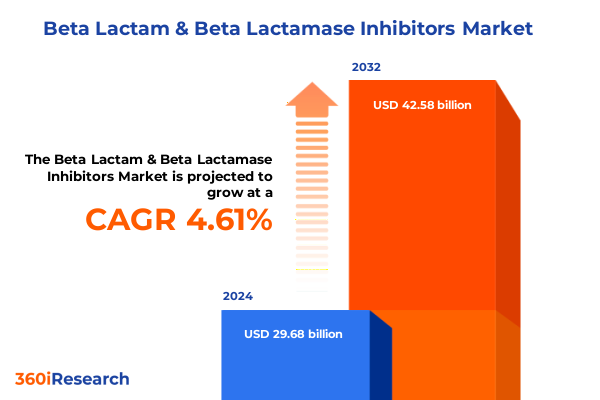

The Beta Lactam & Beta Lactamase Inhibitors Market size was estimated at USD 30.98 billion in 2025 and expected to reach USD 32.35 billion in 2026, at a CAGR of 4.64% to reach USD 42.58 billion by 2032.

Exploring the Foundation and Evolution of Beta-Lactam and Beta-Lactamase Inhibitors as Cornerstones in Contemporary Antibacterial Therapy

Beta-lactam antibiotics represent one of the most enduring and widely used classes in modern medicine, anchored by the signature four-membered beta-lactam ring. This structural motif underpins the bactericidal action of penicillins, cephalosporins, monobactams, and carbapenems by irreversibly binding penicillin-binding proteins and inhibiting bacterial cell wall synthesis. From the first discovery of penicillin to the development of fifth-generation cephalosporins, these molecules have served as the cornerstone of antibacterial therapy for both community-acquired and nosocomial infections.

However, the widespread use of beta-lactams has driven the emergence of beta-lactamase enzymes, which hydrolyze the beta-lactam ring and render these antibiotics ineffective. The World Health Organization’s 2024 Bacterial Priority Pathogens List categorizes third-generation cephalosporin-resistant Enterobacterales, carbapenem-resistant organisms, and other resistant Gram-negative bacteria as critical priorities for research and intervention, underscoring the urgent need for innovative inhibitors and novel treatment regimens to preserve the efficacy of beta-lactam therapies. In response, the integration of beta-lactamase inhibitors into combination therapies has become essential to overcome resistance and extend the clinical utility of beta-lactam antibiotics.

Identifying Transformative Shifts Redefining the Beta-Lactam Landscape Through Innovations, Policy Evolutions, and Emerging Resistance Dynamics

The beta-lactam landscape is undergoing a period of profound transformation driven by scientific breakthroughs, evolving regulatory frameworks, and the relentless progression of antimicrobial resistance. Recent regulatory endorsements, such as the FDA’s approval of EMBLAVEO™-the first intravenous monobactam/β-lactamase inhibitor combination-highlight how targeted molecular engineering can restore activity against multidrug-resistant Gram-negative infections and fill critical therapeutic gaps. Simultaneously, next-generation inhibitor combinations like ceftazidime/avibactam and meropenem/vaborbactam are setting new benchmarks in clinical efficacy against carbapenemase-producing pathogens, reinforcing the momentum toward precision antibiotic therapy.

On the global stage, the 2024 WHO bacterial priority pathogens update has catalyzed public-private collaborations and incentivized R&D investments aimed at replenishing the antibiotic pipeline and addressing the most urgent resistance mechanisms. Advances in rapid diagnostic technologies and digital surveillance platforms are further revolutionizing stewardship strategies by enabling real-time detection of beta-lactamase variants and guiding empiric therapy. Together, these shifts underscore a new era in which innovative drug design, augmented by policy support and advanced diagnostics, coalesce to redefine how beta-lactam agents will be developed and deployed in the fight against antimicrobial resistance.

