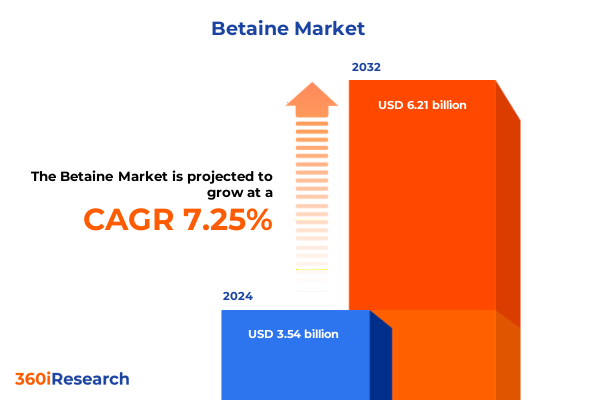

The Betaine Market size was estimated at USD 3.75 billion in 2025 and expected to reach USD 3.98 billion in 2026, at a CAGR of 7.45% to reach USD 6.21 billion by 2032.

Exploring the Significance of Betaine Across Industrial Applications and Unraveling Its Multifaceted Role in Modern Ingredient Formulations

Betaine, a naturally occurring amino acid derivative known for its role as an osmoprotectant and methyl donor, has emerged as a pivotal ingredient across a spectrum of industries seeking functional versatility and performance enhancements. Historically sourced from sugar beets and other plant materials, betaine’s chemical structure imparts humectant properties that have proven invaluable in personal care formulations, while its role in methylation processes underpins critical applications in animal nutrition and pharmaceuticals. As ingredient ecosystems evolve, betaine’s dual identity as a natural osmolyte and a synthetic counterpart offers formulators a flexible toolkit to address moisture retention, flavor stabilization, and metabolic support.

In recent years, the convergence of sustainability imperatives and consumer demand for clean-label solutions has propelled betaine into the spotlight as a more eco-conscious alternative to traditional surfactants and performance enhancers. Moreover, advances in microbial fermentation techniques have lowered production costs and improved the environmental footprint of natural betaine, expanding its appeal to food and beverage manufacturers aiming to fortify functional products without compromising on ingredient transparency. Consequently, the integration of betaine into nutraceuticals has gained traction, with formulators leveraging its methyl donor capacity to develop supplements targeting cognitive health, liver function, and athletic recovery. The introduction sets the stage for understanding how betaine has transformed from a niche specialty chemical to a mainstream ingredient driving innovation across multiple markets.

How Disruptive Technological Advances and Evolving Consumer Demands Are Redefining the Global Betaine Ingredient Landscape

The betaine industry has recently experienced transformative shifts driven by breakthroughs in production technologies, changes in consumer preferences, and tightening regulatory requirements. Technological advancements in microbial fermentation, for instance, have enabled the use of engineered yeast and bacteria to synthesize high-purity natural betaine at competitive yields, thereby reducing reliance on chemical synthesis and plant extraction. This shift towards bio-based production not only aligns with corporate sustainability goals but also addresses raw material volatility associated with agricultural feedstocks.

Concurrently, consumer demand for cleaner, safer ingredient profiles has prompted formulators in personal care and food sectors to reevaluate legacy surfactants and emulsifiers in favor of betaine’s mild and multifunctional properties. This trend has been reinforced by evolving regulations in Europe and North America, where stricter labeling requirements and ingredient transparency initiatives have elevated the strategic importance of naturally derived compounds.

In parallel, digital formulation tools and predictive analytics have revolutionized ingredient innovation by enabling rapid screening of betaine-based systems for moisture management, stability enhancement, and organoleptic improvements. Consequently, ingredient suppliers have formed collaborative ecosystems with academic institutions and technology startups to accelerate R&D programs, focusing on co-creating tailored betaine derivatives with specific functional attributes. Taken together, these shifts underscore a broader industry paradigm in which betaine is not only a reactive solution to performance challenges but also a proactive enabler of next-generation products.

