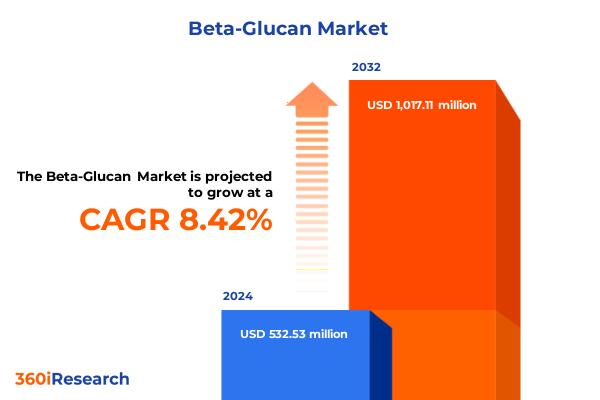

The Beta-Glucan Market size was estimated at USD 575.51 million in 2025 and expected to reach USD 622.35 million in 2026, at a CAGR of 8.47% to reach USD 1,017.11 million by 2032.

Uncovering the Multifaceted Benefits and Applications of Beta-Glucan as a Core Functional Ingredient Driving Health and Industry Innovation

Beta-glucans, naturally occurring polysaccharides found in the cell walls of cereals, yeast, mushrooms, and certain algae, have captured widespread attention for their multifaceted health-promoting properties. In recent years, extensive research has elucidated how beta-glucans engage the immune system via the Dectin-1 receptor, triggering a cascade of intracellular signaling events that enhance macrophage and dendritic cell activation and promote the secretion of critical cytokines such as interleukin-1β through a Syk–NLRP3 pathway in human macrophages. Concurrently, novel investigations have revealed the potential of beta-glucans to modulate B-cell differentiation, augment antibody production, and support adaptive immune responses in preclinical cancer models, positioning these compounds as promising immunotherapeutic adjuvants.

Beyond immunomodulation, beta-glucans exhibit cholesterol-lowering effects by increasing intestinal viscosity and binding bile acids, thereby supporting cardiovascular health and glycemic control. Such physiological benefits have driven adoption across diverse sectors, ranging from dietary supplements and functional food and beverages to personal care formulations and pharmaceutical applications. These cross-industry use cases underscore the versatility of beta-glucans as functional ingredients capable of addressing key consumer demands related to immune resilience, metabolic wellness, and holistic health maintenance.

In light of this expansive potential, industry stakeholders are seeking a deeper understanding of the complex interplay between source variations, extraction and purification techniques, and regulatory frameworks. As a result, the beta-glucan landscape is poised for significant evolution, driven by breakthroughs in extraction technologies, clinical validation efforts, and shifting consumer expectations. Against this backdrop, this executive summary provides a structured analysis of the trends, challenges, and opportunities shaping the beta-glucan market as of mid-2025.

Emerging Technological Advances Regulatory Reforms and Consumer Preferences Driving a Transformative Shift in the Beta-Glucan Industry Landscape

The beta-glucan sector is undergoing a period of rapid transformation, fueled by technological breakthroughs in raw material processing and delivery systems, evolving regulatory landscapes, and intensifying consumer demand for clean-label, science-backed solutions. Recent advances in cryo-milling and nanoparticle fabrication have enabled the production of beta-glucan nanoparticles with enhanced oral bioavailability, sustained release characteristics, and targeted delivery potential for pharmaceutical applications. For example, researchers have developed gemcitabine-loaded beta-glucan nanoparticles via freeze-milling, achieving a 7.4-fold extension in drug half-life and a 5.1-fold increase in oral bioavailability compared with conventional formulations.

Similarly, the strategic coating of nanoliposomes with oat-derived beta-glucan has demonstrated improved physicochemical stability under gastrointestinal conditions, delivering controlled release of encapsulated actives and modulating mucus penetration to enhance absorption profiles. These micro- and nano-encapsulation approaches are not only expanding the application horizon of beta-glucans but also catalyzing partnerships between ingredient suppliers and pharmaceutical manufacturers seeking innovative excipients for next-generation therapeutics.

On the regulatory front, novel food and dietary fiber designations are being refined to accommodate emerging beta-glucan sources, such as algal strains and standardized yeast preparations. In parallel, global trade policies and tariff reviews are prompting industry coalitions to engage with policymakers to ensure balanced frameworks that support domestic manufacturing while maintaining access to critical imports. Moreover, clinical research continues to validate beta-glucan’s role in immune training and antitumor responses, reinforcing its status as a scientifically substantiated functional ingredient and fostering consumer confidence in evidence-based formulations.