Assessing the Far-Reaching Consequences of United States Tariff Regimes on Antimicrobial Supply Chains and Beta-Lactam Accessibility

The recent expansion of United States tariff regimes has introduced significant pressures on the supply chains underpinning beta-lactam antibiotic production and distribution. Beginning in April 2025, a blanket 10% tariff on all imported goods-covering active pharmaceutical ingredients (APIs), medical devices, and critical raw materials-has elevated production costs and prompted a reevaluation of global sourcing strategies among pharmaceutical manufacturers. Compounding this, tariffs on Chinese imports have surged to as high as 245%, directly affecting roughly 40% of APIs used in U.S. generic drug manufacturing and threatening to constrict the availability of key antibiotic inputs.

In parallel, 25% levies on pharmaceuticals and medical devices from Canada and Mexico, along with proposed higher tariffs on all foreign-origin medicines, have intensified concerns over potential drug shortages and cost inflation. Healthcare providers and generic manufacturers warn that narrow profit margins leave little room to absorb these added expenses without passing them to patients or curbing supply. Pharmaceutical industry associations have cautioned that sustained tariffs could exacerbate existing antimicrobial shortages, underscoring the need for contingency planning, diversification of API sourcing, and potential onshoring efforts to preserve access to essential beta-lactam therapies.

Revelations From Detailed Segmentation Analysis Highlighting Drug Class, Administration Routes, Patient Demographics, Clinical Applications, and End-User Perspectives

A nuanced segmentation analysis reveals distinct performance drivers across multiple dimensions of the beta-lactam and beta-lactamase inhibitor market. Drug class segmentation shows that diverse carbapenems such as meropenem and imipenem play a pivotal role in treating severe Gram-negative infections, while a broad spectrum of cephalosporin generations-from first to fifth-addresses both community and hospital settings. Penicillins, including aminopenicillins and extended-spectrum variants, retain relevance for respiratory and urinary tract infections. Meanwhile, monobactams provide an essential niche against pathogens expressing metallo-beta-lactamases.

Route of administration influences both clinical adoption and formulation strategies, with oral capsules and tablets facilitating outpatient therapy, and intramuscular or intravenous delivery supporting acute hospital care. Age-specific patient demographics-young adults through seniors, alongside detailed pediatric cohorts ranging from neonates to adolescents-demand tailored dosing and safety profiles. Application categories, from respiratory and skin infections to intraoperative prophylaxis and urinary tract conditions, underscore the need for targeted therapeutic portfolios, particularly as combination therapies address complicated intra-abdominal and gynecological infections. End users, spanning hospital systems to academic research laboratories, drive demand through procurement cycles, educational outreach, and clinical trial collaborations. Together, these segmentation insights illuminate strategic opportunities for differentiated product positioning and optimized patient targeting across the beta-lactam ecosystem.

This comprehensive research report categorizes the Beta Lactam & Beta Lactamase Inhibitors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route of Administration

- Patient Type

- Application

- End User

Uncovering Regional Variations Impacting Beta-Lactam and Beta-Lactamase Inhibitor Dynamics Across Americas, Europe, Middle East and Africa, and Asia-Pacific Ecosystems

Regional market dynamics for beta-lactam and beta-lactamase inhibitor therapies exhibit unique patterns shaped by regulatory frameworks, healthcare infrastructure, and local resistance profiles. In the Americas, robust generic manufacturing capacity in North America and growing local production in Latin America support high-volume distribution, yet cost containment pressures and stewardship initiatives increasingly demand novel inhibitor combinations and rapid diagnostic integration. Policy shifts around drug pricing and reimbursement further influence formulary decisions and access.

Across Europe, the Middle East, and Africa, stringent regulatory harmonization under the European Medicines Agency and emerging AMR strategies in Middle Eastern and African countries drive a focus on standardized quality controls, surveillance of resistance trends, and equitable access. Collaborative regional programs are fostering investments in antibiotic stewardship and local API production to reduce dependency on distant suppliers, while public health campaigns emphasize appropriate prescribing.

In the Asia-Pacific region, leading pharmaceutical hubs in India and China serve as critical API suppliers, supplying roughly 35% of generic drug APIs in the U.S. market and a significant proportion of branded APIs in Europe. Concurrently, national initiatives in Japan, South Korea, and Australia are accelerating R&D for next-generation beta-lactamase inhibitors, promoting public-private partnerships, and enhancing regulatory expedited pathways. Geographic diversification and strategic alliances within Asia-Pacific are thus reshaping the global supply chain.