Analyzing the Cumulative Effects of 2025 U.S. Reciprocal and Universal Tariffs on Import Flows and Industry Supply Chains for Betaine

On April 2, 2025, the administration announced a universal 10% tariff on all imports into the United States, effective April 5, 2025, as part of an executive order aimed at addressing persistent trade imbalances by leveraging reciprocal tariff mechanisms. Shortly thereafter, on April 9, reciprocal tariffs ranging between 11% and 50% were applied to imports from over fifty countries identified as contributing to sizable trade surpluses against U.S. industries. These measures introduced an immediate layer of cost pressure for imported betaine, with suppliers compelled to reassess landed costs and reengineer global supply chains to mitigate margin erosion.

Beyond these broad-based levies, China-specific duties further complicated the trading environment. In May 2025, the United States augmented existing tariffs with a 20% ad valorem “fentanyl tariff” on all Chinese-origin goods, which combined with the baseline 10% reciprocal tariff to yield a cumulative 30% duty on betaine imports from China, the world’s largest producer of both synthetic and plant-derived betaine. These compounded tariffs disrupted traditional sourcing strategies, precipitating a marked shift toward domestic production capacity expansions as well as intensified negotiations for tariff relief under free trade agreements.

As a direct consequence, U.S.-based betaine manufacturers accelerated capital investments in new fermentation facilities, while multinational ingredient suppliers explored joint ventures with Gulf Coast chemical parks and inland biotechnology hubs to enhance nearshoring capabilities. The resulting supply chain realignment has not only altered global trade flows of betaine but also underscored the critical interplay between trade policy and ingredient availability in today’s interconnected markets.

Illuminating Key Segmentation Insights by Product Type, Source, Application, and Distribution Channels Driving Betaine Market Differentiation

The betaine market can be dissected into distinct categories that reveal nuanced dynamics and growth opportunities across product, source, application, and distribution realms. In terms of product type, betaine anhydrous continues to dominate applications requiring high solids content and consistent osmoprotective performance, whereas betaine monohydrate is gaining favor in formulations where moisture balance and solubility profiles demand a higher water content. Meanwhile, betaine HCl retains its niche in pharmaceutical and nutritional supplement segments, valued for its acidifying properties and ease of integration into capsule and tablet systems.

Turning to source segmentation, natural betaine-produced either through microbial fermentation or direct plant extraction-commands premium positioning among clean-label brands, while synthetic offerings persist as cost-effective alternatives for high-volume industrial uses. The microbial fermentation pathway has emerged as the preferred route for natural betaine, given its scalability and lower environmental footprint compared to traditional sugar beet extraction, which is subject to crop yield variability and seasonal price swings.

Application insights reveal that the animal feed segment not only accounts for the largest consumption volumes but also demonstrates the most complex sub-segmentation, including aquaculture, pet food, poultry, ruminants, and swine-each with unique nutritional requirements and regulatory frameworks. Food and beverage applications likewise reflect a diversified landscape, spanning bakery, beverages, dairy and frozen desserts, and functional foods, where betaine’s flavor enhancement and moisture retention benefits are exploited. In personal care, hair care, oral care, and skin care formulations increasingly incorporate betaine to bolster mildness and hydration claims, whereas pharmaceutical usage splits between over-the-counter and prescription products focused on methylation support and digestive aids.

Distribution channels further differentiate the market, with direct sales favored by large-scale end users seeking customized formulations. Distributors-comprising agents and wholesalers-play a pivotal role in reaching regional and niche customers, while online retail channels, including company websites and third-party e-commerce marketplaces, cater to smaller buyers and DIY formulators seeking rapid fulfillment. These segmentation insights underscore betaine’s versatility and highlight targeted pathways for suppliers to tailor offerings and optimize go-to-market strategies.

This comprehensive research report categorizes the Betaine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Application

- Distribution Channel

Unpacking Regional Dynamics and Strategic Growth Drivers Across the Americas, EMEA, and Asia-Pacific Betaine Markets

Across the Americas, the betaine industry benefits from robust domestic feed production and a well-established chemicals infrastructure, driving early adoption of onshore fermentation capacities to offset tariff-driven import pressures. Brazil’s aquaculture sector, in particular, exemplifies high-growth demand for feed-grade betaine, where formulators leverage its osmoregulatory properties to enhance fish health and yield. In North America, rising investments in precision nutrition and sports supplements have catalyzed new applications, prompting suppliers to expand their portfolio toward premium betaine monohydrate and specialty blends tailored for human consumption.