Together, these technological, regulatory, and scientific developments are reshaping the beta-glucan value chain, accelerating innovation in product design, standardization, and market positioning. As a result, stakeholders must adapt to shifting dynamics by integrating advanced processing capabilities, aligning with evolving regulatory standards, and investing in targeted clinical research to differentiate their beta-glucan offerings.

Assessing the Compounding Effects of U.S. Tariff Structures on Beta-Glucan Sourcing Costs Supply Chains and Market Access in 2025

The U.S. tariff environment has exerted a compounding effect on the sourcing, cost structure, and supply chain resilience of beta-glucan ingredients in 2025. Since the initial Section 301 measures imposed a 25% duty on select Chinese botanical and fungal products, industry participants have navigated significant cost pressures and procurement challenges, particularly for yeast-derived and mushroom-sourced beta-glucans. These duties have been further exacerbated by tit-for-tat reciprocal tariffs that escalated Chinese import duties to 145% in early 2025, intensifying disruptions for companies relying on established supplier relationships in the Asia-Pacific region.

In April 2025, the U.S. government introduced a two-tier tariff structure comprising a 10% universal duty on non-exempt countries effective April 5 and country-specific reciprocal tariffs ranging from 11% to 50% beginning April 9. These layers stack cumulatively atop existing Section 301 levies, with some Chinese imports of critical supplement ingredients facing combined rates surpassing 70%, prompting strategic stockpiling and contract renegotiations among manufacturers.

As a consequence, beta-glucan producers and end-product manufacturers have pursued diversified sourcing strategies, including the development of domestic cultivation and extraction capabilities for oats, barley, and algae. Additionally, supply chain actors are exploring alternative supplier networks in regions with more favorable trade agreements. While short-term cost absorption remains a challenge, these tariff-driven dynamics are fostering a longer-term emphasis on vertical integration and regional production hubs that can mitigate exposure to geopolitical trade volatility.

In-Depth Analysis of Beta-Glucan Market Segmentation by Type Source Form Purity Application and Distribution Channels for Strategic Clarity

A nuanced understanding of beta-glucan market segmentation provides critical guidance for product positioning, R&D focus, and supply chain planning. When analyzed by type, the market is principally divided into insoluble beta-glucan, prized for its cholesterol-binding and gut-health benefits, and soluble beta-glucan, valued for viscosity modulation and immune support. Within source classifications, cereal-derived glucans from barley, oats, and wheat coexist alongside yeast-based fractions from baker’s and brewer’s yeast, with fungal strains such as shiitake, reishi, and maitake mushrooms, and algae species including Chlorella and Spirulina completing the spectrum.

Form preferences further differentiate the market, spanning powders-both standard and microencapsulated-for incorporation into dry blends, to ready-to-drink syrups and suspensions, as well as capsules, tablets, and novel gel matrices designed for consumer convenience and dose accuracy. Purity levels range from crude, multi-constituent extracts to semi-purified fractions and highly purified isolates tailored for pharmaceutical-grade applications.

Functionally, dietary supplement formulations leverage beta-glucan in capsules, powders, and tablets to support immune health, while the functional food and beverage sector integrates it into bakery and confectionery products, dairy formulations, beverages, and snacks to deliver value-added nutrition. In personal care, hair care, oral care, and skincare products capitalize on beta-glucan’s hydrating and barrier-support properties, and the pharmaceutical industry employs it in drug delivery systems, medical devices, and vaccine adjuvant applications. Lastly, distribution channels split between offline specialty and mass retail outlets and online platforms, each demanding tailored packaging and marketing strategies to optimize consumer reach and engagement.

This comprehensive research report categorizes the Beta-Glucan market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Form

- Purity

- Application

- Distribution Channels

Regional Dynamics and Insights Highlighting the Distinct Drivers Challenges and Growth Opportunities for Beta-Glucan across the Americas EMEA and Asia-Pacific

Geographic nuances exert a profound influence on beta-glucan market development, with the Americas, EMEA, and Asia-Pacific regions each presenting distinct drivers, constraints, and growth trajectories. In the Americas, robust R&D infrastructure across the U.S. and Canada has fueled innovation in extraction methods, clinical validation of immune and metabolic health claims, and the establishment of strategic partnerships between ingredient suppliers and leading CPG firms. This environment has also fostered investment in domestic cultivation of oats and barley and the expansion of specialty yeast fermentation facilities to mitigate reliance on imports.