This comprehensive research report examines key regions that drive the evolution of the Beta Lactam & Beta Lactamase Inhibitors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights Into Leading Industry Players Shaping Beta-Lactam Innovation Through Strategic R&D, Partnerships, and Global Market Positions

Leading pharmaceutical companies are capitalizing on innovation, strategic partnerships, and global reach to shape the future of beta-lactam therapies. Pfizer’s extensive antibiotic portfolio spans penicillins and cephalosporins, supported by cross-sector collaborations with global health agencies and targeted investments in next-generation inhibitor research. Meanwhile, GlaxoSmithKline leverages its infectious disease expertise and stewardship programs to expand access to critical cephalosporins and penicillins, while co-investing in novel research partnerships aimed at overcoming emerging resistance mechanisms.

Merck & Co. maintains a robust pipeline of carbapenems and monobactams, integrating sustainable manufacturing practices with advanced molecular engineering to address resistant Gram-negative pathogens. Novartis, through its Sandoz generics unit, ensures broad geographic distribution of essential beta-lactams, while its R&D divisions probe innovative formulations and combination therapies to tackle multi-drug resistant bacteria. Sanofi complements these efforts with targeted investments in novel delivery systems and inhibitor technologies, reinforcing its commitment to antimicrobial research partnerships and licensing agreements. Recent product launches of ceftazidime/avibactam and meropenem/vaborbactam exemplify the drive toward effective, inhibitor-enhanced beta-lactam therapies, reflecting a shared industry focus on preserving antibiotic efficacy amid growing resistance threats.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beta Lactam & Beta Lactamase Inhibitors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Aurobindo Pharma Limited

- Bio-Rad Laboratories, Inc.

- Bristol-Myers Squibb Company

- Centrient Pharmaceuticals Netherlands B.V.

- Cipla Ltd.

- Creative Diagnostics

- F. Hoffmann-La Roche AG

- Marubeni Corporation

- Melinta Therapeutics, LLC

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Protech Telelinks

- Qpex Biopharma, Inc. by Shionogi Inc.

- SciClone Pharmaceuticals (Holdings) Limited

- Sumitomo Pharma Co., Ltd.

- Thermo Fisher Scientific Inc.

- TOKU-E

- Venatorx Pharmaceuticals, Inc.

- Zai Lab Limited

Actionable Strategies for Industry Stakeholders to Strengthen Supply Resilience, Foster Responsible Antibiotic Stewardship, and Capitalize on Emerging Opportunities

Industry leaders can bolster their competitive positioning by executing strategies that enhance supply chain resilience, accelerate scientific innovation, and foster sustainable stewardship. First, diversifying API sourcing beyond traditional hubs and investing in selective onshoring of critical production assets will mitigate tariff volatility and strengthen supply security. Pairing this with strategic alliances between multinational pharmaceutical firms and regional manufacturers can harmonize quality standards and reduce lead times.

Second, augmenting R&D capabilities with AI-driven discovery platforms and high-throughput screening can compress development timelines for novel beta-lactamase inhibitors. Integrating real-world evidence and advanced diagnostic data will refine clinical trial design and support smoother regulatory pathways. Third, embedding robust antimicrobial stewardship programs into commercial strategies-through provider education, digital surveillance tools, and collaborative public health initiatives-will ensure rational use and extend the lifecycle of existing therapies.

Finally, forging public-private partnerships with academic research centers and global health organizations can unlock co-funding opportunities, leverage policy incentives, and facilitate access to emerging markets. By operationalizing these recommendations, industry stakeholders will be well-positioned to navigate the evolving beta-lactam landscape and sustain antibiotic efficacy.

