaborations with fitness influencers and professional athletes can lend credibility, while integrated digital platforms provide a seamless experience from trial to purchase. By executing these recommendations in concert, industry players can solidify their market positioning and achieve sustained growth amid dynamic industry shifts.

Detailing the Robust Mixed-Methods Approach Underpinning Comprehensive Insights into Beta-Alanine Market Dynamics

This analysis is grounded in a rigorous research framework combining primary and secondary methodologies to ensure comprehensive market coverage. Primary research encompassed in-depth interviews with industry executives, formulation scientists, supply chain experts, and key channel partners, yielding qualitative insights into production practices, consumer behaviors, and strategic priorities. Concurrently, surveys targeting end users provided quantitative data on consumption patterns, purchase drivers, and brand preferences.

Secondary research involved an extensive review of regulatory filings, peer-reviewed studies on ergogenic efficacy, industry association publications, and publicly available financial reports. This triangulation of data sources facilitated cross-validation of insights, ensuring the reliability of conclusions drawn. Furthermore, supply chain maps were constructed through procurement databases and customs records to quantify the impact of recent tariff changes on material costs and lead times.

Segment and regional breakouts were developed by synthesizing demographic data, consumption statistics, and distribution channel trends to identify key growth pockets and consumer segments. The final analysis underwent iterative validation with subject matter experts to confirm the robustness of strategic recommendations and market characterizations. This methodological rigor underpins the credibility and actionable value of the findings presented here.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beta-Alanine Supplements market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beta-Alanine Supplements Market, by Form

- Beta-Alanine Supplements Market, by Application

- Beta-Alanine Supplements Market, by Packaging

- Beta-Alanine Supplements Market, by End User

- Beta-Alanine Supplements Market, by Distribution Channel

- Beta-Alanine Supplements Market, by Region

- Beta-Alanine Supplements Market, by Group

- Beta-Alanine Supplements Market, by Country

- United States Beta-Alanine Supplements Market

- China Beta-Alanine Supplements Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Innovations, Channel Evolutions, and Strategic Resilience to Chart the Future of Beta-Alanine Supplementation Market

In conclusion, the beta-alanine supplement market stands at a pivotal juncture defined by technological innovation, evolving consumer preferences, and regulatory complexities. The ingredient’s proven performance benefits have catalyzed its adoption across a broad spectrum of fitness and wellness applications, while distribution models continue to diversify through digital and traditional channels. At the same time, the introduction of tariffs has underscored the importance of supply chain agility and strategic sourcing.

As market stakeholders navigate these multifaceted dynamics, the ability to synthesize scientific rigor with consumer-centric marketing will determine competitive differentiation. Formulation enhancements, sustainable practices, and targeted educational initiatives are poised to shape future growth trajectories. Regional variations in demand and regulatory landscapes further highlight the necessity for tailored market entry and expansion strategies.

Ultimately, organizations that adopt a holistic approach-integrating innovative product development, resilient supply chain management, and data-driven consumer engagement-are best positioned to capitalize on the opportunities within the global beta-alanine supplement landscape. The insights and recommendations provided herein serve as a strategic roadmap for leaders aiming to secure market share and drive sustained value creation.

Engage with Our Expert Associate Director to Secure the Definitive Beta-Alanine Supplement Market Research Report for Strategic Advantage

Driven by a commitment to precision insights and strategic guidance, we invite you to engage with Ketan Rohom, our Associate Director of Sales & Marketing, to secure access to the comprehensive market research report on beta-alanine supplements. His expertise and deep understanding of the sports nutrition sector will ensure that your organization receives tailored solutions and actionable intelligence. By partnering with him, you will gain direct access to client-focused consultations, exclusive executive briefings, and priority support to accelerate your market initiatives. Connect with Ketan to schedule a personalized demonstration of the report’s capabilities, explore bespoke data packages, and unlock the full spectrum of opportunities in the evolving global beta-alanine supplement landscape. Your strategic advantage begins with a conversation.

- How big is the Beta-Alanine Supplements Market?

- What is the Beta-Alanine Supplements Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?