Within Europe, the Middle East, and Africa, regulatory emphasis on novel food approvals and dietary fiber health claims has shaped ingredient usage parameters and labeling requirements. Notably, yeast-derived beta-glucans have benefitted from the European Food Safety Authority’s novel food designation, reinforcing market confidence in yeast-based immune health solutions. However, complexity in regional trade agreements and differing national tariffs necessitate agile supply chain strategies to ensure ingredient compliance and competitive pricing.

In Asia-Pacific, rapidly expanding consumer markets in China, Japan, India, and Australia drive demand for both traditional cereal glucans and emerging algae-sourced variants. The region’s abundant raw material availability, combined with government incentives for functional food innovation, has positioned Asia-Pacific as a leading production hub. Concurrently, heightened regulatory scrutiny and alignment with global quality standards are prompting local producers to pursue international certifications, thereby enabling broader export opportunities across key markets.

This comprehensive research report examines key regions that drive the evolution of the Beta-Glucan market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Beta-Glucan Innovators and Market Influencers Shaping Product Development and Competitive Strategies in Today’s Nutraceutical and Functional Ingredient Sectors

Leading companies in the beta-glucan arena are leveraging differentiated strategies spanning clinical research, product innovation, and capacity expansion to fortify their market positions. Biothera, with its flagship Wellmune postbiotic yeast beta-1,3/1,6 glucan, has amassed a robust portfolio of peer-reviewed clinical studies demonstrating innate immune support, respiratory health benefits, and intestinal barrier function improvements in stressed adults. The company’s emphasis on scientific rigor and strategic partnerships with co-manufacturers underscores its commitment to sustaining Wellmune’s leadership in immune-focused formulations.

Kerry Group, the owner of the Wellmune brand, continues to drive product diversification by integrating yeast-derived beta-glucan into beverages, bakery ingredients, and nutritional supplements. Through targeted clinical collaborations and novel applications in sports nutrition and functional foods, the company is broadening Wellmune’s reach across both consumer and industrial segments.

Kemin Industries has pursued capacity augmentation and sustainability initiatives, as evidenced by its 2022 expansion of the Cavriago facility, with a particular focus on algae-derived beta-glucans such as Euglena gracilis for high-purity, specialty applications. In addition, its BetaVia Complete product line secured Thai FDA certification, highlighting the company’s global regulatory engagement.

Meanwhile, major ingredient suppliers such as Tate & Lyle and DSM-Firmenich are capitalizing on their global manufacturing networks to offer diversified cereal and yeast-sourced beta-glucan solutions tailored for food, beverage, and personal care markets. By integrating sustainability standards, clean-label processing, and traceable supply chains, these companies are responding to evolving consumer expectations and regulatory requirements to maintain competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beta-Glucan market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABF Ingredients Group

- Alltech Life Sciences

- Angel Yeast Co., Ltd.

- Archer-Daniels-Midland Company

- Associated British Foods PLC

- Auriga Group

- BENEO GmbH

- Better Way Products, INC

- Biopolymer Engineering Inc.

- Biorigin

- Biotec Pharmacon ASA

- Cargill, Incorporated

- Ceapro Inc.

- DSM Nutritional Products AG

- Euglena Co. Ltd

- Garuda International, Inc.

- Givaudan SA

- GlycaNova AS

- Kemin Industries Inc.

- Kerry Group PLC

- Merck KGaA

- NutraQ AS

- NutriScience Innovations, LLC

- Super Beta Glucan Inc.

- Tate & Lyle PLC

Strategic and Operational Recommendations to Enable Industry Leaders to Strengthen Supply Chains Innovate Product Portfolios and Enhance Market Positioning with Beta-Glucan

To capitalize on the dynamic beta-glucan landscape, industry leaders should prioritize strategic initiatives that enhance supply chain resilience, accelerate product innovation, and strengthen market positioning. First, diversifying raw material sourcing through the development of domestic cultivation and fermentation capabilities can mitigate exposure to tariff volatility and supply disruptions. Investing in regional production hubs for oats, barley, yeast, and algae will foster greater control over quality, lead times, and cost structures.