Transparent Description of Rigorous Research Methodology Encompassing Secondary Research, Expert Validation, and Data Triangulation Techniques

Our research draws on a multi-tiered methodology that combines comprehensive secondary research, rigorous primary validation, and structured data triangulation to ensure robustness and accuracy. Initially, a detailed review of industry literature, regulatory filings, patent databases, and scientific publications was conducted to map the current landscape of beta-lactam and beta-lactamase inhibitor therapies.

This was complemented by interviews with key stakeholders, including pharmaceutical executives, infectious disease experts, and regulatory authorities, enabling validation of emergent themes and contextual insights. Quantitative datasets from proprietary and third-party sources were then integrated, encompassing API import data, clinical trial registries, and regional health statistics. A systematic triangulation process reconciled these inputs, resolving discrepancies and reinforcing the validity of critical findings.

Finally, iterative peer review sessions and expert workshops were employed to refine strategic implications and ensure that conclusions reflect both near-term realities and longer-term industry trajectories. This rigorous approach underpins the credibility of our analyses and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beta Lactam & Beta Lactamase Inhibitors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beta Lactam & Beta Lactamase Inhibitors Market, by Drug Class

- Beta Lactam & Beta Lactamase Inhibitors Market, by Route of Administration

- Beta Lactam & Beta Lactamase Inhibitors Market, by Patient Type

- Beta Lactam & Beta Lactamase Inhibitors Market, by Application

- Beta Lactam & Beta Lactamase Inhibitors Market, by End User

- Beta Lactam & Beta Lactamase Inhibitors Market, by Region

- Beta Lactam & Beta Lactamase Inhibitors Market, by Group

- Beta Lactam & Beta Lactamase Inhibitors Market, by Country

- United States Beta Lactam & Beta Lactamase Inhibitors Market

- China Beta Lactam & Beta Lactamase Inhibitors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Core Findings to Outline the Future Trajectory and Strategic Imperatives Within the Beta-Lactam and Beta-Lactamase Inhibitor Sector

The beta-lactam and beta-lactamase inhibitor sector stands at a pivotal juncture where scientific ingenuity, policy support, and market dynamics converge. The foundational efficacy of beta-lactam antibiotics remains indispensable, yet it faces relentless pressure from evolving resistance mechanisms and external economic factors such as trade tariffs. Simultaneously, transformative innovations-including novel inhibitor combinations and advanced diagnostics-are redefining therapeutic paradigms and reinforcing the imperative for collaborative investment.

Segmentation analyses elucidate differentiated growth opportunities across drug classes, patient cohorts, and therapeutic applications, while regional insights highlight the strategic importance of localized production, regulatory harmonization, and targeted stewardship initiatives. Leading companies are responding with integrated R&D, sustainable manufacturing, and strategic partnerships to maintain the antibiotic armamentarium. As the competitive landscape evolves, industry stakeholders must deploy coherent strategies that blend supply chain resilience, cutting-edge research, and responsible use frameworks.

Together, these insights crystallize a roadmap for sustaining beta-lactam effectiveness and addressing the mounting global challenge of antimicrobial resistance. Continued innovation, robust policy engagement, and disciplined execution will be essential to safeguarding patient outcomes and driving long-term sector growth.

Take the Next Step and Connect With Ketan Rohom to Access Comprehensive Beta-Lactam Market Intelligence and Drive Strategic Decision-Making

The complexities of the global antibiotic landscape demand precise, data-driven insights and forward-looking strategies. To fully appreciate the nuanced trends, regulatory shifts, and competitive dynamics shaping the beta-lactam and beta-lactamase inhibitor market, we invite you to engage directly with our research leadership. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through the comprehensive market intelligence contained in our full report. By connecting with Ketan, you will gain tailored access to detailed segmentation analyses, exclusive regional assessments, and actionable recommendations designed to accelerate your strategic decision-making and secure competitive advantage. Reach out to Ketan Rohom to explore licensing options, acquire supplementary datasets, and collaborate on customized insights that align with your organizational priorities. Take this opportunity to transform high-level trends into practical initiatives that drive growth and resilience in the evolving antibiotic marketplace.

- How big is the Beta Lactam & Beta Lactamase Inhibitors Market?

- What is the Beta Lactam & Beta Lactamase Inhibitors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?