In the Europe, Middle East & Africa bloc, stringent regulatory frameworks and consumer preferences for natural and organic ingredients have fueled a migration from synthetic to bio-fermented betaine. The European Union’s restrictive policies on chemical pesticides and nonrenewable feedstocks have reinforced the appeal of microbial fermentation routes, and Middle Eastern countries have begun establishing incentive programs for biotechnology parks, positioning the region as an emerging hub for sustainable amino acid derivatives. Meanwhile, Africa remains a frontier market where small-scale sugar beet processing coexists with burgeoning feed formulation opportunities in poultry and aquaculture.

Asia-Pacific remains the fastest-expanding region, underpinned by large-scale aquaculture operations in China and Southeast Asia, as well as a booming personal care sector in Japan and South Korea. China’s capacity for plant-extracted and synthetic betaine continues to underpin global supply, but rising labor costs and environmental compliance requirements have spurred a shift toward fermentative technologies. India’s pharmaceutical and nutraceutical industries are increasingly turning to betaine HCl for digestive health formulations, driving local investments and international partnerships to secure reliable supply chains. Collectively, these regional dynamics reveal differentiated growth drivers and underscore the necessity for tailored market entry and expansion strategies.

This comprehensive research report examines key regions that drive the evolution of the Betaine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players: Strategic Initiatives, Capacity Expansions, and Partnerships Reshaping the Betaine Competitive Landscape

Leading the competitive landscape, DuPont de Nemours harnesses long-standing expertise in methyl donor chemistry and has made strategic investments in fermentation technology to extend its natural betaine portfolio. As of mid-2023, DuPont and BASF emerged as titans in the global betaine market, leveraging joint R&D initiatives and channel partnerships to accelerate new product introductions and broaden geographic reach. Evonik has responded by optimizing its global production network, investing in modular fermentation plants to rapidly localize supply and mitigate tariff exposures.

Regional chemical conglomerates such as American Crystal Sugar Company and Cargill maintain specialized lines of plant-derived betaine, capitalizing on integrated sugar-beet processing facilities to create vertically integrated supply chains that offer cost advantage in feed and food segments. Meanwhile, specialty chemical providers like Stepan Company and Merck KGaA emphasize customized formulations, targeting high-value personal care and pharmaceutical markets with premium betaine derivatives and value-added blends.

Additional competition arises from Asia-based producers including Tianjin Binhai Chemical and Wuhan Ginkgo Bioworks, which leverage low-cost feedstocks and growing bioreactor capacity to supply both local and export markets. New entrants, particularly biotechnology startups in North America and Europe, are exploring gene-editing platforms to craft next-generation betaine analogues with enhanced solubility, stability, and targeted functional performance. This competitive tableau underscores a race to innovate production processes, secure downstream partnerships, and differentiate product offerings through sustainability, service, and scientific expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Betaine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agri-Neo Co., Ltd.

- BASF SE

- Cargill, Incorporated

- Dow Chemical

- Evonik Industries AG

- International Flavors & Fragrances Inc.

- Kemin Industries, Inc.

- Merck KGaA

- Nouryon Chemicals

- Seawin Biotech Co., Ltd.

- The Lubrizol Corporation

Formulating Actionable Strategic Recommendations for Industry Leaders to Navigate Supply Chain Challenges and Capitalize on Emerging Betaine Trends

To navigate the evolving betaine landscape and capitalize on emerging opportunities, industry leaders should prioritize the development of integrated supply networks that combine microbial fermentation hubs with strategic plant-extraction assets. By diversifying raw material sourcing across multiple geographies and production pathways, companies can build resiliency against trade policy volatility while optimizing cost and environmental performance.