Second, stakeholders should intensify collaboration with academic and contract research organizations to expand the clinical evidence base supporting beta-glucan health claims, particularly in emerging areas such as gut microbiome modulation, metabolic health, and immuno-oncology. Demonstrating mechanism-of-action through advanced in vitro and in vivo models will reinforce regulatory approvals and consumer trust.

Third, manufacturers and brand owners must integrate advanced delivery technologies-such as microencapsulation, nanoparticle carriers, and targeted liposomal systems-to improve bioavailability, tailor release profiles, and unlock new applications. Coupling these technologies with digital traceability platforms will ensure compliance with ever-tightening regulatory standards and enhance transparency for ethically and sustainability-conscious consumers.

Finally, industry participants should actively engage with policy-makers and trade associations to advocate for balanced tariff structures and streamlined novel food approvals. By shaping favorable regulatory frameworks and fostering public-private partnerships, the beta-glucan sector can secure sustainable growth pathways and reinforce the market’s role as a driver of health innovation.

Comprehensive Research Methodology and Analytical Framework Ensuring Data Integrity Market Insights and Actionable Intelligence on Beta-Glucan Dynamics

This research synthesis employs a robust methodology combining secondary data collection, expert consultations, and triangulation techniques to ensure comprehensive and reliable insights. Secondary sources encompassed peer-reviewed journals, regulatory filings, tariff notifications, trade publications, and reputable newswire releases to capture the latest technological advances, clinical findings, and policy developments. Market segmentation and regional analyses leveraged industry databases and customs records to map supply chain flows and tariff impact scenarios.

In parallel, qualitative interviews with subject matter experts-ranging from process engineers and formulators to regulatory affairs specialists-provided contextual depth on extraction innovations, compliance trends, and strategic responses to trade dynamics. These perspectives were systematically validated against quantitative data points to avoid bias and ensure accuracy.

Data normalization processes addressed discrepancies across sources, while scenario modeling of tariff evolutions and regulatory shifts enabled forward-looking risk assessments. The research approach adhered to rigorous standards of data integrity, employing cross-source verification and peer review to deliver actionable intelligence that supports informed decision-making across the beta-glucan value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beta-Glucan market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beta-Glucan Market, by Type

- Beta-Glucan Market, by Source

- Beta-Glucan Market, by Form

- Beta-Glucan Market, by Purity

- Beta-Glucan Market, by Application

- Beta-Glucan Market, by Distribution Channels

- Beta-Glucan Market, by Region

- Beta-Glucan Market, by Group

- Beta-Glucan Market, by Country

- United States Beta-Glucan Market

- China Beta-Glucan Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Summarizing Key Beta-Glucan Market Insights Technological Trends Regulatory Impacts and Strategic Imperatives for Stakeholders and Investors

In summary, the beta-glucan market in 2025 stands at the convergence of scientific validation, technological innovation, and regulatory evolution. Immunomodulatory and metabolic health benefits, underpinned by robust dectin-1 receptor research, have catalyzed broad adoption across dietary supplements, functional foods, personal care, and pharmaceutical applications. Concurrently, advances in micro- and nano-delivery systems are expanding the utility and efficacy of beta-glucan formulations, while diversified sourcing strategies mitigate tariff-induced supply chain risks.

Regionally, the Americas lead in R&D investments and clinical partnerships, EMEA offers a complex yet opportunity-rich regulatory environment, and Asia-Pacific drives volume growth through abundant raw material production and dynamic consumer markets. Leading companies are responding through targeted capacity expansions, strategic regulatory engagements, and innovation alliances that align with sustainability and clean-label imperatives.

As the industry continues to evolve, stakeholders should focus on strengthening domestic production capabilities, deepening clinical research collaborations, embracing advanced delivery platforms, and shaping favorable policy frameworks. By doing so, they will be well positioned to harness the full potential of beta-glucans and deliver differentiated health solutions to a global audience.

Contact Our Associate Director Sales and Marketing to Secure Your Complete Beta-Glucan Market Research Report and Gain Competitive Edge Today

Don’t miss out on the opportunity to acquire a comprehensive and actionable beta-glucan market research report tailored to your strategic needs. Reach out today to discuss how this in-depth analysis can equip your organization with the insights required to navigate evolving regulations, optimize supply chains, and capitalize on emerging product innovation avenues in the beta-glucan landscape. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore customizable packages, sample report sections, and exclusive add-on insights that will empower your team to make data-driven decisions with confidence and secure your competitive advantage.

- How big is the Beta-Glucan Market?

- What is the Beta-Glucan Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?