Manufacturers and brand owners should collaborate with academic and technology partners to accelerate innovation in betaine derivatives, leveraging advanced analytics and high-throughput screening to tailor formulations for specific performance attributes. Engaging in precompetitive research consortia can de-risk R&D investments while establishing technology standards that benefit the broader ecosystem.

Given the impact of reciprocal tariffs on imported betaine, stakeholders should evaluate nearshoring strategies, including joint ventures with local chemical parks and shared-capacity agreements with fermentation specialists. Such collaborative models can reduce lead times, lower logistics costs, and ensure reliable access to high-purity betaine variants.

Finally, organizations must adopt transparent sustainability reporting and participate in recognized certification programs to validate green production claims. This practice will strengthen brand equity among end-users who demand verifiable environmental and social credentials, further differentiating betaine offerings in increasingly competitive markets.

Detailing a Rigorous Research Methodology Integrating Primary Interviews and Secondary Data Sources to Ensure Comprehensive Betaine Market Insights

This report’s findings are grounded in a rigorous methodology that integrates both primary and secondary research to ensure a balanced and comprehensive understanding of the betaine market. Secondary data was gathered from government trade databases, regulatory filings, and public financial disclosures to map tariff changes, production capacities, and regional trade flows. These sources provided a factual baseline for analyzing the impact of macroeconomic policies and global trade developments.

Complementing this, primary research was conducted through interviews with senior executives at leading ingredient manufacturers, formulators in the personal care and food industries, and procurement specialists in the animal nutrition sector. These discussions yielded qualitative insights into technology adoption rates, sourcing strategies, and future demand projections. Additionally, surveys of end-users were undertaken to quantify performance requirements and purchasing criteria across different applications.

Quantitative data was triangulated through comparative analysis of point-of-use pricing, capacity utilization rates, and investment announcements to validate emerging trends and gauge competitive intensity. Finally, cross-validation workshops with industry experts ensured that conclusions and recommendations reflect the latest market realities and stakeholder perspectives. Together, these methodological pillars underpin the credibility and actionability of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Betaine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Betaine Market, by Product Type

- Betaine Market, by Source

- Betaine Market, by Application

- Betaine Market, by Distribution Channel

- Betaine Market, by Region

- Betaine Market, by Group

- Betaine Market, by Country

- United States Betaine Market

- China Betaine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Implications to Chart the Future Trajectory of the Global Betaine Industry

The comprehensive exploration of betaine’s functional versatility, technological advancements, and geopolitical influences reveals an industry in the midst of paradigm shifts. From the adoption of bio-based fermentation techniques that enhance sustainability and cost efficiency, to the ripple effects of sweeping U.S. tariff policies that have accelerated supply chain realignment, betaine has proven to be both resilient and adaptable. Segmentation analysis underscores the multifaceted nature of the market, with distinct opportunities emerging across product forms, sources, applications, and distribution channels.

Regionally, growth trajectories differ markedly: the Americas lean heavily on feed applications and nearshoring strategies, EMEA emphasizes natural and organic credentials, and Asia-Pacific drives volume through aquaculture and personal care consumption. Leading companies are responding with capacity expansions, strategic partnerships, and product innovation, setting the stage for intensified competition around quality, sustainability, and service.

Ultimately, the future of the betaine market will be defined by the ability of stakeholders to integrate technological innovation with agile supply chain models and transparent sustainability practices. Those who successfully navigate the interplay of regulatory dynamics, consumer demands, and production capabilities will unlock the next wave of growth in a sector that is increasingly central to diverse end-use industries.

Engage with Ketan Rohom to Access an Exclusive In-Depth Market Research Report That Empowers Your Strategic Growth in Betaine

To obtain the in-depth insights, detailed analysis, and strategic guidance outlined in this executive summary and tap into emerging opportunities in the betaine market, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Leverage this comprehensive market research report to inform your next growth initiative, optimize your supply chain strategies, and outpace competitors. Engage with Ketan Rohom today to purchase the complete study and empower your strategic decision making with the most authoritative and actionable intelligence on global betaine dynamics.

- How big is the Betaine Market?

- What is the Betaine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?